June 21st, 2024 | 07:00 CEST

Biotech: What counts is selection! Bayer, Vidac Pharma, Formycon, and Evotec in focus

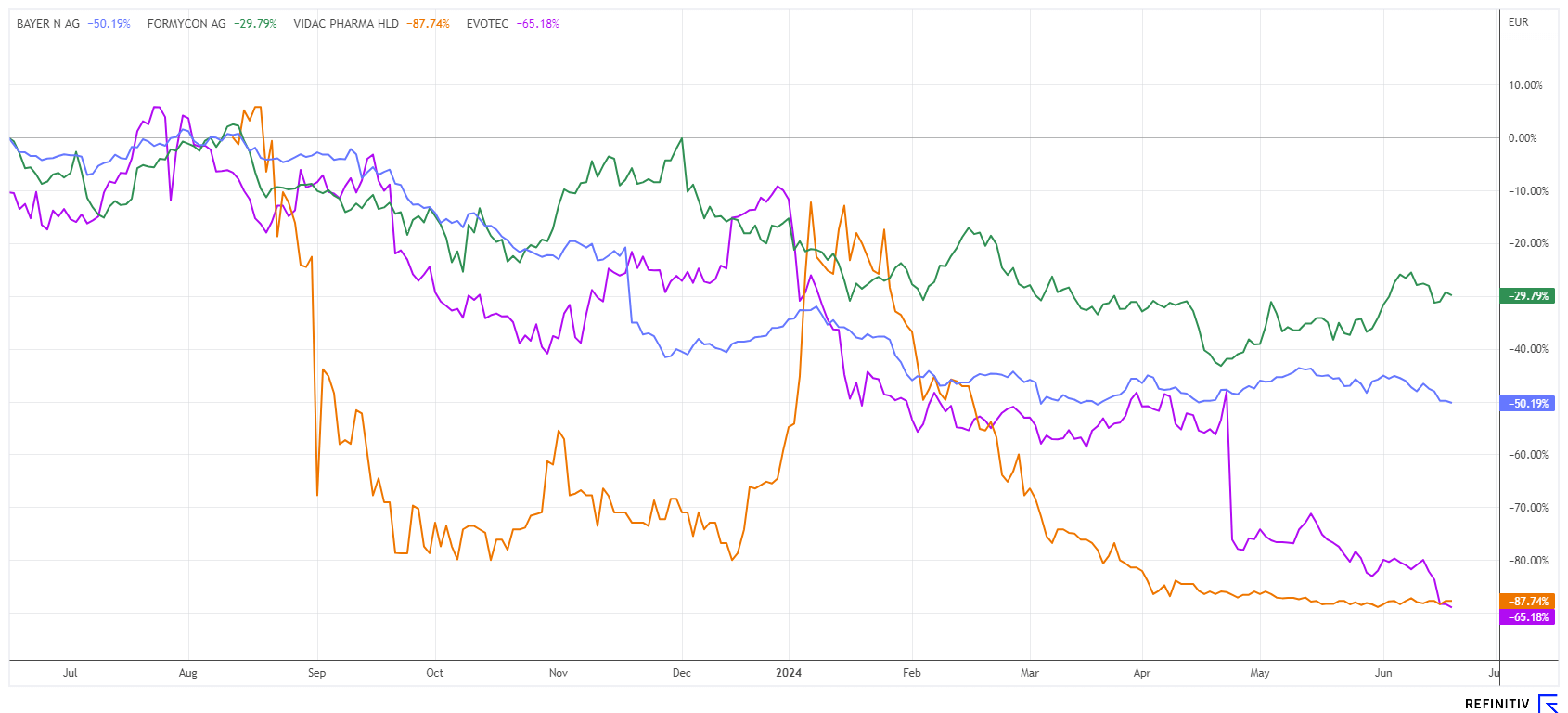

The biotech sector has so far been unable to keep pace with the high-tech-heavy NASDAQ. However, there are now signals from the central banks that a turnaround in interest rates is imminent. This is because, on the one hand, the US economy is weakening, and on the other hand, inflationary pressure appears to be easing. With lower interest rates, life science companies can refinance themselves more cheaply. Due to the different dynamics, it is now important to fish out the pearls. We select attractive entry levels.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , FORMYCON AG | DE000A1EWVY8 , BAYER AG NA O.N. | DE000BAY0017 , EVOTEC SE INH O.N. | DE0005664809

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer - This is what the restructuring plans look like

A challenging environment! Bayer is gradually losing patent protection for its two top sellers in the pharma division, Xarelto and Eylea, making the "new" products from the Leverkusen-based company, such as the prostate cancer drug Nubeqa, all the more important. In Q1 2024, Bayer increased its revenues in the Pharmaceuticals Division by 3.9% to EUR 4.36 billion. The new products Nubeqa and the kidney drug Kerendia contributed to a growth of around 65%. Adjusted EBITDA increased by 8% to EUR 1.19 billion, although the division was burdened by negative currency effects.

Hopes are now pinned on the ailing CropScience sector. The lawsuits relating to Monsanto's glyphosate have already resulted in losses in the double-digit billions. The Leverkusen-based company now wants to launch a total of 10 new blockbusters on the market over the next ten years and thus give its agricultural division a strong boost. Each top seller is said to have a sales potential of EUR 500 million, and the research and development pipeline is said to be worth more than EUR 32 billion. The Company announced this at the "Crop Science Innovation Update 2024" in Chicago.

Vidac Pharma - Patent application and new coverage

We have reported several times on Vidac Pharma plc in recent weeks. The interest in the share is enormous for a penny stock, with over 200,000 shares changing hands at times. The Company has just announced that the US Patent and Trademark Office (USPTO) has issued a notice of allowance for a patent application to protect a group of molecules. These molecules can trigger an immune response in various cancers by detaching the enzyme hexokinase-2 (HK2) from the mitochondrial VDAC pores. The molecules are the key compounds in Vidac's two drug candidates, VDA-1102 and VDA-1275.

"This US patent is the centerpiece of Vidac's efforts to develop an entirely new class of cancer drugs for patients. Our molecules are able to remove the HK2 enzyme from the mitochondrial VDAC pores, which reverses the abnormal metabolism of cancer cells and restores immune-supportive conditions and programmed cell death. We have had some very promising early results with our two drug candidates both in vitro and in the clinic," said Max Herzberg, CEO of Vidac Pharma.

Analysts have now initiated coverage of the Company. Sphene Capital has placed the Vidac milestones on a plausible timeline and anticipates the launch of the drug VDA-1102 in 2027 and 2028. This sets the trigger for revenues in the high double-digit range, reaching up to GBP 287 million by 2033. Discounted to present value, this results in a 12 to 24-month price target of EUR 4.90. The highlight: The share is currently available for purchase at a fabulous EUR 0.19 - please use your calculator for the corresponding potential.

Evotec and Formycon - Is there a chance of a rebound?

For weeks, the Evotec share has traded in the EUR 7.20 to 8.00 range. Yesterday, takeover rumors came to the table for the first time. Market players apparently recalled the selling spurts of the MorphoSys share in the spring. The takeover of Novartis was then immediately on the table, and the price paid was almost five times the low traded levels. The jump in Evotec's share price to EUR 8.50 was triggered by a report in the financial service "Bloomberg" that there were a number of potential buyers. Specifically, these are said to be private equity companies specializing in majority shareholdings or complete takeovers of medium-sized companies and groups. Let's see if the rally continues; one would certainly wish the scolded Hamburgers a strong share price recovery.

Munich-based biosimilar experts Formycon should also be kept on the radar. In April, the stock hit lows around EUR 37. Since then, however, the share price has gradually risen again. Currently, Formycon is starting the Phase I study "Dahlia" for the biosimilar FYB206. The aim is to investigate the pharmacokinetics, safety, and tolerability of FYB206 with the reference drug "Keytruda" against malignant melanoma. A treatment period of one year is planned with the first test subjects. The study is being conducted in close coordination with the relevant authorities in the US (FDA) and Europe (EMA). The Phase III "Lotus" study for FYB206, which will focus on non-small cell lung cancer, is also set to begin soon. According to Formycon, market approval for FYB206 could be achieved in the US by 2029 and in the EU by 2030. Yesterday, the EUR 50 mark was recaptured, and technically, the share is free to move upwards from EUR 55.

The stock market gives and takes away. In the case of biotech stocks, 2024 has so far been a lean period. After the sell-off, however, there are now opportunities again, as many companies can demonstrate progress, which should also boost share prices again. Additionally, takeover speculations similar to MorphoSys are in the air. Selection remains key!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.