VIDAC PHARMA HOLDING PLC

Commented by Mario Hose on February 27th, 2026 | 07:05 CET

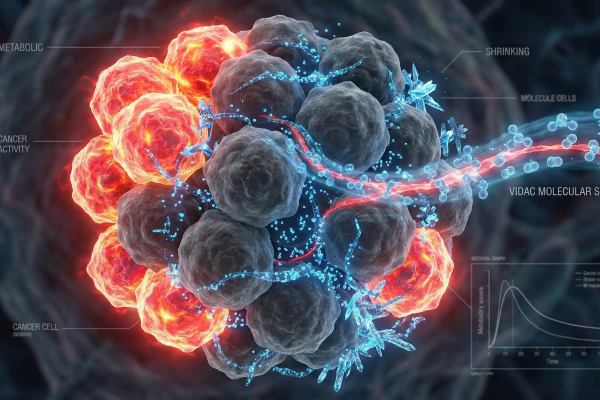

Revolution in cancer therapy: Vidac Pharma attacks the cancer throne of the big players! Why the smaller competitor could steal the show from giants like Bayer and BioNTech!

The world of biotechnology and pharmaceuticals is currently in turmoil, as technological breakthroughs and strategic realignments promise an exciting future for investors. The focus is particularly on Vidac Pharma, an innovative company that wants to revolutionize the fight against cancer with a completely new approach to oncology and is currently celebrating one milestone after another. While Vidac Pharma shines with impressive clinical progress and strong internal backing from its main shareholder, Dr. Max Herzberg, industry giant Bayer has recently struggled with the late effects of the Monsanto acquisition, but is now increasingly being touted as an exciting candidate for a split or takeover by financial investors. At the same time, BioNTech remains synonymous with cutting-edge mRNA technology, with the market eagerly awaiting the next phase after the pandemic. In this dynamic environment, Vidac Pharma is emerging as a particularly bright star in the biopharmaceutical sky, causing a sensation with its unique method of specifically normalizing the metabolism of cancer cells.

ReadCommented by Armin Schulz on February 17th, 2026 | 08:10 CET

Cancer Research as a Growth Driver: How Bayer, Vidac Pharma, and Pfizer can enrich your portfolio

Oncology will be put to the test for the pharmaceutical industry in 2026. Never before have so many highly specialized active ingredients been on the verge of market launch at the same time. While checkpoint inhibitors and targeted therapies are revolutionizing treatment, business models are shifting from broad-based approaches to precision medicine. But the reality remains complex: between medical advances, narrow patient groups, and pressure on prices, companies need to readjust. Current developments at Bayer, Vidac Pharma, and Pfizer show how three players with different strategies are responding to this change.

ReadCommented by Fabian Lorenz on February 10th, 2026 | 11:20 CET

SHARE PRICE FIREWORKS! RENK and Novo Nordisk shares take off! Vidac Pharma next?

Share price fireworks at Novo Nordisk yesterday. The battered pharmaceutical stock rose by around 6%. After a weak outlook and the prospect of increasing competition for its blockbuster product, there was some positive news for a change: a competing product is not permitted to be sold in the key US market. RENK shares also rose significantly yesterday. Since last Thursday, the share price has risen by over 10%. Positive analyst commentary is increasing. Vidac Pharma is poised for a rally. The biotech company is working on an attractive oncology pipeline, has once again secured an important patent, and the stock is receiving tailwinds from its Xetra listing. Analysts see the potential for a multiplication.

ReadCommented by André Will-Laudien on February 4th, 2026 | 07:10 CET

Starting signal! Biotech sector benefits from rotation! Keep an eye on Evotec, Bayer, Vidac Pharma, and BioNTech

The stock market has started 2026 on a positive note. The mining and commodities sector recently proved that return opportunities are not limited to the technology sector, with several stocks doubling in price and a few even increasing tenfold. A breath of fresh air is needed, because other sectors also want to enjoy the stock market spring. Life science stocks have indeed taken a break for almost three years. But now they are back! After a long period of silence, selected companies are showing the first signs of a technical recovery. For investors with a penchant for opportunities and timing, now is the time to rethink old strategies and realign portfolios. In cancer research, recent breakthroughs in personalized immunotherapies have significantly increased the prospects of success for clinical trials. We take a closer look.

ReadCommented by Nico Popp on January 30th, 2026 | 07:25 CET

The hunt for the cancer pill from BioNTech & Co.: Why Eli Lilly's billion-dollar bet is a wake-up call for Vidac Pharma

It is one of the oldest rules in the biotech sector: when the big pharmaceutical companies can no longer grow on their own, they open their coffers. The latest billion-dollar deal between US giant Eli Lilly and Dresden-based startup Seamless Therapeutics is more than just a headline – it is a wake-up call for the entire industry. Eli Lilly, now one of the most valuable companies in the world, is desperately seeking innovations to secure its pipeline beyond its booming weight-loss injections. This hunger for new mechanisms of action inevitably focuses attention on small, specialized companies researching revolutionary approaches. In this environment, Vidac Pharma is becoming the focus of strategic investors. The Company is working on an approach that is as elegant as it is radical: it aims to starve cancer rather than poison it by manipulating its metabolism. While Eli Lilly and BioNTech are spreading their billions across a wide range of areas, Vidac is delivering precisely the kind of specialized "deep science" that is often lacking in the pipelines of the big players.

ReadCommented by André Will-Laudien on January 19th, 2026 | 07:20 CET

Black Monday: Despite Greenland disputes, tariffs, and Mercosur, biotech is on the rise! Bayer, Vidac Pharma, BioNTech, and Novo Nordisk in focus

The stock market has had a very volatile start to 2026. Now, due to the unresolved Greenland issue, punitive tariffs are even being reintroduced for European countries that wish to stick with the Danish administration. Questions of international law did not impact the stock market in any of the conflicts of 2025. What usually receives a lot of attention, however, are shrinking margins caused by artificial tariffs. Just as the EU had been patting itself on the back over the Mercosur agreement, the next Trump-style threat is looming. The biotech sector is advancing steadily and with considerable momentum. Can the life sciences leaders outperform the DAX?

ReadCommented by Nico Popp on January 14th, 2026 | 07:20 CET

Targeting cancer metabolism: Why Bayer and Pfizer are restructuring - and why Vidac Pharma is filling a scientific gap

The investment year 2026 marks a decisive turning point for the global biotechnology and pharmaceutical sector. After a period of macroeconomic uncertainty, we are witnessing a renaissance in the life sciences, driven by two fundamental forces: the urgent need for big pharma players to replace their expiring patents with innovation, and the scientific breakthrough of novel mechanisms of action in agile biotech small caps. While industry giants such as Pfizer and Bayer are attempting to steer their cumbersome tankers onto a new course through massive restructuring, the as-yet little-noticed biotech company Vidac Pharma is delivering the technological innovation the market is looking for. With an approach that directly addresses cancer metabolism and reverses the "Warburg effect," which has been known for almost a century, Vidac is positioning itself as a disruptive force in oncology and dermatology. For investors, this constellation offers a rare opportunity: to observe the stability of the giants while betting on the explosive potential of a technological innovator that analysts say is massively undervalued.

ReadCommented by Armin Schulz on January 8th, 2026 | 07:05 CET

How to benefit from the healthcare industry's comeback in 2026: Novo Nordisk, Vidac Pharma, and Pfizer in focus

After a disappointing year for investors in the pharmaceutical and biotech industries, the tide is now turning decisively on the stock market for these stocks. Political clarity, a return to major acquisitions, and groundbreaking clinical data are laying the foundation for a sustainable comeback. This new optimism is opening up concrete opportunities for strategic investments. Three companies exemplify these promising drivers: Novo Nordisk, Vidac Pharma, and Pfizer.

ReadCommented by André Will-Laudien on January 2nd, 2026 | 07:05 CET

Attention - fasten your seatbelts! 2026 could be a rocket launch for Novo Nordisk, Evotec, Bayer, and Vidac Pharma

The stock market is starting the new year 2026 in a buoyant mood. The mining and commodities sector showed that it is not only possible to make money with tech stocks, with almost every stock doubling in value, and some even increasing tenfold. The coming year, however, could bring yet another shift in perspective. The biotech sector has been quiet for quite some time, but some of the protagonists in our selection are showing, in part, significant technical base formations. For risk-aware investors, it may be time to reshuffle more decisively and realign portfolios. Come in and find out!

ReadCommented by Carsten Mainitz on December 23rd, 2025 | 08:45 CET

USD 600 billion market potential – Pfizer and Bayer are in the race, Vidac Pharma in the fast lane?

The market for cancer drugs is the largest segment within the pharmaceutical industry and currently has a volume of over USD 200 billion. According to experts, the market will already be worth USD 500 to 600 billion by 2032 or 2033. Companies such as Pfizer and Bayer are among the industry leaders. As is often the case, however, there are promising stocks from the second and third tiers beyond the blue chips. One such company is Vidac Pharma. The Company is pursuing a new, promising approach to skin cancer. Analysts attest to the shares' great potential.

Read