July 24th, 2024 | 07:00 CEST

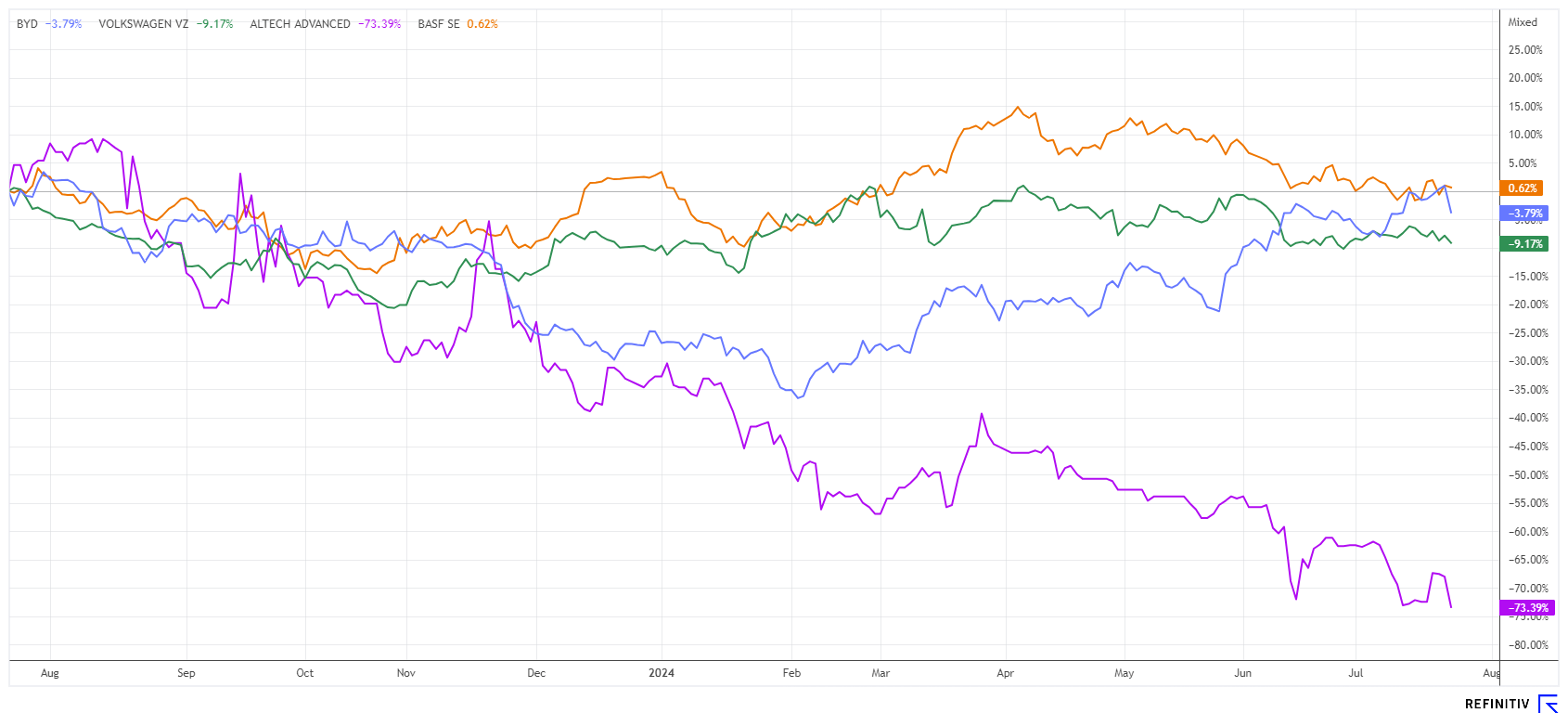

Averting power outages, starting the battery revolution! BASF, Altech Advanced Materials, BYD, and VW

Varta is undergoing a complete restructuring and reorganization, likely leaving legacy shareholders empty-handed. The back and forth since 2023 has given the German SME sector an increasingly unsettling look. The environment is challenging, and only the strongest will survive the looming storm. Traces of Habeck's poor planning can also be seen in the energy transition. Instead of fully utilizing renewable energies, six new gas-fired power plants are now being planned, which will, of course, be powered by hydrogen. This draws investors' attention back to battery storage systems, as they are needed to successfully store surplus energy. Where do the opportunities lie for resourceful investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BASF SE NA O.N. | DE000BASF111 , ALTECH ADV.MAT. NA O.N. | DE000A31C3Y4 , BYD CO. LTD H YC 1 | CNE100000296 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] Boron is one of the most versatile elements in the whole world! Everyone reading this text regularly uses hundreds of products that depend on boron. [...]" Tim Daniels, CEO, Erin Ventures

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BASF - Analysts are becoming more positive

BASF SE from Ludwigshafen is one of the world's largest battery materials manufacturers. However, the Company has been shaken up in Germany for two years due to high gas prices. In the weeks leading up to the Annual General Meeting in April 2024, the share price rose by a full 23% to just under EUR 55. The high dividend of an unchanged EUR 3.40 seemed tempting, even though the Ludwigshafen-based company's operating business has deteriorated dramatically. Although the Company reported earnings per share of EUR 0.25 in 2023 after a horror year in 2022, revenue fell from EUR 87.3 billion to EUR 68.9 billion. After the dividend, the share price lost the entire premium again.

For the current year, the Company now expects to consolidate at a low level in operational terms, with revenue of EUR 68.2 billion again, but at least profits are expected to rise to EUR 3.03. This means the generous dividend would no longer have to be paid from the Company's assets. BASF is now looking to relocate large production facilities abroad, but the main plant in Ludwigshafen and research and development are to remain in Germany. While this is a tragedy for the local site, it will soon lead to ringing cash registers for shareholders.

At the depressed share price level of around EUR 44, analysts are now becoming more optimistic again. Berenberg is sticking to its "Buy" rating and has set a target price of EUR 54, with the potential outsourcing of the "Coating" division inspiring enthusiasm. UBS also votes "Buy" with a price target of EUR 58 but sees high risks in the second half of the year. Investors will receive more figures on July 26. Until then, it is best to remain patient.

Altech Advanced Materials - Focus on the medium-term start of production

The Altech Advanced Materials stock has been quieter recently. After a promising, positive feasibility study at the beginning of the year, the German battery innovator is now looking for approvals and subsidies from Germany and the EU. Additional investments are needed before the first units roll off the production line at the Schwarze Pumpe site. The focus is on a new sodium chloride solid-state battery for intermediate energy storage in the grid, which originates from the joint venture project with Fraunhofer called CERENERGY®. In addition to the existing pilot plant for the new sodium-based battery, the patented Silumina Anodes™ coating process is also set to be industrialized in the future.

Altech recently published its half-year figures. The first half of the 2024 financial year was naturally characterized by set-up and development costs, resulting in a planned loss of EUR 0.82 million. Revenues were minimal, but a provision for impending losses in the amount of EUR 0.19 million was reversed. The preliminary balance sheet, according to HGB, as of June 30, 2024, shows equity of around EUR 7.87 million, an increase of 56% compared to the end of 2023. The Management Board continues to expect a loss of around EUR 1.6 to 2.1 million for 2024 as a whole but remains extremely confident.

Altech Advanced Materials is now sufficiently capitalized, as 62% of the balance sheet total of EUR 12.75 million consists of equity. At the end of June, the cash balance was EUR 1.22 million and it now depends on the subsidies applied for, which are likely to flow soon due to the full-bodied promises on the energy transition from Berlin and Brussels. Risk-conscious investors can currently enter the future value at a valuation of EUR 31.4 million. If the battery innovations quickly conquer the market, a dream return beckons.

BYD versus VW - And the winner is China

Anyone currently wondering about the uneven course of the two major vehicle manufacturers, VW and BYD, should take a closer look at their strategic positioning in the promising e-mobility market. While BYD is only laughing about the EU's punitive tariffs because they will no longer be relevant anyway with the opening of plants in Hungary and Turkey from 2026, the VW Group is still struggling with its electric strategy. Software errors, delivery delays, and the cancellation of the scrapping bonus are destroying growth hopes in Wolfsburg for the current year.

The VW Group is turning to the US start-up Rivian for help and hopes to find support in programming sensible software control systems there. All of this is taking time and swallowing up billions, while BYD already has entire shiploads unloaded in Europe daily. In terms of price, BYD is, on average, 20% cheaper in the market and even impresses traditional German combustion engine enthusiasts with its strong performance and technical appeal. The Chinese vehicle works and solves the everyday problems of short-distance urban traffic with parking shortages and diesel driving bans. It is clear that the Chinese innovator will continue to score points until the German premium manufacturers can deliver a low-cost equivalent. VW is likely still around two years away from doing so, which is why BYD is worth significantly more on the stock market than the Wolfsburg-based company. A 2024 P/E ratio of 18.5 versus 3.5 does not seem to bother anyone either. Nevertheless, we think both protagonists are worth buying.

The energy transition in Germany is creating both winners and losers. While the topic of hydrogen is barely getting off the ground, battery technology is now clearly the focus of investors. This is because surplus alternative energy needs to be stored in intermediate storage systems. BASF, BYD, Volkswagen, and Altech Advanced Materials have different approaches but share a common vision: an electrified future. Portfolios should be well diversified to significantly reduce any risks.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.