November 28th, 2023 | 07:00 CET

GreenTech 2024 - The turnaround analysis: Siemens Energy, Almonty Industries, JinkoSolar and Nordex. Is the turnaround near?

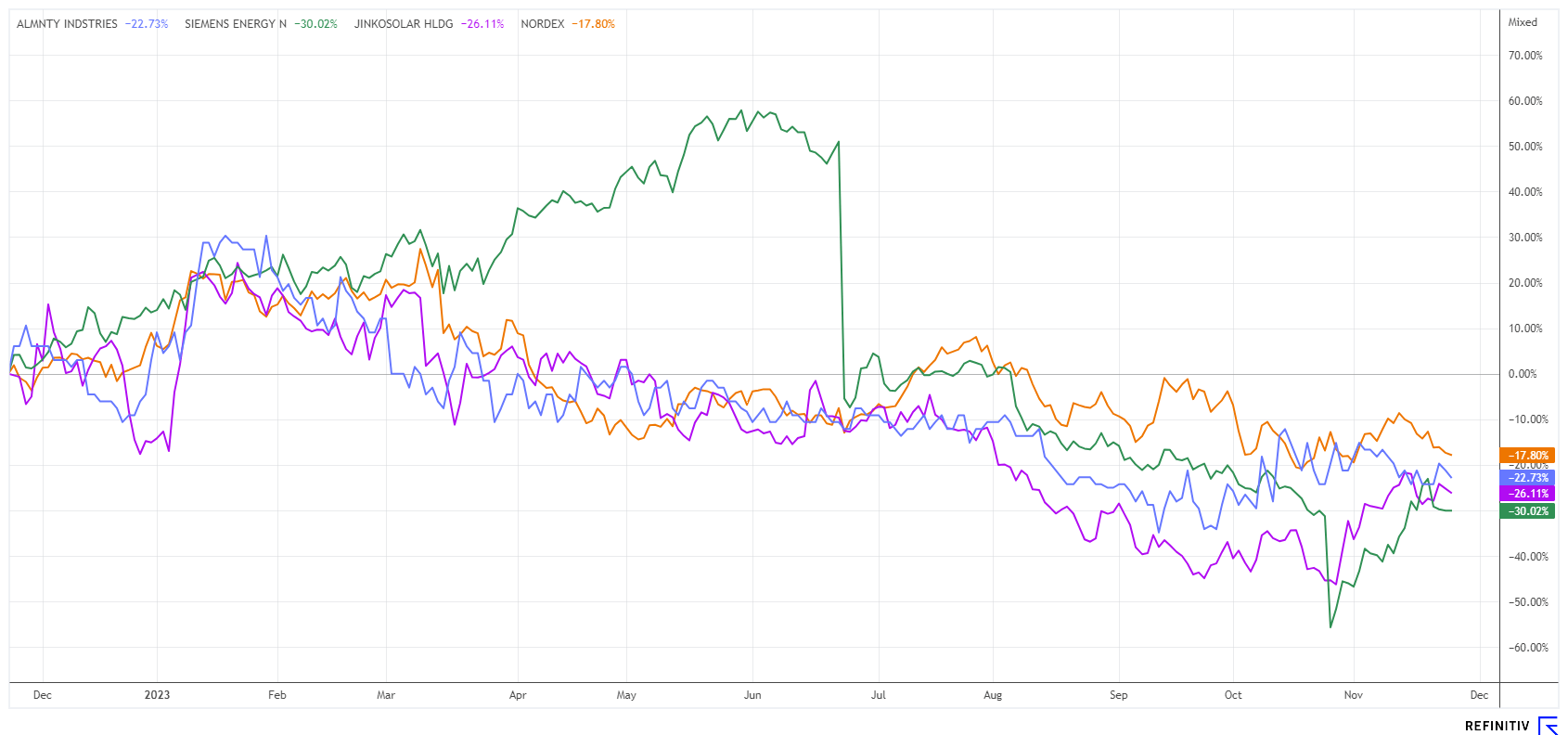

The Western hemisphere is experiencing unprecedented inflation due to the impact of Corona and subsequent geopolitical conflicts. This time, it is not a boom causing prices to explode but the scarcity of raw materials, manpower and capital. The rise in interest rates is making infrastructure projects worldwide more expensive and jeopardizing the implementation of climate projects. In such an environment, GreenTech companies try to plan carefully, but they are still dependent on the support of public budgets. After sharp price corrections this year, investors can now enter the market a good 50% below the highs, but has the bottom already been reached?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

SIEMENS ENERGY AG NA O.N. | DE000ENER6Y0 , ALMONTY INDUSTRIES INC. | CA0203981034 , JINKOSOLAR ADR/4 DL-00002 | US47759T1007 , NORDEX SE O.N. | DE000A0D6554

Table of contents:

"[...] While tungsten has always played an important role in the chip industry, it is now being added to batteries for e-cars. [...]" Lewis Black, CEO, Almonty Industries

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Siemens Energy - After a 70% correction, now 100% profit?

The spin-off of the energy division from the parent company Siemens still requires extensive support to survive in the market. Due to almost EUR 5 billion being written off for the quality deficiencies of the Spanish subsidiary Gamesa, Siemens Energy's equity has become very tight. Fresh capital is needed for the pre-financing of large projects in order to continue working on the bulging order books.

With a guaranteed commitment of EUR 12 billion from the German government, banks, and the former parent company, the Munich-based company held its Capital Markets Day last week and took a stand on the current plight. The Company wants to introduce a restructuring by the 2025/26 financial year, which should lead to annual savings of EUR 400 million at the Gamesa subsidiary. It has been announced that Gamesa should break even again in the current financial year. Gamesa is struggling with quality problems with land turbines, start-up difficulties with offshore turbines and significantly higher production costs. Orders are to be accepted more selectively in future, which will initially reduce the order trend. The 2023/24 financial year, which started in September, is expected to incur another billion-dollar loss.

Siemens Energy announced its 2025/26 targets for the divisions and the Group in mid-November. As a long-term target, the management expects an operating margin of 8% or more; in the past fiscal year, it slipped into the red for the first time at 8.9%. In addition to the hoped-for turnaround at Gamesa, grid technology and industrial transformation should ensure better profitability. The share has already recovered by 70% from the lows of around EUR 6.40, bringing the market capitalization back to around EUR 8.6 billion. At EUR 11.40, the book value would also be reached again; we can only hope that no further mega write-downs occur. On the Refinitiv Eikon platform, 19 out of 20 analysts are optimistic and expect an average 12-month price target of EUR 14.75. Calculated from the bottom, that would be more than 100%, and with today's entry, it is still just under 50%. All in all, an investment in Siemens Energy still requires consistency and nerves of steel. Therefore, consider setting a profit-taking stop at EUR 9.50 just in case.

Almonty Industries - Tungsten mining in Korea in focus

With the recent ruling of the Federal Constitutional Court, some transformation projects will have to be reconsidered because it is no longer so easy for the government to re-declare special funds at will. Assuming the availability of funds, the energy transition's success stands and falls with the availability of stable jurisdictions that do not spring up due to extensive geopolitical tensions. GreenTech companies such as Siemens Energy depend on a steady supply of essential metals. For instance, 1,300 cubic meters of concrete and 180 tons of steel are used in a wind turbine today. The rotor, metal superstructure and generators also require 35 tons of aluminum, 5 tons of copper and some rare earths. The production of wind turbines and photovoltaic systems is therefore highly dependent on countries such as Brazil (iron ore), Peru and Chile (copper), Guinea (bauxite) and China (rare earths).

Almonty Industries is a Canadian company that owns 4 properties rich in the rare metal tungsten. The Company has been working hard for several years to revitalize the Sangdong mine in South Korea, and production is expected to start soon. The properties in Spain are also expected to resume production shortly, providing additional cash flow for the South Korean operations. In November, a further USD 13.7 million was released by the financing bank KfW as part of a USD 75.1 million facility negotiated in 2021. With its extensive tungsten and molybdenum resources, Almonty has a potential production volume that could account for up to 5% of global tungsten consumption. With such a quantity, major Western buyers will likely be queuing up quickly.

Deutsche Rohstoff AG and the Austrian Plansee Group are already on board as strategic investors, giving the project a high degree of stability. The free float in the Almonty share is currently around 50%, and the imminent start of production could soon lead to stronger demand for the share. The analysts at Sphene Capital and First Berlin recommend buying with a good 200% upside potential. Due to the recent news on South Korea, speculative investors may want to take advantage of the current "tax loss season".

CEO Lewis Black will answer investor questions live at the 9th International Investment Forum on December 5 at 16:00 CET. Click here to register free of charge.

Nordex versus JinkoSolar - Where are the technical resistances?

In the current environment, keeping a closer eye on the GreenTech stocks Nordex and JinkoSolar makes sense. Nordex recently disappointed slightly with its Q3 figures, while JinkoSolar was able to confirm its good fundamental trend. Nevertheless, both shares are down 20% and 32%, respectively, over the past 12 months. The reduced visibility with regard to government orders is a burden for investors, which is now increasingly becoming a disadvantage for the previously sought-after climate stocks.

The analysts at Deutsche Bank have slightly lowered their price target for Nordex to EUR 16 despite a buy recommendation, while Jefferies still believes the Hamburg-based company is worth EUR 17. For Jinko, on the Refinitiv Eikon platform, there are only eight interested analysts, but their ratings are consistently diverse. An average target price of EUR 46.70 is expected, representing a premium of 50% on the current share price. Nevertheless, the development of the Chinese solar panel manufacturer stands and falls with the willingness of Western governments to spend on climate change.

In purely technical terms, the next buy signal for Nordex lurks above the EUR 11 mark. Although JinkoSolar is growing at a fundamental rate of 15 to 20%, the chart only shows a real buying mood above the EUR 37 mark. **For those looking to reduce risk, combining reasonable amounts of both stocks and hoping for a new flood of spending from Berlin could be a strategy. However, without public subsidies, progress is likely to be bumpy.

Strategic metals form the foundation for the implementation of the climate transition. However, Russia and China remain the largest suppliers. Western industrialized nations are therefore called upon to establish alternative procurement channels. Almonty Industries is only a few weeks away from starting production. Once the mine is up and running, Siemens Energy, Nordex and JinkoSolar will likely be lining up for a tungsten supply from a secure jurisdiction.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.