July 11th, 2023 | 07:10 CEST

End of the downward spiral - Shell, Saturn Oil + Gas, TotalEnergies

With the break of the downward trend established since June 2022, the oil markets, both Brent and WTI, received a significant boost. Fossil fuels are expected to gain further support from the announcement of production cuts by OPEC+ countries, including Saudi Arabia and Russia. The desert state plans to cut its production quota by one million barrels per day, while Russia plans to reduce production by 500,000.

time to read: 3 minutes

|

Author:

Stefan Feulner

ISIN:

Saturn Oil + Gas Inc. | CA80412L8832 , TOTALENERGIES SE | FR0000120271 , Shell PLC | GB00BP6MXD84

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

Stefan Feulner

The native Franconian has more than 20 years of stock exchange experience and a broadly diversified network.

He is passionate about analyzing a wide variety of business models and investigating new trends.

Tag cloud

Shares cloud

Shell - Optimistic analysts

The analysts of Deutsche Bank Research concede a price potential of 40% to the largest oil and gas company in Europe, headquartered in London. Following the publication of a second-quarter update, the experts raised the price target from the initial GBp 2,907 to the current GBp 3,268, maintaining a "buy" rating for Shell's stock. The driving factors for this increase are, in addition to the new appointment of the top management, a renewed focus on value.

The US colleagues of JP Morgan, on the other hand, continue to consider a price target of GBp 2,950 realistic and see the energy giant as an "Overweight" candidate after the analysis of the Capital Markets Day. Analysts at Jefferies also reiterated their buy recommendation with a price target of GBp 3,100, with the oil multinational's interim report generally in line with the outlook already published.

Shell announced in an update that significantly lower sales in its gas division were expected for the second quarter. In addition, impairment charges of up to USD 3 billion were expected, mainly due to a 1% increase in the discount rate for impairment testing.

Saturn Oil & Gas - Strong growth fizzles out

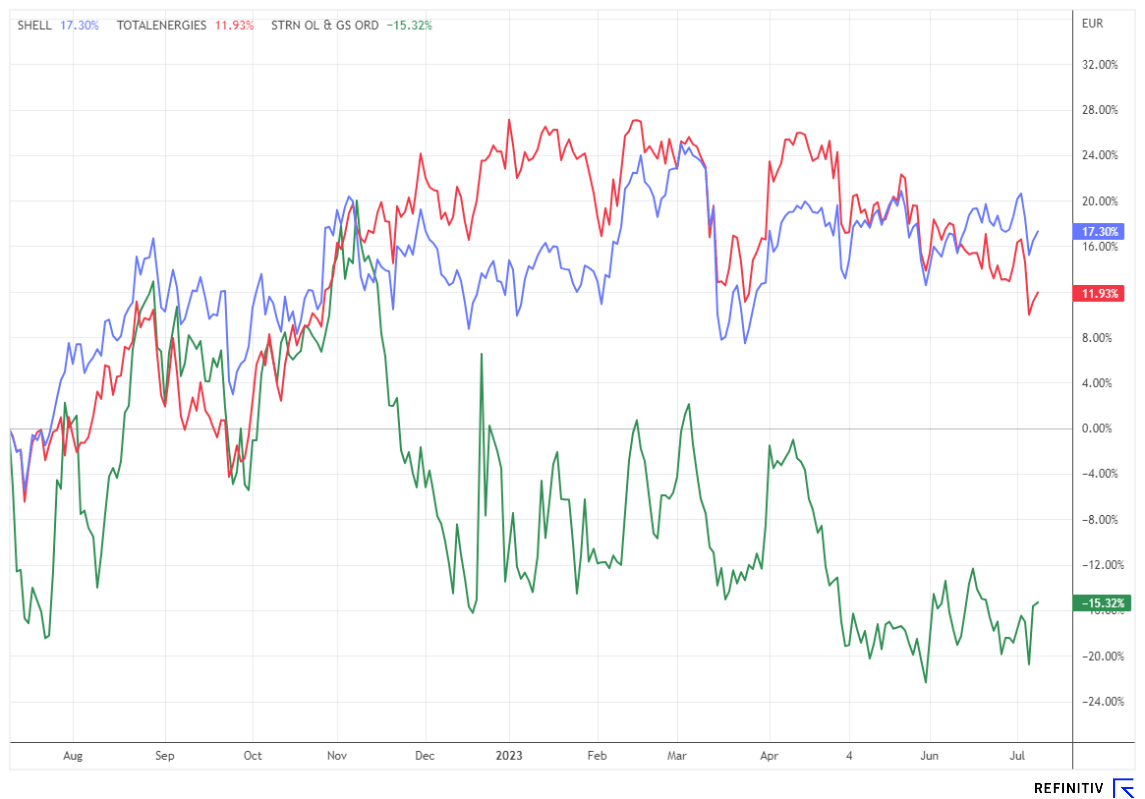

As can be seen in the chart above, Canadian growth company Saturn Oil & Gas is significantly lagging behind its peer group with an annual performance of minus 15.32%, even though several acquisitions have increased the daily production rate from around 600 barrels per day in mid-2021 to 30,000 barrels light oil equivalent today. This results in an operating earnings guidance of CAD 475 million on an EBITDA basis.

After deducting reinvestment costs for new properties, this means a cash flow per share of approximately CAD 3.00. With the high positive cash flow, Saturn Oil & Gas plans to reduce its debt to zero by the end of 2025, down from CAD 550 million at the end of the first quarter.

With an increased market capitalization through several capital measures in recent years, which currently amounts to CAD 316.57 million, the Calgary-based company is becoming increasingly interesting for institutional investors. The listing on the Toronto Stock Exchange, which has been in place since mid-June, should make access to larger addresses even easier.

The analyst firm Eight Capital sees significant undervaluation in the case of Saturn Oil & Gas, with a price target of CAD 7.50. Similarly, First Equity Research has attached a price tag of CAD 6.30 to the oil producer. The undervaluation prompted GMT Capital Corp., a major investor from South Atlanta, to increase its stake in Saturn Oil & Gas by a further 7 million shares. Following the acquisition, the shareholding stands at 24.91%.

TotalEnergies with a mega deal

French energy giant TotalEnergies has been cooperating with Iraq in oil and gas exploration since the late 1920s. This cooperation has now been significantly expanded once again with the signing of a USD 27 billion energy agreement. The aim of this partnership is firstly to increase oil and gas production and secondly to increase the country's energy production capacity through four oil, gas and renewable energy projects. In the Gas Growth Integrated Project (GGIP), TotalEnergies is to receive a share of over 45%. Qatar Energy has a one-quarter stake, with the Persian Gulf state holding the remaining 30%.

The project is designed to improve the country's electricity supply by recovering flared gas from three oil fields and using the gas to supply power plants, helping to reduce Iraq's import bill. TotalEnergies announced plans to develop a solar power plant with a capacity of 1 GW. Iraq, in turn, hopes the project will attract new foreign investment in its energy sector, which has been absent since a series of deals following the US invasion more than a decade ago.

Exxon Mobil, Shell, and BP had scaled back their operations in Iraq in recent years, contributing to stagnation in oil production. As a result, oil production capacity in recent years has been just 5 million barrels per day, compared with about 12 million barrels per day pumped to the surface by Saudi Arabia.

The oil markets delivered a clear buy signal with a breakout from their downward trend. Analysts are positive about Shell and Saturn Oil & Gas. TotalEnergies attracted attention with a billion-dollar deal with Iraq.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") may hold shares or other financial instruments of the aforementioned companies in the future or may bet on rising or falling prices and thus a conflict of interest may arise in the future. The Relevant Persons reserve the right to buy or sell shares or other financial instruments of the Company at any time (hereinafter each a "Transaction"). Transactions may, under certain circumstances, influence the respective price of the shares or other financial instruments of the Company.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.