September 2nd, 2024 | 07:55 CEST

Globex Mining, Bayer, and Plug Power - Which company offers the best return with low risk?

Investors understand the interplay between risk and return. Which sectors offer high returns? The Canadian commodities company Globex Mining skillfully balances risk and return in the commodities sector with its diversified portfolio of over 200 commodities projects in North America and Europe. Its setup is akin to a mini-version of Berkshire Hathaway. Bayer AG is tapping into new growth opportunities in the pharmaceuticals sector with its Phase III study for a lung cancer drug. This is much needed as numerous patents are expiring. Plug Power, a pioneer in hydrogen technology is putting all its eggs in one basket - with the potential for huge profits but also considerable losses, as evidenced by the share price plunge from USD 70 in 2021 to currently below USD 3 shows. Which company offers the best return with low risk?

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

GLOBEX MINING ENTPRS INC. | CA3799005093 , BAYER AG NA O.N. | DE000BAY0017 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

Globex Mining: Canadian commodities incubator on the road to success

The name Warren Buffett is well known to investors worldwide. With the establishment of his investment company Berkshire Hathaway, the now 94-year-old investor has created a life's work from which numerous shareholders and partners benefit. The Company uses cash flows from the insurance business to invest in a broadly diversified portfolio of companies and shares. Berkshire focuses on the long-term acquisition and management of high-quality companies with stable cash flows. The acquired companies are managed largely autonomously, while Berkshire benefits from their dividends and increases in value.

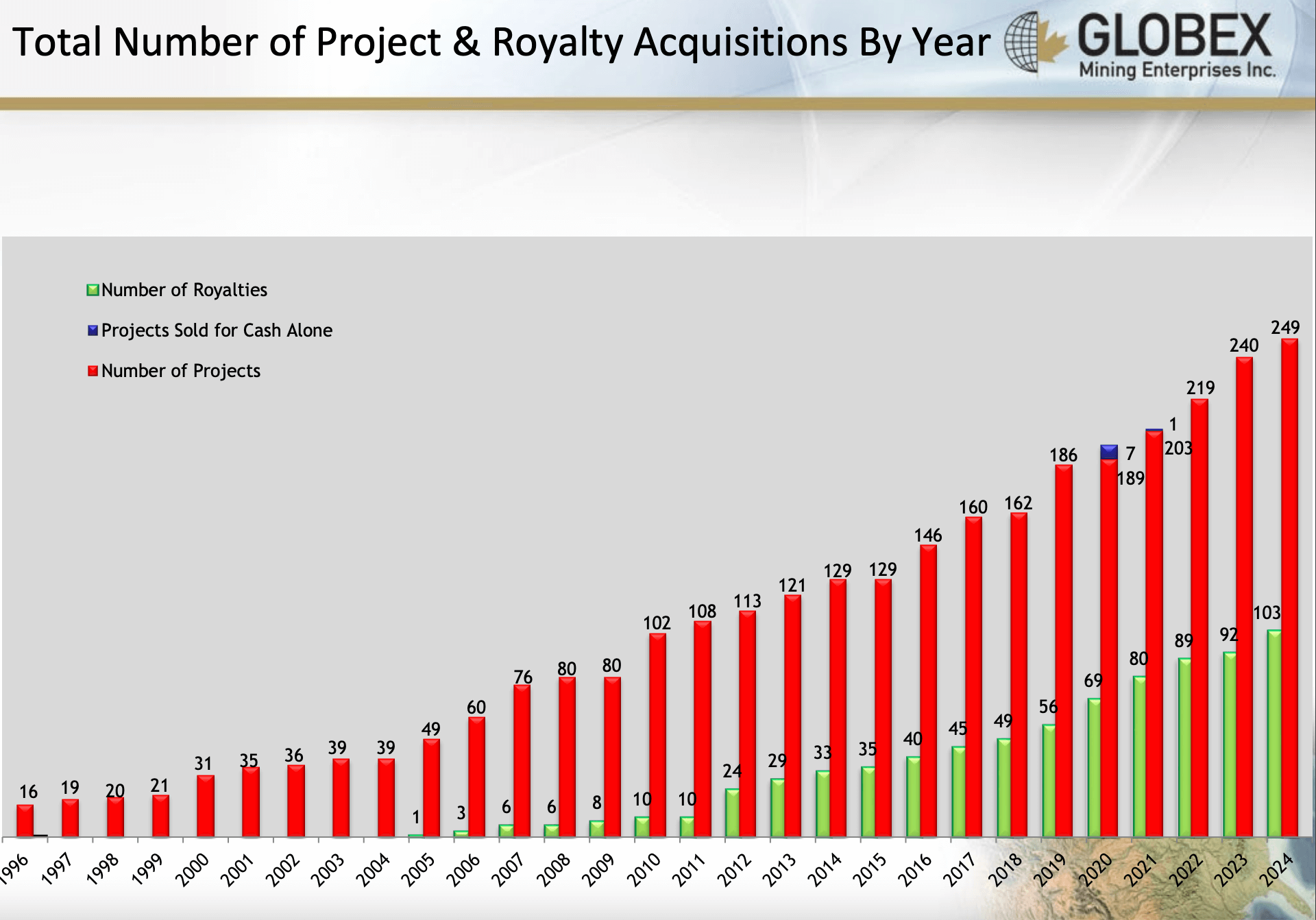

Comparable to Berkshire's portfolio diversity is the Canadian company Globex Mining Enterprises. Globex specializes in the exploration and development of natural resource projects. As a business model, Globex Mining acquires promising early-stage resource projects and upgrades them through initial exploration. It also partners with other mining companies to benefit from further development through option agreements, equity stakes, and future licenses while spreading risk and minimizing its own exploration costs. Globex Mining pursues a diversified strategy with low political risk by focusing on Eastern Canada, Germany, and the US and holds over CAD 20 million in cash, shares, and marketable securities without debt. Assets include over 40 former mines, underscoring the Company's extensive experience and broad portfolio.

The Company recorded a significant financial improvement in the second quarter of 2024. Revenue increased by 99% to CAD 688,900 compared to the same quarter of last year. The Company achieved a net profit of CAD 1.21 million, representing a significant increase compared to the loss of CAD 550,100 in the second quarter of 2023. Earnings per share improved accordingly from a loss of CAD 0.01 to a profit of CAD 0.022.

Bayer launches Phase III study for promising lung cancer drug

German pharmaceutical company Bayer has announced the start of a pivotal clinical study for its drug BAY 2927088 for the treatment of non-small cell lung cancer (NSCLC): The first patient has been enrolled in the Phase III SOHO-02 trial, which is evaluating the efficacy and safety of the drug as first-line therapy in patients with advanced NSCLC and activating HER2 mutations.

The market for non-small cell lung cancer (NSCLC) is expected to grow from USD 16.1 billion in 2021 to USD 38.8 billion by 2030, at a compound annual growth rate (CAGR) of 10.4%. New therapies, such as targeted cancer cell therapies and immunotherapies, are driving market growth. Leaders in this area include Roche, AstraZeneca, Pfizer, Novartis, and Merck.

The FDA granted the compound breakthrough therapy designation in February 2024, followed by a similar designation by Chinese authorities in June. Results from an earlier Phase I/II study will be presented next month.

Bayer sees the development of BAY 2927088 as an opportunity, as there is currently no approved first-line targeted therapy for NSCLC patients with mutations. Success could help the Company strengthen its pharmaceutical division, which is currently suffering from generic competition. The problems in the agrochemicals division are also continuing. In plain language, Bayer is facing patent expirations in the pharmaceuticals sector, and there is a threat of claims for damages from products resulting from the Monsanto takeover.

Despite positive developments in the pipeline, including new studies and regulatory filings, Bayer continues to face setbacks. The shares have lost 16.4% of their value since the beginning of the year. Meanwhile, CEO Anderson continues to streamline internal hierarchies, dismiss executives, and reduce in-house bureaucracy in order to speed up decision-making processes within the Company.

Plug Power fights for trust: Share price slumps, analysts remain optimistic

Relying on a single energy source can lead to significant volatility within that sector. A prime example of this is the current share price of the US company Plug Power. The developer of hydrogen fuel cells is experiencing turbulent times on the stock market. The share price has fallen from a high of USD 70 at the beginning of 2021 to below USD 3. Despite the ongoing losses and financial challenges, Wall Street analysts remain optimistic, with an average price target of almost USD 5 per share.

The difficulty in valuing Plug Power lies in the long-term nature of the business outlook. According to Goldman Sachs analysts, the Company has an equity life of 25.8 years, which means that the weighted average of expected cash flows is about 26 years in the future. This makes forecasting extremely difficult and susceptible to changes in assumptions.

Despite growing demand for clean hydrogen by 2050, the necessary infrastructure is still lacking. In addition, there are elections in the US in November and it is still uncertain what the strategy of the next government will be. Plug Power continues to record high losses while at the same time investing heavily in infrastructure development. Last year, net losses amounted to over USD 1 billion.

Plug has now brought fresh expertise into the boardroom: Colin Angle, the former CEO of iRobot, has been appointed to the Board of Directors. Angle brings extensive experience in technology innovation and strategic leadership. This appointment will support the Company in its global expansion and the development of the hydrogen economy.

Analyst opinions on Plug Power are divided. While some analysts have lowered the price target, others still see potential. The consensus recommendation is "Hold", with an average price target of USD 5.19.

Globex Mining, with its diversified portfolio of over 200 resource projects, shows a remarkable balance between risk and reward. As a "mini version of Berkshire Hathaway" in the commodities sector, the Company offers a broad diversification that reduces the risk of individual projects. Globex Mining is a solid option for investors who want to profit from the commodities sector without taking on too much exposure. Bayer AG urgently needs to tap new growth opportunities as important patents in the pharmaceutical segment are expiring. The Phase III trial for a lung cancer drug provides hope. However, pharmaceutical research also harbors the risk of setbacks. Bayer may have opportunities in the mid-term if the new developments are successful, but the risk remains. In addition, CEO Anderson is still trying to achieve a turnaround within the Company structures. Plug Power represents the highest risk/return profile of the three companies. As a pioneer in hydrogen technology, the Company has enormous potential, as illustrated by the earlier rise in the share price to USD 70. However, the sharp fall to below USD 3 highlights the volatility and risk of this form of energy. There is still a lack of infrastructure. Plug Power could offer the best long-term returns if hydrogen technology prevails. However, the risk remains as to which form of energy will prevail in the future. For investors with a low risk appetite, Globex Mining appears to be the most attractive option. The Company offers solid diversification and has already shown financial improvements. Bayer could be of interest to medium-term investors betting on successful product developments. Plug Power remains a bet on the future of hydrogen technology.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.