Digitization

Commented by Armin Schulz on March 3rd, 2026 | 07:30 CET

PayPal, Aspermont, Palantir: Three digital business models that are being further optimized through AI

The era of simple digitization is history. What separates companies today from tomorrow is no longer a question of software implementation, but one of fundamental value creation architecture. Artificial intelligence has evolved from an efficiency tool to the operating system of entire business models, with a consequence that is becoming apparent for the first time in the current quarterly figures: those who fail to rethink their scaling strategy are not only giving away growth, but also risking their very existence. We take a look at how PayPal, Aspermont, and Palantir have aligned their digital business models with AI.

ReadCommented by Carsten Mainitz on February 19th, 2026 | 06:55 CET

Stock Picking Alert! Huge upside for Power Metallic Mines, TeamViewer at record low, Barrick solid!

One of North America's largest polymetallic deposits is still available at a bargain price. Analysts at Noble Capital Markets believe Power Metallic Mines' stock could nearly triple in value. Renowned industry giants are already among the company's shareholders, giving it the seal of approval. In terms of valuation, the NYSE listing planned for this year will provide a boost. At Barrick, the precious metals boom is leading to record highs. The planned IPO of North American gold assets has not yet been priced in. Meanwhile, frustration prevails at TeamViewer despite megatrends such as AI. Where is it worth getting in now?

ReadCommented by André Will-Laudien on February 3rd, 2026 | 11:30 CET

Sell-off or healthy correction? Quality stocks in focus: SAP, D-Wave, and Aspermont

Market activity has picked up noticeably in recent days. Upswing here, sharp pullback there! Volatility is back, driven by political statements and economic uncertainties. While the sudden 30% crash in silver is unsettling commodity investors, and SAP shares are undergoing a significant correction, many investors are fleeing to defensive sectors and tangible assets. Crypto markets remain in a downward spiral, and the perennial topic of AI is being viewed with increasing selectivity. Against this backdrop, Australian media and commodities specialist Aspermont is leveraging its long-established network and data assets to accelerate growth using AI. At the same time, it remains to be seen whether there is still hope for higher valuations after the sell-off at SAP and D-Wave. Time to get out the magnifying glass, Sherlock Holmes style.

ReadCommented by Armin Schulz on January 28th, 2026 | 12:00 CET

In the eye of the commodities storm: How Aspermont, with its 190-year history, is becoming the data center of the mining industry

Gold is breaking records, copper is driving the energy transition, and critical raw materials such as rare earths are becoming a geopolitical currency. While investors are considering direct commodity investments, a company that has transformed itself into an indispensable architect of this new era is operating in the background: Aspermont. Once a traditional specialist publisher, the Company has quietly evolved into a data-driven control center for global mining. In a market characterized by resource nationalism and supply chain stress, reliable information is the most valuable commodity. Aspermont delivers just that, not as a cyclical player, but as a provider of critical infrastructure for decision-making. This transformation is complete, financially sound, and meets with a perfect environment.

ReadCommented by Fabian Lorenz on January 28th, 2026 | 07:10 CET

PRICE EUPHORIA at OHB! Rheinmetall takes on Airbus and Elon Musk? D-Wave completes acquisition! Finexity shares take off!

Could Rheinmetall, together with OHB, soon challenge Elon Musk's Starlink and Airbus? At any rate, OHB's share price reacted with a jump of more than 50%. Finexity shares have also surged. Following its pilot project with a savings bank, the Company has brought another exciting partner on board for its marketplace for tokenized assets. The price jump is likely to be just the beginning, as the market capitalization remains low. By contrast, D-Wave shares are showing no signs of slowing down. The Company has successfully completed an important acquisition, which is expected to be a milestone in strengthening its leading position in the quantum computing space.

ReadCommented by Nico Popp on January 23rd, 2026 | 07:05 CET

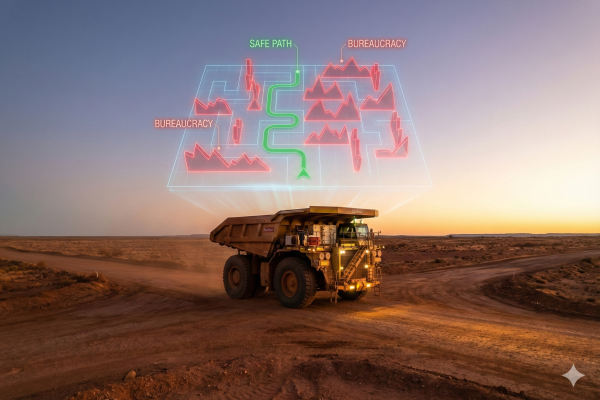

The battle for resources is being fought in the data room: How Aspermont Uses AI to Boost the Returns of Rio Tinto, Alamos Gold & Co.

It is the greatest paradox of the modern economy: while demand for copper, lithium, and rare earths is exploding due to trade wars and the insatiable appetite of the AI industry, building a new mine has never been more difficult. Large mining corporations are increasingly failing not because of geology, but because of bureaucracy, environmental regulations, and, in remote regions of the world, geopolitical pitfalls. In this new era, where a legally binding permit is often more valuable than spectacular drilling results, validated information is becoming the most critical resource in the commodities sector. Analyst firms such as McKinsey and the International Energy Agency (IEA) warn of a massive structural supply deficit, as the development of new mines in the West often requires more than a decade of legal wrangling. It is precisely in this area of tension that the Australian media and tech company Aspermont is positioning itself as the decisive problem solver. With a treasure trove of data spanning centuries of industrial history and a new alliance with industry giant Rio Tinto, the Company is transforming itself from a media company into a kind of "Google of mining" – offering investors an opportunity based on intelligence rather than luck.

ReadCommented by Nico Popp on January 22nd, 2026 | 06:55 CET

AI and the uranium comeback: How American Atomics is becoming the winner of the energy transition and what that has to do with Meta Platforms and Infineon

The era of artificial intelligence (AI) is not only an era of enormous productivity gains, but above all an era of infrastructure and gigantic energy consumption. While the last decade was dominated by software, the future will be all about hardware. Generative AI and the path toward artificial general intelligence (AGI) are transforming data from an intangible asset into a massive consumer of power. Analysts at Goldman Sachs estimate that investments by major US tech companies in energy infrastructure could reach the astronomical sum of over USD 500 billion by 2027. This new reality is forcing a two-pronged energy strategy: on the one hand, the massive expansion of storage and efficiency technologies, and on the other, the inevitable return to the only CO2-free energy source that reliably provides base load – nuclear power. We explain what tech titan Meta Platforms and chip manufacturer Infineon have to do with this development and why American Atomics is considered a highly speculative but strategically brilliant bet on the uranium comeback.

ReadCommented by Armin Schulz on January 21st, 2026 | 08:25 CET

Evotec, A.H.T. Syngas Technology, Deutsche Telekom: Three stocks on the verge of a decisive turning point?

Germany's economy is at a crossroads. Its old strengths are crumbling, but this is precisely what opens up opportunities for companies that are strategically realigning themselves. The key to success is not simple adaptation, but a fundamental turnaround. Three decisive paths are emerging: disruptive innovation in the biotech industry, energy production and decarbonization, and the development of sovereign digital networks. Today, we take a closer look at three companies and analyze which stocks are on the verge of a turnaround: Evotec, A.H.T. Syngas Technology, and Deutsche Telekom.

ReadCommented by Armin Schulz on January 20th, 2026 | 07:30 CET

How to position yourself in time for the upcoming trend in 2026: Deutsche Bank, Finexity, and Coinbase in focus

The boundary between traditional and digital markets is disappearing. Driven by clear regulation and institutional engagement, tokenization is now reaching the mass market. This fundamental transformation is creating unprecedented efficiency and new asset classes. Those who understand how established financial giants and digital pioneers are shaping this wave will be able to identify early opportunities. We see Deutsche Bank as a German financial heavyweight, Finexity as a pioneer in digital assets, and Coinbase as a global crypto exchange – all key players in this new ecosystem.

ReadCommented by Stefan Feulner on January 20th, 2026 | 07:00 CET

Polymetallic treasure discovered – Power Metallic Mines with massive potential

Electrification, the energy transition, defense spending, and digitalization are structurally driving up demand for conductive and critical metals. At the same time, geopolitical tensions and fragile supply chains are intensifying competition for reliable sources of raw materials. North America is increasingly coming into focus as a secure counterweight. It is precisely in this environment that Power Metallic Mines is positioning itself, with one of the most promising polymetallic exploration projects on the continent.

Read