GreenTech

Commented by Armin Schulz on August 18th, 2025 | 07:10 CEST

Hydrogen renaissance – Plug Power, Pure Hydrogen, and Nel ASA want a slice of the USD 680 billion pie

The global hydrogen economy is on the verge of a breakthrough. This is being driven by multi-billion-dollar decarbonization targets, the quest for independence from fossil fuels, and falling costs for renewable energy. Demand could increase fivefold by 2050. By 2035, 60% of energy demand is expected to come from clean production, supported by over 1,500 large-scale projects worldwide. Despite gaps between planning and implementation, investments of up to USD 680 billion in the coming years and groundbreaking industry contracts signal an irreversible transformation. Amid this momentum, three key players are strategically positioning themselves: Plug Power, Pure Hydrogen, and Nel ASA.

ReadCommented by André Will-Laudien on August 18th, 2025 | 07:05 CEST

Hydrogen versus nuclear power – 300% with Plug Power and dynaCERT, caution advised with Oklo and NuScale

Fuel cells have long been seen as a beacon of hope in propulsion technology, though they have only gained limited traction in the automotive sector. While batteries dominate the mass market, fuel cells score points primarily in heavy-duty and long-distance transport due to their range and short refueling times, as well as in stationary systems. Plug Power is working on infrastructure projects, while dynaCERT is making existing drives more efficient with hydrogen systems, thus serving as a bridge to the next era. At the same time, small modular reactors (SMRs) from suppliers like Oklo and NuScale are gaining in importance as they promise a stable, low-carbon energy supply for industry and hydrogen production. This opens up opportunities for investors in two future markets: sustainable mobility and scalable energy solutions – both enjoying political tailwinds and high growth potential. How should investors proceed with their portfolios?

ReadCommented by Fabian Lorenz on June 10th, 2025 | 07:00 CEST

Up more than 1,000%! Siemens Energy and D-Wave! Insider tip First Hydrogen shares jump after announcement!

Siemens Energy stock is a tenbagger! Anyone brave enough in fall 2023 to buy the shares despite speculation about insolvency can now look forward to a price gain of over 1,000%. The reason is the growing appetite for energy demand from artificial intelligence and quantum computing. The latest news from the Company shows where the journey is headed. In the US, in particular, tech companies are focusing on small modular reactors (SMRs). First Hydrogen is another insider tip in this area. The partnership announced yesterday sounds promising and sent the stock soaring. Its valuation still appears attractive. Anything but favorable is D-Wave Quantum after its 2,000% rally - yet this does not appear to be deterring investors. The latest news is driving the stock further.

ReadCommented by André Will-Laudien on June 6th, 2025 | 07:10 CEST

Greentech is now exploding – a 300% comeback for hydrogen? nucera, dynaCERT, Plug Power, and Nel ASA

Although the US administration under Donald Trump does not think much of climate change, the outlook for the hydrogen sector is improving all the time. This is because it is no longer the US setting the tone but Europe and Asia. Global efforts to make local transport cleaner and more sustainable are now also reaching the transport, logistics, and mining industries. There is still enormous potential for improvement here in terms of reducing climate-damaging emissions. Innovative technologies such as those developed by dynaCERT are now well-known in the market. Therefore, decision-makers in public office will no longer be able to avoid discussing these issues if they want to remain in their positions in the coming years. The public pressure to combat negative climate change globally is increasing. Forward-looking investors should start positioning themselves now.

ReadCommented by Armin Schulz on May 15th, 2025 | 07:10 CEST

Exploding profits? BYD's exports, Power Metallic Mines' drilling, Mercedes-Benz's tariff tactics

The mobility transition is accelerating, but the road to an electric future is fraught with dynamics and dilemmas. While global demand for electric vehicles is exploding, shortages of key raw materials such as nickel, copper, lithium, and cobalt threaten to slow down ambitions. Innovations in recycling, alternative materials, and ethical sourcing are becoming a decisive competitive advantage. At the same time, new technologies and government subsidies are pushing the market into an era full of opportunities. Three players are at the center of this upheaval: BYD as a battery pioneer, Power Metallic Mines as a raw material supplier, and Mercedes-Benz as a premium manufacturer, who are jointly rewriting the rules of the green revolution.

ReadCommented by Armin Schulz on April 2nd, 2025 | 07:20 CEST

dynaCERT: Government-backed, certified, profitable – Driving your returns green

The Ontario government is leading by example – and dynaCERT could be one of the beneficiaries. The Canadian cleantech company, known for its revolutionary HydraGEN™ technology, is receiving government support in a market that is hungry for solutions for more efficient mobility and measurable CO₂ reductions. In an era when climate goals and economic considerations can no longer be at odds, dynaCERT is positioning itself as a bridge between ecology and economy. A new player is emerging here in the billion-dollar market for emission certificates.

ReadCommented by Juliane Zielonka on March 20th, 2025 | 07:10 CET

Steyr Motors, dynaCERT, and NEL – Growth drivers in defense and greentech

Investors love companies that impress with fresh ideas and strong growth. In the greentech and defense sectors, three players are in focus: Steyr Motors AG is convincing in its 2024 annual report with a 9.2% increase in revenue. The defense sector is booming, and the Austrian company's expansion into Asia is making it a global player. A revenue jump of at least 40% is even expected for 2025. The Canadian greentech company dynaCERT is making waves with its HydraGEN™ technology. It is particularly attracting attention in Canada's oil and gas industry because it upgrades heavy-duty diesel engines with hydrogen technology, making it the ideal bridging technology. A new major order for over 140 units proves how dynaCERT combines innovation, efficiency, and ESG goals. Nel is cooperating with SAMSUNG E&A in the hydrogen sector: SAMSUNG is integrating Nel's electrolysers into its hydrogen plants and acquiring 10% of the shares. Three companies, three paths – what opportunities could arise for your portfolio?

ReadCommented by Armin Schulz on February 20th, 2025 | 07:00 CET

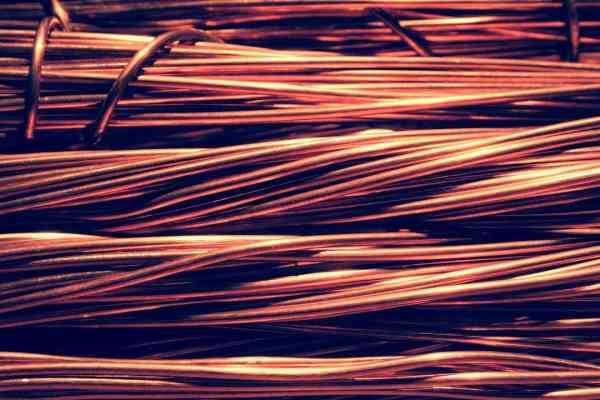

BYD, Benton Resources, Nordex – Copper Boom: The hidden treasure of the greentech industry

In a world balancing between climate targets and geopolitical tensions, three companies are working on the future of the energy and mobility transition and depend on critical raw materials like copper. While the 2025 German federal election is reigniting the debate on renewable energies – with demands for clear framework conditions for wind power and critical voices from the political arena – other players are pushing ahead with disruptive technologies. BYD showcases the future with AI-driven assistance systems. Benton Resources is unlocking key resources for green technologies like copper, nickel, zinc, and gold, and Nordex receives record orders despite uncertain markets. These companies have more in common than their focus on sustainability: they represent a new era of innovation in which strategic decisions made today determine tomorrow's competitiveness.

ReadCommented by André Will-Laudien on February 17th, 2025 | 07:35 CET

Shooting star Rheinmetall continues to rise - Greentech stocks like Nel, dynaCERT, and Plug Power are in the starting gate!

With the start of the security conference, they were back – the defense stocks. Rheinmetall thus exceeded the EUR 800 mark for the first time. The DAX 40 index is also doing brilliantly, currently at 22,600, well ahead of the NASDAQ. Now, rumors of peace talks are circulating, but the stock market is still not quite believing it. The losers of recent months were, not least, due to the re-election of Donald Trump, the greentech stocks. They were simply ignored in the face of the "climate change deniers" from the White House. But the charts no longer reached new lows. This is reason enough for us to refocus on these stocks. dynaCERT made its first leaps with the VERRA certification, but there is still much more potential. Selection remains key!

ReadCommented by André Will-Laudien on January 23rd, 2025 | 07:45 CET

Trump is back! NATO rearmament with Rheinmetall, Renk, Hensoldt and Nova Pacific Metals

After a grand inauguration night, the 47th US President Donald Trump is diving straight into government business. The first decrees include an exit from the WHO and the Paris Climate Agreement. At the same time, he repeated his demand that NATO countries drastically increase their investment budgets if they expect to continue to be protected by the US. What this could mean for the planet is alarming. For the stock market, this means getting out of Greentech stocks and into high-tech and defense for the time being. Strategic metals are also coming back into focus because nothing will move forward without them. Where can investors still make a return now?

Read