November 15th, 2023 | 06:30 CET

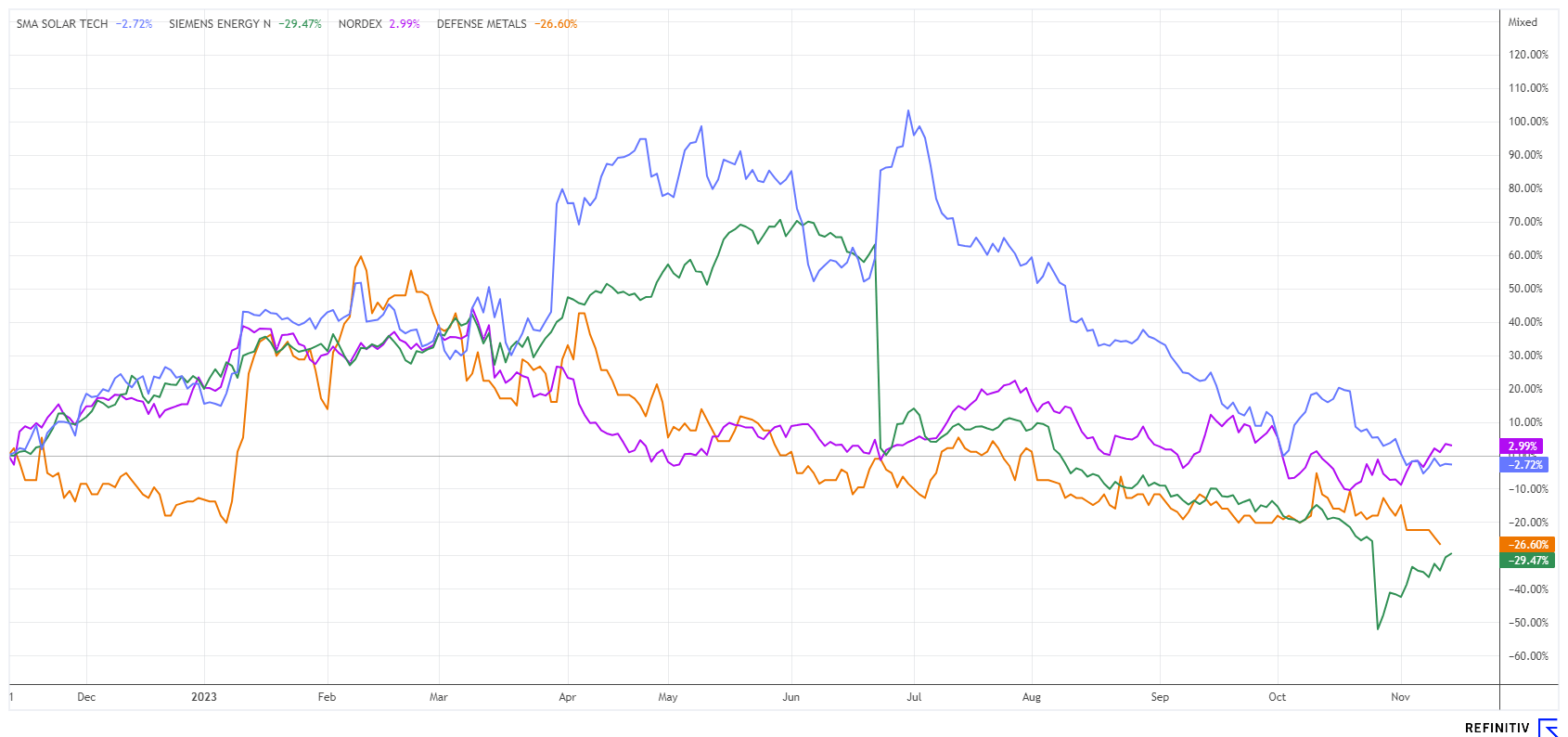

Greentech sector buybacks - The stage is set for a 100% rally! Nordex, Defense Metals, SMA Solar and Siemens Energy

With the new EU Climate Law, Europe has once again raised its long-term target for reducing greenhouse gases by 2050. Instead of a reduction of 80% to 95%, the aim is now net zero emissions, i.e. "climate-neutral". This is to be followed by negative emissions in subsequent years. The idea sounds promising: emission reducers can offset emission sources! However, climate change generally requires the use of modern Greentech technologies that "produce" these savings. Those looking to reduce or replace fossil fuel consumption typically need large apparatus and innovations, such as various alternative energy sources converted into electricity. Europe, in particular, faces the challenge that most of the necessary metals are classified as critical, making it financially unrealistic to roll out innovative projects on a broad scale. Which shares stand out in this environment?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NORDEX SE O.N. | DE000A0D6554 , DEFENSE METALS CORP. | CA2446331035 , SMA SOLAR TECHNOL.AG | DE000A0DJ6J9 , SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0

Table of contents:

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

SMA Solar - Not quite out of the woods yet

When it comes to solar technology, investors find themselves right in the midst of Greentech confusion. Where are the margins, and where does one need to invest to get a piece of the pie? The inverter manufacturer SMA Solar Technology has seen its share price plummet significantly. At the end of June, the share was still trading at EUR 112; yesterday, EUR 53.60 was written on the board, a smooth halving in just 5 months.

As reported last week, SMA increased consolidated sales by 84.7% to around EUR 1.34 billion in the first nine months of 2023, compared to just over half of this figure of EUR 724 million in the same period of the previous year. In the home segment, i.e. business with private households, sales more than doubled to EUR 486 million. However, sales in the commercial and industrial segment also increased by 74.4%. Revenue from solar parks rose to around EUR 518 million, an increase of more than 70%. The operating result (EBITDA) managed a 360% leap to EUR 231.2 million, which corresponds to a margin of 17.3%.

With an order backlog of just over EUR 2 billion, management has again confirmed its upwardly adjusted sales forecast of EUR 1.8 to 1.9 billion for the 2023 financial year. Despite all the euphoria, analysts have turned their thumbs down. The experts at Jefferies lowered their 12-month price target from EUR 68 to EUR 60 and confirmed their "Hold" rating. Berenberg and Deutsche Bank make the same assessment but with price targets of EUR 85. With a 2024 P/E ratio of 1 and a price/earnings ratio of 12.5, the share is no longer too expensive. Pay attention to whether the technical support line at EUR 49.50 can withstand the pressure.

Defense Metals - Rare earths from Canada

The EU wants to ensure a reliable and sustainable supply of critical raw materials with a new set of rules. Representatives of governments and the European Parliament recently agreed on the text of a corresponding regulation. In particular, it is intended to promote the refining, processing and recycling of critical raw materials in Europe in order to reduce dependence on countries such as China. The battery raw materials copper, nickel, graphite, lithium and cobalt and the spectrum of rare earths are currently considered particularly critical. These are a group of 17 metals that are essential for many high-tech applications such as e-mobility, electronics and renewable energies.

Rare earths are in high demand at the Canadian Explorer Defense Metals (DEFN). An updated NI 43-101 resource estimate has now been announced for the 4,262-hectare Wicheeda Rare Earth Project. Report highlights include 6.4 million tons of Measured Mineral Resources averaging 2.86% Total Rare Earth Oxide (TREO1). Indicated and Inferred Mineral Resources of 27.8 million tons averaging 1.84% TREO and 11.1 million tons averaging 1.02% TREO are also reported. In open pit mining, these metals could be mined at a cut-off grade of 0.5% TREO. This shows a significant upgrade of the resource compared to 2021 data.

Defense Metals shares are currently suffering from tax-loss selling, which has pushed the stock down somewhat on a year-to-date basis. Due to the new data, this level is suitable for additional purchases. At the beginning of the year, the value had already reached the CAD 0.40 mark. In the current political climate, a strong rebound at the turn of the year is extremely likely.

Nordex versus Siemens Energy - Where is it worth getting in?

Yesterday, Nordex presented its 9-month figures and was at least able to save analysts from a negative surprise. Sales rose by almost 16% to EUR 4.5 billion in the last three quarters, and order intake increased again. Orders excluding the service sector climbed by 10.6% to 4.9 gigawatts (GW). The Hamburg-based company thus exceeded the previous year's weak level of 4.4 GW. Nordex's operating result (EBITDA) remained in the red at EUR -67 million, significantly less than in the previous year (EUR -200 million). There is still a noticeable net loss of EUR 334 million. The stock market reacted cautiously; we are still waiting for the reassessments from the experts. **On the Refinitiv Eikon platform, 9 out of 13 analysts are positive so far and expect an average 12-month price target of EUR 15.60.

The situation for Siemens Energy is serious. After horrendous write-offs of over EUR 4.5 billion, the Company now lacks the equity to process its huge order backlog. Siemens is facing immense restructuring costs at its wind subsidiary Gamesa in Spain, which is facing significant quality issues. Siemens now needs a federal guarantee to secure future sales. The vote from Berlin is positive. The German government is granting a guarantee of EUR 7.5 billion. This is part of the required guarantee lines totaling EUR 15 billion, which have been agreed upon with private banks, among others. Specifically, a consortium of banks will provide guarantee lines totaling EUR 12 billion, which will be partially secured by the federal government's guarantee. The Company is to secure a further EUR 3 billion in negotiations with other parties. The federal government will only provide the guarantee if these investors also make their contributions. The catch - the third investor has yet to be found but could turn out to be the parent company Siemens. Everything is not yet in the bag, and the share quickly lost initial gains of over 5% yesterday. Technically, the beaten-up share is now at the critical rebound level of EUR 10. Keep watch!

Investors have been focusing on the Greentech sector since the energy transition. While hydrogen came under a lot of pressure here, energy plant manufacturers have also been hit recently. Meanwhile, Siemens Energy, SMA Solar and Nordex are considered the pioneers of climate-neutral power generation. If you want to add the important critical metals, Defense Metals is the right address.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.