December 18th, 2023 | 07:15 CET

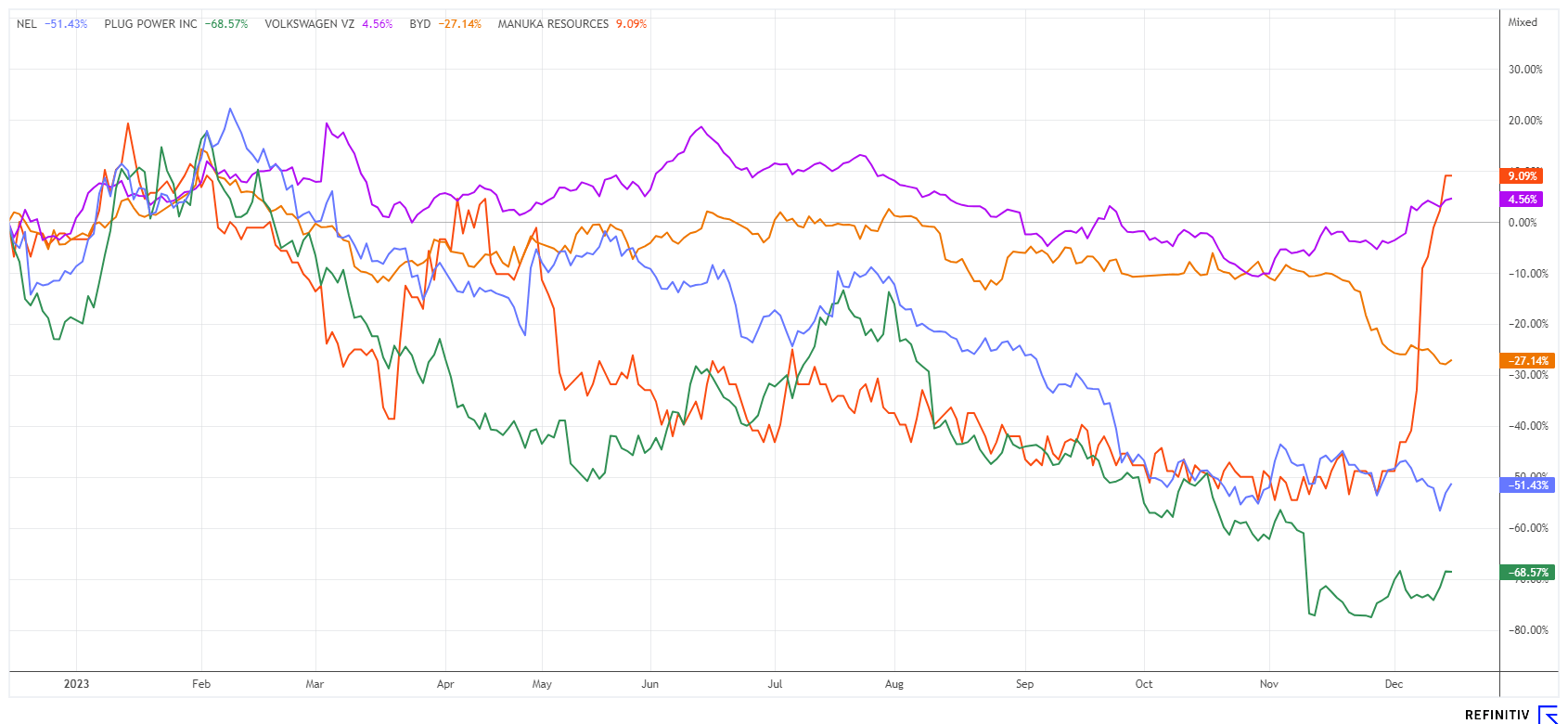

COP28 - Acting on climate change in 2024! Nel ASA, Manuka Resources, BYD and VW - more than 200% is possible

Despite all reservations, the science is unanimous! Failing to limit global warming will pose significant risks to humanity in the next two decades. At the end of the World Climate Conference in Dubai, the revised resolution text was adopted without objection by almost 200 countries. COP28 President Sultan Ahmed Al Jaber described the outcome as "historic" and a "foundation for transformative change". The agreement calls for a global transition away from fossil fuels. It is thus the first resolution of a UN climate conference that concerns the future of all energies - including oil, natural gas, and coal. Criticism and rejection came from the Gulf States, as they intend to continue their "Affordable Oil & Gas from the desert sand" business model. How do typical GreenTech shares react to the latest climate policy?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , Manuka Resources Limited | AU0000090292 , BYD CO. LTD H YC 1 | CNE100000296 , VOLKSWAGEN AG VZO O.N. | DE0007664039

Table of contents:

"[...] We will trigger indirect creation of 1,665 new jobs nationwide, while directly employing 300 staff - 270 operational and 30 administrative. [...]" Dennis Karp, Executive Chairman, Manuka Resources Limited

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA - Will the turnaround work?

Climate conferences have lost their appeal. The industrialized West wants to do more for the planet, while the Middle East and Asia insist on their business models. By 2027, China will have connected 106 gigawatts of coal-fired power plants to the grid, five times more than other countries can shut down altogether. What Germany is doing in this context is irrelevant internationally but highly dangerous nationally. In order to follow the "ideology of progress", we are risking our hard-earned prosperity in this country. But we know from history: What three generations build, one wrongly oriented generation can quickly wipe out again.

A reflection of the failed GreenTech wave is the share of Nel ASA. For some years, the Company has been fighting to secure public contracts and attract funds from hopeful investors betting on green renewal. After great euphoria in 2020/21, investors have now seen the valuation of the Norwegian electrolyser specialist fall by 82%. In addition to the long-term decline of the share, it must be noted that during the big crash in the last three years, strong upward impulses were repeatedly recognisable, sometimes even resulting in a 70% increase at the peak. Timing is, therefore, crucial in Nel ASA.

Those with a cyclical approach took advantage of the environmentalists' frustration last week and were able to enter the market at sell-off prices of EUR 0.54. On Friday, the share was already back at EUR 0.65 and had thus bounced a good 20% off its 4-year low. Fundamentally, the share is unfortunately still not a "Buy" because estimated 2024 sales are still being paid at this level. And there are no profits or dividends expected before 2027.

Manuka Resources - Change of government in New Zealand gives wings

Anyone with an eye on the raw material requirements for future-oriented energy technologies should look at safe countries of origin because, given the many smouldering geopolitical conflicts, the supply chains for essential metals could also be interrupted. The Australian mining company Manuka Resources operates far from political interference in the Pacific region, which has recently attracted much attention due to its proximity to the Asian high-tech industry. Therefore, Western producers have long had their eye on the region, and investment in securing strategic metals has risen by 65% in the last three years.

In addition to the gold and silver projects in Cobar Basin, New South Wales, Manuka Resources also has the highly promising South Taranaki Bight (STB) vanadium property. In the course of global efforts to design more efficient and stable energy storage systems, the metal vanadium is of great importance. The vanadium redox flow batteries currently used are perfect for storing wind or solar energy. They are used in large-scale plants and agriculture in particular.

Six weeks after the general election in New Zealand, the new conservative Prime Minister Christopher Luxon has taken office. He announced that strengthening the economy is the top priority for his three-party coalition. The 53-year-old leader's National Party won the parliamentary election in mid-October but depends on a coalition with the right-wing liberal ACT and NZ First. The new government is seen as economically offensive and resource-friendly. Minister Jones was quoted as saying: "Deep sea mining has a legitimate place in New Zealand's regional economy...I can assure you that the Environmental Protection Agency (EPA) laws will be amended if necessary to provide certainty for investors."

Manuka owns an asset gem with its vanadium-iron-titanium deposit near the coast. If the government's efforts to change the existing legislation intensify, this would mean a considerable jump in valuation for the Company, which is currently valued at AUD 54 million. The share price has already doubled in just 2 weeks, and Manuka could be due for an absolute revaluation in 2024. Log in before the parliamentary debate on mining, as the STB project alone would be worth around AUD 500 million in the event of a favourable decision. Recent increases in revenues already indicate corresponding positioning.

BYD versus VW - Bet on Germany now

Fierce competition has broken out among the major car manufacturers in the field of e-mobility. BYD has already impressively demonstrated its Chinese supremacy at this year's IAA Mobility in Munich, and now the first models are rolling into Europe. Supported by subsidies, BYD can currently offer prices that are a good 20% lower, and the EU is already examining the current competitive situation. Those who compare BYD and VW often forget that existing VW owners in Germany still have a high level of customer loyalty to the domestic brand. BYD must, therefore, make aggressive moves to penetrate the local market. Currently, only a few models can be seen on the roads. These are likely marketing vehicles used by regional sales representatives.

In a direct comparison of the two shares, VW makes the better technical impression, having bottomed out at around EUR 100, whereas BYD shares have been caught in a steep downward trend since mid-November. Fundamentally, the VW share is far too cheap, with a 2024 P/E ratio of 3.7, while BYD is relatively expensive at 18.5. If the ECB launches the first interest rate cuts in 2024, German consumers will likely emerge from hibernation and quickly catch up on postponed investments. By then, however, VW could already be EUR 50 higher.

Before the climate conference is after the climate conference. CO2 reduction remains an issue for wealthy nations, so investments are likely to increase further in 2024. Automotive stocks BYD and VW will continue to engage in a head-to-head for the favour of electric vehicle buyers, while Nel ASA and Plug Power hope for a turnaround. Manuka Resources has doubled from its initial position - boosted by the large vanadium deposits near New Zealand.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.