DYNACERT INC.

Commented by Nico Popp on February 26th, 2026 | 07:05 CET

Hydrogen transition: How dynaCERT, Plug Power, and Ballard Power Systems are decarbonizing the transportation sector

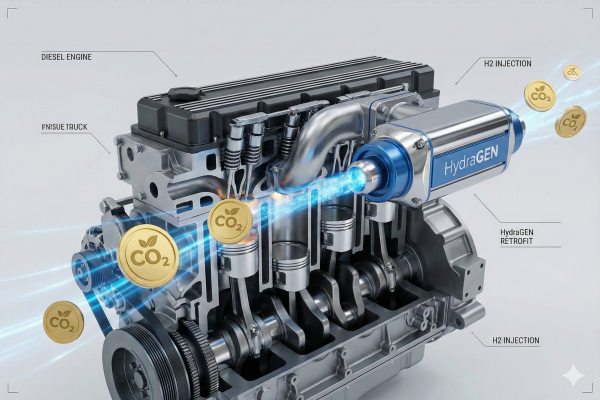

The market for hydrogen-powered logistics is set to reach a volume of USD 32.47 billion in 2026 and is expected to grow to USD 204.9 billion by the end of the decade. The International Energy Agency (IEA) reports that global demand for hydrogen was nearly 100 million tons last year, but less than 1% of that came from low-emission sources. In the US, tariffs on electrolysers and fuel cells, ranging from 10% to 30%, are forcing the industry to build local supply chains. In Europe, the REPowerEU plan, together with the EU hydrogen strategy, creates a stable framework for investment in infrastructure. However, an immediate and comprehensive replacement of the global heavy-duty fleet with completely emission-free vehicles would be difficult to achieve and also economically nonsensical. Instead, companies are preparing to retrofit existing fleets or promote the hydrogen transition in other ways.

ReadCommented by Fabian Lorenz on February 17th, 2026 | 07:05 CET

Things are set to take off in 2026! Steyr Motors, TeamViewer, and dynaCERT in focus!

TeamViewer is heading downward in 2026. The software company's shares are trading at an all-time low and are threatening to slip below the EUR 5 mark. So is now the time to get in? In contrast, dynaCERT shares could be on the verge of multiplying in value. However, that would require an operational breakthrough. According to the company's outlook for 2026, this scenario appears entirely possible, as is a revaluation. Steyr Motors shares underwent a revaluation last year. This needs to be underpinned by significantly higher revenue and profits in the current year. Analysts remain bullish on the defense stock.

ReadCommented by Armin Schulz on February 4th, 2026 | 07:25 CET

Hydrogen explosion: How to cash in on the coming boom with Plug Power, dynaCERT, and Linde!

The next phase of the energy transition is taking shape. Driven by billions in subsidies and a political consensus on clean energy, hydrogen is on the verge of a decisive breakthrough. Falling costs for green hydrogen are meeting exploding demand from industry and transportation, while new technologies are overcoming old infrastructure hurdles. In this historic upheaval, three concrete investment opportunities are emerging that play different but essential roles. We analyze the current situation of Plug Power, dynaCERT, and Linde.

ReadCommented by Carsten Mainitz on January 26th, 2026 | 07:35 CET

2026 – The comeback of hydrogen stocks: Now it is substance that counts, not hype! The hidden potential of dynaCERT, Ballard Power, and VW

For years, hydrogen stocks were considered the promise of the future. The hype was followed by a hangover. Valuations have fallen sharply, and after a phase of exaggerated expectations, the focus is now shifting to robust business models and industrial scaling. dynaCERT stands out with its innovative bridge technology that meets high environmental standards. Its ready-to-use solutions for reducing emissions are convincing more and more customers from industry. As an established player, Ballard Power is driving the further development of fuel cells in heavy-duty transport. Volkswagen is taking a different approach. A few days ago, the automaker published key data for the past fiscal year, which came as a positive surprise.

ReadCommented by André Will-Laudien on January 20th, 2026 | 07:35 CET

Will new Trump tariffs slow down the stock market boom? Keep an eye on Plug Power, dynaCERT, and Nordex

The stock market currently has to cope with all kinds of weather conditions. First, there is a very dry and cold winter, which is causing problems for Ukraine in particular due to the war. To make matters worse, the energetic US President Donald Trump is suddenly laying claim to Greenland. Most likely, he is only interested in securing the entire NATO, hence the pressure over the new tariffs. The EU will also have to make a huge security contribution for Greenland. It feels as if the war machine is running at 300% capacity. How the states intend to finance all this is more than questionable, because taxes will no longer cover the costs if they do not want to stifle their economies. In this environment, capital market interest rates should actually be skyrocketing, but Trump is vehemently demanding interest rate cuts. We are looking for attractive opportunities in a challenging environment.

ReadCommented by Nico Popp on January 14th, 2026 | 07:05 CET

Between euphoria and industrial realism: How Linde, Hapag-Lloyd, and dynaCERT are defining the new reality of the hydrogen economy

We are witnessing a decisive turning point in the global hydrogen economy: The phase of speculative euphoria that characterized the beginning of the decade has given way to a phase of industrial realism and technocratic implementation. In investor circles and industry analyses, the term "mean reversion" has become established – a return to reality, away from unrealistic hyper-growth scenarios and toward physically feasible projects. According to the International Energy Agency's (IEA) Global Hydrogen Review 2025, the hydrogen sector continues to grow steadily and reached demand of nearly 100 million tons in 2024, but the structure of this growth is more complex than previously forecast. In this new environment, where regulatory interventions such as FuelEU Maritime and emissions trading (EU ETS) set the pace, three distinct winner profiles are emerging: infrastructure giant Linde, logistics heavyweight Hapag-Lloyd, and technology bridge builder dynaCERT, which occupies a highly compelling niche.

ReadCommented by Fabian Lorenz on December 30th, 2025 | 07:00 CET

HYDROGEN STOCK with 10x POTENTIAL! Nel ASA, thyssenkrupp, and dynaCERT are starting the new year in different ways

Hydrogen stocks have had a challenging year. However, analysts see the potential for 10x growth in the new year, specifically, for the cleantech company dynaCERT. Operational tailwinds are coming from market entry in Mexico and sales successes in Europe. Successes in Asia are expected to follow in 2026. The decisive factor for 2026 will be whether dynaCERT makes progress in terms of order volume, capacity utilization, and recurring revenues. With its retrofit solution, dynaCERT is setting itself apart from large plant manufacturers such as thyssenkrupp nucera and Nel ASA. Analysts praise the former for its efficient structures and full coffers. The other is aggressive despite its share price being at an all-time low.

ReadCommented by Armin Schulz on December 23rd, 2025 | 07:05 CET

The strategic positioning of Plug Power, dynaCERT, and Nel ASA in the USD 110 billion market

2025 marks the long-awaited turning point for the hydrogen economy: with global investments of over USD 110 billion, annual volumes recently exploding by 70%, and groundbreaking infrastructure projects such as Germany's 400 km core network, the vision is becoming a commercial reality. Technological milestones, such as Bosch's production-ready fuel cell truck system, and ambitious EU targets underscore the enormous potential for decarbonization. In this dynamic environment, it is innovative companies that are translating these macroeconomic dynamics into concrete growth opportunities. Against this backdrop, it is worth taking a closer look at the pioneers Plug Power, dynaCERT, and Nel ASA.

ReadCommented by Carsten Mainitz on December 18th, 2025 | 07:30 CET

When will the next hydrogen boom begin? How will dynaCERT, Nel, and Siemens Energy stocks benefit from this in concrete terms?

The hydrogen sector will enter a new phase in 2026. Investors can still position themselves early on. The framework conditions in Europe have improved significantly thanks to a matchmaking portal for hydrogen projects and subsidies. The US is attracting investors with tax incentives for clean hydrogen. Overall, the market has become more technologically mature and increasingly more large-scale projects are being realized. Everything points to a revival of hydrogen stocks. Who will be ahead next year?

ReadCommented by Nico Popp on December 10th, 2025 | 07:05 CET

Second hydrogen wave with Linde, BASF, dynaCERT: Why 2026 will be the year of truth

fundamentally from the hype cycles of 2020 and 2021. Back then, enthusiasm was driven largely by visionary PowerPoint presentations rather than real-world progress. The transition to 2026, however, marks the start of a new industrial reality. Investors who have followed the sector for years now recognize a clear shift in market dynamics - one based less on hope and more on regulatory certainty and technological maturity. As Der Aktionär correctly notes, a new tailwind is emerging for industry. We explain what improved framework conditions and the market launch of large-scale plants in Europe could mean for the shares of Linde, BASF, and dynaCERT.

Read