Commented by André Will-Laudien on March 12th, 2026 | 08:20 CET

Drone revolution and defense boom: Why Volatus Aerospace is emerging as a new aerospace player

The daily news reports currently begin with war coverage. This is not a desirable situation, but it is a bitter reality. Nowadays, much reconnaissance and destructive power is achieved "unmanned." This is demonstrated by the dramatic increase in autonomous air operations in conflict regions and illustrates the strategic relevance of modern drone technologies. Volatus Aerospace is positioning itself in this environment as an integrated platform provider: from manned flight and unmanned drone systems to AI-supported analysis and security services. The growing demand for highly scalable solutions in Europe, North America, and NATO partner countries is driving structural, double-digit growth in the defense and security market. Analysts see enormous potential for companies with platform expertise such as Volatus. Investors are taking notice, as the valuation remains reasonable and major developments are in the pipeline!

ReadCommented by Mario Hose on March 12th, 2026 | 08:00 CET

Mining without excavators: Franco-Nevada, Triple Flag, and Globex Mining compared

After a long dry spell, mining stocks are back in vogue. However, operating mines comes with its own risks. Geological challenges, technical failures, rising energy costs, or labor strikes can quickly disrupt operations. There is, however, a clever alternative: so-called royalty and streaming companies. These firms benefit from mining activity without having to drill holes in the ground themselves. In this article, we compare three representatives of this business model across different size classes: Franco-Nevada, an established industry giant; Triple Flag Precious Metals, a mid-tier player; and Globex Mining Enterprises, a (still) small but particularly diversified challenger.

ReadCommented by Carsten Mainitz on March 12th, 2026 | 07:45 CET

Underestimated prospects in the precious metals sector: Lahontan Gold, Barrick Mining, and First Majestic Silver are the favorites

Market volatility has skyrocketed in the wake of new global armed conflicts. This trend is evident across all asset classes. Investors are currently focusing on the price of oil and the question of what impact high prices will have on the real economy. In contrast, precious metal prices are proving to be very robust. With gold trading above USD 5,000 and silver above USD 80, record margins are on the cards for producers such as Barrick and First Majestic, despite rising costs. An investment in exploration company Lahontan Gold, which plans to start production in 2027, appears even more lucrative.

ReadCommented by Armin Schulz on March 12th, 2026 | 07:40 CET

AI fuels demand, investors reap rewards: ExxonMobil, Standard Uranium, and Nordex in focus

Electricity demand is exploding, driven by electrification and the race for supremacy in artificial intelligence. Governments and corporations are desperately searching for solutions to power data centers around the clock. The old dogma of climate neutrality is giving way to a pragmatic realignment. Every available kilowatt-hour counts, whether fossil, nuclear, or renewable. This tension between security of supply and technological competition is currently giving rise to three promising investment opportunities that could not be more different. While US oil giant ExxonMobil is benefiting from the return to fossil fuels, Standard Uranium is betting on the nuclear renaissance, and Nordex relies on wind power as an indispensable pillar of the future energy mix.

ReadCommented by Fabian Lorenz on March 12th, 2026 | 07:25 CET

Breaking News! Takeover speculation? BioNTech, Evotec, Vidac Pharma

First, the positive news: Vidac Pharma's drug candidate VDA-1102 was recently used in a compassionate treatment case in connection with a girl's third brain surgery. Following the treatment, the patient's condition improved significantly. In addition, the Vidac platform is now being tested beyond oncology. 2026 could mark a potential breakthrough year for the company and its stock. It was a different story this week for BioNTech, whose shares suffered a sharp setback. The rather mixed results for 2025 and the cautious outlook for the current year likely played only a limited role. More troubling for shareholders is likely the impending departure of the founding couple. This raises the question: Could BioNTech become a takeover target? There were also long faces at Evotec this week. The company's restructuring program has failed to convince the market, and the stock has slipped below an important technical support level.

ReadCommented by Armin Schulz on March 12th, 2026 | 07:20 CET

Antimony Resources: Why a war in Iran could unleash the silent antimony crisis

The first 48 hours of a modern conflict consume billions and reveal a dangerous dependency. When fighting in Iran escalated at the end of February 2026, the Pentagon estimated ammunition costs of USD 5.6 billion for the first two days alone. More than 2,000 precision weapons struck over 5,000 targets. What is missing from this tally, however, is the question of what material the projectiles are made of. Behind every missile fired lies a silent but critical raw material: antimony. The semi-metal hardens lead bullets, ensures precision in primers, and enables thermal imaging technology in guidance systems. And this is exactly where the real problem begins.

ReadCommented by Nico Popp on March 12th, 2026 | 07:15 CET

Nuclear power comeback in the EU! Solid returns with American Atomics, Amazon, and E.ON

Since the EU nuclear summit in Paris a few days ago, it has become clear that nuclear energy is once again socially acceptable in Europe. At the meeting, the European Commission described the former move away from nuclear power as a strategic mistake and launched a comprehensive offensive for small modular reactors (SMRs). According to the EU strategy, an SMR capacity of up to 53 GW is to be built up by 2050 in order to reduce the persistently high electricity prices and stop the impending exodus of industry. At the same time, a new factor is driving global electricity demand: artificial intelligence (AI). The International Energy Agency (IEA) predicts that the share of nuclear and renewable energy in the global electricity mix will rise to 50% by 2030. Tech giants such as Amazon increasingly want to satisfy the energy hunger of AI data centers themselves. E.ON is also likely to benefit from this historic strategic shift by operating stable grids. However, at the source of the new boom is the up-and-coming exploration company American Atomics, which is searching for urgently needed uranium and closing a strategic gap in the supply chain. We highlight where investors can find the most attractive opportunities.

ReadCommented by Fabian Lorenz on March 12th, 2026 | 07:10 CET

OIL PRICE SHOCK drives these stocks - Nordex, Nel, and dividend gem RE Royalties

The importance of alternatives to oil and gas is once again becoming increasingly clear. RE Royalties is one of the companies benefiting from this trend. The company finances projects in the fields of solar, wind, hydropower, and energy storage. Thanks to its activities in the US, it also benefits directly from the growing energy demand of AI data centers. In addition, the stock attracts investors with a dividend yield of more than 9%. Nordex also plans to pay dividends in the future. The stock would normally be considered due for consolidation after its recent rally. However, a steady flow of new orders continues to support the share price. Nel shareholders are still far from receiving dividends. The latest results for Q4 2025 and the company's outlook have been disappointing. Are new catalysts in sight?

ReadCommented by André Will-Laudien on March 12th, 2026 | 07:05 CET

Sector rotation favors biotech and life sciences! BASF, MustGrow, Novo Nordisk, and BioNTech in focus

Surprises are currently widespread. Former Agriculture Minister Cem Özdemir will now lead the state parliament in Baden-Württemberg. The Green Party won over 30% of the vote in a landslide victory, putting issues such as environmental protection, social affairs, and, from Mr. Özdemir's time as minister, the agricultural industry back in the spotlight. With a human-centered approach and a focus on healthy nutrition, this means that established agricultural companies are increasingly being forced to reconcile productivity with sustainability. In this environment, MustGrow Biologics is positioning itself as a strategic technology provider whose achievements have already been validated by leading market players. An expanded sector view also includes the life sciences industry with the protagonists BASF, Novo Nordisk, and BioNTech - an exciting mix.

ReadCommented by Nico Popp on March 12th, 2026 | 07:00 CET

Solutions instead of energy crisis: The potential of CHAR Technologies, Linde, and DuPont

The German economy is under enormous pressure. After years of rising energy prices and an increasingly complicated supply of raw materials, the population and industry are gripped by fears of a creeping decline. Electricity prices for energy-intensive companies remain at a level that is significantly higher than in previous years. Industry experts have long warned of a permanent exodus of production capacities to cheaper regions such as the US, where electricity costs for industry last year were less than half those in the European Union. To ensure the survival of industry, new approaches are coming into focus. Solutions are needed that break the dependence on fossil fuel imports and make supply more flexible. Different approaches are being taken here: While Linde and DuPont prefer to partner with the big players, Canadian innovator CHAR Technologies is occupying the exciting niche of decentralized energy generation.

ReadCommented by Armin Schulz on March 11th, 2026 | 07:35 CET

BYD's blade offensive, the raw materials frenzy at Power Metallic Mines, and the Volkswagen earthquake: Seize the opportunity now!

The new battleground of the global economy is hidden behind the inconspicuous casing of a battery. The race for electromobility has long since become more than just a battle for the best range. It is a bitter battle for strategic raw materials and technological supremacy that will determine the winners and losers of the next decade. While the hunger for copper, nickel, and lithium is forcing new mining projects, a wide variety of strategies are colliding in this arena. We take a look at the current situation at BYD, Power Metallic Mines, and Volkswagen and analyze the opportunities and risks.

ReadCommented by Nico Popp on March 11th, 2026 | 07:30 CET

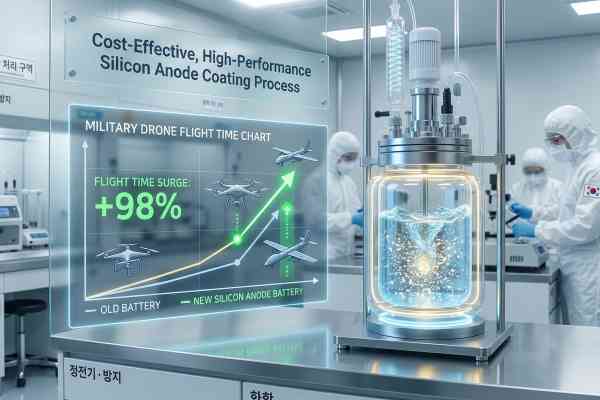

A new drone contender: The potential of NEO Battery Materials, DroneShield, and Amprius Technologies

Energy efficiency and defense capabilities are two sides of the same coin. This is especially true in the rapidly growing drone business, where powerful batteries are crucial. While global demand for batteries continues to rise sharply, according to McKinsey's analysis, the military sector is focusing on a highly specialized niche: maximizing energy density while eliminating dependence on Asian supply chains. The US National Defense Authorization Act (NDAA) for fiscal year 2026 requires that batteries for the Department of Defense be subject to strict criteria in the future in order to end the influence of rival states. In this environment, Amprius Technologies sets the standard with its enormous energy density for long-range drones (UAS). But there is promising competition with its own advantages: NEO Battery Materials' NBMSiDE technology ensures that the batteries in demand can be manufactured independently of China. The technology, which has only been validated in field tests for a few weeks, is entering a market environment in which drone defense is more important than ever. Although the global market leader DroneShield, with its AI-powered defense solutions, is considered the obvious answer to the new threats, drones are increasingly being countered directly by other drones. In this constellation, NEO Battery Materials is coming into the focus of investors.

ReadCommented by André Will-Laudien on March 11th, 2026 | 07:25 CET

Iran, Israel, USA – Investors turn to gold! Buying opportunities for Desert Gold, Barrick Mining, TUI, and Lufthansa

The daily news is not easy to stomach. Wars, conflicts, and human tragedies – who still thinks about traveling at times like these? Or is now precisely the time when people want to switch off and escape for a while? For years, investors have had to live with geopolitical uncertainty. So far, however, this has had little impact on equities, as there are always sectors that receive particular attention in such environments. Gold and silver have weathered the inflation surges since the COVID-19 pandemic remarkably well, while the tourism sector has been more of a roller coaster ride with several loops along the way. But what has worked in recent years is now back on the agenda: buy when the cannons thunder! It may sound lacking in empathy, yet it has consistently increased the wealth of those who accept the world as it is. We once again take a look at gold and the travel sector and prepare for another turbulent ride.

ReadCommented by Armin Schulz on March 11th, 2026 | 07:20 CET

Three trends, one goal: How Bayer, MustGrow Biologics, and BASF are turning the agricultural revolution into a profit opportunity

Three trends are currently driving the global agricultural economy: skyrocketing fertilizer prices, regulatory pressure to preserve biodiversity, and the insatiable hunger of a growing population. As farmers navigate between existential fears and the pressure to go green, a billion-dollar transformation of industry is looming. Old chemistry is reaching its limits, while demand for biological alternatives and precision technologies is reaching an all-time high. Amid this tension between volatility and opportunity, the future of plant production is being reshaped. We take a look at how Bayer, MustGrow Biologics, and BASF are driving this transformation and could benefit from it.

ReadCommented by Nico Popp on March 11th, 2026 | 07:15 CET

Mining comeback in Europe: Solid returns with Group Eleven Resources, Boliden, and Glencore

The European raw materials landscape is undergoing a realignment. For decades, the industry relied on cheap imports from overseas. But those days of largely unchallenged globalization are coming to an end. In order to end dependence on uncertain supply chains and ensure the survival of the industry, the focus is shifting to domestic extraction of critical metals. The European Commission has defined clear goals with the Critical Raw Materials Act and the ambitious RESourceEU Action Plan: By 2030, 10% of the mining and 40% of the processing of critical metals should occur within the EU. In this environment, the European zinc and silver sector is making a comeback. While zinc has historically been in demand primarily in the construction industry, it is now indispensable for the corrosion protection of wind turbines. Silver is even becoming a critical industrial metal due to the tremendous boom in artificial intelligence (AI) and the construction of data centers. Ireland, in particular, is establishing itself as a raw materials region in this phase. The country has one of the world's most productive geological provinces for high-grade base metals and boasts excellent geoscientific data from the Tellus program. Established mining giants such as Boliden and Glencore are setting standards, while up-and-coming explorers such as Group Eleven Resources are shining with spectacular discoveries and offering investors extremely lucrative entry opportunities.

Read