July 17th, 2024 | 09:00 CEST

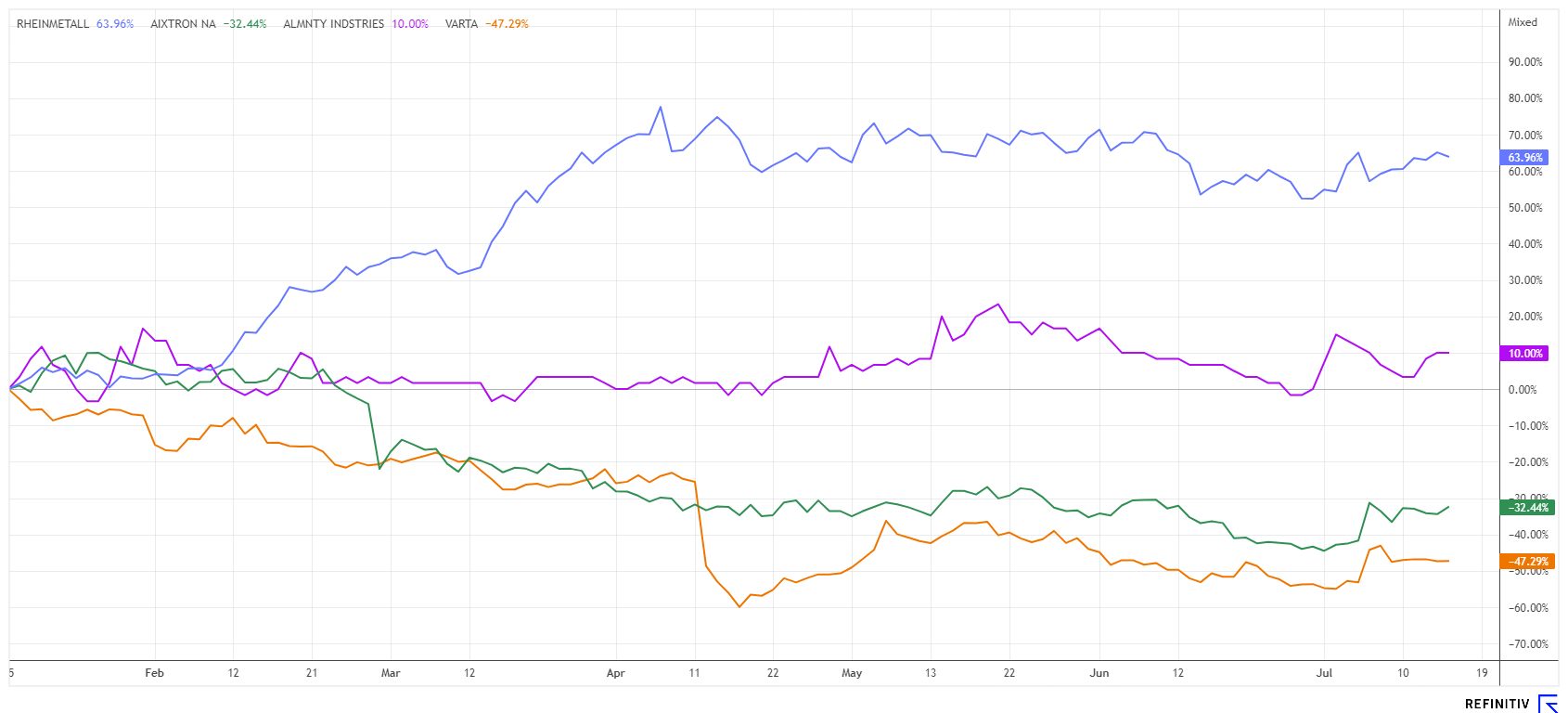

Elon Musk finances Donald Trump - Now a strategic move with Rheinmetall, Aixtron, Almonty Industries, and Varta

An assassination attempt with consequences. Tech billionaire Elon Musk has expressed his deepest solidarity with presidential candidate Trump following the assassination attempt. The Tesla CEO will henceforth financially support the Republican presidential candidate's campaign massively. Musk intends to provide around USD 45 million per month, as reported by the Wall Street Journal. The latest election polls now put the Republican clearly ahead of Biden. This could lead to a strongly US-oriented policy in the spirit of "America First". Above all, Trump aims to halt immigration, invest in the ailing infrastructure, massively arm the national security, and revitalize "Old America". Everything suggests that the blockbuster sectors of high-tech and armaments will continue thriving for now. The focus is clearly on strategic raw materials due to the efforts to reduce foreign dependencies. Where are the opportunities for shareholders?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , AIXTRON SE NA O.N. | DE000A0WMPJ6 , ALMONTY INDUSTRIES INC. | CA0203981034 , VARTA AG O.N. | DE000A0TGJ55

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall - Important for Ukraine, but in the Kremlin's sights

Russia is said to have planned an assassination attempt on Armin Papperger. Anyone committed to Ukraine's defense capability is at risk. Papperger's company, Rheinmetall, is the second-largest armaments company in Germany. Last year, the arms manufacturer generated revenue of around EUR 7.2 billion, with a jump to EUR 9.8 billion expected in the current year. The decisive factor for this operational upswing is primarily Russia's war of aggression against Ukraine. This is starkly evident when comparing past figures: Revenue was still at EUR 4.5 billion in 2022 - demonstrating a doubling in just two years.

Management recently announced that it will soon be able to provide 700,000 rounds of ammunition per year. There are also plans to build the Lynx tanks in Ukraine itself. With the commitment to support Ukraine, the CEO has become a target for Russia. According to insiders, his security protection is as high as that of German Chancellor Olaf Scholz. Papperger makes no secret of the fact that he wants to work off orders from the German government for the benefit of his shareholders. The Rheinmetall share hardly reacted to the attack rumors and remained stable above the EUR 500 mark. We continue to recommend implementing a stop at EUR 495. If the price turns, it will likely do so very quickly because when it comes to valuation, 2026 figures are already being priced in.

Aixtron - First glimmer of hope

The news situation at chip technology company Aixtron is gradually improving, as the Management Board and analysts are already looking ahead again after the last sales and profit warning and are focusing on stabilization. After somewhat slower growth in Q1, things should soon pick up again. The current news situation also fits in with this. Aixtron supports Nexperia in expanding its 200mm volume production for SiC and GaN power devices. Global semiconductor company Nexperia is headquartered in Nijmegen, the Netherlands, and operates factories in Hamburg and Greater Manchester. For its next product series, management has chosen Aixtron's market-leading G10 SiC equipment. Aixtron CEO Felix Grawert is visibly relieved, as the existing concerns about a possible dip in demand for SiC production equipment are likely to diminish with every announcement of new orders. Investors will find out more details on July 25 with the half-year figures. Prices below EUR 20 are history for the time being. The turnaround could work!

Almonty Industries - A center for high technologies is being created

Industrial manufacturing on a large scale involves a whole basket of important raw materials. The heat-resistant hardening metal tungsten is in demand in vehicle technology, high-tech, and defense sectors. As with many metals, there has been a dependency on China for years, as 70% of global demand is mined there. The geopolitical changes between the US-dominated West and the newly formed BRICS group of states appear dangerous. They are increasingly captivating countries seeking to distance themselves from the US dollar zone. Tungsten, in particular, could become a difficult-to-source metal.

As already reported several times, the Canadian company Almonty Industries is setting out to significantly increase the amount of tungsten available for Western industrial customers. Currently, they own four properties in Europe and South Korea. Things are about to get exciting in Sangdong. Almonty Korea Tungsten Corp. (AKTC) has announced that the foundation stone for the downstream tungsten oxide plant has been laid. It is located in the Yeongwol district, around 30 kilometers from the revitalized Sangdong tungsten mine. It will provide a new location for high-tech companies that use local mineral resources for their production processes. Almonty is transparent about its commitment to exclusively supply the West with its raw materials to alleviate tensions with Western governments.

AKTC intends to produce refined and smelted tungsten and tungsten alloys. In the course of construction, AKTC plans to invest around 100 billion won (approx. USD 72 million) in the construction of the downstream tungsten oxide plant and a further 40 billion won (approx. USD 29 million) in the modernization of the processing plant. Once implemented, Yeongwol-gun will become an outpost of the Korean industrial belt, with the prospect of many jobs and a high regional economic dynamic. The settlement will contribute to building a national resource security system by securing a stable supply chain for the strategic minerals needed for Korea's high-tech industry. Almonty Industries, with a market value of almost EUR 110 million, is already in the sights of international mining groups. The share price is currently moving sideways; a good time to position oneself.

Varta - Talks with Porsche again

Close observers of the Varta share have noticed repeated turnover accumulations in the EUR 10 range in recent weeks. There is a reason for this: the battery manufacturer from Ellwangen is currently back in negotiations with Porsche about a possible investment by the sports car manufacturer in the large-format lithium-ion cell business (V4Drive). A majority stake in V4Drive Battery GmbH, a wholly-owned subsidiary of Varta AG, is under discussion. Varta and Porsche have already signed a non-binding letter of intent in this regard. It will still take some time, as the parties are in the first phase of agreeing on the documentation for such a transaction, as Varta recently announced in a press release. As is usual with such projects, several due diligence reviews are now underway, and ultimately, the Varta shareholders must also give their approval.

Varta is currently undergoing a tough restructuring program, which is to be completed by 2026. In March 2021, the Ellwangen-based company announced its intention to produce battery cells for electric vehicles, but there was no real go-ahead for mass production. This was recently followed by another sales warning. The background to the adjustment is a significant deterioration in the market environment for energy storage systems, particularly in the second quarter of the current year. At least the share price has finally stabilized at around EUR 10. However, the Company will still have a long way to go before it is repositioned. Anyone buying today should, therefore, be patient for at least 3 years.

The attack on Donald Trump shows the divided nature of the American people. While many are secretly cheering the attack, patriots, in particular, are shocked by the brutalization of conditions and are denouncing the security situation. It remains likely that the US will return to Republican rule in the fall. For investors, this means a preference for the high-tech, defense, and infrastructure sectors. If the Fed also cuts interest rates, investors can prepare themselves for a hot fall.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.