July 22nd, 2024 | 07:00 CEST

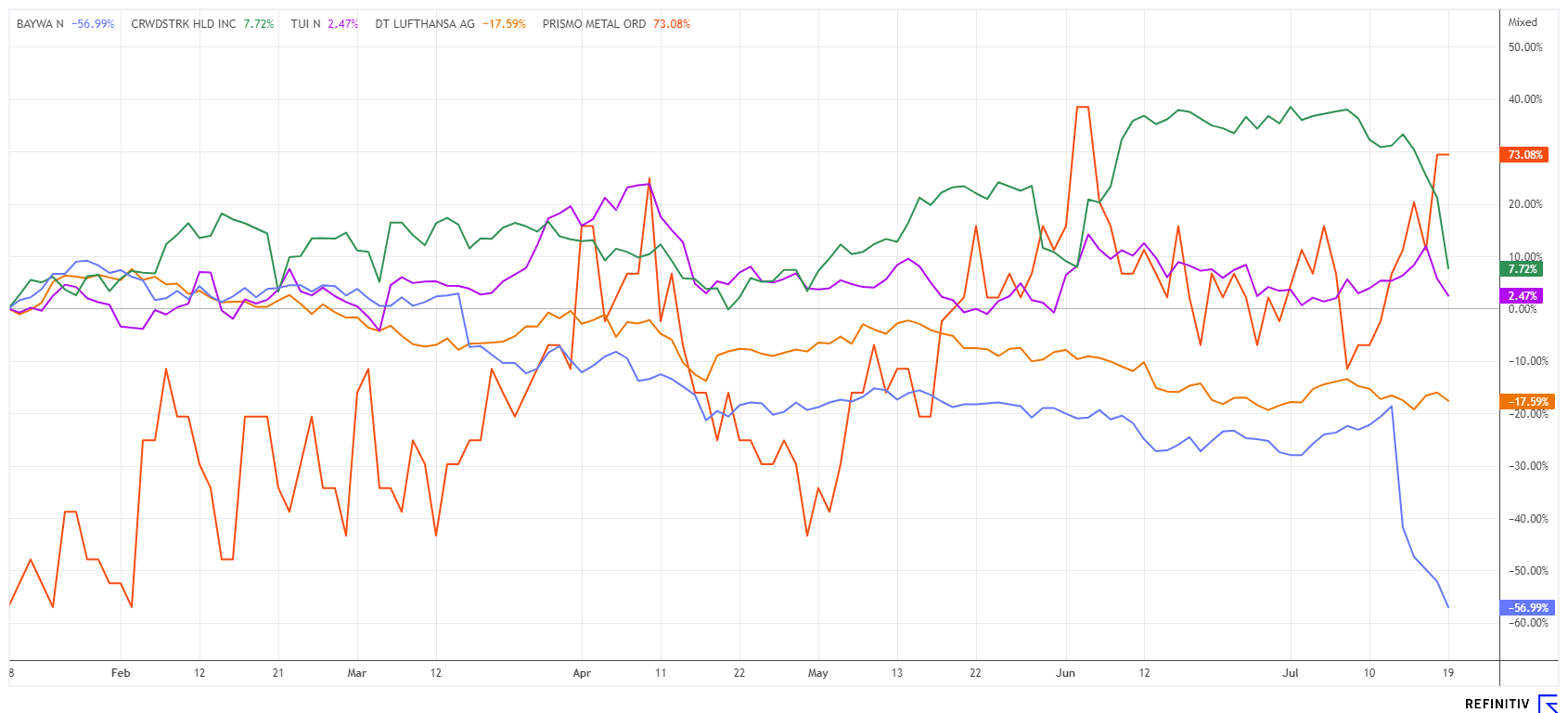

Despite the super disaster with CrowdStrike, 100% returns are possible with TUI, Lufthansa, Prismo Metals and BayWa!

The CrowdStrike outage shows us just how dependent the world has become on multinational corporations from America. Within hours, everything came to a standstill - nothing worked at airports, supermarkets, and banks, and some hospitals had to postpone operations. Does this make those responsible think about what urgently needs to be changed? In addition to a completely dependent situation in the IT sector, Europe, in particular, is in a pretty poor state regarding raw materials. Chancellor Scholz is looking for resources in Serbia, a country that would like to join the EU but is closer to the aggressor Vladimir Putin. Can Brussels overlook such facts and transfer billions more to Ukraine at the same time? Europe's needs are obviously manifold, and the most urgent need is likely to master the energy transition to prevent industry migration to more favourable jurisdictions. Investors are currently facing enormous challenges. We provide some ideas for a 100% portfolio.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

CROWDSTRIKE HLD. DL-_0005 | US22788C1053 , TUI AG NA O.N. | DE000TUAG505 , LUFTHANSA AG VNA O.N. | DE0008232125 , PRISMO METALS INC | CA74275P1071 , BAYWA AG NA O.N. | DE0005194005

Table of contents:

"[...] China's dominance is one of the reasons why we are so heavily involved in the tungsten market. Here, around 85% of production is in Chinese hands. [...]" Dr. Thomas Gutschlag, CEO, Deutsche Rohstoff AG

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BayWa - This does not look good

Almost 70% loss in 12 months and then the shock: The heavily indebted SDAX-listed company BayWa has brought in a restructuring expert to examine its strained financial situation. The Munich-based agriculture and energy trader employs around 24,000 people, and CEO Marcus Pöllinger is optimistic that the precarious situation can be resolved in the long term. However, with a debt of over EUR 5 billion, this is no easy task, as the market capitalization has fallen to around EUR 430 million. The recent rise in interest rates has made financing the billions in loans immensely more expensive, with the threat of over-indebtedness looming. The Company did not initially disclose who the expert is and when the first measures will be available.

BayWa AG celebrated its 100th birthday last year and ended the anniversary year with a net loss of EUR 93 million. In the first quarter, BayWa slipped even deeper into the red with a loss of EUR 108 million. At the end of March, the Company had accumulated non-current and current liabilities of almost EUR 5.6 billion. At the Annual General Meeting in June, CEO Pöllinger announced socially responsible job cuts and the sale of non-essential business areas. Most of this debt was built up by Klaus Josef Lutz, who left the Company in 2023 and transformed BayWa into a conglomerate, expanded globally and, above all, built up the renewable energy business as a second pillar of the Company. One sip too many from the bottle. Now, it is time for a brutal reorganization. Let's see how this unfolds. Wait and see!

Prismo Metals - Copper from Arizona is just the beginning

The Canadian exploration company Prismo Metals is heading in the opposite direction. The share price has risen by an astonishing 70% in the last 6 months. The reason is as short as it is obvious. In addition to gold and silver projects in Mexico, the junior also owns a property called "Hot Breccia" in resource-rich Arizona. The property consists of 1,420 hectares with a total of 227 contiguous mining claims located in the world-class copper belt between the well-known Morenci, Pinto Valley, Ray and Resolution copper mines. Hot Breccia shares many similarities with these neighbouring systems, most notably a swarm of porphyry veins and a series of breccia pipes containing numerous fragments of well-copper mineralized rock.

Prismo conducted an airborne electromagnetic (ZTEM) survey last year that identified a very large conductive anomaly. Additional sampling on the project has shown the presence of copper mineralization associated with polymictic breccia that has brought fragments of sedimentary rock and mineralization to surface from a depth of probably 400 to 1,000 metres. Ten days ago, Prismo Metals received approval from the Bureau of Land Management (BLM) for 10 drill pads at Hot Breccia. So we are ready to go!

According to Wood Mackenzie, annual primary copper demand will increase by 30% to around 25 million tons by 2030, and ore is already in short supply. The expansion of renewable energies, artificial intelligence, and e-mobility requires significantly more copper worldwide than previously estimated, and there are currently no significant new mine openings. The construction of a copper mine takes up to 10 years and costs billions. This is why properties such as Prismo Metals are in focus, as the energy supply, processing facilities, and infrastructure are already available for use by neighbouring mines. A major company seeking new mineral deposits for the necessary expansion is currently paying only CAD 11.7 million for the outstanding 53.3 million shares. A drop in the bucket - the next copper rally will likely further boost the Prismo share price.

TUI and Lufthansa - Still struggling

The two tourism giants, TUI and Lufthansa, are still under pressure. While the Hanover-based TUI is issuing a new convertible bond worth EUR 487 million, they are simultaneously buying back EUR 472 million of old shares maturing in 2028. The offer represents the final step in refinancing the credit line received from the state development bank KfW, which is to be reduced from the current EUR 550 million to around EUR 210 million. The remaining amount of the COVID-19 aid is expected to be repaid by the travel company in the first half of the calendar year 2025. With this step, TUI is extending the maturity profile of its debt and significantly reducing its interest costs. The newly issued 1.95% bonds mature in 2031 and can be converted at EUR 9.60. A smart move in the ongoing restructuring, yet the stock market acknowledged the action with a 10% loss in just 48 hours.

Lufthansa is still struggling. The system shutdown led to considerable delays on Friday, but the share price was nevertheless able to bounce back from its Wednesday low of EUR 5.58 to EUR 5.76. The Swiss investment bank UBS confirmed its "Buy" rating with a target price of EUR 12.3. The experts on the Refinitiv Eikon platform are not quite as optimistic. They expect an average 12-month share price of a low EUR 6.80. Both TUI and Lufthansa need a little more air under their wings. Nevertheless, in better times, prices 50% higher could certainly be seen again. Stand ready!

Copper, in particular, has become very important for the energy transition, and Prismo Metals is a supplier in the pipeline. CrowdStrike will have to do a lot of good to iron out last week's mistakes. TUI, Lufthansa, and BayWa need to quickly revamp their business models to be able to take off again.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.