July 26th, 2023 | 07:35 CEST

Climate protection, yes, but why is the plan not working out? Nikola, Nordex, Saturn Oil + Gas and JinkoSolar in focus

The world often presents itself differently than it really is. In Germany, for example, there is a shortage of oil and gas, which is a major burden for industry and private consumers. Renewable energies now account for 56% of the installed nominal value of all power plants, but unfortunately, they cannot meet baseload demand. If there is little sunshine and no wind, gas and coal-fired power plants must be shifted up a gear to meet energy consumption. Oil, in particular, remains the base material for 100,000 products that contain plastic. So the green dream of complete independence from fossil fuels will not happen for a while. Where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NIKOLA CORP. | US6541101050 , Saturn Oil + Gas Inc. | CA80412L8832 , NORDEX SE O.N. | DE000A0D6554 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

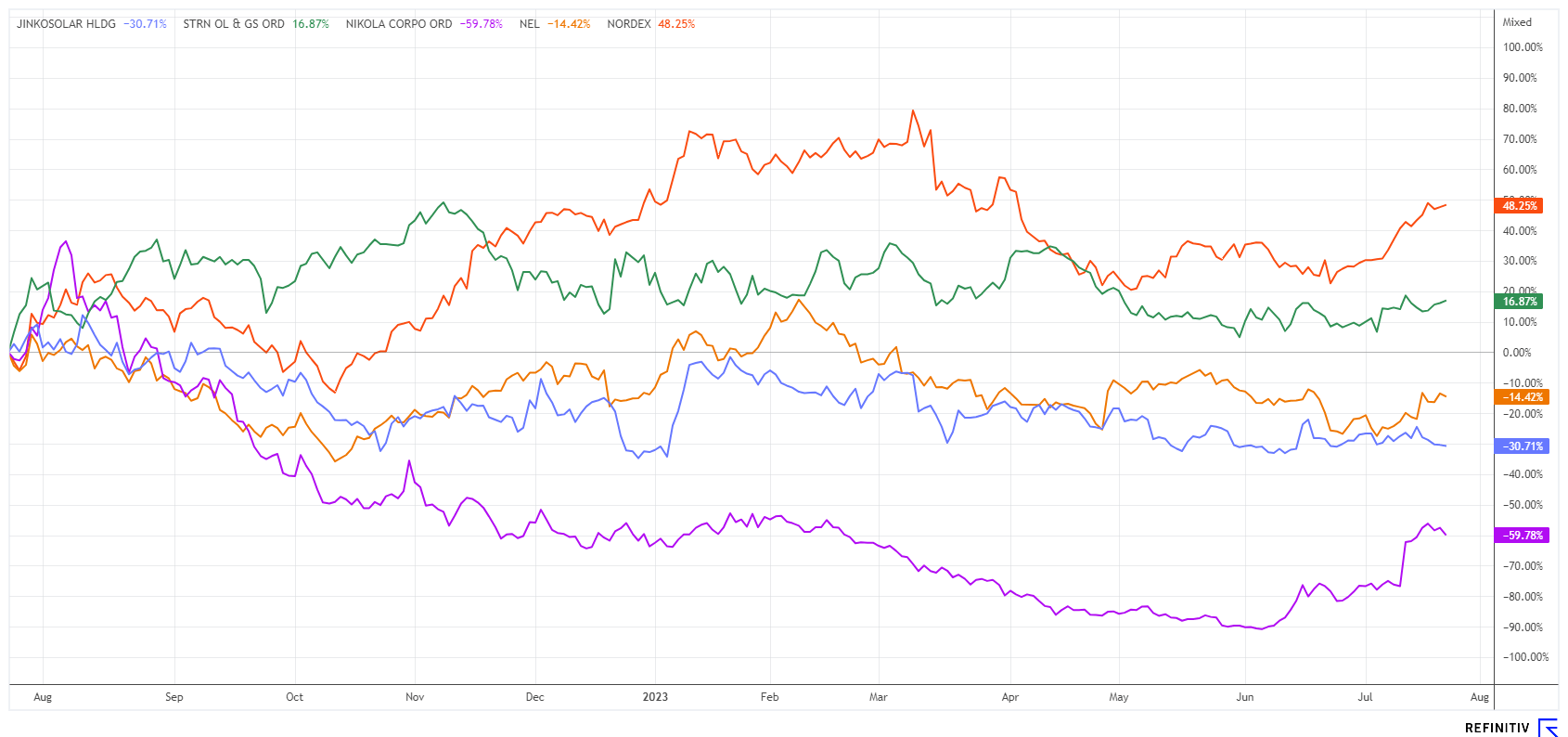

JinkoSolar versus Nordex - Taking significant steps forward

The proof-of-concept in solar energy seems positive in the long run. While JinkoSolar, the world's largest solar module manufacturer, can report increasing profits, the wind turbine manufacturer Nordex's outlook seems bleak until 2024. Completely disregarded in the eco-balance of green politicians is the fact that wind and solar turbines run for a maximum of 20 years before they have to be recycled. This results in thousands of tons of hazardous waste every year, and the first wind turbines are already in demolition condition.

Chinese solar specialist JinkoSolar sees itself in a position to positively shape the world's energy portfolio and thus take responsibility for the future. According to a speech by CEO David Li, this has been the company's vision since its founding. By mid-2023, JinkoSolar will have shipped more than 150 GW of modules. So far, 1,320 GW of solar modules have been installed worldwide, so every 10th element comes from Jinko's Chinese production. However, access to the US market, which is subject to high tariffs due to ongoing trade disputes, is still causing problems.

Nordex wants to increase sales by about 5% each year, and in 2024 the Company expects to achieve its first profit. After three profit warnings in 2022, the Company is currently on the upswing again. Tomorrow, on July 27, the financial results for the second quarter will be released, with experts estimating a loss per share of around 29 cents - a reason to take a closer look.

On the Refinitiv Eikon platform, 6 out of 9 analysts rate JinkoSolar as a "buy" with an average price target of EUR 58.20, around a 50% premium on the current price of EUR 38.80. For Nordex, 9 out of 13 are positive and have a target price of EUR 15.20. The analysts are much more cautious here. Both stocks fit into a "green portfolio" because of their market position.

Saturn Oil & Gas - Major shareholders continue to stock up

Saturn Oil & Gas has catapulted itself into a new dimension through two mega-deals in 2022 and early 2023. The still relatively young oil company is taking advantage of the opportunities presented by the abundant availability of shale oil & gas in Saskatchewan and Alberta. In doing so, the Company is operating in a very sustainable manner, taking care of its drilling sites as well as the concerns of the surrounding community. Average daily production is now over 30,000 barrel equivalents consisting of 95% oil and 5% natural gas.

A look at the numbers inspires. The current operating earnings guidance for 2023 is approximately CAD 475 million on an EBITDA basis. After deducting reinvestment costs for new properties, this results in a bottom-line cash flow per share of approximately CAD 3, a good 25% above the current market price. Over the next 30 months, the available cash flow will still be used for debt repayment, and only then can a dividend be expected.

Five analysts on the Refinitiv Eikon platform expect a 12-month target price of CAD 6.22. Taking advantage of the apparent undervaluation, major shareholder GMT and some affiliates have increased their exposure by 6.99 million shares to a now 24.91% total stake. With an EV/EBITDA ratio of just 1.7, Saturn Oil & Gas tops the list of cheapest, North American oil producers. As of 2 weeks ago, a total of 30.54 million warrants have expired, and at CAD 2.38, the value is only 13% above the very low transaction price of the Ridgeback acquisition.

Nikola Motors - The market is waiting for the first product

The Nikola Motors share is still far from out of the woods. The US startup wanted to launch the first electric-powered truck as early as 2022. However, a damaged electric truck caught fire at the Company's site in Arizona, causing setbacks. In the medium term, management has decided on fuel cells as the future for clean transportation and logistics solutions. The Company has already announced some initial deals in this area. Fortescue Future Industries (FFI) is acquiring the Company's Phoenix Hydrogen Hub project to build an electrolysis-based hydrogen production facility there.

Nikola needs to work with partners in its capital-intensive energy strategy to get its H2 strategy on the road. It hopes to receive millions in aid from the Biden Administration's Inflation Reduction Act to take the next significant steps. FFI's acquisition of the Phoenix project is an important step toward a functioning H2 infrastructure, without which there would be no investment from the transportation industry.

The Nikola share remains exciting and highly volatile, as it will likely be many months before the first zero-emission vehicles hit the market. After a rapid short squeeze, causing a 100% surge to over EUR 2.70, the stock fell back to EUR 2.05 yesterday. The analysts at Refinitiv Eikon remain neutral and expect a maximum price of USD 2.60 in the next 2 months. The rather lush short ratio of 21% could, however, continue to bring joy to speculative traders when good news from Arizona rolls in and calls the short sellers to the order desk.

**The Greentech market remains the focus of investors. While most companies in the sector are not yet making money, Saturn Oil & Gas's cash flows are gushing. Reduce your portfolio risk through thoughtful diversification.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.