May 9th, 2024 | 07:00 CEST

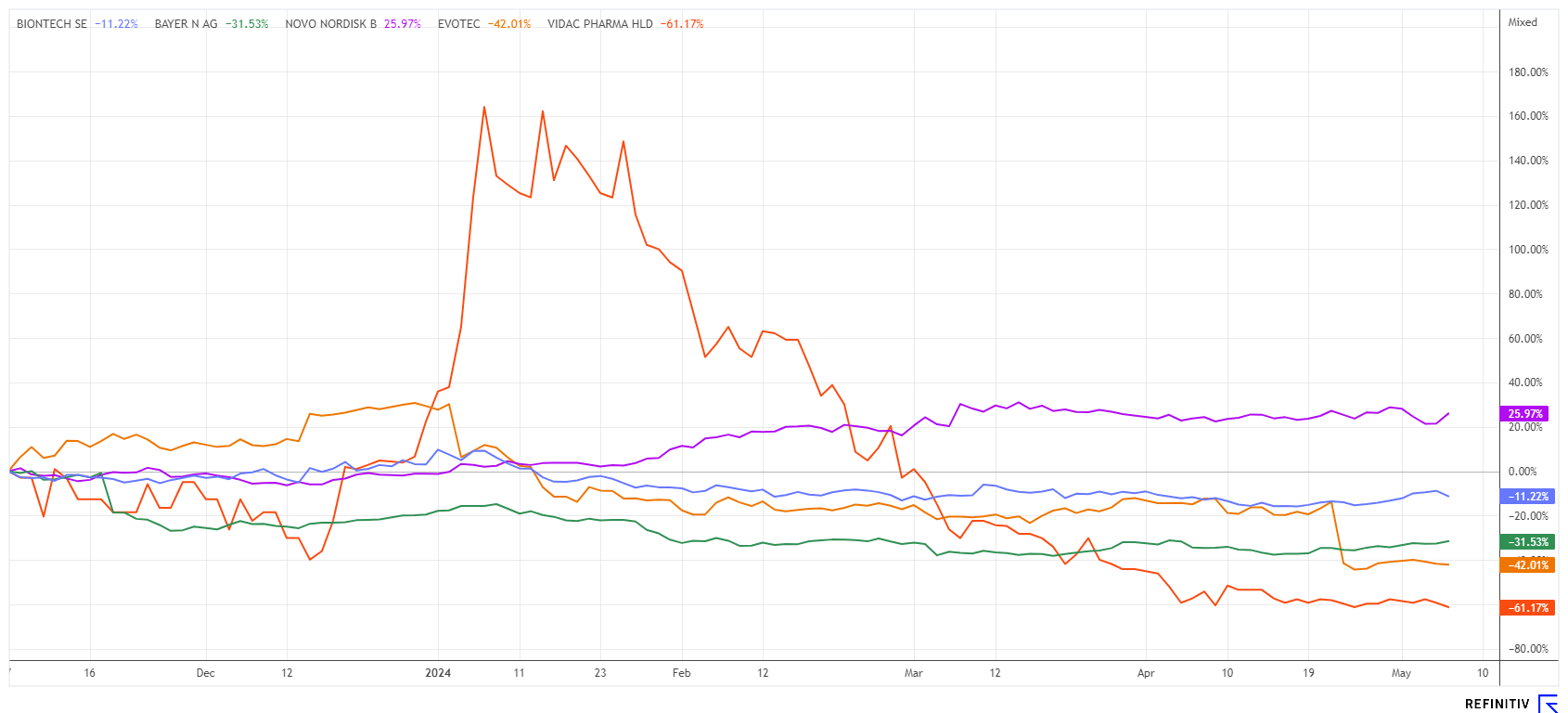

Biotech and pharma stocks finally follow suit! Novo Nordisk, Bayer, BioNTech, Vidac Pharma and Evotec on the buy list

Things looked very different at the beginning of the year. After a brilliant rally in the Nasdaq Biotech Index at the end of last year, investors thought the upswing could continue in 2024. So far, this hope has not been confirmed. The main focus for the industry is the refinancing conditions. These have gradually deteriorated, as stubborn inflation is keeping central bank interest rates high. And judging by the wording of central bankers, the next interest rate cut does not seem to be penciled in yet. However, if it happens in the summer, things will likely move quickly for the life sciences sector. Then a quick sector rotation is the order of the day! Here is our buy list for the upcoming event.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NOVO NORDISK A/S | DK0062498333 , BAYER AG NA O.N. | DE000BAY0017 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , EVOTEC SE INH O.N. | DE0005664809

Table of contents:

"[...] Defence will continue to develop its Antibody Drug Conjugates "ADC" and its radiopharmaceuticals programs, which are currently two of the hottest products in demand in the pharma industries where significant consolidations and take-overs occurred. [...]" Sébastien Plouffe, CEO, Founder and Director, Defence Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Novo Nordisk - Simply unstoppable

The continuing boom in its weight loss drugs has boosted the Danish pharmaceutical group Novo Nordisk again in the first quarter. After an unexpectedly high profit, the Management Board raised its annual targets. "We are pleased with the sales growth in the first three months of 2024, driven by increased demand for our GLP-1-based treatments for diabetes and obesity," said CEO Lars Fruergaard Jorgensen.

In the first months of 2024, the drug "Wegovy" attracted four times more customers than in December. The Company was able to attract 27,000 new patients for weekly injections. Although new production sites have been opened, there are still supply bottlenecks in the US. The diabetes drug Ozempic and the weight loss injection Wegovy helped Novo Nordisk to record revenues and make it the most valuable listed company in Europe. The new guidance for the current year of 19 to 27% revenue growth and up to 30% increase in operating profit impressed analysts after a 27% increase in EBIT in the first quarter.

A total of 7 upgrades were recently issued on the Refinitiv Eikon platform. 17 of 28 analysts now have a "Buy" rating, and the average price expectation is DKK 956. From the current level of DKK 882, this is a premium of just under 10%. However, the pharmaceutical giant Eli Lilly has appeared on the list of competitors and is putting pressure on the margin. Let's see whether the hype surrounding the Danes will last much longer. Raise your stop just below the concise technical support line at EUR 110 to protect your profits.

Bayer, Evotec and BioNTech - When will the German biotechs turn around?

It is worth examining the market technology to assess whether the major biotech consolidation has already ended. In the case of Bayer, the dividend disappointment already seems to have been factored into the share price. A significant double low can also be seen in the EUR 25 to 26 range. Since the Annual General Meeting on April 26, investors have regained hope, and the share price has already gained a good EUR 2. The turnaround is on the table here.

In the case of Evotec, the annual figures for 2023 led to a further slump of 40% to EUR 8.63. After an attempt to recover to EUR 10, the share has headed south again in recent days with considerable turnover. Technically, a further test and continuation of the low for the year would be necessary, as well as good guidance after the Q1 figures on May 22. Warburg and Oddo Research have lowered their price targets to EUR 18 and EUR 13.50, respectively, but the buy ratings have been maintained. Sentiment in the share is expected to turn soon. The distortions of the old CEO Lanthaler should be a thing of the past.

Finally, BioNTech. There is a lot of lamentation about the lack of revenue after the pandemic frenzy. However, the Mainz-based company still has a whopping EUR 17.8 billion in its coffers. The share has tested the EUR 80 range several times. At a currently stronger EUR 84.20, investors are waiting to see the first quarter report on May 17. With a market capitalization of EUR 20.7 billion, 85% of the share price is covered by cash reserves. Buy signals are generated in the EUR 92 to 95 zone. Watch out!

Vidac Pharma - A wealth of opportunities in cancer research

The UK and Israel-based company Vidac Pharma plc has attracted a lot of attention in recent weeks. On some days over 200,000 shares of this small cap were traded. The reason could lie in the latest progress reports. At the end of April, for example, it was announced that the cancer drug VDA-1275 had entered the next phase of preclinical studies. In in vitro studies, VDA-1275 has shown strong synergistic effects with standard treatment for solid tumors in several mouse and cancer models and cellular organoid models. Using a CT-26 colon cancer line that develops tumors in mice, the new animal study will evaluate the activity of VDA-1275 alone and in combination with cisplatin, a widely used chemotherapy.

"These trials are another important step towards clinical studies for VDA-1275. We have already achieved exceptionally good results in laboratory tests. They confirm our approach of targeting the mislocalization of the enzyme hexokinase-2, which we believe plays an important role in the development of cancer", says CEO Prof. Max Herzberg. "We believe that the mechanism of action of VDA-1275 could have broad application in various tumors."

In the earlier in vitro studies, VDA-1275 showed statistically significant efficacy as a monotherapy as well as synergistic effects in combination with two standard cancer therapies: Sorafenib, a kinase inhibitor, and cisplatin, a widely used chemotherapeutic agent. The studies also showed that VDA-1275 elicited an immunologic response by inducing anti-tumor macrophages and memory T-cells and inhibiting tumor-promoting macrophages. Both VDA-1275 and the more advanced VDA-1102, which is currently in Phase 2b clinical trials for the treatment of advanced actinic keratosis and Phase 2 testing in cutaneous T-cell lymphoma, disrupt the interaction between hexokinase 2 and voltage-gated anion channels in mitochondria. Clinical data for Vidac's first-generation metabolic checkpoint modulator candidates have shown that they effectively stop cancer cell proliferation and restore immune responsiveness and apoptosis.

This is very good news for cancer patients looking hopefully to the biotech industry. If Vidac technologies are confirmed as effective therapies for humans, yesterday's market capitalization of around EUR 10 million is likely to multiply rapidly. CEO Prof. Max Herzberg is no stranger to the industry and has led several companies to success. And for those closely monitoring the share prices in Stuttgart and Hamburg, one might already suspect a "collector" today.

Artificial intelligence and defense have come a long way, and once again, the indices are trading near their yearly highs. If not all stocks follow suit, there will likely be no significantly higher highs. The automotive sector is unlikely to be able to turn the tide. This leaves the focus on the lagging biotechs. No one has wanted these stocks for a good 2 years, but the time has come for initial entries. The small-cap Vidac Pharma could make a giant leap at any time with good news.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.