GreenTech

Commented by Nico Popp on February 19th, 2026 | 07:55 CET

Energy transition 2.0: Why CHAR Technologies is thinking much further ahead than Enviva and why Plug Power is still dreaming

The global energy market has learned its lesson - electrons alone cannot save heavy industry. While wind turbines and solar parks are making power grids greener, steelmakers and gas suppliers face a physical dilemma: they need carbon molecules – just "green" ones. In this gigantic market for sectors that are difficult to decarbonize, former biomass giant Enviva has already proven that wood is a suitable energy source. But while Enviva has only burned pellets, CHAR Technologies is igniting the next stage of evolution. With their high-temperature pyrolysis (HTP) process, the Canadians are transforming simple biomass not only into heat, but into two high-value industrial products: biochar for the steel industry and renewable natural gas (RNG) for the grid. CHAR is thus delivering exactly the solution that visionaries like Plug Power are striving for with hydrogen, but can often only achieve with billions in investment in new infrastructure. CHAR Technologies uses the existing gas grid and earns money from day one.

ReadCommented by Armin Schulz on February 18th, 2026 | 07:10 CET

Plug Power, Pure One, Daimler Truck: Your turbocharger for returns in the billion-dollar market of emission-free mobility

The global economy is at a historic turning point in 2026. The forced shift away from fossil fuels is catapulting green technologies into a new dimension. Driven by regulatory hammer blows from Brussels and exploding investments worth billions, the decarbonization of heavy-duty transport and the hype surrounding hydrogen are colliding to create a perfect storm for investors. While battery-electric trucks are already conquering short distances, a race between systems is emerging in long-distance transport, in which only the technology with the best infrastructure can win. The following article highlights how Plug Power, Pure One, and Daimler Truck are shaping this battle for supremacy.

ReadCommented by Carsten Mainitz on January 26th, 2026 | 07:35 CET

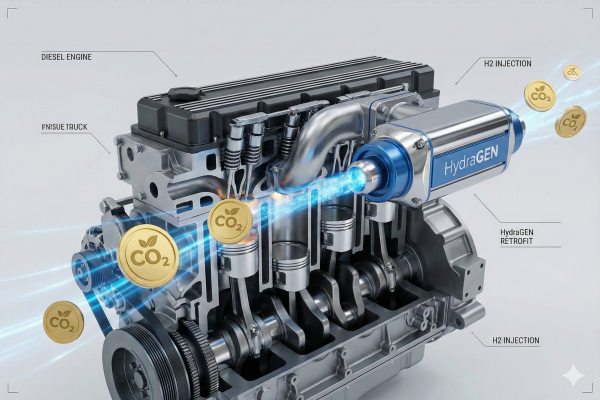

2026 – The comeback of hydrogen stocks: Now it is substance that counts, not hype! The hidden potential of dynaCERT, Ballard Power, and VW

For years, hydrogen stocks were considered the promise of the future. The hype was followed by a hangover. Valuations have fallen sharply, and after a phase of exaggerated expectations, the focus is now shifting to robust business models and industrial scaling. dynaCERT stands out with its innovative bridge technology that meets high environmental standards. Its ready-to-use solutions for reducing emissions are convincing more and more customers from industry. As an established player, Ballard Power is driving the further development of fuel cells in heavy-duty transport. Volkswagen is taking a different approach. A few days ago, the automaker published key data for the past fiscal year, which came as a positive surprise.

ReadCommented by Nico Popp on January 14th, 2026 | 07:05 CET

Between euphoria and industrial realism: How Linde, Hapag-Lloyd, and dynaCERT are defining the new reality of the hydrogen economy

We are witnessing a decisive turning point in the global hydrogen economy: The phase of speculative euphoria that characterized the beginning of the decade has given way to a phase of industrial realism and technocratic implementation. In investor circles and industry analyses, the term "mean reversion" has become established – a return to reality, away from unrealistic hyper-growth scenarios and toward physically feasible projects. According to the International Energy Agency's (IEA) Global Hydrogen Review 2025, the hydrogen sector continues to grow steadily and reached demand of nearly 100 million tons in 2024, but the structure of this growth is more complex than previously forecast. In this new environment, where regulatory interventions such as FuelEU Maritime and emissions trading (EU ETS) set the pace, three distinct winner profiles are emerging: infrastructure giant Linde, logistics heavyweight Hapag-Lloyd, and technology bridge builder dynaCERT, which occupies a highly compelling niche.

ReadCommented by Armin Schulz on January 9th, 2026 | 07:05 CET

Winners and losers in the silver shock: A look at the current situations of BYD, Silver North Resources, and Intel

A new battle over a familiar commodity is shaping the future of major global megatrends. Silver, critical for green energy, electromobility, and the electronics and semiconductor industries, is at the center of an explosive supply gap. The recent surge in silver prices is putting pressure on corporate margins, and like any crisis, it is creating both winners and losers. We therefore take a closer look at the current situation of BYD, Silver North Resources, and Intel.

ReadCommented by André Will-Laudien on October 27th, 2025 | 07:00 CET

Super returns, clear conscience! Nel ASA and JinkoSolar turn around, nucera surprises, and RE Royalties celebrates!

From the climate conference to real implementation! The European Union and other nations have committed themselves to ambitious sustainability programs through so-called "green deals." To support these efforts, the financial instrument known as the "green bond" has become firmly established in the market. Banks, in particular, that are keen to enhance their ESG credentials, are increasingly active in this segment. As a result, the green bond market has grown rapidly, driven by global climate targets, such as those agreed upon in the Paris Agreement. ESG investments are benefiting from political incentives like the US Inflation Reduction Act and are being dynamically sought after by insurers. Between 2015 and 2023, issuances grew by an average of 40% annually, with growth slowing somewhat since 2023. For the full year 2025, total issuance volume is expected to reach between EUR 570 and 630 billion. What, when, and where funding is provided is defined by regulatory authorities. But private organizations such as RE Royalties are also active, because green returns are not only rewarding, they also help society achieve its ambitious climate transition goals. Here are a few investment ideas.

ReadCommented by Armin Schulz on October 15th, 2025 | 07:15 CEST

How your portfolio can benefit from the green energy boom with Nordex, RE Royalties, and JinkoSolar

Winners despite turbulent times: As the global energy transition gains momentum, a future market worth billions is emerging. Ever-larger wind turbines, more cost-effective solar modules, and an explosive growth in demand for green electricity are driving the revolution. Innovative companies that produce, finance, or supply clean energy are at the heart of this boom. Three promising players have already positioned themselves and could benefit directly: Nordex, RE Royalties, and JinkoSolar.

ReadCommented by André Will-Laudien on October 10th, 2025 | 07:30 CEST

Achieve sustainable green returns of over 50%! How do Deutsche Bank, RE Royalties, and Nordex do it?

With the Green Deal, the European Union has committed itself to the most ambitious sustainability program in its history. Through multi-billion-euro funding instruments, from the EU taxonomy to the InvestEU Fund and the Innovation Fund, Brussels is directing capital specifically toward green technologies, renewable energy, and sustainable infrastructure. For investors, the triggers are clear: stricter climate regulations, rising CO₂ prices, and the increasing commitment of institutional investors to comply with ESG standards are creating structural demand for green projects. Those who invest early in low-emission business models benefit twice over - from political support and growing social acceptance. So what makes companies like Deutsche Bank, Nordex, and RE Royalties the winners?

ReadCommented by André Will-Laudien on September 1st, 2025 | 08:50 CEST

This is where the action is! Plug Power has turned around, Pure Hydrogen, nucera, and Nel ASA with top news!

The capital markets are speculating on a US interest rate cut in September. With high inflation and government debt, this is not causing much fiscal enthusiasm, but at least more liquidity is flowing into the markets after the current summer slump. For those paying attention right now, there are opportunities to pick up stocks at bargain prices, but caution is warranted: trading volumes are thinner than usual. Turnaround speculators and medium-term investors should take another look at the hydrogen sector. Many things are changing for the better here, and there are some interesting new additions. We are examining Plug Power, Nel ASA, thyssenkrupp nucera, and Australian hydrogen specialist Pure Hydrogen. The Company is currently expanding successfully into the US, with other continents likely to follow. Where are the opportunities for investors?

ReadCommented by Armin Schulz on August 27th, 2025 | 07:15 CEST

Benefit from the hydrogen boom: The most promising developments at Nel ASA, dynaCERT, and Daimler Truck

The hydrogen market is booming! A groundbreaking efficiency record in electrolysis is revolutionizing production costs. At the same time, the world's first commercial hydrogen flight connection is launching, proving the technology's suitability for everyday use. This boom is confirmed by a European hydrogen auction, which underscores the immense competitiveness of green hydrogen with record results. These three powerful impulses are now also driving the established players. The developments at Nel ASA, dynaCERT, and Daimler Truck are particularly noteworthy.

Read