Gas

Commented by Fabian Lorenz on February 24th, 2026 | 07:30 CET

New German hydrogen gem! Will A.H.T. Syngas eclipse the old favorites Plug Power and Nel ASA?

Is it time for a changing of the guard in the hydrogen sector? The old favorites Plug Power and Nel ASA have been falling short of expectations for years. Yet the benefits of hydrogen in the energy mix of the future are undisputed. A.H.T. Syngas is on its way to becoming the new hydrogen gem. The company produces synthetic natural gas substitutes from biogenic residues and, in the future, hydrogen as well. A.H.T. Syngas has recently achieved an important breakthrough. In addition, it is in the process of transforming itself from a pure plant manufacturer to an energy producer. The revaluation has begun, but is far from complete. Analysts see considerable upside potential.

ReadCommented by Carsten Mainitz on February 20th, 2026 | 06:50 CET

Do not miss out! Small and micro cap upside in the cleantech sector with A.H.T. Syngas Technology, Nel, and SFC Energy!

The supply of electricity from renewable energy and climate protection are important issues not only on the political stage, but also on the capital market. National and international regulations represent decisive guidelines that lead to structural changes. When it comes to hydrogen and fuel cells, Nel and SFC Energy are the companies to watch. A.H.T. Syngas Technology, on the other hand, is a company that has been completely neglected until now. As a provider of syngas solutions, the company combines climate protection and security of supply. A.H.T. is currently undergoing a groundbreaking transformation process. Analysts attest that the stock has the potential to double in value. What can investors expect?

ReadCommented by Nico Popp on February 19th, 2026 | 07:25 CET

The molecular revolution: Why A.H.T. Syngas wins where BASF invests billions and EQTEC paves the way

While policymakers preach electrification, practitioners in heavy industry know that process heat and chemical raw materials require molecules. This is where synthesis gas (syngas), an old acquaintance, is celebrating a spectacular renaissance. Syngas is the backbone of modern chemistry, a mixture of hydrogen and carbon monoxide without which neither fertilizers, plastics, nor synthetic fuels could exist. Market forecasts from research firms like MarketsandMarkets and Grand View Research paint a similar picture: the global syngas market is expected to grow at high single- to double-digit rates through 2030, expanding from several dozen billion US dollars today to a significantly larger market. Three parallel developments are currently taking place in this gigantic growth market. While chemical giant BASF validates the demand and EQTEC proves the large-scale feasibility, German technology specialist A.H.T. Syngas Technology (A.H.T.) is disrupting decentralized applications. We analyze the market and the key players.

ReadCommented by Carsten Mainitz on February 4th, 2026 | 07:20 CET

Profits with a plan: Spin-offs as return drivers – Now it is Pure One's turn, Infineon and TKMS have shown the way!

The market often undervalues complex companies. Spin-offs - the separation of a division, technology, or subsidiary from an existing company - are a proven way to make hidden value visible. Investors can benefit from this, often with clear advance notice. One of the most well-known spin-offs is PayPal. In 2015, eBay shareholders received 0.22 PayPal shares for each eBay share held. Today, PayPal is one of the world's largest payment service providers. The Australian company Pure One will soon be listing its highly sought-after gas activities on the stock exchange via an IPO. This is an opportunity investors should not miss.

ReadCommented by André Will-Laudien on January 29th, 2026 | 07:35 CET

Iran conflict and oil prices at USD 100? Caution advised for Nel ASA, A.H.T. Syngas, and Plug Power

The stock markets are in absolute stress mode! The US dollar has been depreciating for days, silver, gold, and copper are skyrocketing, and yesterday oil also started to rise. The threatening gestures from Washington are slowly making it clear that the number of geopolitical conflicts could even expand to include Iran in the short term. The Pentagon has sent an armada of ships to the Persian Gulf. Just another Donald show? Maybe, but maybe not! On platform X, he makes it unmistakably clear that an intervention in Iran's sovereignty could be imminent at any time. This means absolute "panic mode" for the commodity markets, as Iran produces over 4 million barrels of oil per day, and Western industries fear for their supply chains. We take a look at a few scenarios that are related to this situation in extended mode.

ReadCommented by Nico Popp on January 22nd, 2026 | 07:20 CET

Gas boom Down Under: Omega Oil + Gas and Elixir Energy becoming increasingly expensive – balance sheet treasure at Pure One Corporation

There is a strange discrepancy in the global energy markets that is nowhere more tangible than on Australia's east coast. While politicians and ESG funds have been rehearsing the demise of fossil fuels for years, reality is now hitting the economy with full force. Sentiment in trading rooms from Sydney to Perth has shifted markedly. A gold-rush mood has returned – this time for natural gas. In its "Gas Statement of Opportunities 2025," market operator AEMO warns in an almost alarmist tone of an impending supply gap. Gas explorers such as Omega Oil & Gas and Elixir Energy have already risen sharply. But away from the obvious investments, hydrogen company Pure One presents a classic arbitrage opportunity that is still largely ignored by the broader market. The Company is preparing to spin off its gas division, and a detailed comparison with its peers suggests that investors can currently acquire this asset at virtually no cost – a gift for anyone who knows how to read balance sheets.

ReadCommented by Nico Popp on January 16th, 2026 | 07:00 CET

Trash to gas: How A.H.T. Syngas, EQTEC, and 2G Energy are making companies self-sufficient

German industry is undergoing one of its toughest trials. The "trilemma" described by analysts - volatile energy prices, rising CO2 taxes, and the physical uncertainty of the power grids - has driven production costs to a level that poses a massive threat to competitiveness. While politicians debate hydrogen pipelines that will take years to complete, innovators are already creating a new reality: decentralized energy supply from waste materials. Three players are emerging in this booming sector, working together to solve the puzzle of energy self-sufficiency. While CHP market leader 2G Energy provides the hardware for a green future with its engines and British supplier EQTEC validates gasification technology worldwide, Germany's A.H.T. Syngas Technology closes the crucial gap for small and medium-sized enterprises. With compact plants, A.H.T. transforms industrial waste into the clean gas that keeps the engines running – regardless of Putin's war or price jumps on the Leipzig energy exchange EEX.

ReadCommented by Nico Popp on January 15th, 2026 | 07:25 CET

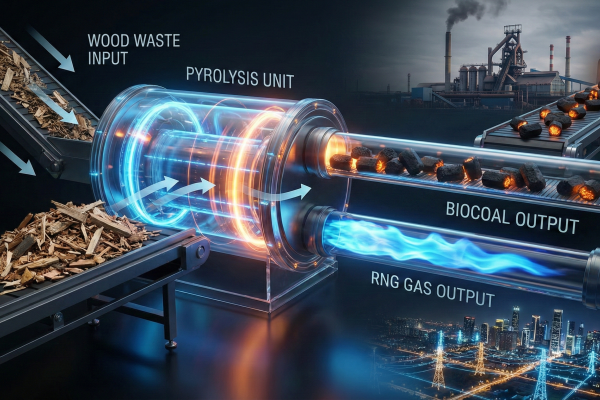

Double returns: How CHAR Technologies is closing the gap between ArcelorMittal's coal hunger and Montauk's gas profits

We are witnessing a historic turning point for global heavy industry. We are currently seeing not only a technological evolution, but also a fundamental revaluation of industrial assets, driven by two parallel megatrends: the decarbonization of primary steel production and the monetary revaluation of waste streams for energy security. While regulatory constraints are forcing steel giants such as ArcelorMittal to reinvent their blast furnaces, and specialists such as Montauk Renewables are demonstrating the enormous valuations possible in the renewable natural gas (RNG) market, CHAR Technologies is positioning itself at the intersection of these two worlds. With its proprietary high-temperature pyrolysis technology, the Canadian company provides the answer to both questions at once: it produces biochar for the steel industry and RNG for the energy grid – from a single waste source.

ReadCommented by Armin Schulz on October 21st, 2025 | 07:15 CEST

Barrick Mining and Kobo Resources: Gold as security – Occidental Petroleum: Energy as opportunity

In an era of geopolitical upheaval and monetary policy experimentation, tangible assets are gaining strategic importance. Gold remains a fundamental store of value, while the transformation of the energy sector is driving demand for critical raw materials. Even oil, despite volatile prices, retains its status as a geopolitical lever. In this environment, companies with access to these resources are well-positioned. Three players are in focus: the gold producer Barrick Mining, the exploration specialist Kobo Resources, and the oil and gas company Occidental Petroleum.

ReadCommented by Nico Popp on September 3rd, 2025 | 07:15 CEST

Investing in hydrogen with management on board: Air Liquide, Pure Hydrogen, Air Products & Chemicals

When management representatives hold large amounts of their own company's shares or when their compensation is linked to the performance of the share price, this is generally good news for all investors. A management team with "skin in the game" typically takes a more long-term view and aligns more closely with shareholder interests. We present three hydrogen stocks in which management holds shares – some more, some less. Where are the biggest opportunities, and which stocks come with hidden risks? Read on to find out!

Read