May 16th, 2024 | 06:45 CEST

Saturn Oil + Gas, RWE, thyssenkrupp - Full speed ahead in energy and heavy industry

The oil and gas industry has evolved significantly thanks to technological developments. The Canadian energy company Saturn Oil & Gas has already completed four successful wells in southeast Missouri, USA, in the first quarter of 2024, with promising results. Further strategic investments, such as the acquisition of assets and financing commitments, strengthen Saturn Oil & Gas as an industry leader. RWE reports positive quarterly results. Despite lower earnings in the 'Flexible Generation' segment, the Company is optimistic due to the expansion of renewable energy projects. Thyssenkrupp reported stable results in the second quarter, although order intake and sales were down compared to the previous year. CEO Miguel López emphasizes the progress made in Marine Systems. Despite challenges, thyssenkrupp is sticking to its forecasts. Where is an investment worthwhile?

time to read: 5 minutes

|

Author:

Juliane Zielonka

ISIN:

THYSSENKRUPP AG O.N. | DE0007500001 , RWE AG INH O.N. | DE0007037129 , Saturn Oil + Gas Inc. | CA80412L8832

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

Juliane Zielonka

Born in Bielefeld, she studied German, English and psychology. The emergence of the Internet in the early '90s led her from university to training in graphic design and marketing communications. After years of agency work in corporate branding, she switched to publishing and learned her editorial craft at Hubert Burda Media.

Tag cloud

Shares cloud

New technologies drive oil and gas production: Saturn Oil & Gas leads innovations

Oil drilling has been around for more than a century. But thanks to numerous technological developments, the industry evolved enormously during that time. The growth of oil production continues to be crucial to the economic progress of various countries. Saturn Oil & Gas, a growing Canadian energy company is focused on developing high-quality assets with an emphasis on light oil. Their current portfolio in Saskatchewan and Alberta offers long-term opportunities for oil production. They are committed to an ESG-focused culture and seek to grow reserves, production and cash flow while delivering attractive returns.

In the first quarter of 2024, Saturn completed four horizontal wells in the Brazeau area of Missouri, USA, targeting Cardium light oil. These wells produced outstanding results, including the Brazeau 100/03-17-045-11W5 well with an impressive IP30 rate of 723 boe/d (50% light oil and NGLs). Saturn also has several risk-relieved horizontal drilling locations in central Alberta, Canada. In addition, Saturn has recently announced a number of innovations and strategic investments, including:

- Asset Acquisitions: Saturn has acquired assets in southeast and southwest Saskatchewan that will add 13,000 boe/d to its production and increase its drilling inventory by 65%. This establishes Saturn as the sixth-largest producer in the province of Saskatchewan.

- Financing Commitments: The Company has secured USD 625 million in debt financing to reduce its existing debt and increase its flexibility.

- Equity Financing: Saturn aims to support the acquisition and strengthen its financial position through equity financing of USD 100 million.

On completion of the acquisition, Saturn will be positioned as a leading midstream oil producer, with a market value of USD 541 million and an enterprise value of USD 1.3 billion. These strategic moves underscore Saturn Oil & Gas' position as an industry leader in the development of new technologies and business opportunities.

RWE on the upswing: Stable quarterly results and expansion of green energy projects mark a successful start to the new year

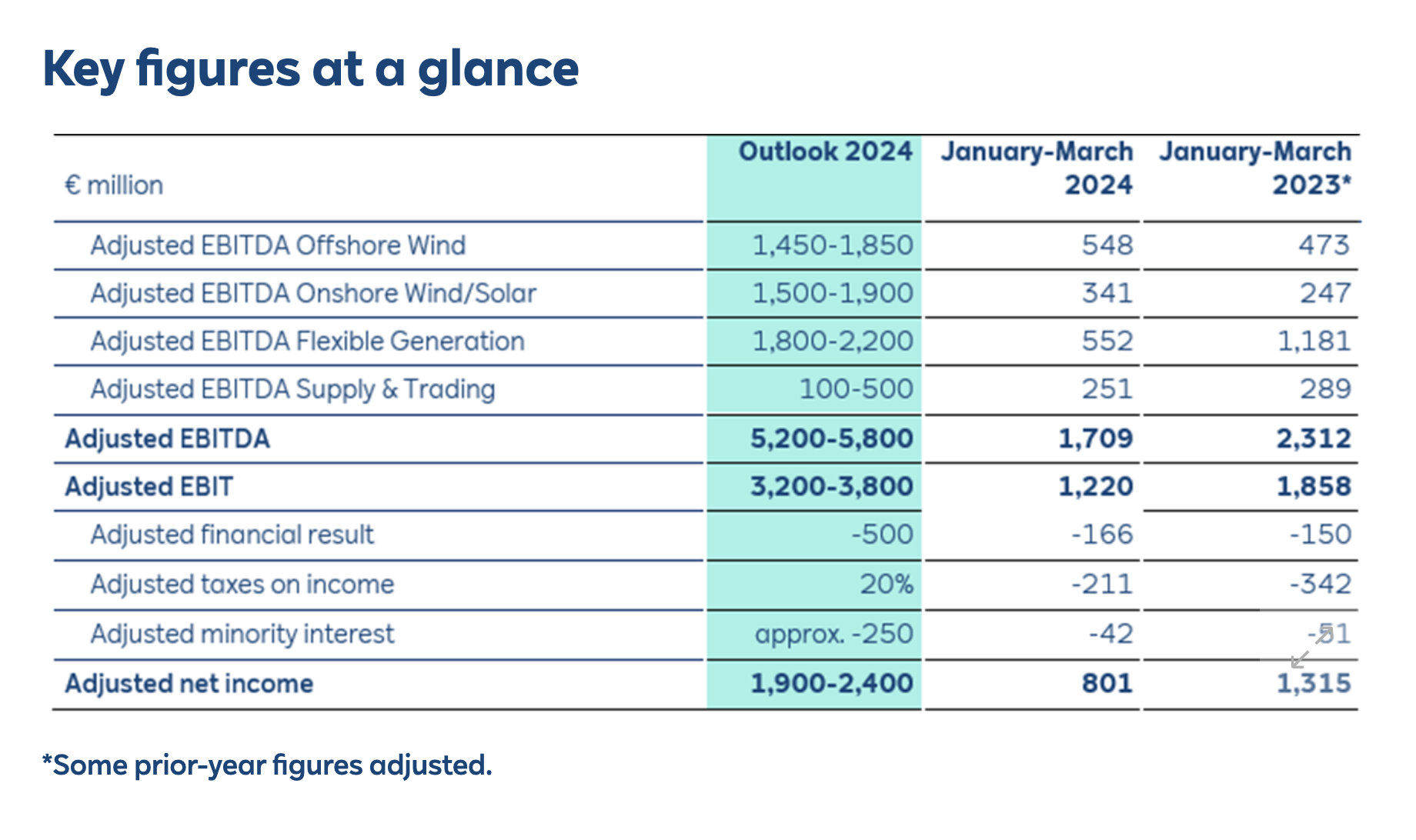

The global energy group RWE AG published its figures yesterday. In the first quarter, the Company achieved an adjusted EBITDA of EUR 1.7 billion and an adjusted net profit of EUR 0.8 billion. This decline compared to the previous year is mainly due to lower earnings in the 'Flexible Generation' segment.

Michael Müller, CFO of RWE AG, is optimistic: "We can look back on a solid first quarter of 2024, with significant increases in earnings in both Offshore Wind and Onshore Wind/Solar. This demonstrates that our investments are paying off."

In the first quarter of 2024, RWE is investing EUR 2.3 billion net, with around EUR 1 billion going towards the acquisition of three offshore wind projects off the coast of the UK. RWE is also investing more than twice as much in the construction of new wind and solar power plants as in the same period of the previous year.

RWE is currently building offshore wind power plants with a total capacity of 8.3 GW, such as 'Thor' in Denmark with 1.1 GW. The expansion of onshore wind and solar energy and the construction of new batteries are also being driven forward. Here is how the business development by segments fared in the first quarter of 2024:

- Offshore Wind: Adjusted EBITDA amounted to EUR 548 million, compared to EUR 473 million in the first quarter of 2023.

- Onshore Wind/Solar: Adjusted EBITDA amounted to EUR 341 million compared to EUR 247 million in the prior-year period.

- Flexible generation: The segment's adjusted EBITDA fell from EUR 1.181 billion in the same period of the previous year to EUR 552 million.

- Trading & Sales: The segment's adjusted EBITDA amounted to EUR 251 million, compared to EUR 289 million in the previous year.

Despite high investment activity, RWE is in a solid financial position. As of March 31, 2024, net debt amounted to EUR 11.2 billion. RWE confirms its target of distributing a dividend of EUR 1.10 per share for the current financial year.

Steel giant thyssenkrupp on track despite challenging market conditions in Q2

In the second quarter of this year, thyssenkrupp delivered a stable performance in line with management's forecasts despite challenging market conditions. However, both order intake and sales are below the previous year's figures. The main reason for this is the current difficult economic situation in Germany.

The adjusted operating result (EBIT) is also slightly lower than in the previous year, but internal processes are running more smoothly, which is due, in particular, to the effects of the "APEX" performance program. Free cash flow before M&A increased compared to the previous year but remained negative due to seasonal factors. Despite these challenges, thyssenkrupp confirms its full-year guidance for adjusted EBIT and free cash flow before M&A for fiscal year 2023/2024.

CEO Miguel López emphasizes that despite challenges, his company continues to make progress in strategic realignment, especially in the steel sector. The results of the various divisions are moving in different directions. Some areas are reporting declining results, while others are showing encouraging growth. Among the divisions reporting encouraging growth, the Marine Systems division stands out. In the second quarter of the 2023/2024 financial year, thyssenkrupp was able to increase both order intake and revenue, mainly due to projects in the surface and subsea sectors. Despite this rather mixed result, thyssenkrupp remains confident and is sticking to our forecasts for the current financial year.

For investors, this means that despite current market fluctuations and structural changes, the Company is in a position to pursue its financial targets and create long-term value for shareholders.

Overall, the quarterly results of the three companies, Saturn Oil & Gas, RWE and thyssenkrupp, show different trends and developments. Saturn Oil & Gas achieves solid results in the first quarter of 2024. It continues to focus on innovation and strategic investments to expand its portfolio and strengthen its position in the industry. The planned acquisitions and financing commitments indicate that the Company has promising growth potential, particularly in terms of tapping into new technologies and business opportunities. RWE also reports positive quarterly results, with a focus on the expansion of green energy projects. RWE's ongoing expansion of offshore and onshore wind and solar projects could contribute to a sustainable growth strategy in the long term. thyssenkrupp, on the other hand, is struggling with challenges due to difficult market conditions despite stable performance. But Marine Systems is recording growth - in plain language: armaments. The latter is booming due to geopolitical tensions. For investors, an investment in Saturn Oil & Gas could prove promising, as the Company is on its way to strengthening its position in the industry and further expanding its portfolio. RWE could also be attractive to investors interested in renewable energy who want to benefit from the Company's long-term growth strategy. For thyssenkrupp, investors should monitor the Company's performance closely as current market conditions and strategic realignment bring further uncertainty.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.