September 2nd, 2024 | 07:30 CEST

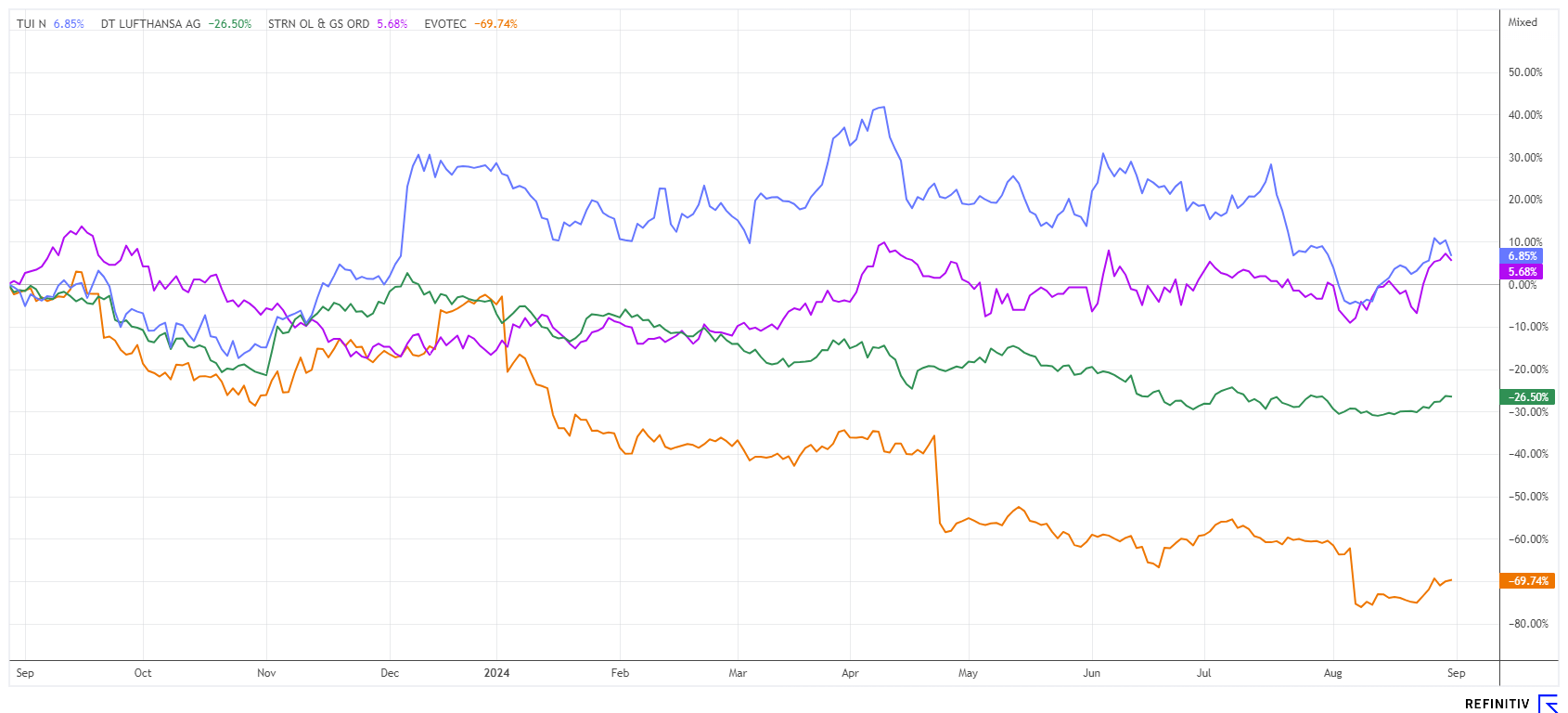

DAX on a high, clear turnaround at Evotec and Saturn Oil + Gas, TUI and Lufthansa in a daily battle

The current stock market euphoria might seem out of place at first glance, given the geopolitical uncertainties, sluggish economic growth, and persistent inflation. However, it is important to remember: The stock market is looking 6 to 9 months ahead. The expectation is that inflation will weaken significantly, and the current interest rate level will fall considerably. In this environment of "steadily improving conditions", technology shares seem to be on the rise. Wars such as those in Ukraine or the Middle East may weigh on people's minds, but they boost the balance sheets of the defense industry. In this respect, there is little reason for pessimism, and the DAX at least reached new all-time highs at the end of August. It is worth taking a look at some of the lagging stocks.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

EVOTEC SE INH O.N. | DE0005664809 , Saturn Oil + Gas Inc. | CA80412L8832 , TUI AG NA O.N. | DE000TUAG505 , LUFTHANSA AG VNA O.N. | DE0008232125

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec - Now it is time to grill the shorties

Not a good week for the short sellers of Evotec shares. On the one hand, insider buying is increasing; on the other hand, most research houses have completed their downgrades. The highlight here is certainly Deutsche Bank, with a "Sell" vote and a price target of EUR 4. Investors should be wary of such pronounced expert opinions because, at some point, pessimism turns into optimism again. After three consecutive revenue and profit warnings and the unceremonious departure of longstanding CEO Lanthaler, the shares of the Hamburg-based biotech company fell to EUR 5.06 in early August. However, it stopped there, and the share has been on an upward trend for several weeks now.

Further insider transactions were published last week. This time, however, it was not the new CEO, Christian Wojczewski, but the Supervisory Board member, Iris Löw-Friedrich, with a purchase volume of over EUR 100,000. Board member Craig Johnstone had also reported purchases in the days prior. Due to the high turnover and a strengthening of the market capitalization to EUR 1.17 billion, the share can likely defend its position in the MDAX through September. Institutional investors, who have been turning their backs on the share for months, might be compelled to re-enter. Speculative investors are already stocking up, with technical resistance still present between EUR 7.50 and EUR 8.50.

Saturn Oil & Gas - Share buyback and optimistic analyst views

The acquisition of the new assets in Saskatchewan has been completed since mid-June. The deal size for the Canadian Saturn Oil & Gas was CAD 525 million this time, bringing the daily production capacity up by a further 10,000 barrels per day (BOE) to a new level of 38,000 to 40,000 BOE. After an initial period of consolidation weakness in the share price, the Company's new size is now becoming dominant and attracting larger investors. With this transaction, Saturn has joined the ranks of "midsize producers" with an enterprise value exceeding CAD 1.5 billion.

With the greatly increased production output, the Calgary-based company can now press ahead with reducing its debt and even wants to buy back its own shares. This is possible because it was possible to negotiate an interest rate of less than 10% for nominally more credit during the last debt restructuring. Due to the persistent undervaluation of the share, the Board of Directors has now decided on a one-year share buyback program for up to 11.3 million shares. In accordance with the TSX bylaws, the maximum number of common shares that can be repurchased on the TSX on any one trading day is 46,032. This represents approximately 25% of the average daily trading volume of the common shares over the last six months. Saturn intends to finance the purchases from cash on hand.

A positive sign for the stock price, which rose by 15% immediately following the announcement. Analysts have recently reaffirmed their positive assessments. Eight Capital, First Berlin, and Echelon Capital have issued "Buy" ratings, with price targets of between CAD 6.50 and CAD 7.50. At the end of August, Ventum Capital Markets confirmed its "Buy" recommendation with a target of CAD 7.50 and is expected to handle the buybacks. At a current share price of CAD 2.75, a potential upside of 200% exists.

TUI and Lufthansa - The battle for the EUR 6 mark

The TUI share is currently benefiting from strong demand for vacation travel, with Turkey, the US, and Thailand in particular demand for the upcoming fall vacations. The FTI bankruptcy has revealed an opportunity for TUI, and the Hanover-based company can now sell additional capacity. This led to a record number of bookings in the last quarter. However, the old problems remain: High costs and still significant debt. At least the share price has now briefly exceeded the EUR 6 mark again, closing at EUR 5.95 on Friday after a turbulent week. However, the sentiment for the TUI share has clearly turned; new investors are now setting their stop at EUR 5.70 and are simply letting their profits run.

The crane airline is still facing turbulence. The strike at the subsidiary Discover Airlines is being extended. On Thursday, the pilots' union, Vereinigung Cockpit, announced that the strike would continue until Sunday. Along with the flight attendants' organization UFO, the unions aim to force the airline to negotiate its first collective agreements, following recent agreements between management and the competing service union Verdi. Lufthansa intends to do everything in its power to maintain as many flights as possible during the remaining summer vacation period, with most of the replacement program being managed internally. A slight spring breeze is gradually appearing on the stock market, with the share price now nibbling at the EUR 6 mark again. If the strike ends "positively", there is technical potential for the share to rise to around EUR 6.75.

A new wave of buying replaced the usual July correction in 2024. Once again, it was tech stocks that led the way upwards. This time, even the DAX managed to achieve a swing of 10%. TUI and Lufthansa are doing their best, while Evotec seems to have turned a corner. The consolidation following the recent acquisition now also seems to be coming to an end at Saturn Oil & Gas. If the resistance at CAD 2.85 is broken, the share will likely move quickly into new dimensions.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.