February 23rd, 2024 | 07:00 CET

Will GreenTech soon be back in vogue? Nel ASA, Klimat X, Nordex, and Plug Power are under analyst scrutiny!

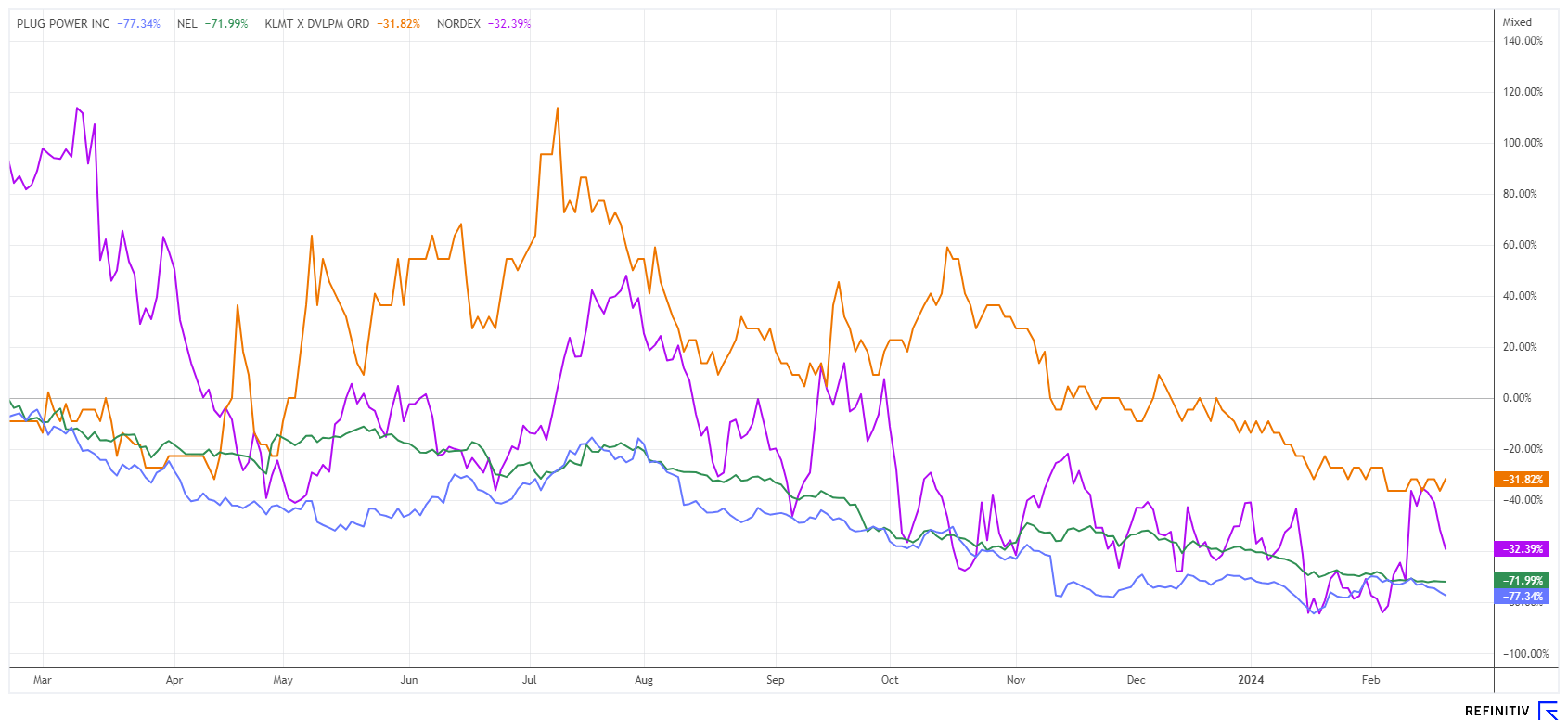

Despite new record highs in global stock markets, the GreenTech sector has yet to show any gains. The hydrogen sector, in particular, which was hyped in 2020/21, has been struggling for the past three years. With share price losses of 70 to 90%, investors are hopeful that a bottom could be reached in the foreseeable future. We analyze whether this could already be the case and present an alternative in the form of Klimat X. Business is running smoothly here, and the CO2 savings are even certified.

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , KLIMAT X DEVELOPMENTS INC | CA49863L1067 , NORDEX SE O.N. | DE000A0D6554 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] The VERRA certification adds credibility to dynaCERT's emission reduction technologies by demonstrating compliance with internationally recognized standards for carbon emissions reductions and sustainable development. [...]" Jim Payne, CEO, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA - When will the Norwegians show strength again?

Nel ASA is currently unable to break away from its negative trend. Losing almost 72% in the last 12 months, it continues to lead the list of losers alongside industry leader Plug Power. The pressure on the share is accompanied by high trading volumes, with institutional investors selling off their holdings. Many investors bought the share at significantly higher prices during the hydrogen hype of 2020/21; with a current value of EUR 0.42, the share is only 3% above its yearly low.

Analysts, including the Swiss investment bank UBS, are currently very critical of the sector. In a recent study on hydrogen, the Nel ASA share was also examined more closely for the first time. In his summary, expert Christopher Leonard arrives at an initial "Sell" rating with a 12-month price target of NOK 3.70 or the equivalent of EUR 0.32. This is almost 25% below the current level. Leonard believes that Nel's technology is lagging behind the competition and that it is not very competitive in terms of price. On the Refinitiv Eikon platform, only 5 out of 26 experts recommend the share as a "Buy". However, the average share price expectation is still relatively high at NOK 7.24, but it was around NOK 18.50 a year ago.

For 2024, analysts expect sales of around NOK 2.2 billion, which still puts the price/sales ratio at 3. It remains to be seen whether Nel can surprise positively in 2024. The Norwegians will report on the past year on February 28, and there will likely be an outlook. This could once again influence the title!

Klimat X Developments - Next CO2 deal in Mexico

The implementation of CO2-neutral projects is the basis for sustainable resource savings. Unfortunately, even at the recent COP 28 Climate Conference in Dubai, it was evident that mere lip service about future savings predominated. A great deal of investment is needed to implement climate models successfully, and the Canadian company Klimat X demonstrates how projects can be successfully implemented with support from well-established industry donors.

Klimat X started in Africa, where industrialization is still in its infancy. Here, it is possible to avoid the ecological mistakes of Western countries at an early stage. The Company is concerned with the management of forest, land, and sea areas in order to counteract the industrial consumption of virgin forests and mangroves. The idea is as simple as it is successful: so-called compensation areas are renaturalized, which are made available by local landowners for a fee, and credits in emission certificates for these measures are received, which in turn can be purchased by investors. The interest of multinational corporations is great, as they need assets in their environmental balance sheet.

So far, highly active in Africa, Klimat X can now announce a deal in Mexico. A binding letter of intent has been signed with partner Imperative Global Projects Pte. Ltd. for the joint development of a large-scale mangrove restoration project in the Mexican state of Yucatan. The project area covers almost 100,000 hectares of both intact and damaged mangroves, providing the opportunity to restore up to 40,000 hectares through a combination of hydrological reactivation of tidal currents and large-scale replanting of native mangrove species. Once completed, more than 10 million tons of carbon credits can be generated over 30 years. The project will be conducted according to Verra standards.

On the CIX exchange in Singapore, top prices of over USD 30 per tonne are being quoted for mangrove projects, and the experts at Trove Research also report that prices of over USD 20 can be expected for nature-based restoration projects in 2024. According to the Boston Consulting Group, the market is expected to grow eightfold by 2030 due to the surge in demand. Klimat X's shares should receive a significant tailwind, as the Company is valued at just CAD 7 million, which is only a fraction of the expected compensation revenues.

Plug Power and Nordex - Close to historic lows

Plug Power and Nordex are also still in the valley of tears. Plug Power's CEO Andy Marsh would like to see more government interest, as private investors are unlikely to jump on board until public investment sentiment truly shifts toward hydrogen. However, despite many announcements, this shift is only homeopathically visible; nobody knows today whether the alternative energy technology "green hydrogen" can ever be made available at reasonable prices and thus be widely deployed. The Berlin traffic light coalition is cleverly practising green verbal erotica on the topic of H2 but cannot provide any conclusive evidence for its efficient industrial use. Without technical proof of these futuristic ideas, it seems unlikely to materialize.

The next example of Berlin's failed climate policy could be wind power. Here, too, the use of resources up to the commissioning of the turbines is so high that the finished wind turbine has to run at full load for 8.5 years before the costs can be offset sustainably. It is a well-known fact that, due to a lack of wind, wind turbines in Germany are only utilized on average 42%, meaning the revenue from the sale of green electricity makes it difficult for wind turbines to turn a profit within their 20-year operating period without subsidies. Due to the necessary "eco-surcharges", however, the price of electricity in Germany has doubled in the last 5 years, thus endangering the local industrial location in the long term. The Nordex share reflects this misery, with a 53% drop in the share price over the last 3 years. Although the wind turbine manufacturer's order books have recently been well filled, the margin is falling steadily due to rising costs. Nordex is unlikely to become a truly profitable company in the foreseeable future, making a debt ratio of over 80% potentially dangerous.

GreenTech shares remain under pressure. The large, well-known standard stocks such as Nel ASA and Plug Power are strongly affected by the downward trend. Nordex disappointed with weak margin development and fell below the critical support level of EUR 10 again. For the second-line stock Klimat-X, it is time for a sustained upward move, as the Company is delivering consistently.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.