June 18th, 2024 | 07:00 CEST

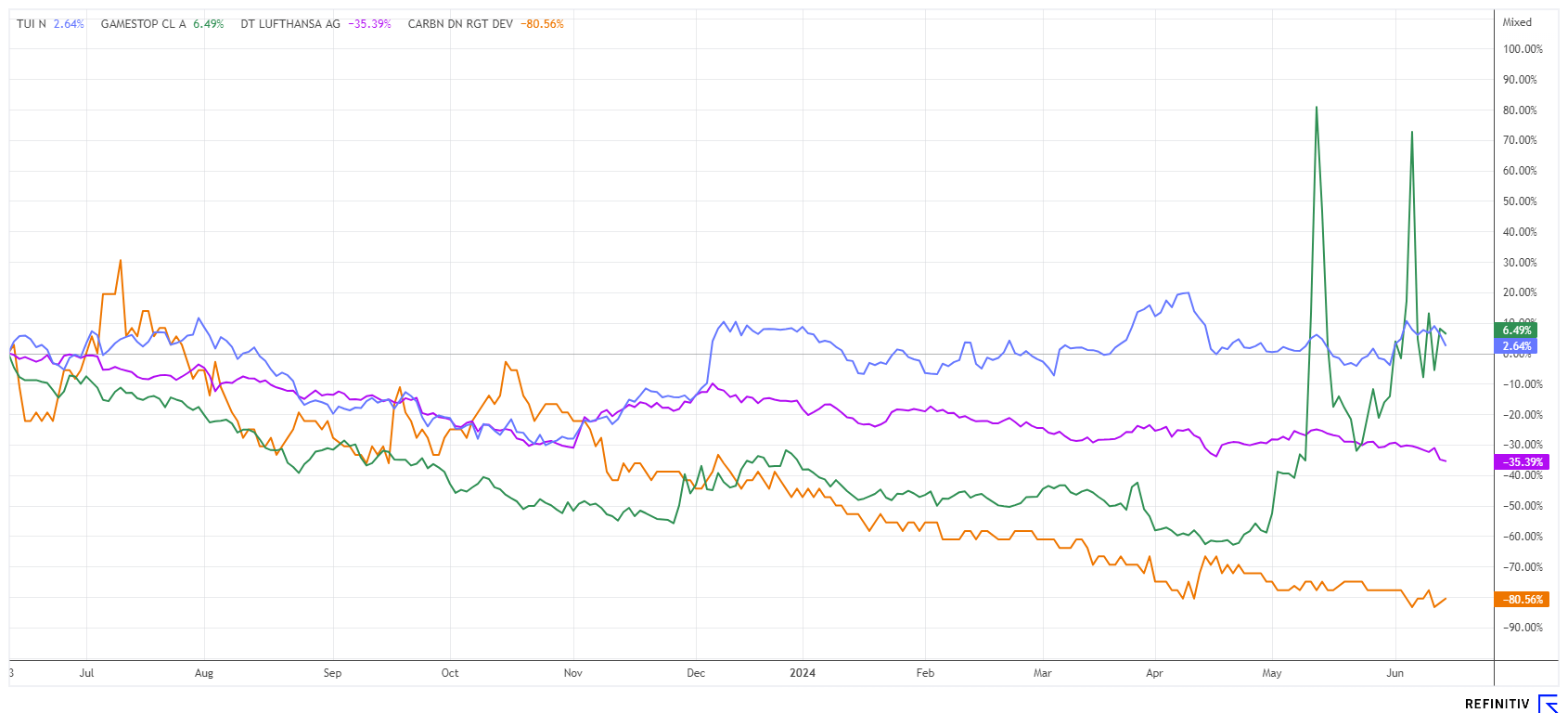

Reduce CO2 and stop storms now! Lufthansa, TUI, Carbon Done Right and GameStop in the analysis check

Historic floods hit Germany. The rain of the last 4 weeks has brought indescribable masses of water to more than 3,000 communities in southern Germany. Flooded cellars and living rooms, washed away vehicles, and severely damaged buildings caused damage of around two billion euros in Bavaria and Baden-Württemberg alone. The Ahr Valley in Rhineland-Palatinate was hit by a flood of the century back in 2021. Investors can take a sustainable approach to stock selection and set green criteria for their portfolio selection. Returns are not always a factor, but at least the savings are working for a good cause. We select a few options.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

TUI AG NA O.N. | DE000TUAG505 , CARBON DONE RIGHT DEVELOPMENTS INC | CA14109M1023 , GAMESTOP CORP. A | US36467W1099

Table of contents:

"[...] In addition to campsite fees, Pathfinder Ventures has put itself in a position to offer all of these sought-after camping solutions. The only thing they don't sell is the RV itself. [...]" Joe Bleackley, CEO, Pathfinder Ventures Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Carbon Done Right - IPO in London ahead

The implementation of CO2-neutral projects is the basis for sustainable resource conservation. However, a lot has to be invested in technology and environmental protection for the successful implementation of climate models. The Canadian company Carbon Done Right shows how projects can be successfully implemented with well-known donors from industry. The Company started in Africa, where industrialization is still in its infancy. However, it is still possible there to avoid the ecological mistakes of Western countries at an early stage.

Carbon Done Right is meticulously concerned with the management of forest, land and sea areas, for example, in order to counteract industrial land consumption with new forests and mangroves. Combined with financial incentives, the idea is as simple as it is successful: so-called compensation areas are renaturalized, which are made available by local landowners for a fee and receive credits in emission certificates for these measures, which in turn can be purchased by investors. Multinational corporations are very interested in this, as they need green assets for their carbon footprint.

Carbon Done Right has been working on its IPO in London since the beginning of 2024. The necessary paperwork has been submitted for approval. In order to better address the market, the Company also wants to implement modern blockchain-based business models. This means that every transaction in the trading of emission certificates can be carefully recorded in a decentralized ledger so that the origin, ownership and complete transaction history of each certificate can be verified and cannot be changed. In addition to the climate fantasy, the share also has its appeal for crypto experts. Carbon Done Right is currently only valued at a low EUR 2.5 million. Exciting!

Lufthansa and TUI - Tourism is practising sustainability

The much-maligned tourism stocks Lufthansa and TUI have been practising sustainability for years. Under the motto "MakeChangeFly", Lufthansa summarizes its measures to achieve climate neutrality by 2050, focusing primarily on green fleet modernization, sustainable fuels, and waste avoidance. However, due to its kerosene-heavy business model, achieving "zero-zero" is still a long way off. TUI wants to take another 26 years to achieve this major goal and is hoping for technological help. TUI supports the UN Sustainable Development Goals (SDGs) and is working intensively to achieve 13 individual goals. These include reducing fuel consumption, replacing marine diesel with methanol, eliminating single-use plastic items, and actively cooperating with sustainable hotel operations. The agenda also includes combating social imbalances in vacation destinations. CEO Sebastian Ebel has made this well-defined sustainability agenda his top priority.

Anyone wishing to invest in the tourism stocks Lufthansa and TUI is currently doing so only slightly above the multi-year lows. Both companies are currently struggling with high costs and falling travel budgets among German citizens. After a 30% increase in prices, the turnover of recent years can just about be maintained, but nobody is talking about decent growth any more. With share prices of EUR 5.87 and EUR 6.95, the two stocks are now trading at 2024 P/E ratios of 4.9 and 6.5, respectively. Technically, TUI should overcome the EUR 8 mark, while Lufthansa is currently heading back towards the historic lows of around EUR 5.50. Collect!

GameStop - Roaring Kitty forces Citron to come to its senses

The senseless back-and-forth trading of the ailing games distributor GameStop is probably less sustainable. The so-called meme share is repeatedly recommended as a "Buy" in social forums such as Reddit. Fundamentally, investors are taking great risks here, as the Company has been making losses for years. Nevertheless, the management managed to sell as many as 75 million shares as part of an "at-the-market" offering program, raising around USD 2.14 billion in the process. According to Reuters, the average selling price per GameStop share was around USD 28.50. The video game retailer had already raised more than USD 933 million through the sale of 45 million shares in May.

The GME share initially reacted to the successful capital raising with a further jump in the share price after Keith Gill, better known as Roaring Kitty, held a striking livestream just a few days ago. The meme frenzy then slowly came to an end over the course of the week. The reason for the downward turn was the news that Citron Research announced via X that it had liquidated its short position. "We respect the irrationality of the market," announced the short trader Citron on the X platform. Once again, only better-informed circles are likely to have profited from the rally. The analysts at Wedbush lowered their price target from USD 13.50 to USD 11.00. With USD 9.50 in cash, the operating GameStop business is valued at only USD 1.50 per share. Casino feeling at its best!

The storms of recent weeks have shown us the climate distortions of modern times. International efforts to finally limit CO2 emissions show that things cannot go on like this. TUI and Lufthansa are trying their hand at sustainable tourism, which is a start. A listing on the London Stock Exchange could bring the necessary attention to Carbon Done Right in Europe.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.