July 25th, 2024 | 08:20 CEST

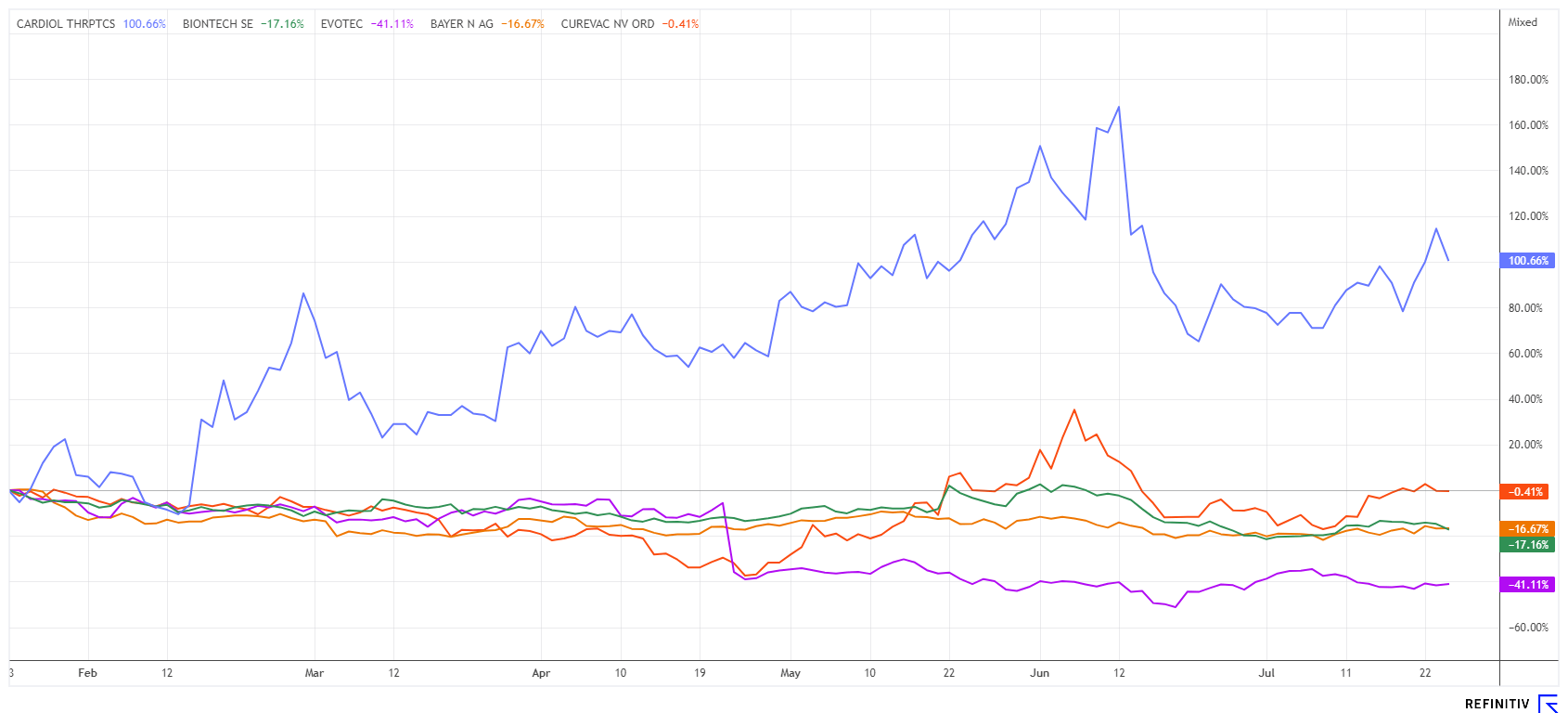

BioNTech, CureVac, Bayer, Cardiol Therapeutics, and Evotec: Tripled and still in turbo mode?

On the stock market, separating the wheat from the chaff is essential, especially in the biotech sector. This task becomes challenging when ongoing studies conclude, and their results must be interpreted. The market does not always react correctly to announcements, as evidenced by this year's acquisition of MorphoSys. While the stock market rejected the supposedly poor results, Novartis built up the first favourable positions, ultimately acquiring the Munich-based company for EUR 2.7 billion. From a low of around EUR 12, the acquisition price was a high EUR 68, making it a 500% deal. But opportunities are always lurking. Here is a selection of promising candidates.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , CUREVAC N.V. O.N. | NL0015436031 , CARDIOL THERAPEUTICS | CA14161Y2006 , EVOTEC SE INH O.N. | DE0005664809 , BAYER AG NA O.N. | DE000BAY0017

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec or Bayer - Who will turn the corner first?

Finally, some good news! The Evotec share has received three upgrades in the past few days. Meanwhile, the eagerly awaited half-year figures will not be published until August 14. Apparently, the recent technical bottoming out at around EUR 8 has instilled confidence in analysts. The difficult period following the Lanthaler affair seems to be over, and investors are again focusing on the operational side. Most recently, the investment bank Jefferies spoke out, now voting 'Buy' with a target price of EUR 16 - a near doubling of the current EUR 8.80. Canada's RBC is sounding the same note. Warburg in Hamburg is leaning a little further out of the window at EUR 18, with hopes pinned on the recent expansion of the partnership with Sandoz. It seems the sails are already set ahead of the half-year report.

Bayer's yo-yo movement between EUR 25 and EUR 28 continues unabated. As there are currently no new lawsuits from the glyphosate corner, investors are once again looking more confidently at the Pharmaceuticals division. The next study data on Kerendia are on the agenda here. The active ingredient against chronic kidney disease could possibly make up for the loss of sales of Xarelto and Eylea. The analysts at JPMorgan see the Kerendia event as a trigger and remain on the sidelines for the time being with a 'Neutral' rating and a price target of EUR 34. Kerendia has already been approved and is used to treat adults with abnormal levels of the protein albumin in the urine in connection with type 2 diabetes. In Q1, the Leverkusen-based company was already able to generate sales of EUR 85 million with this product, which, of course, does not yet help it out of the valley of tears. The Q2 figures will be available on August 6.

Both Evotec and Bayer should now have reached the bottom of the long correction. We expect a gradual improvement in the operating data and medium-term price gains. Keep an eye on the technical resistances at EUR 9.80 and EUR 28.80, respectively.

Cardiol Therapeutics - This stock is generating enthusiasm

Investors currently have little to worry about with the Canadian biotech stock Cardiol Therapeutics. The Nasdaq-listed stock (CRDL) experienced a remarkable rally from December to June, soaring from approximately USD 0.83 to USD 2.97. The share is currently back at USD 2.22. In the big picture, this movement appears to be a healthy consolidation. To reach new groups of investors, it is sometimes necessary for early investors to take profits.

Cardiol Therapeutics’ promising drug candidate CardiolRx™ is at the centre of interest. Their novel pharmaceutically manufactured oral solution formulation is well on the way to being able to help people with pericarditis and myocarditis. Research has taken years to address myocarditis with therapeutic methods because heart muscle inflammation is not accompanied by typical symptoms, making it difficult to detect in time. It often follows a respiratory or gastrointestinal viral infection. Less commonly, other germs or autoimmune diseases can lead to this dangerous heart disease. This provides an opportunity for CardiolRx™ to be the first FDA-approved therapy for myocarditis.

The Chimera Research Group has been investigating Cardiol in more detail in the context of the ongoing MAvERIC-Pilot study for recurrent pericarditis, which should be concluded in the third quarter of 2024. Cardiol Therapeutics presented good topline data for CardiolRx™ from the 8-week treatment period of the study, which remarkably aligns with the early data that kicked off an accelerated Phase 3 development program of the one FDA-approved drug for recurrent pericarditis. Chimera is very optimistic about the further course of the study and sees CEO David Elsley's recent purchase of 50,000 shares of CRDL as evidence that the share price pullback should be seen as an attractive entry point. At a share price of USD 2.22, the Company is currently valued at just under EUR 141 million. Collect!

CureVac and BioNTech - The eternal dispute continues

Trouble continues on the court front.The US trial between CureVac and BioNTech/Pfizer has now been set for March 3, 2025, by the District Court in Virginia. The lawsuit is based on material patent infringements during the COVID-19 pandemic. The partners BioNTech and Pfizer generated billions in revenue and profits with the globally distributed Comirnaty vaccine, while CureVac was already claiming the alleged patent infringement at the time. The issues are now being negotiated individually and a result is not expected before mid-2025. CureVac remains the sole plaintiff after reaching an out-of-court settlement with Acuitas Therapeutics. A hearing is now scheduled for September 10, 2024, before the Düsseldorf Regional Court concerning the European patent on separate poly-A sequences and a utility model.

If CureVac were to prevail, payments in the high double-digit or triple-digit million range could be expected. The Biotech share is currently valued at EUR 793 million on the stock exchange. Analysts on the Refinitiv Eikon platform expect BioNTech's revenues to fall from EUR 3.8 billion to EUR 2.7 billion in the current year. This is likely to result in a negative EBIT of EUR 930 million. 8 out of 19 analysts still have a 'Buy' recommendation and the average price expectation is USD 108 compared to the current price of USD 83.5. The CureVac share could become very interesting if the judge sides with the Tübingen-based company.

Sometimes investors wonder about stagnation. It can happen since shares do not always go up or down. In the case of BioNTech, Bayer, and Evotec, there are at least clear signs of a bottom forming. CureVac has already given positive technical signals. And Cardiol Therapeutics may also consolidate after a mega rally. As the entry level falls, the many spectators will finally be able to join the party again. Because the party continues!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.