December 19th, 2023 | 07:20 CET

GreenTech in turnaround in 2024? Siemens Energy, Altech Advanced Materials, Nordex and Varta in focus

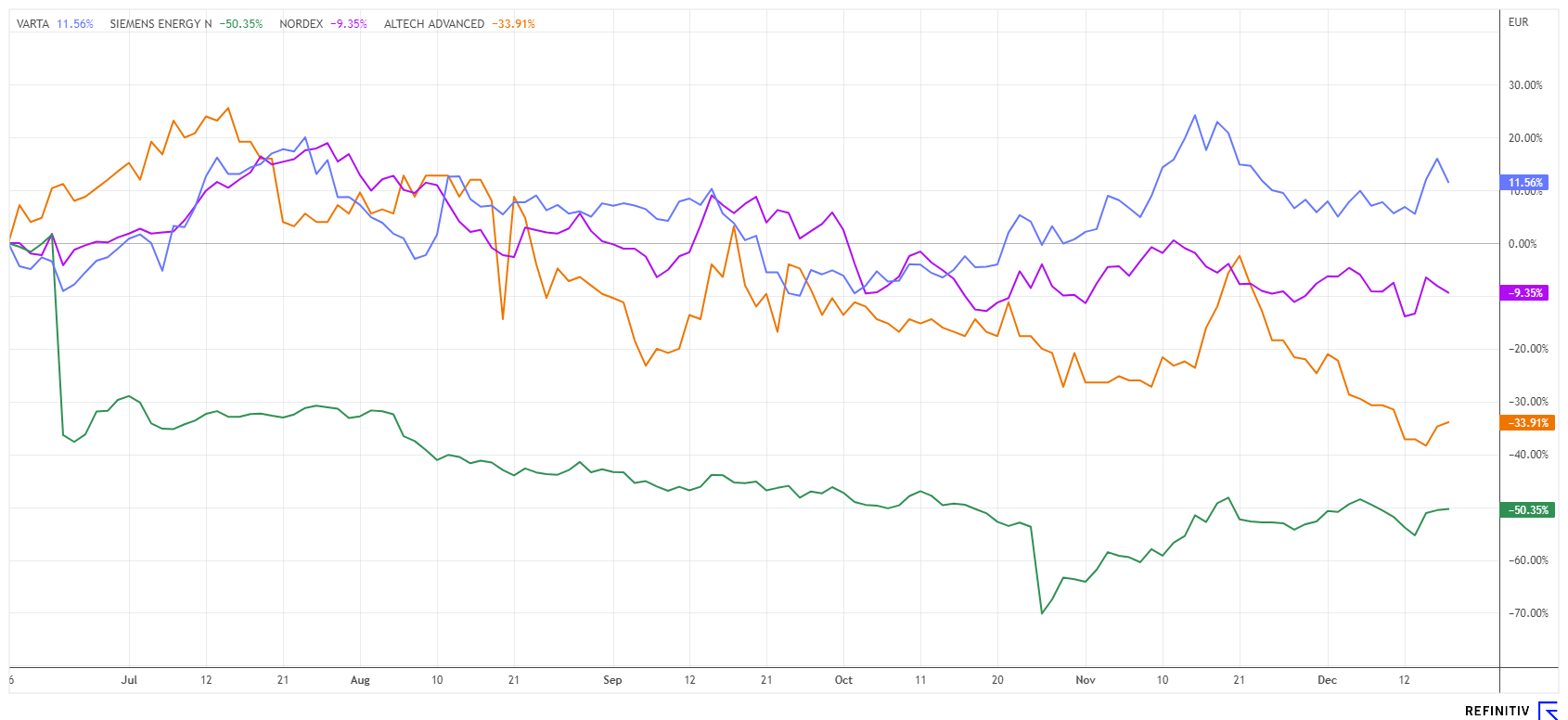

The investment year 2023 was not a highlight for owners of GreenTech shares. All stocks that were supposed to benefit from the government's fabulous climate change targets were crushed. Hydrogen stocks lost 75% on average, and the wind and solar sectors fell by at least 50%. A look ahead to 2024 now raises questions, as the Berlin traffic light coalition abruptly halted support for heating and e-mobility due to the Karlsruhe ruling. This will now be a litmus test for GreenTech producers, as they must assert themselves on the market without subsidies. It is a bold experiment if the state no longer offers incentives. We take a closer look.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , Altech Advanced Materials AG | DE000A31C3Y4 , NORDEX SE O.N. | DE000A0D6554 , VARTA AG O.N. | DE000A0TGJ55

Table of contents:

"[...] Silumina Anodes® is a ceramic-coated graphite/silicon anode composite material that we plan to produce in Schwarze Pumpe, Saxony. Here, we aim to supply manufacturers of batteries for e-cars with an application-ready drop-in technology that is low-cost, high-performance and safe. [...]" Uwe Ahrens, Direktor, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Varta - Can the turnaround succeed now?

The shares of the Ellwangen-based battery specialist Varta currently deserve the highest level of attention. After the boom years of 2021/22 with share prices of over EUR 170, investors have already had to endure three profit warnings in the last 14 months. Most recently, a tough restructuring plan was announced, accompanied by the loss of 800 jobs. In its nine-month report, Varta has once again confirmed its annual forecast for 2023, which was last revised in the summer. Revenue is estimated at EUR 820 million; analysts on the Refinitiv Eikon platform also share this opinion and estimate EUR 817 million. According to Varta, this figure is expected to be around EUR 900 million next year, i.e. a planned increase of 10%. The supplier of micro and household batteries, energy storage systems and battery solutions has thus been able to reassure investors. However, it is still too early to sound the all-clear.

The share price could be interpreted as indicative. After a sell-off to EUR 13.95 in June 2023, there was a rapid recovery to around EUR 22.50. However, the recovery rally then stalled. Yesterday, the share consolidated again to below EUR 21. The new CEO, Dr. Markus Hackstein, probably still has a lot of work to do to build confidence until the old wounds have healed. Analysts do not expect a small net profit of EUR 0.12 per share again until 2025. It is advised to consistently enforce our last buying recommendations between EUR 16.00 and EUR 18.50, with a strict stop at EUR 19.50 to avoid falling into negative territory. Technically, a sustained move above the EUR 24.50 mark can be seen as an entry signal.

Altech Advanced Materials - Capital increases successfully completed

The Frankfurt-based holding company Altech Advanced Materials has now completed all capital transactions, allowing the engineers to concentrate on their research goals again this year in order to bring a new blockbuster battery onto the market in the foreseeable future. In the last 12 months, the share has experienced a journey from EUR 3.56 to EUR 17.96, and yesterday, following the completion of the last capital measure, it was back at EUR 8.30. The number of shares has now increased to 7.542 million, valuing the battery expert at around EUR 58.8 million.

In the Silumina Anodes plant planning, the ceramic-coated anode material has now been switched to 100% silicon. With the ongoing feasibility study, the annual production capacity for the new storage facilities has thus been scaled up from 15 to 120 GWh. The planned Schwarze-Pumpe plant for the production of exclusively metallurgical silicon will then have an annual output of 8000 tons. Customers subsequently integrate this product into their own battery factories rather than in Altech's anode graphite facility. The pending Definitive Feasibility Study (DFS) is expected to be published in 2023. With these adjustments, Altech remains very well positioned in the field of energy storage and e-mobility.

Uwe Ahrens, CEO of Altech Advanced Materials AG, summarizes: "With this strategic adjustment in our production, we are hitting several birds with one stone: Coated silicon, as the decisive future material for significantly more efficient batteries, will be available on the market in much higher quantities in a shorter time. At the same time, battery manufacturers have the option of using their own graphite in a drop-in process and are therefore able to cover the large capacities required."

The Altech share is now very tradable due to the increase in the number of shares. Yesterday, over 5,000 shares changed hands at a premium of almost 10% compared to the recent capital increase at EUR 7.60. Given the increased liquidity, institutional investors can now also enter. **If the development keeps pace, a significant jump in valuation can be expected as early as 2024.

Siemens Energy versus Nordex - Who has the edge?

Two other GreenTech stocks are currently making a name for themselves. Firstly, there is Siemens Energy, the energy subsidiary of the Siemens Group, which has come under heavy pressure. At its high, the spun-off share reached just under EUR 35, but at the end of October, the Company had to admit to high write-downs at its Spanish wind subsidiary Gamesa. The Company could only get back on track with a federal and bank guarantee of up to EUR 12 billion. From a low of EUR 6.40, the share price almost doubled again. Last week, it was announced that the German government had negotiated an interest rate of 120 basis points for its guarantee. With an estimated term of 3 years, this could burden the balance sheet by a whole EUR 500 million in guarantee payments. The recovery in the share price has come to a standstill again at around EUR 11.40 following this news. Nevertheless, 19 out of 22 analysts on the Refinitiv Eikon platform are optimistic and expect an average price target of EUR 14.76 in the next 12 months.

Nordex fell below the EUR 10 mark again yesterday. The Hamburg-based company is also plagued by margin problems. The production costs of wind turbines have climbed too high, which could not be passed on in full to customers. Despite all reservations, 9 out of 11 analysts remain on the "Buy" side and expect a 12-month price target of EUR 14.85. However, as the complete recalculation of Nordex's selling prices means that profits will already be generated again in 2024, investors should favour this stock. Nevertheless, both business models will have to face the realities due to decreasing subsidies from Berlin."

The GreenTech sector has recently shown itself to be multifaceted on the stock market. While wind power specialists such as Siemens Energy, Gamesa and Nordex are struggling with extreme margin problems, companies in the battery sector are benefiting from a dynamic environment in e-mobility and energy storage solutions. Varta and Altech Advanced Materials should continue to show strength in 2024, while the stock market is hoping for a sustainable turnaround at Siemens Energy and Nordex.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.