PFIZER INC. DL-_05

Commented by Armin Schulz on February 17th, 2026 | 08:10 CET

Cancer Research as a Growth Driver: How Bayer, Vidac Pharma, and Pfizer can enrich your portfolio

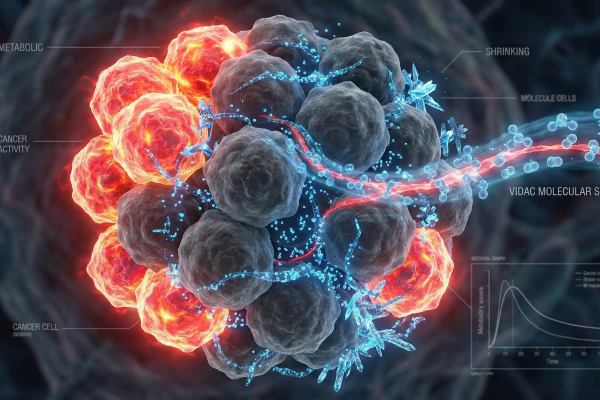

Oncology will be put to the test for the pharmaceutical industry in 2026. Never before have so many highly specialized active ingredients been on the verge of market launch at the same time. While checkpoint inhibitors and targeted therapies are revolutionizing treatment, business models are shifting from broad-based approaches to precision medicine. But the reality remains complex: between medical advances, narrow patient groups, and pressure on prices, companies need to readjust. Current developments at Bayer, Vidac Pharma, and Pfizer show how three players with different strategies are responding to this change.

ReadCommented by Nico Popp on January 14th, 2026 | 07:20 CET

Targeting cancer metabolism: Why Bayer and Pfizer are restructuring - and why Vidac Pharma is filling a scientific gap

The investment year 2026 marks a decisive turning point for the global biotechnology and pharmaceutical sector. After a period of macroeconomic uncertainty, we are witnessing a renaissance in the life sciences, driven by two fundamental forces: the urgent need for big pharma players to replace their expiring patents with innovation, and the scientific breakthrough of novel mechanisms of action in agile biotech small caps. While industry giants such as Pfizer and Bayer are attempting to steer their cumbersome tankers onto a new course through massive restructuring, the as-yet little-noticed biotech company Vidac Pharma is delivering the technological innovation the market is looking for. With an approach that directly addresses cancer metabolism and reverses the "Warburg effect," which has been known for almost a century, Vidac is positioning itself as a disruptive force in oncology and dermatology. For investors, this constellation offers a rare opportunity: to observe the stability of the giants while betting on the explosive potential of a technological innovator that analysts say is massively undervalued.

ReadCommented by Armin Schulz on January 8th, 2026 | 07:05 CET

How to benefit from the healthcare industry's comeback in 2026: Novo Nordisk, Vidac Pharma, and Pfizer in focus

After a disappointing year for investors in the pharmaceutical and biotech industries, the tide is now turning decisively on the stock market for these stocks. Political clarity, a return to major acquisitions, and groundbreaking clinical data are laying the foundation for a sustainable comeback. This new optimism is opening up concrete opportunities for strategic investments. Three companies exemplify these promising drivers: Novo Nordisk, Vidac Pharma, and Pfizer.

ReadCommented by Carsten Mainitz on December 23rd, 2025 | 08:45 CET

USD 600 billion market potential – Pfizer and Bayer are in the race, Vidac Pharma in the fast lane?

The market for cancer drugs is the largest segment within the pharmaceutical industry and currently has a volume of over USD 200 billion. According to experts, the market will already be worth USD 500 to 600 billion by 2032 or 2033. Companies such as Pfizer and Bayer are among the industry leaders. As is often the case, however, there are promising stocks from the second and third tiers beyond the blue chips. One such company is Vidac Pharma. The Company is pursuing a new, promising approach to skin cancer. Analysts attest to the shares' great potential.

ReadCommented by Nico Popp on December 9th, 2025 | 07:05 CET

Attacking the fuel that feeds tumors: Why Roche, Pfizer, and Vidac Pharma are redefining oncology

Modern cancer therapy is no longer about blunt-force attacks, but rather precise, targeted interventions. While oncology in recent decades has been dominated by non-specific cell toxins, today's research resembles surgical intervention in the biological software of a disease. Industry heavyweights, Roche and Pfizer, are securing their market positions with gigantic portfolios of immunotherapies. But away from the corporate headquarters of Basel and New York, agile biotech pioneers are working on approaches that attack the very foundation of cancer cells: their energy supply. Those who pull the plug on cancer cells could be among the big winners in the biotech sector in 2026.

ReadCommented by Fabian Lorenz on November 7th, 2025 | 07:00 CET

Takeover battle between Novo Nordisk and Pfizer! Is BioNxt Solutions the next target?

Who will acquire Metsera? That is currently the subject of dispute between Novo Nordisk and Pfizer. Both pharma giants are seeking access to a new generation of metabolic therapies through the acquisition - treatments that have the potential to transform the billion-dollar market for obesity and diabetes care. Novo Nordisk views Metsera's drug pipeline as a complement to its GLP-1-based preparations, while Pfizer is trying to finally gain a foothold in the market after several setbacks. The takeover battle illustrates that big pharma companies are willing to dig deep into their pockets for innovations. This makes BioNxt Solutions a potential takeover candidate. The Company is not only working on innovations in the field of multiple sclerosis and obesity, but on an entire platform technology.

ReadCommented by Armin Schulz on October 20th, 2025 | 07:05 CEST

Why this structural change in medicine makes Novo Nordisk, PanGenomic Health, and Pfizer must-haves

The medicine of tomorrow does not think in terms of diseases but in terms of opportunities. A radical shift from repair to proactive prevention is revolutionizing the healthcare sector and opening up massive areas of growth. The focus is on personalized, data-driven solutions that improve quality of life and combat widespread diseases costing billions. This structural transformation is creating clear winners, led by pioneers who have mastered the new logic of the healthcare market. Three companies that embody this trend and make it tangible for investors are Novo Nordisk, PanGenomic Health, and Pfizer.

ReadCommented by Fabian Lorenz on October 17th, 2025 | 07:15 CEST

Acquisition of Vidac Pharma and Evotec? USD 400 billion at stake for Pfizer, Merck & Co!

Alarm bells are ringing in Big Pharma! Donald Trump appears serious about reducing drug prices. At the same time, patents on blockbuster drugs are expiring, threatening a USD 400 billion revenue shortfall. Pfizer, Merck, and Co. must refill their pipelines. The acquisition merry-go-round is expected to spin even faster in the coming years. Among the potential takeover targets is Vidac Pharma. The Company is still attractively priced, but if its new approach to fighting cancer proves successful in early clinical trials, a multiplication could be possible. And what about Evotec? The Hamburg-based company has repeatedly been traded as a takeover candidate in recent years. However, data and patents are offset by internal problems.

ReadCommented by André Will-Laudien on October 2nd, 2025 | 07:25 CEST

AI fuels cancer research: Bayer, Vidac Pharma, and Pfizer are the next 150% winners

The stock market remains strong! In addition to the tech and defense boom, the biotech sector has also been catching up in recent days, with the latest news in cancer research bringing the industry back into the spotlight. The key factor here is artificial intelligence, which is revolutionizing cancer research through personalized therapy approaches based on the evaluation of extensive clinical and genetic data. AI models make it possible to predict individual cancer progression better and tailor therapies to individual patients. By analyzing multimodal data, AI systems can more accurately assess the risk of metastasis and thus develop targeted treatment strategies. AI has also improved tumor diagnostics by accurately detecting numerous types of cancer, therefore ensuring a more precise diagnosis.

ReadCommented by André Will-Laudien on September 29th, 2025 | 07:20 CEST

Attention: Acquisitions! Biotechs like Evotec, PanGenomic Health, Pfizer, and BioNTech in focus

The biotech industry is in turmoil! With the expiration of blockbuster patents, there is a threat of sharp declines in revenue, which must be strategically compensated for. Driven by economic pressure and a growing focus on innovation and technology, the industry is increasingly turning to acquisitions of biotech companies with promising drug candidates, new technologies, and digital expertise. Not only are entire pipelines being acquired, but key players from the fastest-growing segments are also being targeted, particularly in the field of obesity therapies, where billions are being paid for drug candidates. Several examples illustrate this wave of transformation. Companies are restructuring, focusing their activities, and rapidly preparing for a phase of sustainable growth. The pace is picking up! Here are some promising investment ideas!

Read