Automotive

Commented by Fabian Lorenz on February 23rd, 2026 | 07:35 CET

IPO and takeover speculation at Steyr Motors, TeamViewer, and Pure One! Share price set to skyrocket?!

IPO and takeover speculation are important drivers of share prices. At Pure One, there is reason to believe that the share price will jump in the short term. Namely, the IPO of its subsidiary Eastern Gas. The gas exploration company has production rights in Australia, where there are currently problems with gas supply. It is therefore not surprising that the IPO is attracting a lot of interest. Pure One's core business is also interesting. TeamViewer was long considered an attractive takeover candidate. However, this topic has quietened down. Instead, the software company is now considered a big AI loser. Is this justified? Steyr Motors has undergone a spectacular revaluation in 2025. The stock market has high expectations for revenue and earnings growth. To meet these expectations, the supplier of special engines is laying a new foundation.

ReadCommented by André Will-Laudien on February 20th, 2026 | 07:00 CET

Europe steps on the gas! E-mobility and secure supply chains - Avrupa Minerals, BYD, VW, and Stellantis

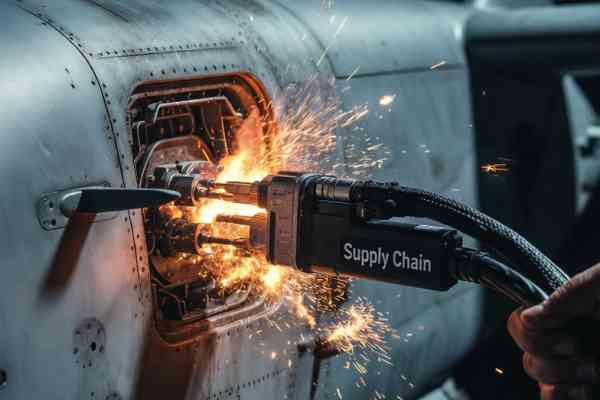

The stock market year has gotten off to a turbulent start, but a new megatrend is gaining traction: critical metals! While 2025 was dominated by AI and high-tech stocks, raw material suppliers, essential for maintaining industrial competitiveness, are increasingly moving into focus. Over the past 12 months, they have been able to offer investors dream returns in the three- to four-digit range. At the same time, there has been hardly any growth on the NASDAQ since the beginning of the year. Former high-flyers like Palantir, Nvidia, and Strategy are currently trading below their 2025 highs. International commodity stocks dealing with the issue of "Western supply chains" have now moved up the list of top performers. Without strategic metals, the secure production of electrical infrastructure, renewable energy systems, and defense technology is not possible. It is therefore worthwhile for investors to rethink their tech portfolios and add good commodity stocks to their watch lists. Meanwhile, the automotive sector, under pressure for months, could be stabilizing after the sobering results of 2025. We take a closer look at the key players.

ReadCommented by Fabian Lorenz on February 17th, 2026 | 07:05 CET

Things are set to take off in 2026! Steyr Motors, TeamViewer, and dynaCERT in focus!

TeamViewer is heading downward in 2026. The software company's shares are trading at an all-time low and are threatening to slip below the EUR 5 mark. So is now the time to get in? In contrast, dynaCERT shares could be on the verge of multiplying in value. However, that would require an operational breakthrough. According to the company's outlook for 2026, this scenario appears entirely possible, as is a revaluation. Steyr Motors shares underwent a revaluation last year. This needs to be underpinned by significantly higher revenue and profits in the current year. Analysts remain bullish on the defense stock.

ReadCommented by Carsten Mainitz on February 16th, 2026 | 07:00 CET

These stocks continue to rise: Almonty Industries, RENK, and Steyr Motors. Do not miss out!

The pause near Almonty Industries' all-time high is likely to prove very short-lived. The arguments in favor of buying the stock are too strong. Several analysts have recently raised their price targets. As one of the world's largest producers of the critical raw material tungsten, the company has geopolitical weight, which is increasing in light of initiatives such as those by the US government to build up strategic reserves of rare earths and other critical raw materials. Several analysts have recently been promoting the two defense stocks RENK and Steyr Motors. Who has the edge?

ReadCommented by Carsten Mainitz on February 9th, 2026 | 07:10 CET

Stellantis Slumps, BYD Holds Steady, Power Metallic Mines Poised to Soar!

The stock market is not a one-way street. While BYD has established itself as one of the world's largest manufacturers of electric vehicles, Stellantis has had to admit to misjudgments that will lead to write-downs exceeding its current market value. This recently shocked the stock market. By contrast, the outlook for Power Metallic Mines is bright. The Canadians have one of the largest polymetallic deposits in North America. This asset is valuable to many industrial groups. In times of building strategic reserves of critical raw materials, the company should attract more attention. Well-known investors have already jumped on board, and analysts attest to the stock's potential to double in value.

ReadCommented by Fabian Lorenz on January 27th, 2026 | 07:15 CET

Silver is unstoppable! Defense stocks in demand! Steyr Motors, Deutz, and Silver North Resources in focus

Silver is currently breaking all records and even eclipsing its big brother, gold. Yesterday, the price of silver climbed to over USD 108. And for good reason: the precious metal is not only a crisis currency, but is increasingly becoming a "critical commodity." Investors who want to profit should not only look at the basic investments, but also at the second-tier winners. In the case of silver, this is Silver North Resources. The explorer's two projects in Canada are so convincing to investors that the current capital increase has been topped up, and the Company is fully financed for two years. The stock now offers an entry opportunity. Steyr Motors shares are also back in the fast lane. A framework agreement with minimum purchase quantities from Asia is providing new momentum. Deutz shares are close to their all-time high. Both engine manufacturers are benefiting from the defense boom.

ReadCommented by Nico Popp on January 21st, 2026 | 07:00 CET

SGS Canada confirms world-class results: Why Power Metallic Mines is becoming indispensable for Mercedes-Benz, Ford & Co. after a metallurgical breakthrough

There are events that change everything—turning points where hopes become certainty. Often, these shifts take place away from the headlines, in laboratories and testing facilities, where the feasibility of the future is decided. For Power Metallic Mines, such a moment has arrived now. The recently published metallurgical test results for the Lion Zone are far more than just technical data – they are proof that the Company holds an asset capable of sustainably securing supply chains for automotive giants such as Mercedes-Benz and Ford. At a time when the global economy is desperately searching for stable sources of copper and platinum group metals, Power Metallic Mines is now delivering the hard currency of the mining industry: validated extraction rates at world-class levels. For investors, this virtually eliminates the most significant risk faced by an explorer – the question of technical feasibility – and opens the door to a fundamental revaluation of the stock.

ReadCommented by Nico Popp on January 19th, 2026 | 07:15 CET

The Netflix of car washing: How Mister Car Wash is reinventing the market, and WashTec is sounding the charge against Dover

The North American vehicle care market is currently undergoing a development that, in its radical consequences, is reminiscent of the transformation of the software industry ten years ago. The old model of weather-dependent individual car washes, where revenue falls when it rains, is being replaced by the predictable profitability of the "subscription economy." This trend is being driven by the phenomenal success of the US chain Mister Car Wash, which has proven that Americans are willing to sign up for a monthly subscription for clean cars, similar to streaming services. But this gold rush is putting massive technological pressure on gas station operators and independent car washes. They have to upgrade to stay competitive. In this battle for infrastructure supremacy, German hidden champion WashTec is now challenging US market leader Dover Corporation on its home turf. The Augsburg-based company supplies precisely the digital technology that enables the broader market to copy Mister Car Wash's successful model – and could thus shift the balance of power in the industry in the long term.

ReadCommented by Armin Schulz on January 15th, 2026 | 07:05 CET

Undervalued in transition - plus dividends? Analysis of Mercedes-Benz, WashTec, and Sixt

The fundamental transformation of mobility is creating two contrasting realities: while established manufacturers are groaning under massive pressure to innovate and shrinking margins, surprising profit opportunities are emerging in the niches of change. The strategic responses to this tension could hardly be more different. A premium automaker, a vehicle care equipment supplier, and a mobility service provider exemplify where the future of driving can also be lucrative for investors. It is therefore worth taking a closer look at the paths of Mercedes-Benz, WashTec, and Sixt.

ReadCommented by Nico Popp on January 7th, 2026 | 07:00 CET

Trade war over batteries: China's export restrictions force the West to act – and position NEO Battery Materials as a potential game changer for AeroVironment and DroneShield

The geopolitical map of the technology sector is currently being redrawn. After China drastically tightened export controls in recent weeks on critical drone components and high-performance batteries, Western defense companies are increasingly facing supply chain risks. In this strategic environment, the Canadian company NEO Battery Materials is evolving from a pure technology developer into a strategically relevant industrial partner. With the recently announced market readiness of its silicon-based battery technology, NEO offers a non-Chinese alternative that could become highly attractive for drone manufacturers such as AeroVironment and counter-drone specialists like DroneShield, as they seek to reduce dependence on Asian supply chains and secure long-term production reliability.

Read