September 4th, 2024 | 07:15 CEST

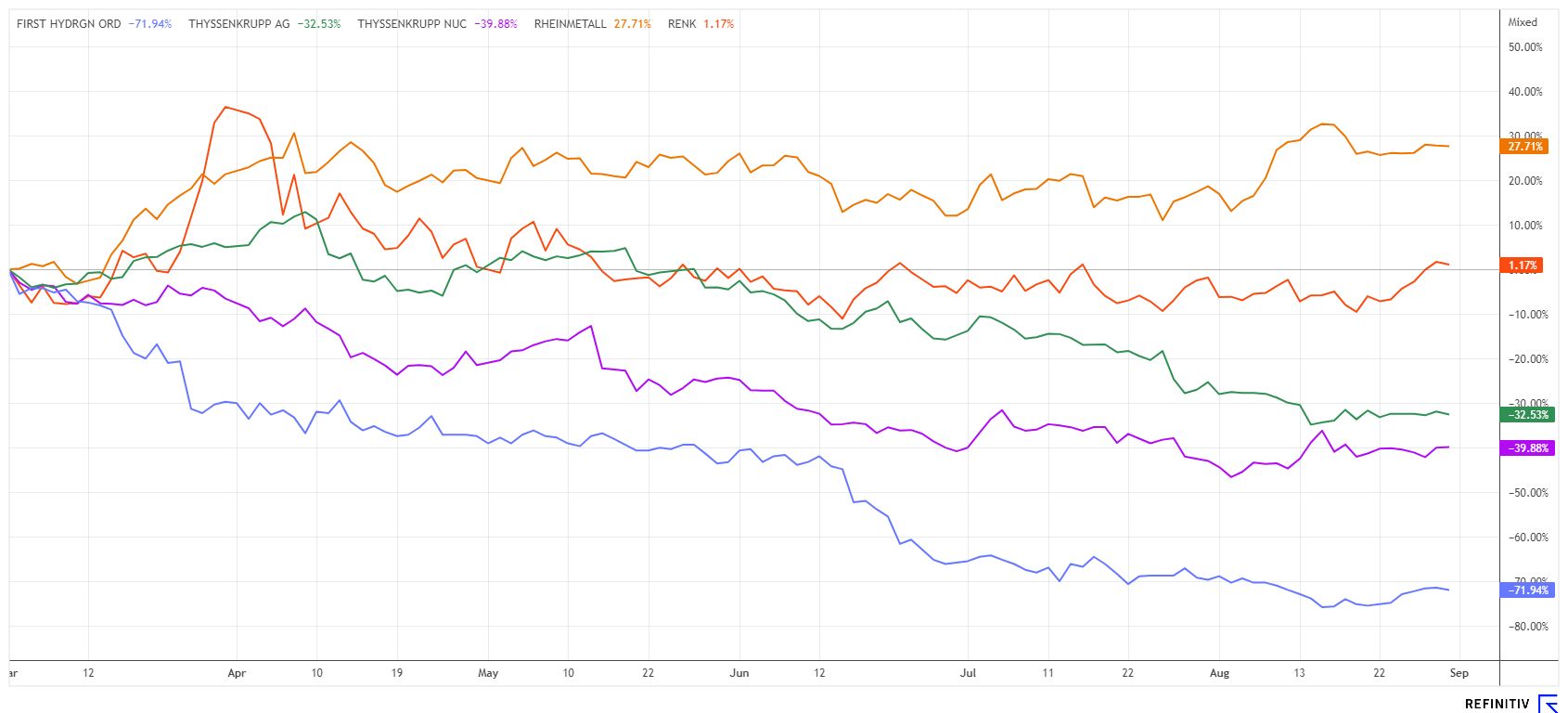

DAX correction - Time to sell defense stocks? Rheinmetall, Renk, First Hydrogen, thyssenkrupp, and nucera

What an incredible rally in just four weeks! At the beginning of August, the DAX 40 index was still at 17,200 points - yesterday, for the first time, it was close to the 19,000 mark. And all against the backdrop of a flimsy interest rate cut announcement from the US. Once again, investors are betting on a big wave of interest rate cuts, but will they materialize? Although inflation is falling slightly, the price of goods and services has risen by a good 50% in the last four years. We are not referring to the misleading consumer price index of the statisticians but rather to the "menu of the people." We are talking about restaurants, consumption, mobility, and housing. The most significant increase has likely been in the housing sector, where energy prices, insurance costs, and rents have risen dramatically. Soon, even homeowners will be affected by property tax, as the wheel of inflation continues to turn. Equities have once again surged ahead as war and expensive raw materials fuel the market. Where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , RENK AG O.N. | DE000RENK730 , First Hydrogen Corp. | CA32057N1042 , THYSSENKRUPP AG O.N. | DE0007500001 , THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001

Table of contents:

"[...] We are committed to stay as the number one Canadian and global leader in the Hydrogen-On-Demand diesel technology [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall and Renk - Get out or stay in?

Following good Q2 figures, the shares of the Düsseldorf-based armaments manufacturer Rheinmetall have once again seen a considerable price swing from EUR 470 to EUR 560. However, the all-time high of EUR 571, which the share had already reached in April, remained untouched. Despite an excellent fundamental outlook, a double top remains on the chart, which could lead to a further steep sell-off to the EUR 460 to 480 region in a tiny technical correction. The share has already lost a good 7% this week, although the leading index has reached new highs. Our advice is, therefore, clear: investors with an affinity for trading should wait for favourable correction levels, while fundamental-oriented long-term investors should bet on a 20% increase in turnover per year and a significant improvement in returns. However, it should not be forgotten that Rheinmetall has to invest a lot of money to cope with the flood of government orders. Of course, things will get tight as soon as promising peace negotiations with Russia are on the agenda. However, these are nowhere near in sight.

The verdict on the Renk share is similar. After a euphoric arms rally to EUR 38, disillusionment quickly set in here. As announced, Triton reduced its stake by a good 10% and thus raised EUR 250 million. At currently EUR 24, Renk is almost 40% below its high and now there are concerns about future growth. The US investment bank Goldman Sachs has lowered its price target from EUR 27.60 to EUR 26.10 after the Q2 figures but left its rating at "Neutral". In an industry study, analyst Victor Allard describes a somewhat mixed set of figures from the Augsburg-based transmission specialists. The consensus for Refinitiv Eikon still stands at a high EUR 31.60 with 6 out of 10 "Buy" recommendations. Due to the weak share price performance, further downgrades will likely follow. The stock is attractive below EUR 20.

First Hydrogen - Cutting-edge technology at sell-off prices

Challenging times for innovative hydrogen companies. In both North America and Europe, governments' hydrogen plans are running into funding difficulties. Germany has still not passed a budget for 2025, while hopes are growing in the US that Kamala Harris will win the race and provide new funding for future-oriented sectors. But there is also the sword of Damocles, Donald Trump, who has often made it clear what he thinks of the global warming debate: Namely, nothing at all!

With the "Hydrogen-as-a-Service" model, First Hydrogen wants to supply customers in the Montreal-Québec City region with clean, green hydrogen fuel for the first time in the next few years. This could create the first emission-free transportation ecosystem in the future. In recent months, it has been announced that one of the largest multinational delivery companies is conducting a major test of the vehicles. Large corporations with billions in sales have the means to give the climate transition a real economic boost.

The First Hydrogen share is currently trading in the EUR 0.30 to 0.32 range in Germany. The placement of a convertible bond is currently underway in Canada. The resulting dilution is depressing sentiment somewhat, but the long-term prospects are excellent, especially if the Democrats win in the US. In addition to good long-term prospects, FHYD shares currently also have high speculative potential, as a major multinational order could materialize at any time.

ThyssenKrupp - Nucera and Marine Systems in focus

The Duisburg-based steel and technology group ThyssenKrupp has entered troubled waters. High debt and huge pension obligations are putting pressure on the balance sheet. The stock market has now caused the market capitalization of the traditional German company to fall below EUR 2 billion, and now rumors of a break-up are doing the rounds. In addition to the 50% stake in the hydrogen subsidiary Nucera, which is worth EUR 600 million, there are repeated discussions about the sale of the profitable Marine Systems division (TKMS). TKMS accounts for around 10 to 15% of total Group sales. TKMS is particularly active in the field of submarine and naval shipbuilding and is one of the world's leading suppliers in this sector. In the dispute over the future of the steel division, Thyssenkrupp Steel has now lost most of its Executive Board members. Four members of the Supervisory Board have also announced their resignations - including the Chairman of the Board, Sigmar Gabriel.

The tension in the group is increasing, with the stock market setting a new all-time low for TKA shares of EUR 3.08 in August. On the Refinitiv Eikon platform, only 3 out of 11 experts are still positive, but we find the average price expectation of EUR 7.20 more than ambitious. The long-term investor collects up to EUR 3.25, and the speculator waits for clear upward breakout signals.

The buying frenzy on the stock markets seems to have ended for the time being, but everyone wants to have enough shares for the next US interest rate cut cycle. The FED event is not far off. Fundamentally, the defense sector continues to look strong, while the hydrogen sector lacks public contracts. The up-and-coming H2 mobility specialist First Hydrogen from Canada has become truly affordable, and with the first product sales expected in 2025, we could quickly see a premium of several 100%.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.