January 9th, 2024 | 06:45 CET

Despite farmers' strike - rally with hydrogen and GreenTech ahead in 2024! Nel ASA, First Hydrogen, Nordex and Siemens Energy

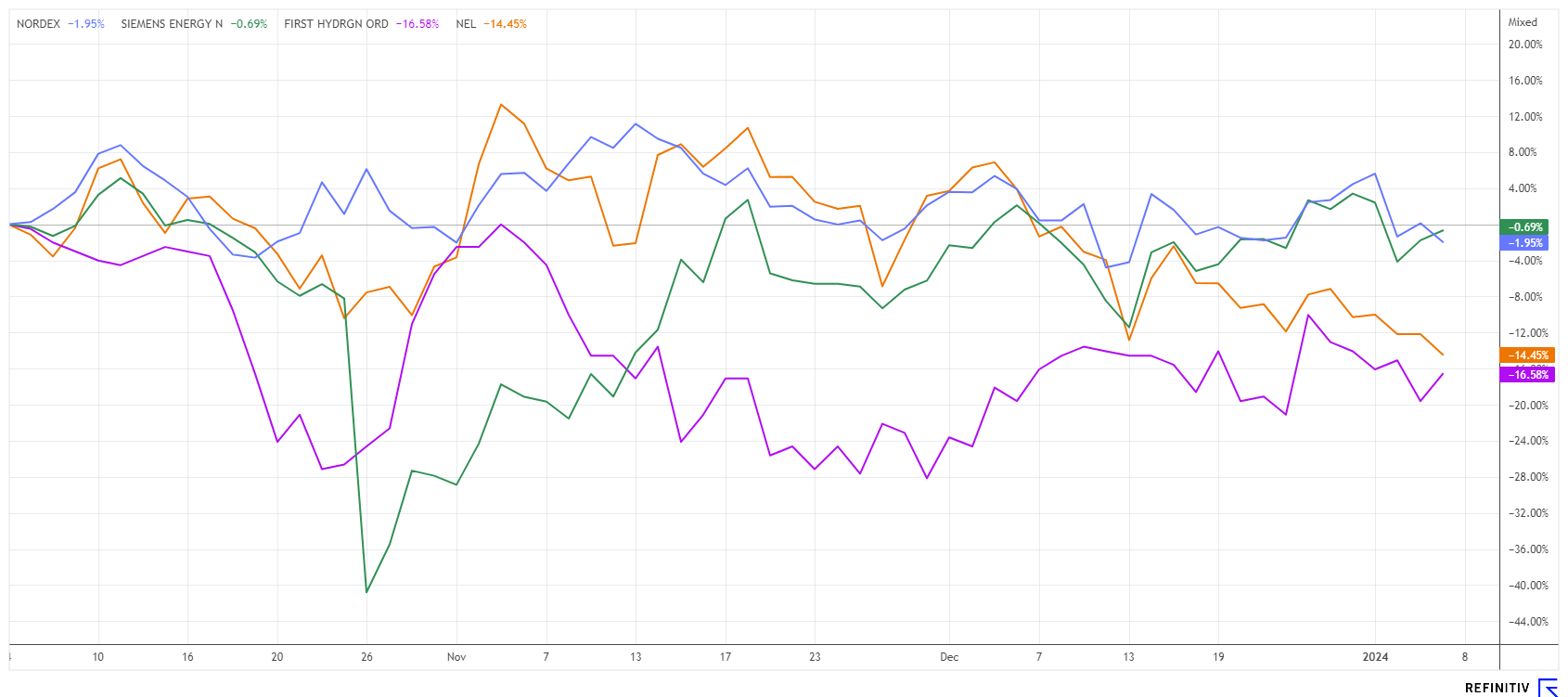

While the DAX and NASDAQ are soaring from high to high, some stocks are completely falling by the wayside. We are talking about countless GreenTech stocks that have missed the boat in terms of profitability. In the 2023 investment year, solar, wind and hydrogen companies suffered losses of between 50% and 80%. Investors responded to the lack of profits with a collective exodus and offset the share price gains of the last three years. The decisions taken at the World Climate Conference in Dubai could now be the starting signal for a medium-term rebound attempt. Those who analyze the situation closely may arrive at surprising insights.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , First Hydrogen Corp. | CA32057N1042 , NORDEX SE O.N. | DE000A0D6554 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA - The catastrophe takes its course

Hard to believe! The farmers' strike in Germany ruthlessly exposes the failed climate resolutions of the Berlin traffic light coalition. For years, the cabinet took care of things such as contemporary nomenclature, gender legislation, immigration and the permanent expansion of the welfare state. However, truly important matters that ensure Germany's long-term success in the global markets have fallen by the wayside. Now, money is lacking on all fronts, and Berlin must make cuts. The red pen of the less experienced government acrobats is now hitting the most critical area of our lives: a secure food supply! Because the current decisions affect our farms' existence and, ultimately, our society's stability. So, dear cabinet, what happens next?

The Norwegian company Nel ASA is a mirror image of delayed investment in green technology of the future: High costs and no prospect of profits. The electrolyser pioneer recently even had to cancel a significant order because the financing was not provided on time. According to analysts on the Refinitiv Eikon platform, NOK 1.6 billion is a possible target for sales for the year, but the balance sheet remains red with a negative EBIT of around NOK 750 million. A turnaround in earnings is not expected until 2026, but until then, the share price is likely to continue to be subject to high fluctuations.

With a 12-month loss of 62%, the Nel share price marked a new 3-year low of EUR 0.536 in December. To send the first positive technical signals, a significant rise above the EUR 0.70 mark would be necessary, but yesterday, it fell again by 2.5% in a friendly environment. Medium-term investors should still watch the action from the sidelines. Traders will become active as the momentum increases.

First Hydrogen - The rollout is now starting in North America

In North America, investments in the future are often linked to special budgets that the US government proclaims for start-up financing. One such measure is US President Joe Biden's so-called "Inflation Reduction Act" (IRA). The three-digit pot of USD 270 billion primarily benefits domestic companies investing in green tech, healthcare and infrastructure. This spirit of optimism can also be felt in neighboring Canada. With supply chains still disrupted and ongoing geopolitical conflicts, western industrial nations are turning to safe commodity countries for their procurement. Canada offers both resources and a great deal of technological innovation.

Since the race track day at the Horiba Mira test site in the UK, the products of the Canadian hydrogen technology company First Hydrogen have been the talk of the town. In addition to the visual impressions, the test drives with the H2-powered fuel cell vehicles (FCEV), in particular, impressed many transportation and logistics providers. Following the successful vehicle tests, First Hydrogen has launched its new program for FCEVs in North America, which perfectly aligns with the Company's expansion plan and the progress of the hydrogen ecosystem in Québec.

In addition to the continuation in the UK, two additional FCEV demonstration vehicles are now being developed to showcase to potential North American fleet customers. Hydrogen propulsion is clearly superior to battery electric powertrains in terms of range, payload and rapid refueling for multiple requirements in the grocery, parcel delivery, mining and utility sectors. The demonstration program now underway is the next step in the Company's journey to establish a vehicle assembly plant and green hydrogen production facility in Québec.

First Hydrogen's "Hydrogen-as-a-Service" model will provide customers in the Montreal-Québec City region with clean, green hydrogen fuel and zero-emission commercial vehicles to accelerate the creation of zero-emission ecosystems. The assembly facility is expected to produce up to 25,000 vehicles annually for distribution across North America and will significantly boost job creation in the green technology sector. Global market leader Amazon recently announced plans to equip some of its logistics centers with hydrogen-powered forklifts. These Titans 50 companies are paving the way for further innovations in decarbonizing the industrial transport sector through their start-up investments.

The First Hydrogen share has had a challenging time in recent weeks, but it is attracting much attention again at the start of 2024. In chart terms, the double low at around EUR 0.94 now marks a significant reversal. Turnover in the share has recently developed well upwards. Given the full pipeline, this will likely be the start of a longer-lasting rally.

Nordex or Siemens Energy - Wind energy on the sidelines

The energy system manufacturer Nordex and Siemens Energy had a difficult time last year. Several profit warnings had to be absorbed by the stock market. At the start of the year, however, there is now hope at both companies that climate investments could pick up again. Following the considerable quality problems at its Spanish subsidiary Gamesa in the fall of 2023, Siemens Energy, in particular, had to take advantage of a federal and bank guarantee for EUR 12 billion in order to continue working on the large order backlog. Berlin's traffic light government is still struggling with its budget, but the red-green dominated government should favor further climate protection investments.

According to the platform Refinitiv Eikon, Nordex is valued at a price of EUR 9.70 with a 2025 P/E ratio of 14, and the operational turnaround should be completed next year. With just under EUR 7 billion in sales, a net profit of EUR 168 million would be on the cards again. The corresponding figures for Siemens Energy are a P/E ratio of 16, with forecast sales of EUR 35.2 billion after EUR 31.1 billion in 2023. The possible free cash flow of over EUR 1 billion in 2026 is interesting here, which could then become the standard in subsequent years. Overall, Nordex and Siemens Energy are currently trading at very promising levels for a long-term investment.

**The GreenTech sector still has the opportunity this year to turn the negative performance from 2023 into a rebound. Investors are, therefore, keeping an eye out for possible turning points in momentum and relative strength. If there are entry signals, performance will likely be very strong in just a few days. Technically, First Hydrogen looks the best, Nel ASA is still looking for a bottom, and Siemens Energy and Nordex are fighting for the critical EUR 10 to 11 zone.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.