May 7th, 2024 | 08:45 CEST

Artificial intelligence is on the rise - Nvidia, Super Micro Computer, Mountain Alliance, and Microsoft in focus

What James Cameron envisioned as a horror movie in the 1980s with his film "Terminator" has now become a reality: "Machines are taking over thinking". Experts expect the use of artificial intelligence (AI) in digitally configurable processes to result in double-digit productivity gains over the next few years. Not since the introduction of industrial robots have there been such leaps. The flip side of the coin is that jobs are now being destroyed around the globe, as simple intellectual tasks that can be performed by machines will gradually be cut back. Standard services or digital control processes, such as those in call or quality centers, will be particularly affected. From this perspective, the stock market has already mapped out a megatrend for an entire decade and sent selected AI stocks through the roof accordingly. What should investors focus on now?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , SUPER MICRO COMPUT.DL-_01 | US86800U1043 , MOUNTAIN ALLIANCE NA O.N. | DE000A12UK08 , MICROSOFT DL-_00000625 | US5949181045

Table of contents:

"[...] In Canada, there is $1.75 of debt for every dollar of disposable income - and that was true even before the pandemic. [...]" Karim Nanji, CEO, Marble Financial

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Microsoft - The AI boom is likely only just beginning

At the end of April, there was great concern on the market that the AI hype had gone too far and that a major correction was imminent. The NASDAQ technology index was also hit twice with corrections of over 400 points. However, each time, the good figures from tech companies helped compensate for negative outliers such as Meta Platforms.

Tech giant Microsoft exceeded analyst estimates by a considerable margin due to stronger-than-expected demand for AI. Revenue in Q3 of the current financial year to June 30, 2024, was just under USD 62 billion, compared to USD 52.9 billion in the previous year. This 17% increase was not expected by analysts, who had only anticipated USD 60.8 billion in advance. With a net profit of USD 22 billion below the line, the Redmond-based company achieved a surplus of USD 2.94 per share. Here, too, estimates were closer to USD 2.84.

Investments in the cloud and AI will be further strengthened with the high free cash flow. USD 1.7 billion is to flow into Indonesia, with a further USD 2.2 billion planned in neighbouring Malaysia. At the same time, Microsoft is further restricting the use of AI data by authorities. The evaluation of text and speech analytic models in connection with Azure OpenAI Service by or for US police authorities is now prohibited. CEO Satya Nadella believes that the way of doing business with AI will greatly change the working lives of many people. Those who listen carefully recognize that the real AI wave is only just beginning. On the Refinitiv Eikon platform, MSFT shares are recommended as a "Buy" by 56 analysts with an average 12-month price target of USD 473 - nearly 20% above the current price.

Nvidia and Super Micro Computer - This could also be a top formation

The popular AI stocks Nvidia and Super Micro Computer have gone completely off the charts. In the last few months alone, they have surged between 100% and 240%. Analytically, the price targets set by experts have long since been reached and the first corrections have set in. What happens now?

Nvidia must be classified as a fundamental special case. There were 58 new ratings and updates for this stock in the first quarter alone. The revenue estimate for the current year is causing increasing headaches for experts, as the consensus has swung upwards from an initially expected USD 87 billion to just under USD 112 billion within 6 weeks. In 2025/26, it is even expected to reach USD 140 billion. The growth comes from the AI-related "Data Center" segment, a hub for the large-scale processing of Big Data. As a result, 54 of 58 experts give the stock a thumbs up and expect an average price target of USD 1004, around USD 120 above the last quote.

In the case of Super Micro Computer, 13 out of 18 analysts are giving the stock a thumbs up, with an average target price of USD 1022. A high of USD 1,229 was already defined in March, since when the share price has corrected by around 25%. Many investors will be calling for new entry prices, but from a technical analysis perspective, a head and shoulders formation has recently formed on the chart, which has caused the price to correct down to USD 720. Even after the significant turnaround on the NASDAQ, the share price has so far only managed to recover to USD 783. After all, the share price stood at around USD 100 just a year ago and has increased twelvefold at its peak - a terrific performance for the specialist in the liquid cooling systems sector for mainframe computers. It should, therefore, be exciting to see whether the SMCI share will start to climb again.

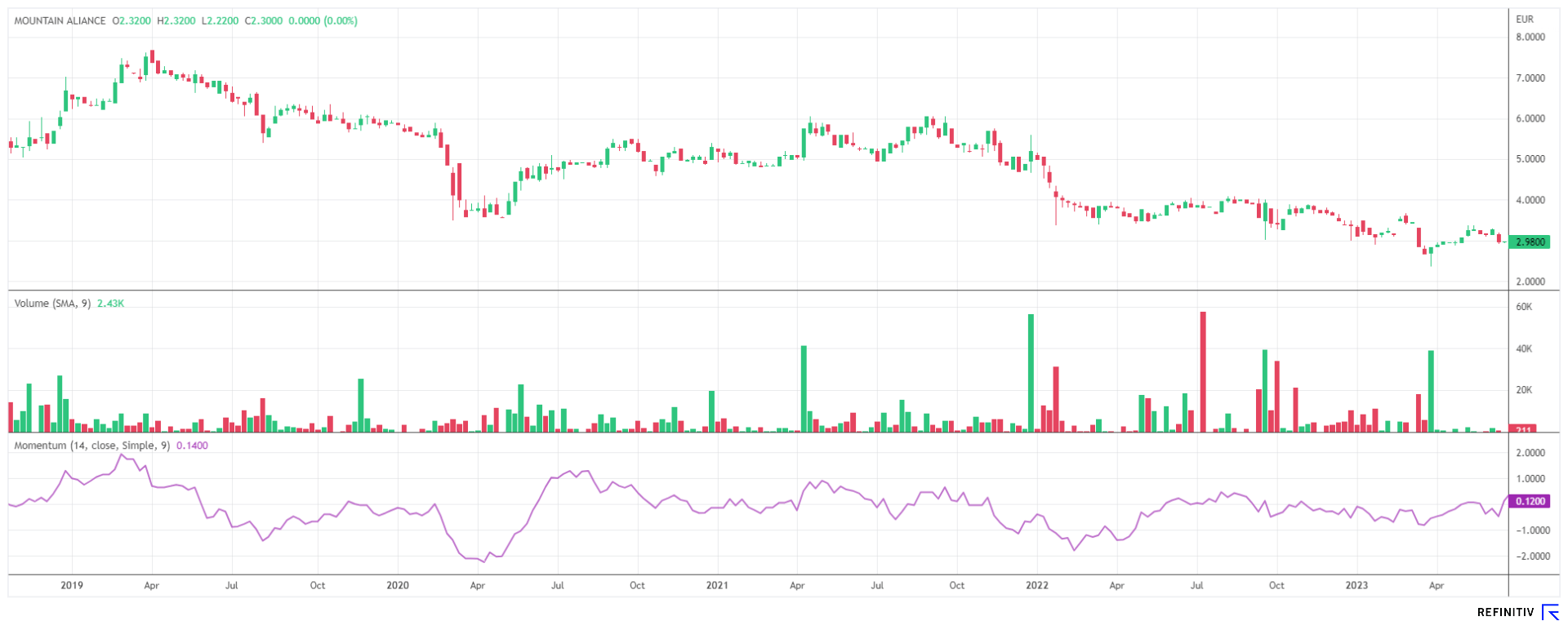

Mountain Alliance AG - Digital value creation in one share

Those looking at German second-line stocks, may discover one or two technology stocks that are preparing to launch successful digital models. The success of digital innovations depends on many factors and is difficult to predict, but successful investments can ultimately result in a double-digit factor for venture investors. A good example is the stock market app Trade Republic, developed in 2015 and now valued at around EUR 5 billion.

**Mountain Alliance AG from Munich is an investment company dedicated to scaling up models in the field of digitalization. The Company, which is listed in the Munich m:access segment, currently holds 23 investments in companies in the areas of meta platforms, SaaS, digital media, value-added e-commerce and digital business services. As of June 30, 2023, Mountain Alliance held the largest stakes in the online language school Lingoda, the online provider of personalized textiles, shirtinator, the contract manager volders, and the online people magazine, Promipool. The total portfolio value was reported at EUR 48.6 million or EUR 6.91 per share at the end of the first half of 2023.

The exit from Bio-Gate and Exasol was completed at the end of 2023, meaning that debt is likely to be close to zero; the individual financial statements for 2023 are to be published today.

Mountain Alliance uses an evergreen approach to provide access to private equity structures in the form of a diversified portfolio of digital assets. CEO Manfred Danner was replaced on January 1, 2024, by the addition of Dr. Ulrich Tetzner. According to co-founder Dr. Cornelius Boersch, Mr. Tetzner is an experienced business angel and meets all the requirements for managing an investment company. In the current year, Supervisory Board member Daniel Wild has attracted attention with several insider dealings.

Despite a very good positioning in the digital business sector, the shares can only represent 33% of the last NAV at EUR 2.3. After hitting a low of EUR 1.79 at the beginning of April, the market capitalization has recently risen back up to EUR 15.9 million. Since then, the share price has been moving in the right direction. Management would like to streamline the portfolio further, and with a little luck it should be possible to close the price gap to the intrinsic value. In their latest analysis in mid-2023, the analysts at Montega issued a "Buy" recommendation with a target price of EUR 6. That is more than 150% potential! There will be an update as early as next week at the Equity Forum Spring Conference in Frankfurt. The story is extremely exciting and the chart shows a nice rebound.

Artificial intelligence is seen as the new megatrend. How far valuations will continue to rise remains questionable, as the potential is currently already priced in until 2026. However, there have been initial corrections in recent weeks. Mountain Alliance AG has 23 active investments and is ideally positioned to benefit from the "digitalization" megatrend.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.