July 19th, 2024 | 07:15 CEST

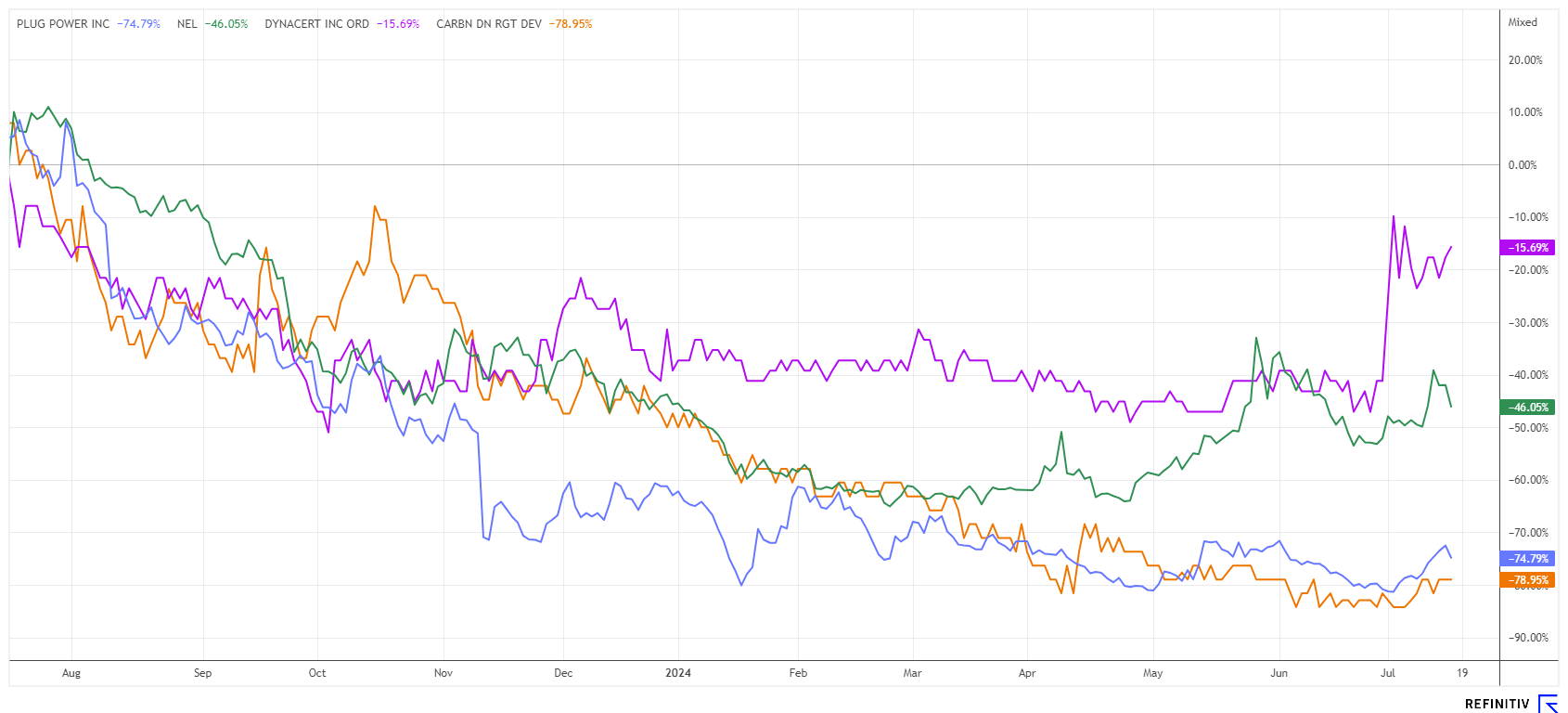

Top energy transition shares: 100% returns through CO2 reduction! Nel ASA, Plug Power, Carbon Done Right, and dynaCERT

Heat records, floods, and energy shortages! This summer, all climate change issues are on the table. Since the nuclear power plants were shut down, Germany has lacked a reliable base load power supply. Pronounced grid weaknesses are increasing, with no improvement in sight. Economics Minister Habeck wants to build gas-fired power plants as quickly as possible, which can later be operated with hydrogen. Nice idea! Meanwhile, Berlin's economic experts are buying French nuclear power to fill existing gaps. Nobody can scientifically prove the difference in climate technology between here and there, but German consumers are happy to pay for this nonsense through their electricity bills. This is how EU energy policy works. Since expenses are continuously rising, we focus on increasing revenue streams. Here are some ideas for your energy portfolio.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , CARBON DONE RIGHT DEVELOPMENTS INC | CA14109M1023 , DYNACERT INC. | CA26780A1084

Table of contents:

"[...] We can convert buses and trucks to be completely climate neutral. In doing so, we take a modular and incremental approach. That means we can work with all current vehicle types and respond to new technology and innovation [...]" Dirk Graszt, CEO, Clean Logistics SE

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA - Deep red figures cause the share price to plummet

This is not what investors would have imagined. The Nel share has traded frivolously upwards in recent weeks, reaching EUR 0.68 after EUR 0.36 in February. Then, the Q2 figures were announced the day before yesterday. Adjusted for a one-off effect, the loss unfortunately increased significantly. Revenue was also much weaker at NOK 332 million after NOK 371 million. The unadjusted loss fell from NOK 228 million to NOK 118 million in the period from April to June. However, this was due to a special effect from last year amounting to NOK 166 million, as Nel sold its shares in the Danish hydrogen company Everfuel. Adjusted for this factor, the Company's quarterly loss almost doubled. Atypical for a growth company, revenues fell once again, and cash and cash equivalents also decreased by 47% to NOK 2.2 billion from NOK 4.1 billion. This is another significant disappointment from Oslo. Stay on the sidelines for the time being. Technically, it would be important to stabilize the line around EUR 0.50 on a sustained basis.

Carbon Done Right - With carbon certificates into the climate transition

The Canadian company Carbon Done Right offers a concept for the energy transition. With major industrial backers, they conduct reforestation and renaturation projects. The Company is involved in mangrove protection and the reforestation of abandoned agricultural land. The projects are mainly carried out in Africa, where industrialization is still in its infancy. Thinking globally means that CO2 avoidance or reduction can be implemented anywhere in the world, which is also the philosophy of the Canadians. When combining these measures with financial incentives, the idea is as simple as it is successful: by renaturalizing so-called compensation areas, the initiator receives credits in emission certificates, which in turn can be purchased by investors.

The interest from multinational corporations is so great that Carbon Done Right is now focusing on the London capital market. London is the most liquid European trading center for financial products of all kinds. And there is another treat in store: In order to better address the market, the aim is also to implement modern blockchain-based business models. This means that when trading emission certificates, every transaction can be carefully recorded in a decentralized ledger so that the origin, ownership, and complete transaction history of each certificate can be verified and cannot be changed. With parallel tokenization, crypto investors are also on board. The KLX share currently costs just CAD 0.045 in Canada; the entire company is available for around EUR 2.5 million. This is an ESG investment at a low entry price.

Plug Power - What can we expect at the half-year mark?

As with Nel ASA, the Q2 figures for Plug Power are just around the corner. The 10 times larger competitor from the US has stabilised its share price in recent weeks after falling a full 95% since 2021. The German government has now announced that it will invest a total of EUR 4.6 billion in the production, storage, and transportation of green hydrogen. Part of the money comes from various EU funds. The Habeck Ministry is hoping for a private investment of EUR 3.3 billion. Plug Power specializes in large-scale series-connected electrolyser plants, so-called megawatt hydrogen power plants. This news might be responsible for the recent stock rally from USD 2.25 to USD 3.25. In the general Nasdaq sell-off of the last few days, it quickly fell back to USD 3.05. However, the chart is now pointing upwards, and collecting in the corridor of USD 2.70 - 3.20 could provide long-term returns. A fundamental update for Q2 is expected on August 6. It will be very interesting to see what CEO Andy Marsh has in store for his investors.**

dynaCERT - VERRA certification on the horizon

Lastly, let's take a look at another climate stock. dynaCERT, the Canadian producer of auxiliary devices for improving diesel combustion for all types of machinery, has doubled from CAD 0.14 to CAD 0.29 in the last three weeks. The market is betting that VERRA certification for the emissions certificate market could be achieved soon. Investors who have been invested for some time and participated in the last capital increase at CAD 0.15 were rewarded. However, those traders who jumped on the bandwagon too late were disappointed. The Company is now fully financed and, starting in August, will be headed by the German manager Bernd Krüper, who has a long industrial career in various technology sectors. According to the motto "A new broom sweeps clean", keeping a close watch on the Toronto-based company in the coming weeks is advisable. After investing over CAD 100 million in research and development, investors can now buy in at a valuation of CAD 94 million. The share has the potential to multiply once VERRA certification is obtained.

No one really expected the sharp NASDAQ correction in the last 3 days. In a long-term comparison, however, the stock market month of July has always been very volatile. Lush profits from May and June are likely being squandered for now. The listing on the London Stock Exchange could represent a European initial spark for the small-cap stock Carbon Done Right.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.