September 16th, 2024 | 07:15 CEST

This is unbelievable! 250% with an announcement: Bayer, Vidac Pharma, Evotec, and Valneva

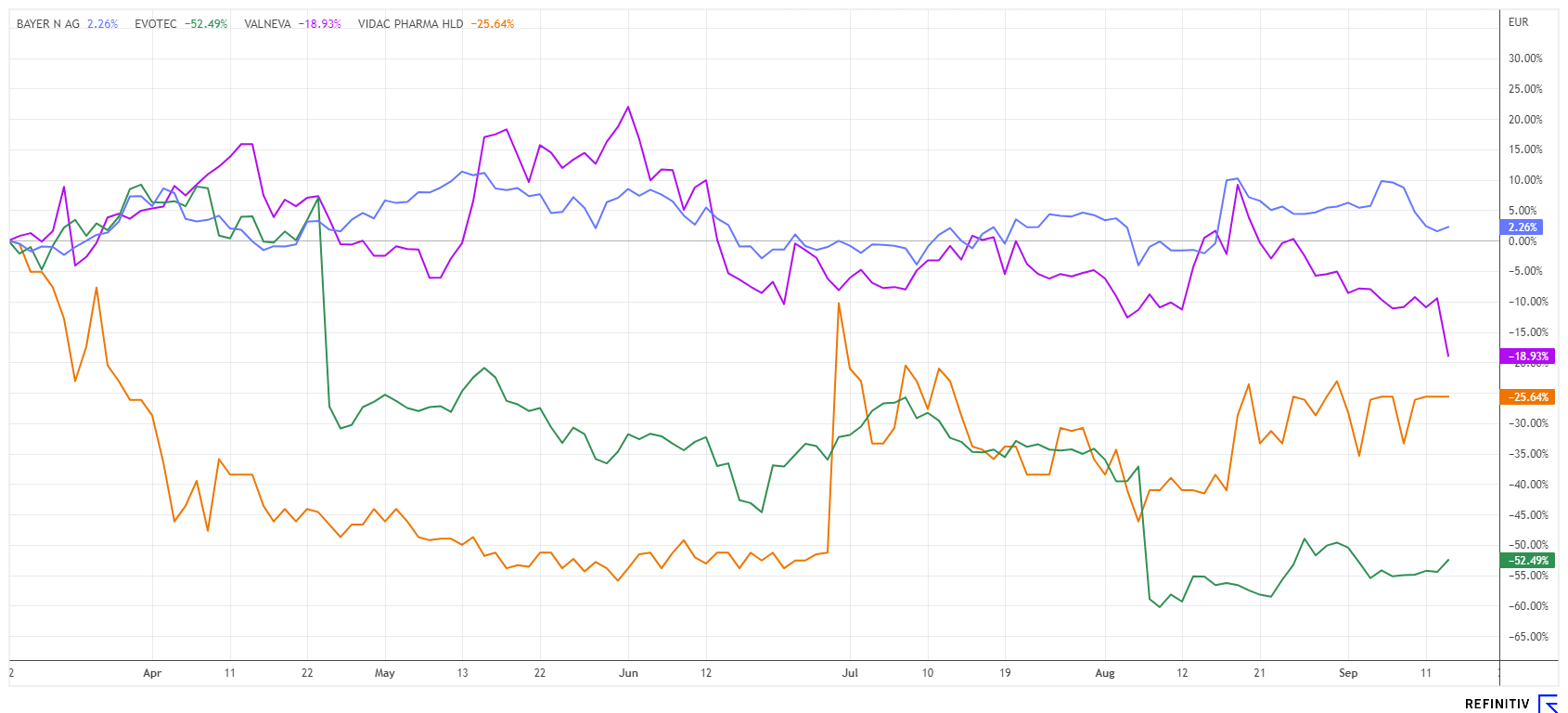

The stock market has been rallying week after week, yet the biotech sector stubbornly lags behind. However, with the first interest rate cut in Europe, the path of lower financing options has now also been mapped out for the US. This week, the FED is set to decide on rate cuts, with 87% of capital market experts expecting a total of three cuts by the end of the year. That would be grist to the mill for growth stocks. Vidac Pharma has already gained 50% in 2 months, and Bayer and Evotec will likely follow soon. Valneva is raising EUR 61 million and aims to break even operationally. What is next for the sector?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , EVOTEC SE INH O.N. | DE0005664809 , VALNEVA SE EO -_15 | FR0004056851

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Valneva SE - Major refinancing weighs on the share price

At EUR 2.83, we currently find the shares of vaccine manufacturer Valneva SE at a 5-year low. The last time the shares of the French-Austrian vaccine manufacturer traded at this price level was at the end of 2019. Due to significant research efforts, the Company placed 23 million new shares with institutional investors at a price of EUR 2.66. Excluding subscription rights, Valneva raised around EUR 61 million. The clinical trials are now set to continue. These include the Phase 3 pediatric and Phase 4 programs for the Chikungunya vaccine and the anticipated Phase 2 programs for the Shigella and Zika vaccine candidates. In addition, a portion of the capital will be used to accelerate preclinical research and development activities and for general corporate purposes. Potential milestone payments and initial revenues from its Lyme disease program give Valneva hope that this is the last of the dilution for existing shareholders and that the operating breakeven point will be reached soon. Unfortunately, the stock has been heavily sold off in recent months and technically looks weak. Wait until the EUR 3 mark is surpassed again before considering any action.

Vidac Pharma - Small molecules against cancer

Those interested in investing in promising biotech small-caps should keep Vidac Pharma on the radar. Despite its manageable size, the Company is already in the clinical development phase. The best-known product, VDA-1275, is the focus of interest according to a specialist article, as this drug candidate for the treatment of solid tumors has achieved impressive results in preclinical studies. As a monotherapy, VDA-1275 shows significant efficacy against tumors. Even more remarkable are the synergistic effects observed when VDA-1275 is used in combination with conventional cancer therapies.

Of central interest is the reversal of the abnormal metabolism of cancer cells to stop their proliferation. This requires a better understanding of the importance of the cells and structures in the immediate vicinity of a tumor. Understanding the interplay between the tumor microenvironment and the cancer itself has opened up new opportunities for drugs to overcome this malignant defense zone. Most cancer cells use aerobic glycolysis as their primary source of energy rather than oxidative phosphorylation. This allows them to take up more glucose, which they use as a carbon source for rapid proliferation and metastasis. The first clinical trials on humans are planned for the first quarter of 2025. These tests mark a decisive step in the development of VDA-1275 and could catapult Vidac Pharma into a new era of cancer treatment options.

Another promising product in the pipeline, VDA-1102, is already in Phase 2 clinical trials. This drug has already shown positive results in the treatment of actinic keratosis. The analyst firm Sphene Capital commented on the promising developments for the first time in July and assessed potential cash flows from commercialization from 2027 onwards. The result was a "Buy" recommendation with an astonishing target of EUR 4.90. The share is currently often traded in large quantities. This could be a sign of interest from major players. The potential is enormous, making the stock highly interesting from a speculative point of view.

Bayer and Evotec - First signs of upward movement

Last week, Bayer overcame the EUR 29 mark in the short term. Positive news about court victories in further glyphosate lawsuits sparked investor enthusiasm. In addition, Bayer published data from the Phase III OASIS 3 study, which is investigating the efficacy and safety of elinzanetant. The drug is to be used in the treatment of moderate to severe vasomotor symptoms during menopause. Positive results from the OASIS 1 and 2 studies had already been obtained, and the safety profile has also been confirmed. Elinzanetant has met the primary endpoint and shows a significant reduction in the frequency of symptoms. Why the share price dipped back below the EUR 27 mark in a positive environment is not clear at first glance. The announced refinancing with new hybrid bonds in the amount of EUR 750 million should not be a further burden on a group worth billions. The bonds, with a term of 30 years and a coupon of 5.50%, were sold exclusively to institutional investors. Up to now, the area around EUR 27 has proven to be a good entry point. Courageous investors should consider entering and adjusting their stop-loss levels upwards accordingly!

The Evotec share has already tested the EUR 6 mark several times in September and finally managed to break out towards the end of the week. Insider purchases are reported time and again, most recently by the new CEO Dr. Christian Wojczewski at a level of EUR 6.11. Investors are still somewhat in the dark about what the Hamburg-based company will do next. However, the short ratio is unusually high and next week, the Company will present itself at the Berenberg Goldman Sachs conference in Munich. Analysts are likely to scrutinize this closely. If sentiment shifts here, it could move quickly, as short sellers may need to cover their positions on short notice. We had already advised an entry below EUR 6 and are now raising our stop-loss level to EUR 6.15. The momentum is building, and the EUR 7 mark should fall significantly by the time of the conference.

Everything points to a hot fall. Interest rate cuts, elections in the US, and shaky economies could really shake up the markets. Statistically, September is one of the worst months on the stock markets. However, the indices are currently gaining points. A turnaround might finally be on the horizon for the biotech sector, as lower interest rates are on the central bankers' agenda.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.