October 14th, 2024 | 07:15 CEST

Hydrogen 3.0 is coming – Where to get on board now? Nel ASA, First Hydrogen, Plug Power, BYD, and BMW

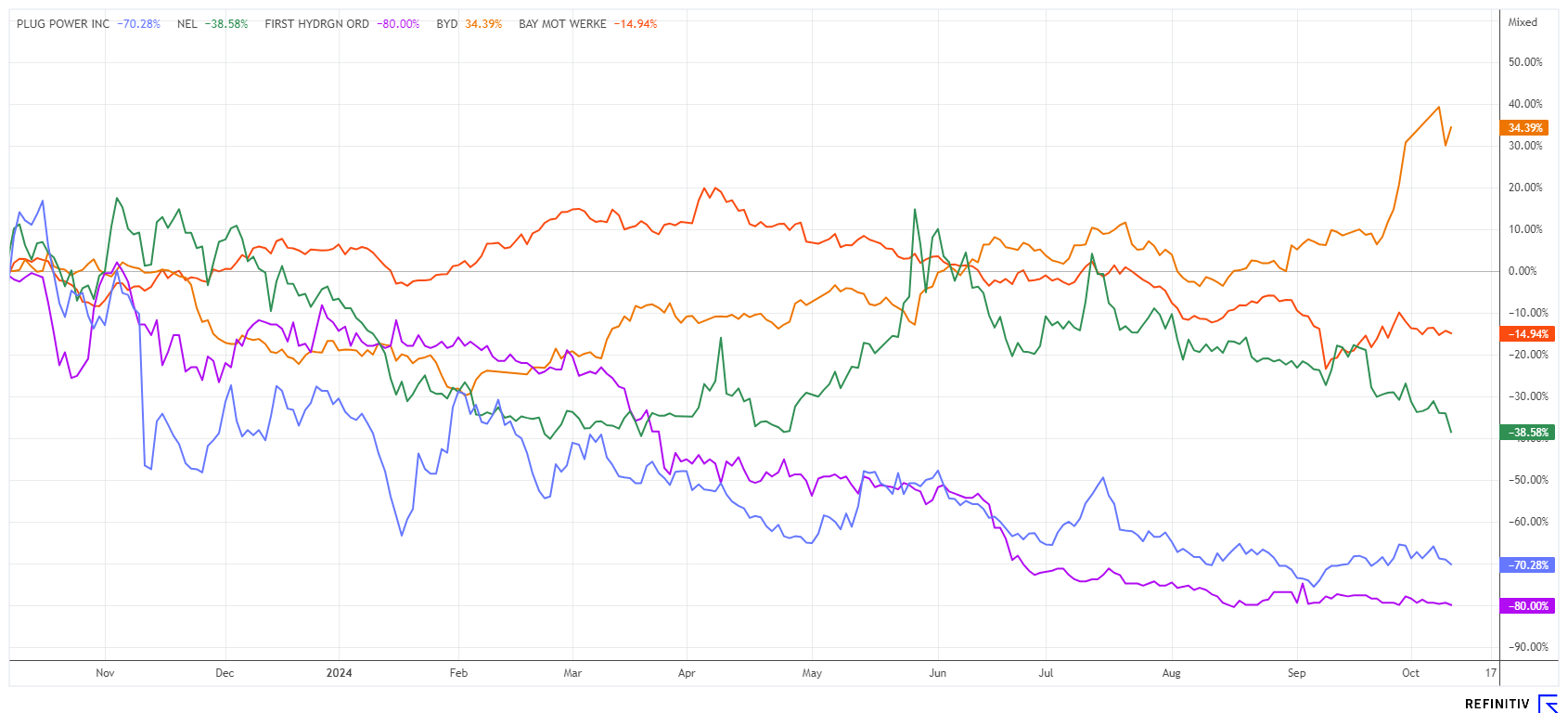

Despite new highs in all major indices, hydrogen stocks are performing poorly. This is because preferences vary widely among countries in the global "net zero" discussion. Topics such as nuclear energy or even nuclear fusion are being discussed, while sales in the e-mobility sector are declining rather than increasing. Assuming that, at some point, the world will once again approach the issue of climate change with an open mind regarding technology, hydrogen technology has a clear place among the green alternative solutions. There is still a cost problem and a lack of courage to move forward faster. However, experienced stock market players know that after a 90% price loss, the sell-off will eventually end. The first signs are evident.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , First Hydrogen Corp. | CA32057N1042 , PLUG POWER INC. DL-_01 | US72919P2020 , BYD CO. LTD H YC 1 | CNE100000296 , BAY.MOTOREN WERKE AG ST | DE0005190003

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD and BMW – Hydrogen next for e-mobility?

The Chinese government is supporting the development of hydrogen technologies with subsidies and funding programs. Beijing plans to put over a million hydrogen-powered vehicles on the road by 2030. Companies such as BYD and Great Wall Motors have been investing in the development of fuel cell vehicles (FCVs) for years. This technology is seen as promising, especially for heavy-duty vehicles such as buses and trucks. Pilot projects in cities such as Shanghai and Beijing are significantly expanding the infrastructure for hydrogen filling stations and promoting the use of hydrogen buses and trucks.

The Munich-based carmaker BMW also plans to start series production of a hydrogen vehicle with a fuel cell in 2028. To this end, the premium manufacturer is expanding its partnership with Toyota in the development of fuel cells. The plan is also to offer an existing model in a hydrogen-powered version. BMW sees hydrogen technology as a second pillar alongside battery-electric vehicles. Given the increasing scarcity of battery raw materials on the one hand, and the inadequate e-charging network on the other, CEO Oliver Zipse does not want to put all his eggs in one basket. He sees electric vehicles powered by hydrogen instead of from a battery as the perfect complement. However, according to a study, Germany and the EU risk missing their own hydrogen targets. It can be assumed that the topic will soon experience renewed momentum.

The stock of BYD has become a consistent performer among vehicle companies, while BMW, at least among the German manufacturers, has fallen the least. However, there is still room for improvement, as the board has been on alert since the last profit warning. Premium combustion vehicles are losing significant market share, especially in Asia. BYD will report its Q3 results on October 30, and BMW will follow on November 6. Analytically, BYD trades at a 2024 P/E ratio of 18.5, while BMW's price-to-earnings ratio is 5.6. On top of that, BMW offers a 6.5% dividend. A rebound after the figures would not be surprising.

However, there is still room for improvement, as the board has been on alert since the last profit warning. Premium combustion vehicles are losing significant market share, especially in Asia. BYD will report its Q3 results on October 30 and BMW on November 6. Analytically, BYD is trading at a 2024 estimated P/E ratio of 18.5, while BMW's earnings ratio stands at 5.6. Additionally, BMW offers a 6.5% dividend. A rebound after the earnings reports wouldn't be surprising.

First Hydrogen – Germany is now on the agenda

The development of a hydrogen economy is crucial for Europe to achieve its "net zero" target for 2050. The European Commission has approved four waves of integrated hydrogen Important Projects of Common European Interest (IPCEI), which aim to raise a total of EUR 43 billion to support more than 120 projects. The money goes primarily to European companies, which encourages foreign companies to set up their own subsidiaries in addition to collaborations.

Using the "Hydrogen-as-a-Service" model, First Hydrogen aims to supply customers in the Montreal-Québec City region with clean, green hydrogen as a fuel for the first time in the next few years. This could create the first zero-emission transportation ecosystem in the future. The Canadians are now also targeting Germany with this approach. The Company has hired several international firms with expertise in renewable energy development, infrastructure construction, mergers and acquisitions, and capital raising to support its own expansion. The first step is now a German subsidiary.

First Hydrogen's shares are currently trading in Germany between EUR 0.25 and EUR 0.30, with recent trading volumes noticeably increasing. In our opinion, the expansive internationalization strategy comes at exactly the right time because if Kamala Harris moves into the White House, the next green wave is likely to sweep across Europe again. The FHYD share is already forming an interesting chart-based double bottom, which can serve as a basis for the next price upswing.

Plug Power and Nel ASA – Too little public support

The big losers of the limited financial leeway of governments are the former stock market favourites Nel ASA and Plug Power. This is because they are suffering from a decline in orders and a reluctance to invest. In the current environment, nuclear energy is once again advancing internationally because this technology is considered mature and promises the lowest production costs for electricity generation. Of course, the problem of radioactive waste remains.

For hydrogen companies, this makes it more difficult for many governments to refocus, particularly on refinancing important research and development work. Ultimately, the lack of orders leads to a shrinking supply of liquidity for the protagonists, which further increases the pressure on prices in the event of a necessary capital increase. Plug Power investors have already been asked to pay up twice in 2024. Nel ASA has at least taken its filling station subsidiary Cavendish public to increase its own liquidity. Nevertheless, the Norwegian electrolyser pioneer is currently falling from one low to the next in terms of its share price. Even good news about a cooperation with the Italian company Saipem fizzled out completely.

The ten times larger US competitor Plug Power is now only 34 cents above its 5-year low of EUR 1.46 and has now lost 97% from its high. Although there is good news in the air again, the price fell by 10% last week. Plug Power has signed a framework agreement with the Australian ammonia producer Allied Green Ammonia (AGA) to construct a 3 GW electrolyser. It does not seem to be attracting any attention. The Q3 figures could be exciting; they are expected on November 7, with Nel ASA reporting as early as next week on October 17. Currently, investors should likely still be on the sidelines, but if the figures and outlook are significantly more positive, the turnaround could happen very quickly.

Almost daily, the stock markets rally anew, but the upturns are only being driven by a very few blockbuster stocks such as Nvidia. Investors are hopeful for the upcoming cycle of interest rate cuts, which may last longer than expected due to unstable economies. Highly invested sectors such as the automotive or hydrogen sector should be able to benefit from lower interest rates and soon reappear on investors' order slips again.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.