November 22nd, 2023 | 07:30 CET

Black Week in the energy sector: Short hydrogen - Long oil! Shell, BP, Prospera Energy, and Plug Power under the microscope

It sounds ambitious! To completely restructure Europe's energy supply, the European Union would need to invest a good EUR 300 billion in alternative energy sources, infrastructure and raw material supply contracts by 2030. As of 2021, Germany alone was importing 45% of its fossil fuels from Russia, which had been a valued partner until then. After the start of the war in Ukraine, this long-standing business partner was removed from the list. However, this also means that the very cheap sources are no longer accessible for Central Europe. Therefore, electricity, heating and mobility prices will remain high while public coffers are empty. Shareholders who bet on Greentech have to endure a crash in the hydrogen sector while fossil fuels are experiencing a renaissance. Where are the medium-term opportunities?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

Shell PLC | GB00BP6MXD84 , ROYAL DUTCH SHELL A EO-07 | GB00B03MLX29 , PROSPERA ENERGY INC. | CA74360U1021 , PLUG POWER INC. DL-_01 | US72919P2020 , BP PLC DZ/1 DL-_25 | DE0008618737

Table of contents:

"[...] The Oxbow Asset now delivers a substantial free cash flow stream to internally fund our impactful drilling and workover programs. [...]" John Jeffrey, CEO, Saturn Oil + Gas Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Shell and BP - The multinationals remain in good business

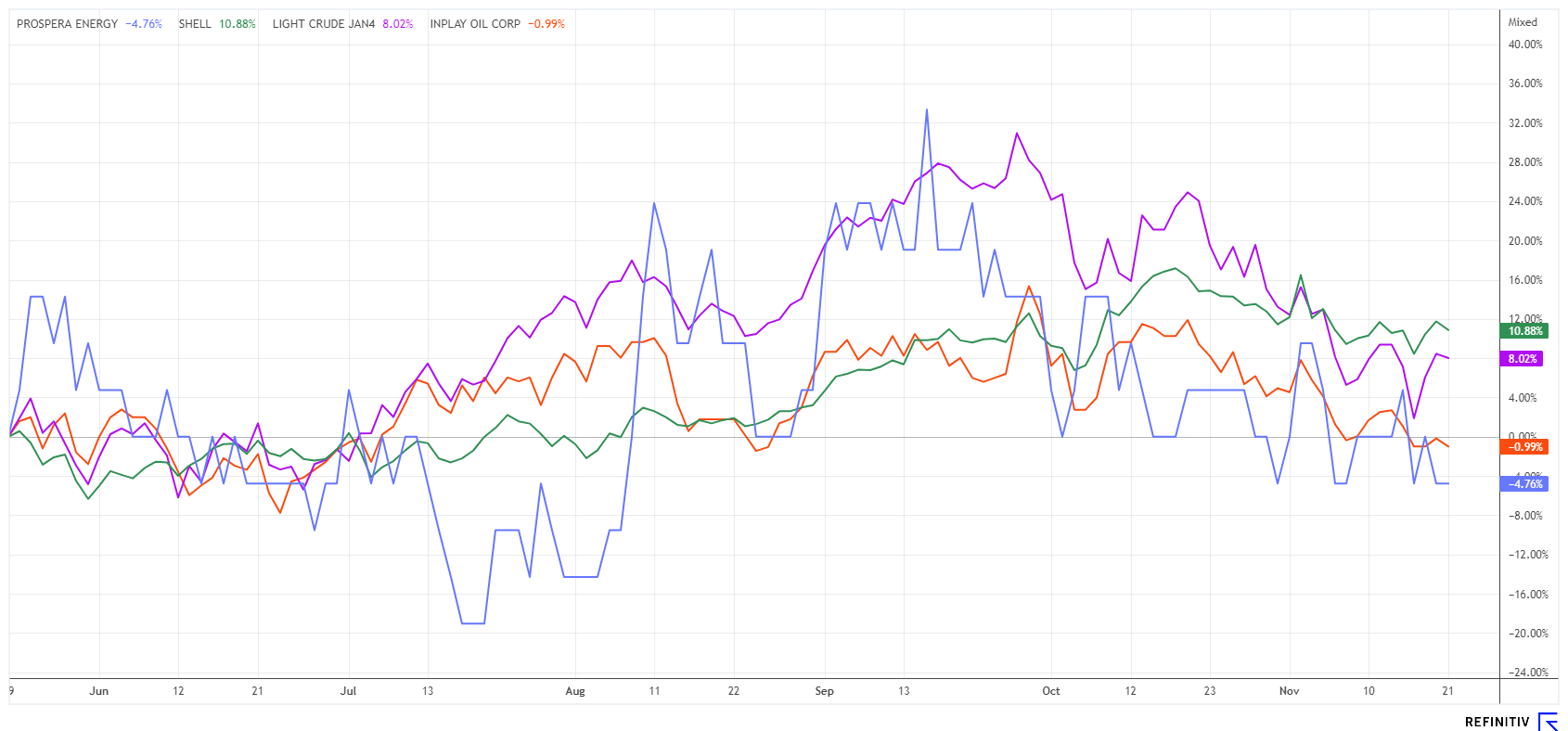

The past quarter provides tangible evidence that business is still going very well for the major oil companies, even though economic expectations have recently been dampened. However, geopolitical distortions are ensuring that energy prices remain high, and a dangerous dependency situation is emerging in Europe.

The British-Dutch oil and gas multinational Shell (formerly Royal Dutch Petroleum) benefited from higher refinery margins and oil prices in the third quarter. At just under USD 7 billion, net profit more than doubled compared to the previous quarter. Although this profit was marginally down on the previous year, 2023 was another record year for the Group overall. Revenue also increased by 2.4% to USD 76.4 billion but was well below the distorted war revenues from 2022, when a barrel of oil traded above USD 120 at times. What should please investors is that Shell plans to buy back USD 4 billion worth of shares.

British competitor BP also did well, but analysts' expectations were significantly higher. With a profit of just USD 3.3 billion, the British company was 60% down on the previous year's figure; experts surveyed wanted to see USD 4 billion. At BP, it was the gas trading business that brought harsh burdens. The high expectations were only scaled back slightly, as a warm winter will lead to further reductions in the price of gas. However, according to industry experts, geopolitics should keep oil and gas prices high. BP also plans to repurchase USD 1.5 billion worth of its own shares. Despite this, the share price recently fell by 16%.

While the analysts surveyed expect Shell's average share price to rise by only 5% to EUR 31.65 over the next 12 months, the hopes for BP are much more aggressive, with a target of EUR 6.34 and 17% potential. Obviously, the gas-heavy BP is currently considered to have more opportunities, but Shell has historically often been a rock in times of crisis.

Prospera Energy - Increasing Oil and Gas Production from Western Canada

No matter what economic scenario one might put forward, the long-term geopolitical landscape will likely keep energy prices up for a while. In this scenario, however, there can always be distortions and artificial shortages. Canadian oil producers are currently showing courage because, in addition to high domestic demand, they are also keeping an eye on the commodity pact with Germany, which the German government negotiated in Ottawa in spring 2023.

Prospera Energy Inc., based in Western Canada, is well positioned. The Company specializes in the exploration, development and production of crude oil and natural gas and is currently undergoing a restructuring. The Company's recent history dates back to 2002 when the projects still yielded over 5,000 barrels of oil equivalent (BOE) from the ground. The oil fields were then successively passed on from large operators to ever smaller, capital-strapped explorers. As a result of many joint venture structures and mutual debt claims, the projects gradually got into difficulties.

With new management, a structural adjustment is now being brought about. Seismic surveys still confirm oil reserves of around 400 million barrels of BOE with a value of around USD 30 billion. Prospera, under the new leadership of CEO Samuel David, announced its Phase 2 development program in the summer of 2023, which aims to increase production significantly. This phase includes converting vertical wells to horizontal wells to develop the significant remaining reserves in the Saskatchewan heavy oil fields. Work will now continue through the winter until the onset of spring thaw next year. Naturally, Prospera wants to bring the new developments online as quickly as possible to take advantage of the current strong oil price environment.

Prospera's current gross production is 1,100 BOE, with a further 700 BOE to be added successively after completion of the optimizations by the end of the year. Capital expenditure per barrel is already falling from the previous USD 38 to the USD 30 to 32 range, further expanding net cash flow. An operating cash flow of CAD 1.6 million was already achieved in the third quarter. In addition, the recent completion of the first phase of the restructuring has already increased the net cash value of the properties to approximately CAD 72 million. Prospera was recently able to refinance with CAD 6 million and will now tackle the next phases. With 399 million shares, the Company's equity is currently valued at around CAD 40 million. The recovery in value is likely to continue apace, so the entry at around CAD 0.10 within the "tax-loss season" is now quite favorable.

Plug Power - A sell-off with an announcement

The hydrogen company Plug Power, under the leadership of CEO Andy Marsh, has gone completely under the radar. After several profit warnings and shareholder lawsuits due to misleading outlooks, the up-and-coming H2 market leader in the US has now got its comeuppance. This was preceded by a subterranean quarterly report that pushed the Company's break-even point into the distant future. The third quarter figures for the 2023 financial year ended with another loss. It amounted to USD -0.47 per share in the reporting period, while analysts' estimates had still been optimistic at USD -0.305. At the same time, Plug Power's turnover was only around USD 198 million, which was only a slight improvement on the previous year.

Delivery problems in the production of fuel cells and high cash outflows ultimately caused the share price to plummet by a further 40% to a new 3-year low of USD 3.23. The valuation has now fallen by 95% from its all-time high at the beginning of 2021. We had regularly warned of the overvaluation. Nevertheless, the high level of attention on this Greentech stock means that quick trading successes are always possible. If the analysts' estimates are to be believed this time, Plug Power is only trading at a 2025 price/sales ratio of 1. The next capital round could be complicated, as cash levels are falling. Stay on the sidelines.

The energy markets remain tense due to the geopolitical situation, as demand for fossil fuels remains high. Majors such as Shell and BP are benefiting from the current supply situation, while smaller oil producers need to secure financing. Prospera Energy has completed a 3-year restructuring and now has excellent prospects.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.