May 28th, 2024 | 07:00 CEST

The high-tech party à la Nvidia continues! Super Micro Computer, MGI, GameStop and Alphabet in focus

Another new NASDAQ all-time high! Meanwhile, things did not look so good the day after the Nvidia figures. The market collapsed by 400 points in just 5 trading hours, but thanks to well-known protagonists, it recovered surprisingly quickly. High-tech investors are currently trading the big growth fantasy of "artificial intelligence" and are patiently waiting for an interest rate signal from the FED. Before then, there will likely be some relief from the ECB. This is because economic development in Europe is not progressing due to Germany's pronounced weakness as a business location. High inflation and the entrenched capital market interest rate are cited as obstacles. This is putting pressure on consumers' budgets. Despite all the prophecies of doom, some business models offer good growth even in challenging economic situations. We provide an insight.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NVIDIA CORP. DL-_001 | US67066G1040 , SUPER MICRO COMPUT.DL-_01 | US86800U1043 , MGI MEDIA AND GAMES INVEST SE | SE0018538068 , GAMESTOP CORP. A | US36467W1099 , ALPHABET INC.CL C DL-_001 | US02079K1079

Table of contents:

"[...] We recognized that there is a lack of business models that combine innovative business concepts, such as "new retail" solutions and omni-channel strategies, with conventional business segments. [...]" Fan Xian Yong, CEO, The Place Holdings

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Alphabet - Google is growing reliably

When the two Stanford graduates Sergey Brin and Larry Page developed a search engine called "BackRub", they probably had no idea that in just 25 years, it would become an internet company with a turnover of over USD 300 billion and a company value of USD 2.2 trillion. The Alphabet holding company, which has existed since 2015, now comprises 15 subsidiaries and invests in hundreds of start-ups via its investment arm "Google Ventures". Google processes around 100,000 queries per second, resulting in around 8.5 billion searches per day. This figure corresponds to the population of humanity on Earth.

In 2023, the Alphabet holding company generated USD 307.4 billion in revenue, of which 77.4% came from advertising, 10.8% from cloud applications, 11.3% from subscription models and devices and around 0.5% from the Company's own experiments. According to consensus estimates, the Californian company is set to grow revenue by around 10% p.a. over the next few years, with operating profit set to increase by a disproportionately high 15% annually. 34 of 44 analysts on the Refinitiv Eikon platform give the stock a "Buy" rating with an average target price of USD 195.80, around 9% above the current price. A great, long-term growth story!

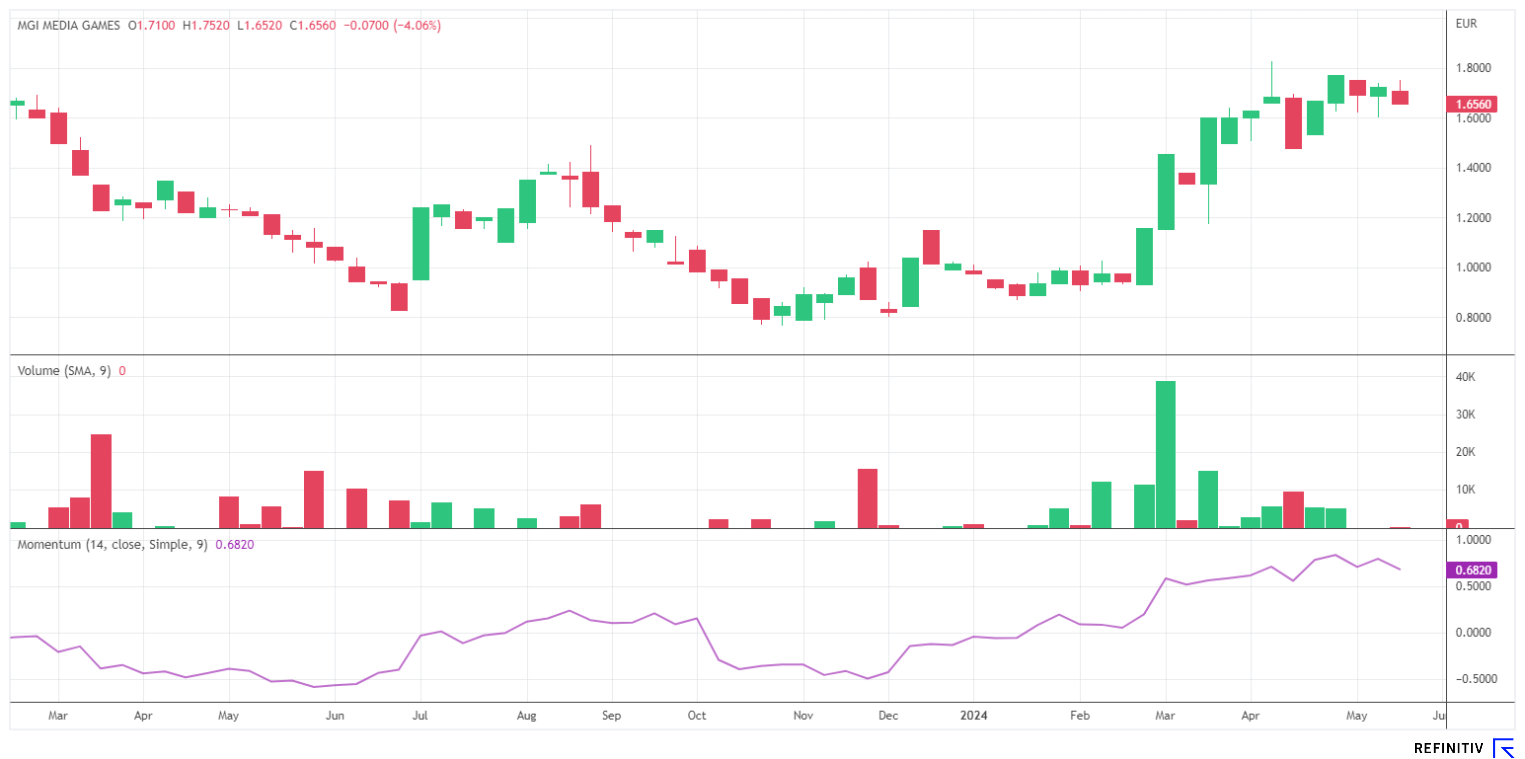

MGI - From games provider to digital advertising professional

MGI - Media and Games Invest SE, based in Stockholm, is also active in the advertising sector but is much smaller. Launched initially as a games company in Germany (at that time under the name gamigo AG), the Company has undergone a fundamental transformation at all levels over the last six years. Operationally, the games business now accounts for only a fraction of the Company's business; its core business is programmatic advertising, which is experiencing strong organic growth. Using a programmatic platform, MGI connects the demand from advertisers with the supply of ads from publishers in milliseconds. Strategic investments in data analysis and the implementation of artificial intelligence are intended to further improve the targeting of audiences.

To complete the transformation process, the Company will change its name to "Verve" after the Annual General Meeting on June 13, 2024, subject to shareholder approval. The operating advertising business has been operating under this brand since 2020. The growth in recent years must be described as rapid. MGI now reaches over 2 billion end devices with its programmatic advertising platform. In 2023, the Company generated revenue of EUR 322 million and adjusted EBITDA of EUR 95 million. Almost 70% of MGI's (soon to be Verve) revenues are generated in North America, the largest and fastest-growing market for programmatic advertising. In the first quarter, revenue increased organically by 21% to EUR 82.5 million as planned, and the number of connected software customers rose by 30% to 2410. Operating cash flow increased by EUR 17 million to EUR 9.1 million, while the Company still has cash of EUR 120 million. With current net liabilities of EUR 318.8 million, the enterprise value is around EUR 590 million. The aim is to reduce debt significantly and annual interest expenses and achieve double-digit organic growth.

For the current year 2024, CEO Remco Westermann expects revenue to increase to between EUR 350 million and EUR 370 million due to the upturn in the advertising markets. With an operating margin of around 27%, an operating profit (EBITDA) of EUR 100 to 110 million should be achievable. Thanks to successful investments in organic growth and innovation as well as targeted acquisitions, MGI has built up an impressive one-stop store for programmatic advertising with the Verve Group. The Company can now buy and sell advertising space across all digital devices. According to Pixalate, the group's growth of 12% in Q4-2023 was even just ahead of the Google AdExchange. It is very exciting to see how things will continue here.

Super Micro Computer - Price trend confirms top formation

Back to the US. In our recent analyses, we identified a top formation with a head and shoulders formation between USD 880 and USD 1225 for Super Micro Computer. After an extensive correction, the stock attempted to surpass the technical hurdle of USD 970 again last week. Despite good figures from Nvidia, SMCI fell back to USD 883 towards the weekend. This means that the price trend is again right on the neckline of the reversal pattern. Following Nvidia's announced stock split, Wall Street is now also speculating on an increase in the number of shares in Super Micro Computer. If the high-tech buying mood persists, the share price could spike again before the split date and possibly follow its predecessor, Nvidia. As before, 13 out of 18 analysts recommend buying, and the average price target on the Refinitiv Eikon platform has risen from USD 1020 to USD 1045 in the last 3 weeks.

GameStop - The plaything of the Super Traders

For the third time, the GameStop meme share is being driven upwards by the return of "Roaring Kitty", aka US investor Keith Gill. Again, the share price rises by more than 400% in 3 days. However, just as in the other two highs, the share price fell again by 70% within 48 hours. Easy come, easy go! GameStop's management reacted quickly this time and announced the miraculous rise in the share price to place an "at-the-market" capital increase of USD 933 million. This amount exceeds the Company's net revenue for the first quarter. The incident highlights how hot the stock markets are again at the moment. Sufficient liquidity is available even for extreme swings. Once again, around 150 million shares changed hands, which is half of all outstanding shares. After the close of trading on Friday, however, the share price rose sharply again, as the successful capital increase was celebrated accordingly. Casino Royale sends its regards!

The stock market is back in high spirits. Shortly after the much-loved dividend season, the markets are bubbling over with liquidity. The main protagonists come from the high-tech and artificial intelligence sectors. Alphabet and MGI (Verve Group) are well positioned here for the long term. One needs strong nerves for the more volatile shares of Super Micro Computer or GameStop.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.