January 8th, 2024 | 07:00 CET

Start of the year with GreenTech hype! Will BYD, Klimat X Developments, Plug Power and Freyr Battery deliver now?

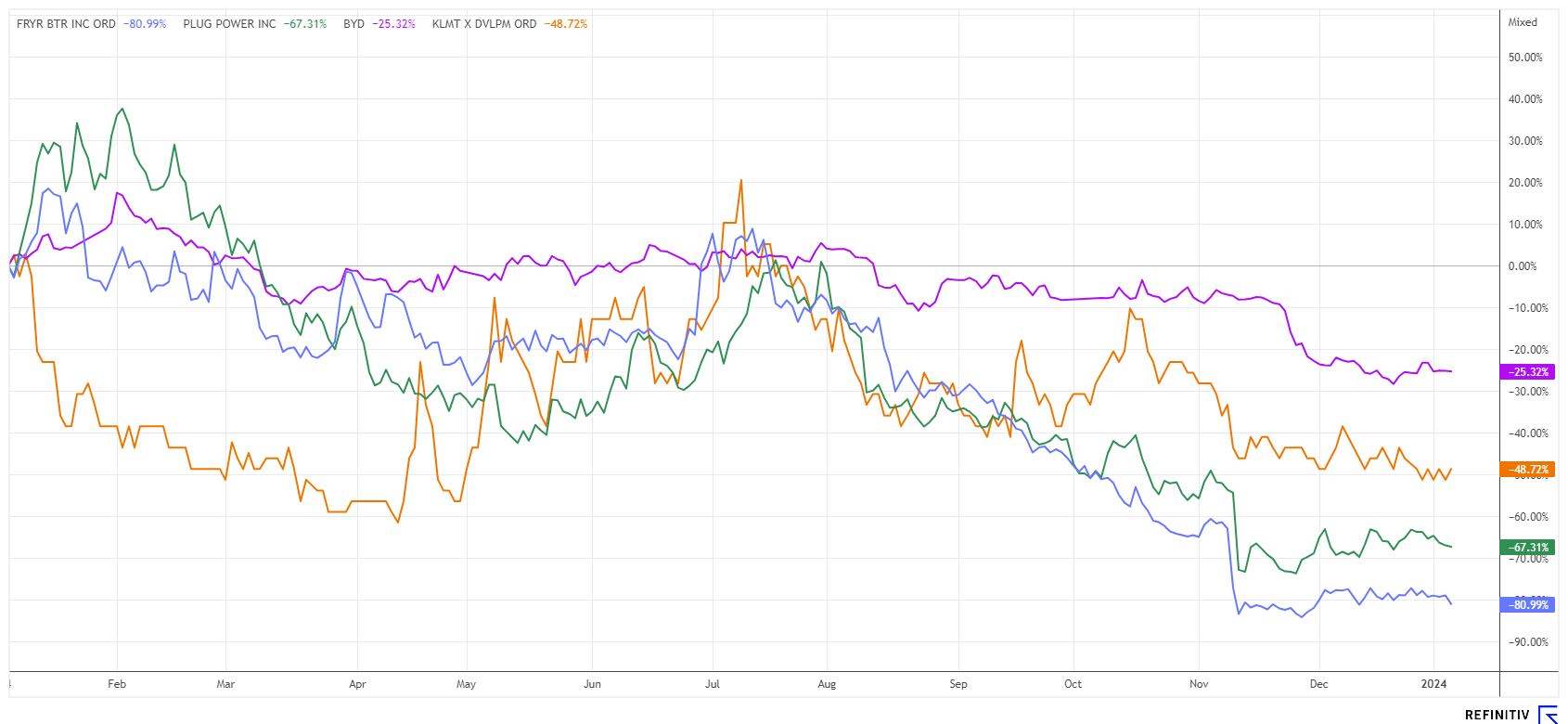

The year 2024 will be the next test for GreenTech shares. In the past investment year, despite bullish markets, they were the biggest losers in the portfolio. Plug Power and Freyr Battery incurred the most significant negative returns, ranging from 70 to 80%, but BYD and Klimat X also saw a slight decline. However, with the resolutions passed in Dubai and new government climate protection programs, things could pick up again in the new year. But who can win the coveted government contracts? We analyze the opportunities and risks.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BYD CO. LTD H YC 1 | CNE100000296 , KLIMAT X DEVELOPMENTS INC | CA49863L1067 , PLUG POWER INC. DL-_01 | US72919P2020 , Freyr Battery | LU2360697374

Table of contents:

"[...] We know exactly what we are doing and are implementing what we consider to be a proven technology in an industrially applicable and scalable way. [...]" Uwe Ahrens, Director, Altech Advanced Materials AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BYD - Record figures at the start of the year

Build Your Dreams (BYD) has long been a core investment of Berkshire Hathaway Holding, led by star investor Warren Buffett. Even though the stake was reduced somewhat in 2022 and 2023, the Omaha-based stock market legend still owns a sizeable stake. When looking back over time, investors learn the significance of "long-term". With an initial investment of USD 250 million in 2008, the fund earned an impressive USD 7 billion by 2023, increasing the investment by nearly thirtyfold.

The Chinese conglomerate announced at the beginning of the year that it had produced over 3 million vehicles with alternative drive systems in 2023. Tesla, on the other hand, reported an output of 1.84 million purely electric vehicles. This puts BYD ahead in the overall view, but Tesla remains the global market leader on the e-stage. Although BYD has exceeded the 3 million mark, annual sales still fell slightly short of analysts' expectations of 3.05 million vehicles. This means that the figure for the last 12 months was only just able to hold its own at minus 4%. However, with a market capitalization of EUR 71 billion, BYD impressively overtook VW, Europe's largest car manufacturer, last year. After all kinds of problems in e-mobility, the Wolfsburg-based company now only has a market capitalization of EUR 56 billion.

At a current BYD share price of EUR 24.50, the P/E ratio for 2024 is 18.5. Sales are growing very steadily at around 13 to 17% per annum. This means BYD remains among the fastest-growing vehicle stocks on the share price list. If the economy performs reasonably well in 2024, the Chinese market leader will likely be able to surprise positively. Collect below EUR 25 with a stop at EUR 22.50.

Klimat X Developments - Step by step reduction of CO2

One thing must be said: Climate protection does not happen through days of debate and final lip service from over 200 participating states. After all, the COP28 event in Dubai alone likely caused as much harmful greenhouse gas as the entire EU could avoid in one quarter with all its efforts due to the enormous energy expenditure for cooling, security and transportation for thousands of participants. Nevertheless, such conferences are necessary to unite the international community on the common "climate denominator".

In Africa, there are commendable examples of how privately organized eco-management of forest, land and sea areas can lead to positive effects. The industrial consumption of rainforests and mangroves has led to a sharp decline in unused land in African urban areas. The Canadian company Klimat X Developments is counteracting these trends by renaturalizing compensation areas made available for a fee by local landowners. By offsetting these carbon credits, tradable certificates can be created that enable industrial companies to initiate a medium-term reduction in pollutants. This process takes time, as the change in industrial processes towards a "green circular economy" spans many years and involves vast sums of investment.

As an industry partner and provider of "pollution rights", Klimat X has already initiated the first projects in Sierra Leone, Ghana, Suriname and Mexico and has also been able to secure strong financing partners. In Sierra Leone, BP Carbon Trading Ltd, a subsidiary of the British Petroleum Group, is providing USD 2.5 million for reforestation. The validation of these projects is being carried out by the world-renowned VERRA Institute. A positive decision is expected by mid-2024. However, Klimat X has much more in the pipeline. Over 50,000 hectares of rainforest are to be restored in the medium term, which, according to current validations, will deliver more than 35 million tons of carbon credits.

According to the Boston Consulting Group, the market is expected to increase eightfold by 2030 due to the surge in demand for emission rights. A perfect breeding ground for the still-small Klimat X Development share. It suffered somewhat from the general reluctance to invest in 2023 but was able to attract a great deal of interest again in the first week of trading. The still low market capitalization of around CAD 10 million should reward risk-conscious investors with medium-term price increases.

Plug Power and Freyr Battery - Is the valley of tears now over?

Plug Power and Freyr Battery painted the 2023 statements of their followers deep red. The crisis sentiment could hardly be greater at present. On the Refinitiv Eikon platform, only 10 out of 29 analysts still dare to issue a "Buy" recommendation. However, the 12-month average price target of USD 14.76 seems quite ambitious, as it is currently almost 250% higher than last Friday's price of USD 4.27. A glimmer of hope: after various profit warnings and a share price loss of over 70%, the dazzling CEO Andy Marsh has announced that the Company will be in the black in 2026. But beware: Of the nearly USD 700 million in cash reserves as of September 30, 2023, only USD 110 million remains. **If the burn rate remains constant at USD 250 million to USD 350 million per quarter, the accounts would have been under considerable pressure since November. A highly dilutive capital increase at the start of the year is, therefore, to be expected. Keep watching!

The book reads similarly for Freyr Battery, with heavy losses of 80% in the share price and a balance sheet that has been weak for quarters. With a current burn rate of EUR 50 million per quarter, the cash position will last until 2025, but additional funds are needed for larger investments, such as the construction of the battery plant in Mo I Rana, Norway. Experts estimate that the first profit can be achieved in 2028 - assuming that the projects now fit into the sales and distribution landscape for energy storage and e-mobility from the first launch in 2026.

Tom Jensen, co-founder and CEO of the Company, emphasizes that a real energy transition in renewable batteries can only be achieved by developing a highly efficient storage system. That is because the irregular electricity supply must be stored and, if necessary, rereleased at night or when there is no wind. The industry still needs a few more years of development work here. Critical investors may well doubt whether the Norwegians have what it takes to survive in this market, with a price increase of ten percent since mid-2022. Caution: A significant capital increase is also to be expected here.

Closing one's eyes and pushing through is of little help with GreenTech shares as they rely on public investment programs. When these programs materialize, the order situation is good, otherwise not, because private interest is rarely seen in this deficit-prone investment market. While Plug Power and Freyr Battery once again need fresh money, BYD can easily fund its growth programs from its cash flow. The small Canadian company Klimat X Developments has landed a major partner in BP. This example could serve as a blueprint for the next major projects.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.