November 23rd, 2023 | 07:30 CET

Getting in now? Hydrogen - The analysis: Nel and Plug Power sold off, rebound at dynaCERT!

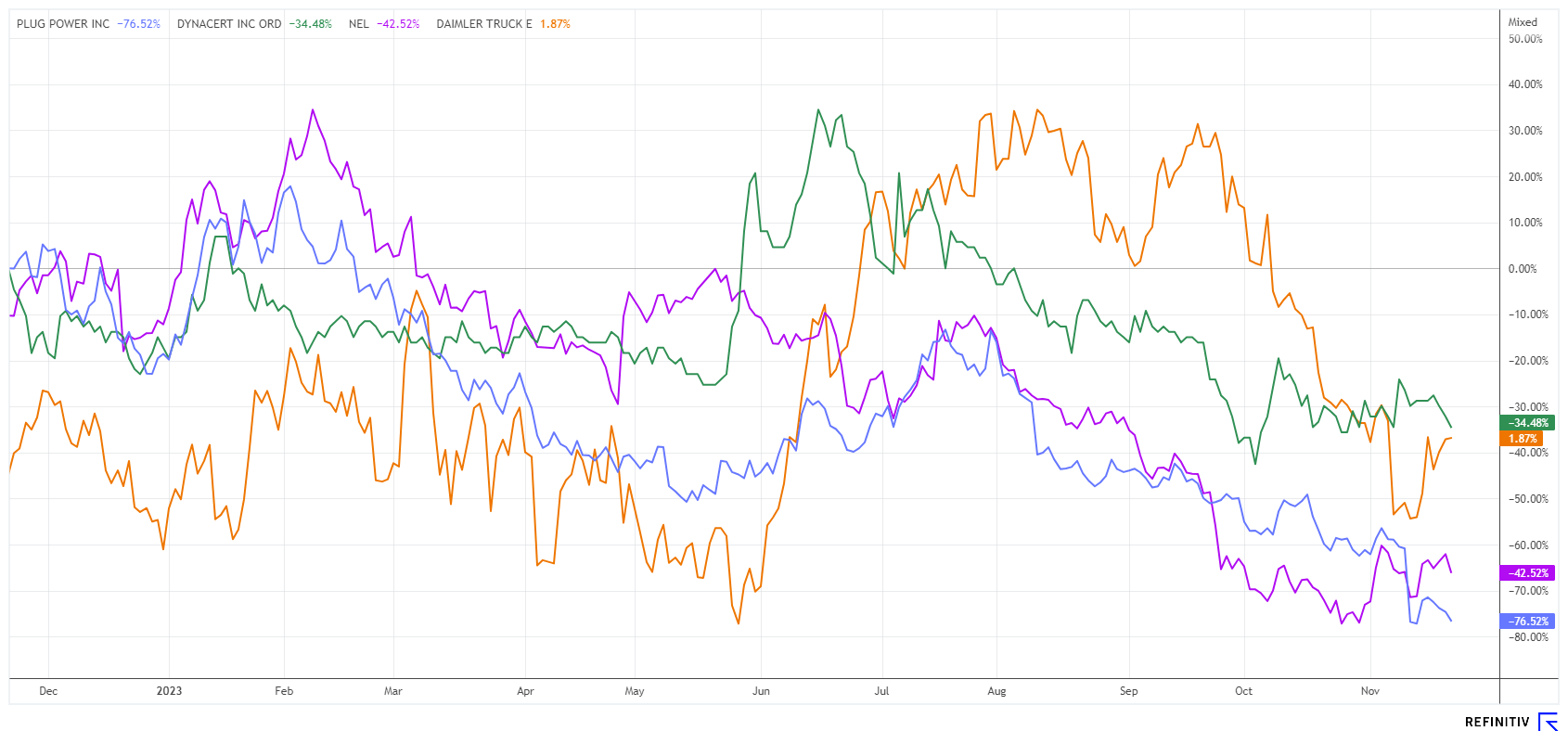

It was like a crash. The hype sector hydrogen experienced one of the most significant sell-offs in recent stock market history with a complete reversal to the downside. Parallel to otherwise bullish markets, losses of 70 to 90% were not uncommon. The rationale behind this is understandable and frustrating at the same time: green-oriented governments around the world are trying to accelerate the climate transition but often have the wrong targets in mind due to their lack of expertise. Hydrogen is just a selectively applicable technology and not a solution for global energy supply. Studies show that only the complete, green production of H2 makes any economic sense. Investors have long since seen through the game, and politicians may have to fail before the necessary insight comes. Nevertheless, there are some opportunities for sensible hydrogen applications. We delve into the topic and put current models to the test.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , PLUG POWER INC. DL-_01 | US72919P2020 , DYNACERT INC. | CA26780A1084

Table of contents:

"[...] Why should a modular electrolyzer cost more than a motorcycle? [...]" Sebastian-Justus Schmidt, CEO and Founder, Enapter AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA and Plug Power - Have the prices dropped far enough?

After share price losses of between 70 and 90%, investors are wondering when the end of the line has been reached. The share prices of the H2 protagonists have been sliding lower and lower since the beginning of the year. Although Nel ASA and Plug Power have well-filled order books, they have not reached the operating plus zone with these volumes. What is clearly missing are a whole series of public orders from the climate protection funds, as private investors are only investing in this technology very selectively due to a lack of returns and competitiveness.

Fundamentally, the EUR 1.2 billion Nel ASA share is still valued at 6 times estimated revenues in 2024. Meanwhile, the operating breakeven is even shifting to 2028. This is an almost incomprehensible timeframe for the investor community because investments must show an annual return to fit into a medium-term investment strategy. 23 analysts on Refinitiv Eikon are positive on the Nel share despite the ambitious valuation and vote Buy with a 12-month price target of EUR 0.87. In our opinion, this stock only fits into a speculative trader's portfolio.

The fundamental situation at Plug Power is somewhat better. After several profit warnings and a very disappointing Q3, the share price fell by a further 40%. Over a three-year period, the share has now lost 85%. There are likely few investors left with any remaining gains. If we also take the year 2024 as a reference, the estimated price/sales ratio is around 1.5, and, according to experts, the breakeven point should be reached in 2026. Hopefully, this forecast does not stem from the visions of CEO Andy Marsh, who has already alienated his supporters on several occasions with overly optimistic expectations. The analysts on Refinitiv Eikon have been wrong for 3 years and still see around 300% potential today. Momentum traders can try their luck repeatedly; otherwise, watch out at the platform edge!

dynaCERT - Many projects and certification in sight

The Canadian company dynaCERT is a representative of applied hydrogen technology. Together with its partner Cipher Neutron, it has been able to land several new orders since summer 2023, for example, for the production of anion electrolysers for the production of green steel. dynaCERT itself is currently supplying a large number of its HydraGEN™ solutions to international transportation and mining companies. The associated fuel savings enable these companies to improve their carbon footprint.

It has now been announced that dynaCERT and its partner Cipher Neutron have received the first order for the purchase of its unique anion exchange membrane (AEM) based electrolysis technology. The AEM electrolysers for green hydrogen production and reversible fuel cell technology enable hydrogen production without using Platinum Group Metals (PGMs) such as platinum, iridium and ruthenium. This makes Cipher Neutron's AEM electrolysers one of the most sustainable solutions currently commercially available for the production of large quantities of green hydrogen. Reversible fuel cell technology enables two-way operation, producing electricity from hydrogen and hydrogen from water. Reversible fuel cells are an attractive alternative to conventional storage media such as batteries, as they eliminate the need for frequent recharging and reduce long-term maintenance.

FuelPositive has also chosen Cipher Neutron's AEM Green Hydrogen Electrolyser technology. After a successful test run and benchmarking, the green ammonia production equipment will be used in the Company's commercial systems. FuelPositive plans to manufacture thirty FP300 systems over the next 12 to 18 months. Incorporating Cipher Neutron's electrolysers into these systems would be the equivalent of using 4.5 megawatts of AEM electrolysis stacks commercially. As can be seen, green ammonia plays a crucial role in the hydrogen economy due to its many applications. A specialized application that makes great sense in stationary applications.

The dynaCERT share is currently trading between CAD 0.14 and 0.17. Investors are now still waiting for certification by VERRA. The management assumes that the examination for the award of the certificate should be completed by the end of the year. For the wealth of solutions, the current capitalization of CAD 55 million is surprisingly low. That could change in a flash!

dynaCERT's CEO Jim Payne will report on the latest progress and answer questions live at the 9th International Investment Forum at 16:30 CET on December 05, 2023. Click here to register.

Daimler Truck - Over 1000 km with fuel cell

With 1047 km on a single H2 charge, Daimler Truck has successfully demonstrated that hydrogen fuel cell technology can be a suitable solution for decarbonizing flexible long-haul road transport. A prototype of the "Mercedes-Benz GenH2 Truck" approved for use on public roads achieved this result between Wörth am Rhein and Berlin. The truck completed the journey fully loaded and with a permissible total weight of 40 tons under real conditions without emitting any CO2 during the journey.

While the orders have recently been formulated by Minister Habeck, they depend on the liquidity of the Transformation Fund, which the Federal Constitutional Court recently restrained with its ruling on inadmissibility.

This marks a milestone in the transformation and decarbonization of the transportation sector. Daimler is making good progress with series production but, at the same time, in Berlin, is calling for the availability of a green energy infrastructure at competitive costs. Although the orders were recently formulated by Minister Habeck, they are dependent on the liquidity of the Transformation Fund, which the Federal Constitutional Court recently put in its place with its ruling on inadmissibility.

In the development of hydrogen-based drive systems, Daimler Truck prefers liquid hydrogen in the long term, which has a significantly higher energy density. Currently, the Stuttgart-based technology company still sells over 95% diesel-powered vehicles. The Daimler Truck share is particularly interesting, as the estimates for 2024 show a P/E ratio of 7.3 and a dividend yield of just under 6%. The 21 analysts on the Refinitiv Eikon platform are consistently optimistic and formulate a 12-month price target of EUR 42.30 - a whopping 45% above the current price of EUR 29.35. After the recent correction, the chart now looks particularly promising.

After the sell-off in the summer, the hydrogen sector has had to endure a second wave of sell-offs. The sector's protagonists are now down by more than 50%. Analytically, normality is now slowly returning. Aside from high valuations, the Canadian company dynaCERT is showing a significant increase in sales with its unique solutions and expects to be certified for entry into emissions certificate trading in the near future.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.