June 10th, 2024 | 07:15 CEST

Evotec, Vidac Pharma, Bayer - Biotech and Pharma: Opportunities for investors

In the constantly evolving pharmaceutical and biotechnology industry landscape, innovative strength and strategic orientation play a decisive role in success. Both established groups and young, up-and-coming companies are competing for market share and scientific breakthroughs. In this context, it is worth taking a closer look at Vidac Pharma, Bayer and Evotec. These companies are pursuing different approaches and strategies to achieve their respective goals. How do they manage to hold their own in a highly dynamic market environment, and what prospects are emerging for the future?

time to read: 4 minutes

|

Author:

Armin Schulz

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , EVOTEC SE INH O.N. | DE0005664809

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

Armin Schulz

Born in Mönchengladbach, he studied business administration in the Netherlands. In the course of his studies he came into contact with the stock exchange for the first time. He has more than 25 years of experience in stock market business.

Tag cloud

Shares cloud

Evotec - Strategic realignment

Evotec's main objective is to develop disease-modifying and transformative therapies for patients with serious neurodegenerative and metabolic diseases. The latest financial results for the first quarter showed a 2% decrease in revenues to EUR 208.7 million, mainly due to weaknesses in the transactional business of the Shared R&D segment. However, the Just-Evotec Biologics segment achieved decent growth with a 383% revenue increase to EUR 53.5 million. These different developments underline the need for the new reporting segments to provide clearer insights into the different business areas.

The adjusted Group EBITDA also fell to EUR 7.8 million, which is attributable to increased costs. Despite the moderate decline in revenues, Evotec is optimistic for the full year 2024, with double-digit revenue growth and mid double-digit growth in adjusted Group EBITDA expected. This is based on new and expanded collaborations, such as the partnership with Owkin to accelerate the therapeutic pipeline in oncology and immunology. Evotec continues to rely heavily on collaborations to support the Company's growth.

Several major partnerships and projects were announced in the first quarter, including a strategic collaboration with Bristol Myers Squibb in neurology with a funding contribution of USD 25 million. The new partnership with Bristol Myers Squibb aims to accelerate Evotec's therapeutic pipeline in oncology and immunology. The latest collaboration with the CHDI Foundation aims to develop therapies for Huntington's disease. The continued partnership with Qiagen to utilize their OmicSoft Land database also underscores Evotec's commitment to technological innovation and more precise therapeutic approaches. So far, the positive news has not boosted the share price. It is currently trading at EUR 8.82.

Vidac Pharma - Important patent approval

The biopharmaceutical company Vidac Pharma, which specializes in developing innovative cancer treatments, has recently achieved a significant milestone. On June 3, the Company was awarded a key patent for its group of molecules by the US Patent and Trademark Office. These molecules can release the enzyme hexokinase-2 (HK2) from the mitochondrial VDAC pores, which triggers an immune response in various types of cancer. This advance strengthens Vidac Pharma's position in the market and demonstrates the potential of its therapies to revolutionize cancer treatment.

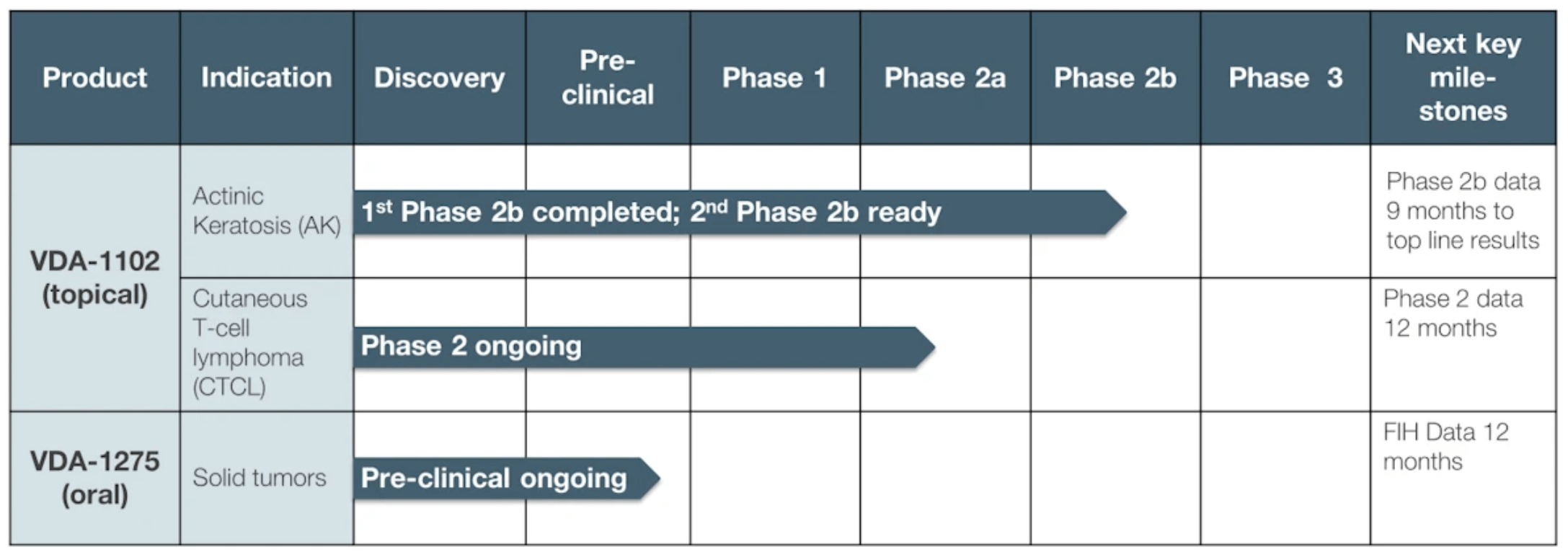

In preclinical studies, Vidac's promising drug candidate VDA-1275 has shown strong synergistic effects in combination with conventional chemotherapies. Of particular note is its efficacy in combination with cisplatin in treating solid tumors. CEO Prof. Dr. Max Herzberg emphasizes the importance of these trials on the way to clinical studies and sees the laboratory tests to date as confirmation of the Company's approach. These positive study results indicate that VDA-1275 is potentially suitable for broad application in cancer therapy.

In addition to VDA-1275, the compound VDA-1102 also plays a central role in Vidac Pharma's pipeline. This compound, which is currently in Phase 2b clinical trials for treating actinic keratosis and cutaneous T-cell lymphoma, interrupts the interaction between HK2 and the voltage-dependent anion channels in the mitochondria. These mechanisms stop the growth of cancer cells and promote apoptosis and immunosensitivity. The clinical data to date indicate high efficacy and safety, which further increases the prospects of success for Vidac Pharma and makes investors optimistic about future developments. The share continues to bottom out between EUR 0.16 and EUR 0.204 and is currently trading at EUR 0.19.

Bayer - Significantly reduced penalty payment in glyphosate litigation

Bayer presented mixed results for the first quarter of 2024. Group revenue reached EUR 13.765 billion, a slight decline of 0.6% compared to the previous year, negatively impacted by currency effects of EUR 525 million. EBITDA before exceptionals fell by 1.3% to around EUR 4.4 billion, while adjusted earnings per share declined by 4.4% to EUR 2.82. Despite these challenges, Bayer confirmed its currency-adjusted outlook for the full year, showing confidence in its planned growth strategy.

The picture within the various divisions was mixed. The Pharmaceuticals division recorded sales growth of 3.9% thanks to new products such as Nubeqa™ and Kerendia™. By contrast, the Agriculture division (Crop Science) recorded a decline of 3.0%, although it still outperformed the market. Although Consumer Health recorded a slight decline in sales of 1.8%, strategic pricing compensated for some of the losses. In the future, the Leverkusen-based company intends to focus on innovation and efficiency improvements to remain competitive in a volatile market environment and maximize future opportunities.

A significant event in the litigation surrounding the glyphosate-based weedkiller Roundup brings Bayer at least partial relief. A court in Philadelphia reduced the original fine of USD 2.25 billion to USD 400 million. Although welcomed by Bayer, this decision continues to be viewed critically as the Company intends to appeal against some aspects of the judgment. Despite this reduction, the stock market is cautiously optimistic and remains cautious due to the pending lawsuits. On Friday, the shares closed Xetra trading at EUR 28.09.

In the dynamic pharmaceutical and biotechnology industry, Evotec is looking to the future through strategic collaborations and growth potential. Vidac Pharma strengthens its position through significant patent approvals and promising study results. Bayer remains confident and focused on innovation despite declining revenue and legal disputes. While Evotec and Vidac are gaining a foothold in the market with new approaches, Bayer is navigating through challenges to remain competitive in the long term.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.