Cancer

Commented by Mario Hose on February 27th, 2026 | 07:05 CET

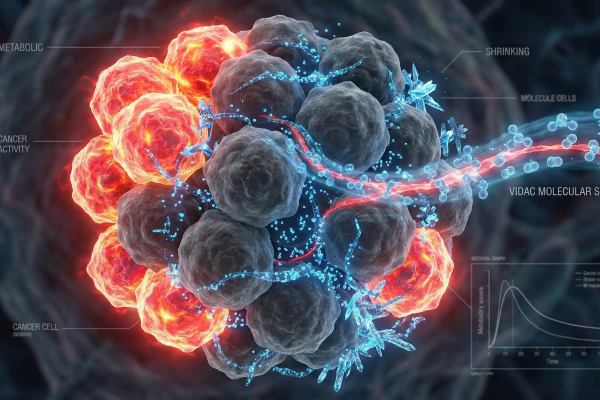

Revolution in cancer therapy: Vidac Pharma attacks the cancer throne of the big players! Why the smaller competitor could steal the show from giants like Bayer and BioNTech!

The world of biotechnology and pharmaceuticals is currently in turmoil, as technological breakthroughs and strategic realignments promise an exciting future for investors. The focus is particularly on Vidac Pharma, an innovative company that wants to revolutionize the fight against cancer with a completely new approach to oncology and is currently celebrating one milestone after another. While Vidac Pharma shines with impressive clinical progress and strong internal backing from its main shareholder, Dr. Max Herzberg, industry giant Bayer has recently struggled with the late effects of the Monsanto acquisition, but is now increasingly being touted as an exciting candidate for a split or takeover by financial investors. At the same time, BioNTech remains synonymous with cutting-edge mRNA technology, with the market eagerly awaiting the next phase after the pandemic. In this dynamic environment, Vidac Pharma is emerging as a particularly bright star in the biopharmaceutical sky, causing a sensation with its unique method of specifically normalizing the metabolism of cancer cells.

ReadCommented by Armin Schulz on February 17th, 2026 | 08:10 CET

Cancer Research as a Growth Driver: How Bayer, Vidac Pharma, and Pfizer can enrich your portfolio

Oncology will be put to the test for the pharmaceutical industry in 2026. Never before have so many highly specialized active ingredients been on the verge of market launch at the same time. While checkpoint inhibitors and targeted therapies are revolutionizing treatment, business models are shifting from broad-based approaches to precision medicine. But the reality remains complex: between medical advances, narrow patient groups, and pressure on prices, companies need to readjust. Current developments at Bayer, Vidac Pharma, and Pfizer show how three players with different strategies are responding to this change.

ReadCommented by Nico Popp on January 30th, 2026 | 07:25 CET

The hunt for the cancer pill from BioNTech & Co.: Why Eli Lilly's billion-dollar bet is a wake-up call for Vidac Pharma

It is one of the oldest rules in the biotech sector: when the big pharmaceutical companies can no longer grow on their own, they open their coffers. The latest billion-dollar deal between US giant Eli Lilly and Dresden-based startup Seamless Therapeutics is more than just a headline – it is a wake-up call for the entire industry. Eli Lilly, now one of the most valuable companies in the world, is desperately seeking innovations to secure its pipeline beyond its booming weight-loss injections. This hunger for new mechanisms of action inevitably focuses attention on small, specialized companies researching revolutionary approaches. In this environment, Vidac Pharma is becoming the focus of strategic investors. The Company is working on an approach that is as elegant as it is radical: it aims to starve cancer rather than poison it by manipulating its metabolism. While Eli Lilly and BioNTech are spreading their billions across a wide range of areas, Vidac is delivering precisely the kind of specialized "deep science" that is often lacking in the pipelines of the big players.

ReadCommented by Nico Popp on January 14th, 2026 | 07:20 CET

Targeting cancer metabolism: Why Bayer and Pfizer are restructuring - and why Vidac Pharma is filling a scientific gap

The investment year 2026 marks a decisive turning point for the global biotechnology and pharmaceutical sector. After a period of macroeconomic uncertainty, we are witnessing a renaissance in the life sciences, driven by two fundamental forces: the urgent need for big pharma players to replace their expiring patents with innovation, and the scientific breakthrough of novel mechanisms of action in agile biotech small caps. While industry giants such as Pfizer and Bayer are attempting to steer their cumbersome tankers onto a new course through massive restructuring, the as-yet little-noticed biotech company Vidac Pharma is delivering the technological innovation the market is looking for. With an approach that directly addresses cancer metabolism and reverses the "Warburg effect," which has been known for almost a century, Vidac is positioning itself as a disruptive force in oncology and dermatology. For investors, this constellation offers a rare opportunity: to observe the stability of the giants while betting on the explosive potential of a technological innovator that analysts say is massively undervalued.

ReadCommented by Fabian Lorenz on December 15th, 2025 | 07:25 CET

Alarm bells ringing at Evotec! BioNTech and Vidac Pharma achieve success in the fight against cancer! Analysts recommend buying!

Alarm bells are ringing at Evotec. A major shareholder has completely withdrawn from the German biotech company. The security is trading at 2016 levels. Vidac Pharma, on the other hand, has reached a milestone. In the EU, the Phase 2b clinical trial for the ointment Tuvatexib (VDA1102) against a particularly active, fast-growing precursor of skin cancer can begin. BioNTech is also continuing the fight against cancer. Initial results from the global Phase 2 trial of the non-specific antibody candidate Pumitamig showed encouraging anti-tumor activity in advanced triple-negative breast cancer. Analysts recommend buying shares in Vidac and BioNTech.

ReadCommented by Nico Popp on December 9th, 2025 | 07:05 CET

Attacking the fuel that feeds tumors: Why Roche, Pfizer, and Vidac Pharma are redefining oncology

Modern cancer therapy is no longer about blunt-force attacks, but rather precise, targeted interventions. While oncology in recent decades has been dominated by non-specific cell toxins, today's research resembles surgical intervention in the biological software of a disease. Industry heavyweights, Roche and Pfizer, are securing their market positions with gigantic portfolios of immunotherapies. But away from the corporate headquarters of Basel and New York, agile biotech pioneers are working on approaches that attack the very foundation of cancer cells: their energy supply. Those who pull the plug on cancer cells could be among the big winners in the biotech sector in 2026.

ReadCommented by Armin Schulz on November 18th, 2025 | 07:05 CET

Patents, potential, takeover candidate? Making money with less risk: The secret of BioNxt Solutions

In the high-risk world of biotechnology, the path from the laboratory to an approved drug is often an ordeal. Canadian company BioNxt Solutions may have found the key to a less painful path. Instead of developing expensive and uncertain new active ingredients, the Company refines proven drugs with innovative administration technology. The past few months have brought a remarkable series of successes that not only confirm the technology but also significantly increase the strategic value of the Company. For investors, this could be a rare opportunity.

ReadCommented by Fabian Lorenz on November 17th, 2025 | 07:10 CET

Out of BioNTech? Into Evotec and Vidac shares? What is going on with Johnson & Johnson?

Big news in biotech: Pfizer is selling its entire stake in German biotech champion BioNTech. Should investors consider doing the same? Meanwhile, Vidac Pharma is providing more and more reasons for a price explosion. The Company is developing a novel cancer therapy and has received approval to begin phase 2 clinical trials in Germany. It is also reportedly in talks with Johnson & Johnson. Might the pharmaceutical giant even make a move? Evotec, on the other hand, has recently sent mixed signals. Another milestone payment is ringing the cash register, and insider transactions are drawing attention. Yet the stock is trading at a multi-year low.

ReadCommented by Armin Schulz on November 14th, 2025 | 07:20 CET

Cancer will become curable - and these stocks could then be priceless: Evotec, Vidac Pharma, and Bayer

Cancer remains one of the greatest medical challenges of our time - but at the same time, it is creating business opportunities worth billions. The oncology market is literally exploding with annual growth of 10.8%, driven by aging societies and groundbreaking therapeutic approaches. Artificial intelligence is revolutionizing diagnostics, personalized medicine is making previously incurable tumors treatable, and digital platforms are dramatically accelerating drug development. While patients benefit from tailored treatments, investors sense big business opportunities. Today, we analyze Evotec, Vidac Pharma, and Bayer for their positioning in this future market.

ReadCommented by Nico Popp on October 22nd, 2025 | 07:00 CEST

Important piece of the puzzle in the fight against cancer: Vidac Pharma, Roche, Merck & Co.

The pharmaceutical market is enormous - and continues to grow. Market research institute Evaluate forecasts an increase to around USD 1.7 trillion by 2030, representing an annual growth rate of 7.7%. Oncology promises the highest sales, at around USD 300 billion. However, there is no single approach. Instead, new modalities and technologies such as antibody-drug conjugates (ADCs), cell and gene therapies, and radiopharmaceuticals are transforming the industry and gaining significant traction. One thing is clear: progress in the biotech sector is increasingly achieved through the combination of active ingredients and technologies. What role does the biotech company Vidac Pharma play in this?

Read