December 12th, 2023 | 13:40 CET

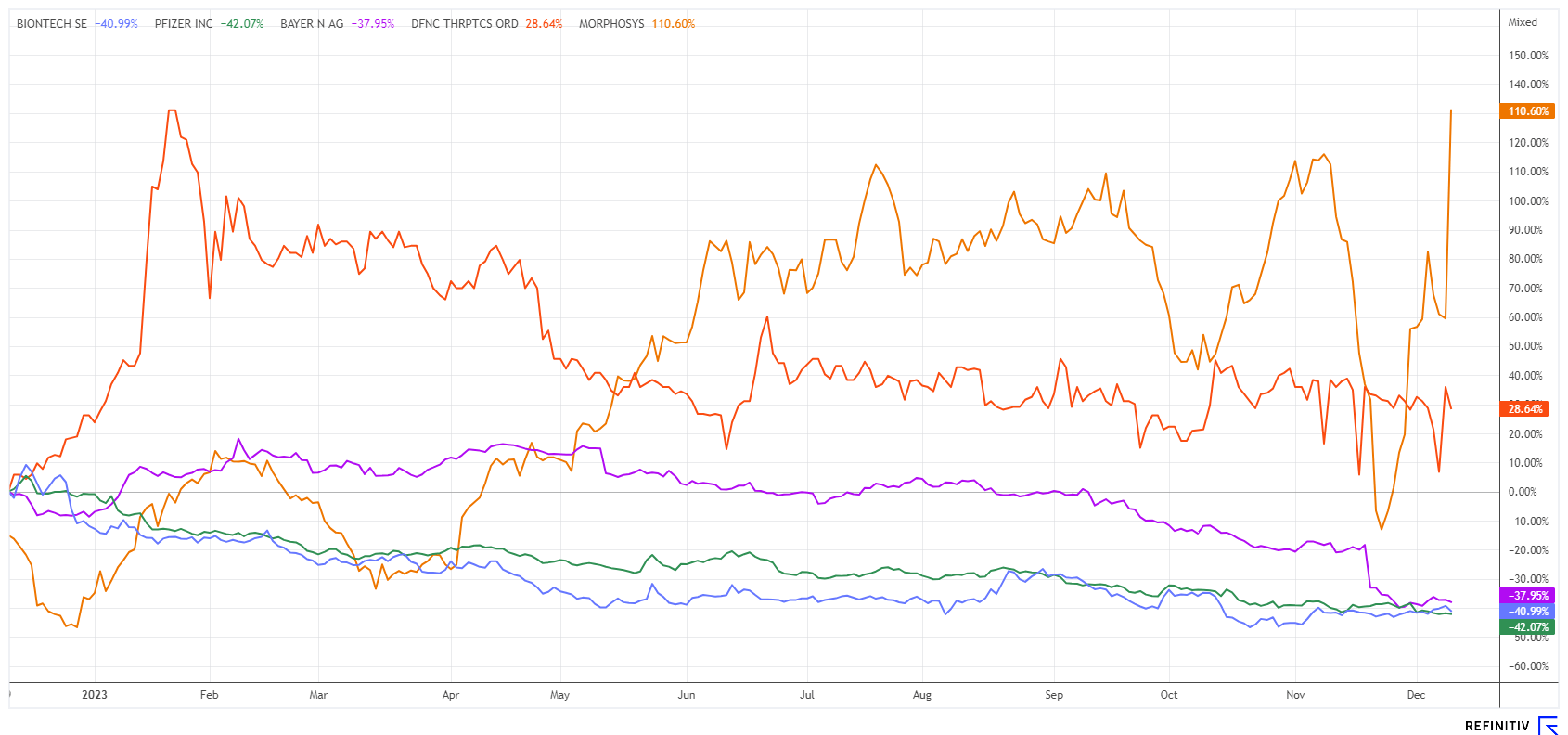

Game Changer in Cancer - The Biotech Gold List for 2024! MorphoSys, Defence Therapeutics, BioNTech and Bayer

The International Agency for Research on Cancer estimates the number of cancer deaths worldwide for the year 2022 to be around 10 million. However, the number of new cancer cases in the same year amounted to around 20 million, and cancer is still considered incurable. Lung cancer remains the sad frontrunner, claiming the most lives worldwide. Colorectal and stomach cancer follow at a considerable distance. However, since the original launch of the "Cancer Moonshot" in 2016, the fight against this incurable disease in the US has made some progress in the realization of therapies. Recently, there has been an increase in success stories from many biotech companies, and investors' enthusiasm is palpable once again. Where are the Biotech game changers lurking for the 2024 investment year?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

MORPHOSYS AG O.N. | DE0006632003 , DEFENCE THERAPEUTICS INC | CA24463V1013 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , BAYER AG NA O.N. | DE000BAY0017

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

MorphoSys - Let the witch hunt begin

Every year, the Munich Oktoberfest looks forward to about 7 million visitors who marvel at the Olympia Looping. Not far from there, in Martinsried, the biotech company MorphoSys is attracting attention with similar share price volatility. The reaction to the first study results resembled a sell-off as critical comments from analysts poured in. The share price plummeted to EUR 14.50 with significant volumes, resembling a capitulation. Some experts noted negatively that the drug was only inadequately able to improve myelofibrosis symptoms. Doubts promptly arose about whether approval would be granted at all and whether the drug could subsequently succeed.

Since its correction low, however, there has been no stopping the share price, which has more than doubled from EUR 14.50 in just four trading days. The presentation of the Phase 3 study data on pelabresib at the ASH Annual Meeting has had an impact and breathed new life into the share. According to a recent press release, the Phase 3 study showed improvements in all four disease characteristics of myelofibrosis when used in combination with the previous standard drug ruxolitinib. Of particular importance is the reduction in spleen size, which is directly linked to patient survival.

Analysts turned quickly and now believe that MorphoSys can obtain approval for pelabresib in the intermediate-risk patient group. Xian Deng from UBS also drew an overall positive conclusion alongside JP Morgan. According to the experts, there is now renewed potential for future revenues in the billions. The price targets of UBS and JPM are currently EUR 31 and EUR 47, respectively. After the technical breakout at around EUR 25, some short sellers may now have to cover above EUR 30, which could become expensive. The share remains a hot potato but is certainly promising in the medium term.

Defence Therapeutics - FDA approval is a game changer

The Canadian biotech specialist Defence Therapeutics (DTC) has news to share once again. This time, it sounds like a game-changing announcement. Yesterday, the US Food and Drug Administration (FDA) approved the application for a Phase I clinical trial with the active ingredient ACCUM-002™ Dimer CDCA-SV40, commonly referred to as "AccuTOX®", as an injectable cancer molecule for the treatment of solid cancer tumors with the rating "Study May Proceed". The approval of AccuTOX®, the Company's first First-in-Class therapy, is a tremendous step forward for Defence in the field of immuno-oncology.

This confirms the submission and safety review of the protocol entitled "Phase I trial with ACCUM-002™" by the US FDA. For Defence, this is the most important milestone in 2023 and decisive for the Company's further strategy with its diverse pipelines. It is now clear that, in addition to its cancer vaccine therapies, AccuTOX® will become the flagship in the field of cancer therapeutics. Defence remains committed to its mission of meeting acute clinical needs and becoming a global leader in developing innovative cancer therapies in the medium term. The next few months are likely to be extremely exciting as to which therapeutic areas will now come into focus.

The Defence Therapeutics share is currently trading in Canada with high turnover in the range of CAD 2.60 to CAD 2.90. However, at the beginning of 2023, the share was already trading at just under CAD 5. The encouraging FDA approval came to light yesterday after the market closed. In Germany, the news is gradually being priced in with rising share prices. For the coming year, 2024, Defence Therapeutics is expected to be at the top of the winners' list again.

BioNTech and Bayer - Little movement in the low mood

The Mainz-based biotech company BioNTech is not having an easy time at the moment, as there are still several inconsistencies from the COVID-19 period to be dealt with. On the one hand, there are lawsuits filed by vaccine victims who want to have their side effects attributed to the Comirnaty vaccine established in court. They point out that BioNTech produced its vaccine in two different ways: One for a select group of people and the other for the masses. Sounds crazy, but according to reports, the plaintiffs are questioning the vaccine quality produced using the second method. On the other hand, there is a patent dispute with the German competitor CureVac. BioNTech aims to have a patent from its Tübingen-based competitor declared null and void. CureVac applied for the disputed patent at the European Patent Office in 2007. The authority granted the patent in 2010, which is valid in 20 countries. The court date for the dispute has been set for December 19.

Bayer shares have been on the sidelines for a long time now. The pharmaceutical company's shares have lost around two thirds of their value over the past 10 years. In November, the Leverkusen-based company announced it would terminate a Phase III trial on the anticoagulant asundexian prematurely due to insufficient efficacy. The drug was expected to be available in 2026 and generate several billion euros in sales for the Group. A spin-off of the Consumer Health or Crop Science divisions has been repeatedly discussed recently. This could potentially release hidden value, but it seems investors are currently placing little emphasis on this prospect. While BioNTech is sitting on a good EUR 17 billion in liquidity, Bayer is trading at a 2024 P/E ratio of 4.5 and is paying out a 7.5% dividend. For long-term investors, current entry points for both shares at around EUR 92.7 and EUR 31.5 offer opportunity. Collect!

Whenever groundbreaking developments occur in the biotech sector, the stock market reacts with leaps of joy. On the other hand, stocks that are simply resting on their laurels are sometimes left behind. In this mixed situation, Defence Therapeutics and MorphoSys are taking off, while Bayer and BioNTech are still in consolidation .

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.