June 3rd, 2024 | 07:15 CEST

Armaments are becoming socially acceptable, and Hydrogen is finally turning! Rheinmetall, Hensoldt, dynaCERT, Nel ASA and Plug Power in focus!

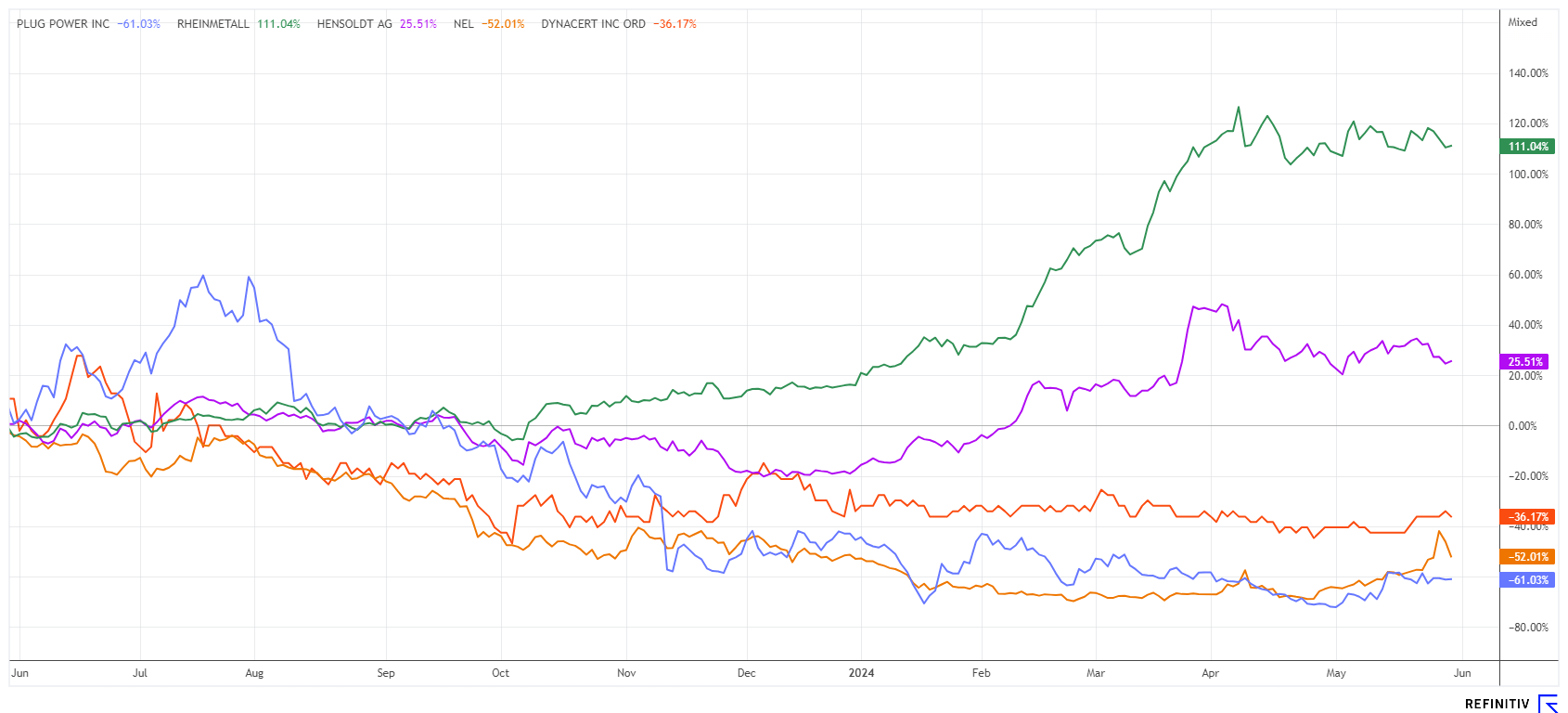

Who would have thought armaments would become acceptable under a pacifist red-green government? Never before have the opportunities for German defense stocks been as great as they are now. This is because the significant increase in geopolitical conflicts has heightened the need for security in Central Europe. In addition, the EU wants to show its support for Ukraine against the aggressor Russia and is ordering substantial amounts of war materials. In contrast, hydrogen values have almost been forgotten in the last two years. But now, there could be a revival. We look at two sectors with different underlying conditions. Investors should sharpen their senses now!

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

RHEINMETALL AG | DE0007030009 , HENSOLDT AG INH O.N. | DE000HAG0005 , NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , DYNACERT INC. | CA26780A1084

Table of contents:

"[...] dynaCERT's HydraGEN™ device offers a retrofit solution for diesel engines designed to protect the environment while providing economic benefits. [...]" Bernd Krueper, President & Director, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Rheinmetall and Hensoldt - Upper turning points recognizable

Geopolitical conflicts everywhere have filled the order books of defense companies worldwide. After years of contraction, huge amounts of taxpayer money are now flowing into the coffers of high-tech industrial companies focusing on defense technology. In addition to full order books, this naturally also means structural adjustments in factory halls, employees and preliminary products. Significantly more of everything is needed now and under enormous time pressure as international customers are waiting. Whether the companies will be able to deliver on time, given the current shortage of resources, remains questionable.

Rheinmetall's popularity is currently so high again that it is even concluding high-profile sponsorship contracts again. Six years ago, Rheinmetall was still being criticized in the daily press for supplying armaments technology to Saudi Arabia. That is how quickly times change - now everything is being reassessed! For a single-digit million sum, Borussia Dortmund now gives Rheinmetall the rights to use high-reach advertising space, marketing rights and event and hospitality services in the stadium and on the club grounds. Rheinmetall becomes a "Champion Partner" of BVB, thus becoming a significant financial sponsor. This follows the example of tank transmission manufacturer Renk, which has sponsored FC Augsburg since September 2023.

Experienced analysts see such "cover stories" as early warning signs of exaggeration. According to fundamental analysis, Rheinmetall and Hensoldt are currently trading at valuations from 2026, which assumes a continuous success story in 2024 and 2025. From a chart perspective, however, the two stocks have already turned sharply at the EUR 570 and EUR 42 marks, respectively. **All that remains to be seen is how far the recent exaggerated rally will now have to correct downwards. Keep an eye on your stop prices at EUR 495 and EUR 35; it could happen quickly.

Plug Power and Nel ASA - When will the sustainable rebound happen?

A hydrogen stock caused a stir two weeks ago. When the US Department of Energy (DOE) announced a guarantee commitment of USD 1.65 billion for the construction of six megawatt H2 factories, the American top dog Plug Power shot up by a full 75% from USD 2.85 to over USD 5.00. However, investors quickly realized that this was just a credit backup line. Plug Power must, therefore, first raise the funds for the entire investment. The hyped value then quickly fell back to USD 3.20, all within just 48 hours.

However, attention is now required. The European competitor Nel ASA also doubled within one trading week**, rising from EUR 0.38 to EUR 0.76. The reason: The Norwegian hydrogen specialist, through its wholly-owned subsidiary NEL Hydrogen Electrolyser AS, has entered into a technology licensing agreement with the Indian conglomerate Reliance Industries Limited. Reliance is India's largest private company and will thus have the opportunity to produce NEL ASA's alkaline electrolysers in India and use them globally for its own needs.

Nel is currently undergoing a small correction, but this is not critical. Both Plug Power and Nel are once again being closely watched by the investment community. Trading volumes on German stock exchanges are sometimes enormous. Next week, on June 5, Plug shareholders will meet in Latham (NY) for the Annual General Meeting. Let's see what news CEO Andy Marsh has in store. Nel ASA could take off again after the minor correction.

dynaCERT - German reinforcement comes on board

With a bang, CEO Jim Payne announced in mid-August the appointment of the German manager Bernd Krüper as the new president and director of the Canadian hydrogen specialist. Krüper's career spans several international universities, Daimler Benz, Rolls-Royce Power Systems, Motorenfabrik Hatz, Deputy Chairman at VDMA, and various advisory and supervisory board positions at startups. As a leader with over 30 years of experience in the automotive and off-highway sectors, as well as in sustainable energy and power generation solutions, he fits perfectly into the profile of the Toronto-based technology company. A good addition for the Canadians!

dynaCERT is a niche supplier of H2 auxiliary equipment for larger diesel combustion engines, such as buses, trucks, mining vehicles, or power generators. The diverse applications of the HydraGEN® technology can optimize the combustion process by adding hydrogen, improving efficiency by double-digit percentage points. dynaCERT is currently having its equipment certified by the globally active VERRA Institute in order to increase its market potential and enter the carbon emissions trading market. The results are expected any day.

At the end of May, a financing of approx. 16.67 million DYA shares at CAD 0.15 each was announced. With the targeted CAD 2.5 million proceeds, dynaCERT can continue to pre-finance the existing orders and continue its international sales activities. It will be interesting when investors hear from Bernd Krüper for the first time, who was appointed as Director and President in mid-May. Due to the VERRA certification, the stock price has been patiently waiting in the trading range of CAD 0.14 to 0.16 for weeks. Very exciting!

The hydrogen sector has recently attracted investors again. After two years of heavy price losses, some stocks have already made significant gains. The situation was different in the defense sector, where there was a special performance due to numerous geopolitical conflicts and the renewed armament of NATO. However, the charts currently indicate top reversal formations. Therefore: Caution at the platform edge, and pay attention to stop-loss orders!

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.