September 10th, 2024 | 07:15 CEST

Warning: DAX and stock correction - Here come the Comeback stocks! TUI, ThyssenKrupp, Nucera, Desert Gold, and Lufthansa

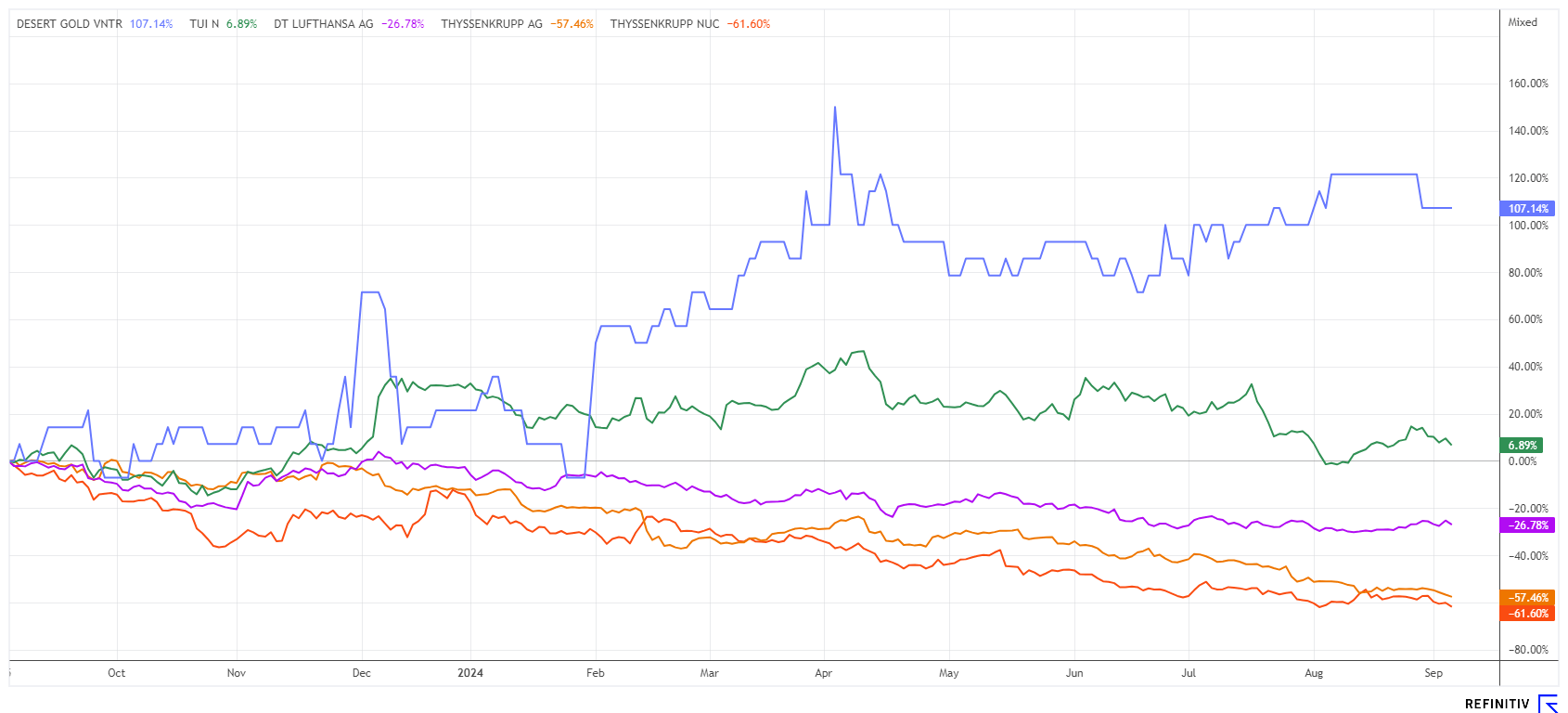

The stock market gives and takes. After a sharp correction in July, there was a real buying frenzy in August. Surprisingly, however, the old crowd pullers did not reach new highs. Chart technicians interpret this as a dangerous double top with a subsequent sell trigger, which was already in place last week. So, while the major stocks continue to sell off day after day, the underperformers of recent months are starting to attract renewed attention. And if the rotation is successful, quick rebounds with decent returns are on the cards. We take a closer look at a few turnaround candidates.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

TUI AG NA O.N. | DE000TUAG505 , THYSSENKRUPP AG O.N. | DE0007500001 , THYSSENKRUPP NUCERA AG & CO KGAA | DE000NCA0001 , DESERT GOLD VENTURES | CA25039N4084 , LUFTHANSA AG VNA O.N. | DE0008232125

Table of contents:

"[...] Both the geology and the infrastructure around the project make for a very attractive cost structure. We expect to be able to produce at 50% of the current gold price. [...]" Bill Guy, Chairman, Theta Gold Mines Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

ThyssenKrupp and Nucera - A traditional company in turmoil

It has finally happened. After weeks of struggle, the share price of steel and technology group ThyssenKrupp fell below the EUR 3 mark as the escalation surrounding the steel division entered the next round. Following the resignation of several key executives and board members from the steel division, investors continued selling off shares, pushing the price to a new all-time low of EUR 2.90. This highlights just how shattered the trust has become within the Company.

Including the EUR 600 million stake in Nucera, ThyssenKrupp is now only worth EUR 1.8 billion. As recently as 2011, TKA shares were trading at over EUR 30. The good thing is that all sell-offs in shares that do not ultimately go bankrupt run statistically from the high to around the 90% loss threshold. Then the tide turns in the medium term, or the stake is lost completely, as in the case of Varta, for example. The stock market is now speculating what the turnaround at ThyssenKrupp might look like? A sale of the steel division to Arcelor? A separation from Nucera or IPO of the Marine Systems division (TKMS)? It will be challenging because the debt, including pension obligations, is still over EUR 20 billion, and the operating business remains at a loss. Then there are the daily disputes with employee representatives. Problems are everywhere, and there are few options for action. Hands off!

Desert Gold - The smell of gold is in the air

There is a lot of movement in equities, but gold remains stable at the USD 2,500 mark. This is largely due to the loss of purchasing power of currencies, as Western economies have had to cope with a cumulative inflation surge of around 40% since the COVID-19 pandemic. Once again, the precious metal has proven its value retention function, delivering an annual return of around 8.5% since 1995, comparable to the returns of an internationally diversified stock portfolio. Then there are the numerous trouble spots and the shaky real estate markets. Concrete gold currently appears to be far inferior to the yellow metal, and there is another advantage: Precious metals can be sold daily at spot prices! This level of liquidity is rarely found in comparable assets.

Africa has been a continent of precious metals and raw materials for several hundred years. Huge potential lies dormant there in important metals and minerals. Traditionally, the connection to Western investors has also been a guarantee for investments on the continent. The Canadian explorer Desert Gold Ventures has been focusing on the Senegal Mali Shear Zone (SMSZ) for several years. Here, 1 million ounces of gold have already been identified close to surface. Further drilling is currently underway, and a feasibility study is being prepared. The current resource should be able to be significantly expanded by new discoveries, and the report could also document the profitability of mining the oxide and transition mineral resources in the Barani East and Gourbassi West gold deposits. This would make low-cost heap leach production conceivable from 2025 onwards.

There is currently an interesting subscription option for holders of the 42.8 million Desert Gold warrants issued. Anyone who declares exercise during the four-week incentive period, which is still subject to approval, will receive a new warrant at CAD 0.08 with a three-year term in addition to the shares purchased. Desert Gold anticipates a high subscription rate and gross proceeds of up to CAD 3.86 million, which will be used to continue development work on the SMSZ project. Based on a low market capitalization of only CAD 17 million, the ongoing discussions with strategic investors may lead to a rapid revaluation. Speculative positioning makes sense.

TUI and Lufthansa - Good booking situation, historically low share prices

TUI and Lufthansa shareholders are learning that things can go even lower almost daily. Despite outstanding booking numbers for the autumn and winter months, new investors are struggling with ongoing issues in the travel sector. In 2024, Lufthansa had to cancel hundreds of flights due to several strikes due to climate activists, as many vacationers were only able to take their vacations with a delay. How the three-digit million losses can be recovered from those responsible remains uncertain. The airline expects an adjusted EBIT of EUR 1.4 to 1.8 billion in the current year. The well-performing Cargo division could help, as it provides a free cash flow of up to EUR 1 billion. Despite having already adjusted its forecast downwards, JPMorgan remains skeptical and is again lowering its expectations. The analysts at the US investment bank have renewed their "Underweight" rating and lowered their 12-month price target from EUR 5.00 to EUR 4.60. In contrast, the experts at UBS view the situation differently. In a sector study, they rate the share as "Buy" with a target price of EUR 9.25.

The TUI share has experienced ups and downs in the last week. The travel giant wants to intensify its cooperation with Turkish hotel partners in order to increase the number of guests. Turkey is a classic all-inclusive destination and offers good value for money despite price increases of 25% on average. Antalya is now ahead of the long-standing leader Mallorca in the demand ranking. Technically, the 50-day line is currently at EUR 6.07. With current prices around EUR 5.80, the path to a buy signal is not far away. The high short-seller ratio could accelerate the move at some point. Both tourism shares offer a 2025 P/E ratio of 4.6; the book value of the Lufthansa share is also above EUR 8.50. In our opinion, the tourism shares will not get much cheaper, meaning that entry prices below EUR 6 over the next 2 to 3 years could yield substantial returns.

The stock market is currently very selective and affected by the high-tech craze. While the large blue chips on the NASDAQ are chasing new highs, the small caps are progressing much slower. However, sentiment seems to have turned in the last week. Blockbuster titles are stuttering, but interest in second-line stocks is rising again. While ThyssenKrupp is restructuring, TUI and Lufthansa are working on the EUR 6 mark. At Desert Gold, it is not only the warrant holders who should assess their positions.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.