February 16th, 2024 | 07:00 CET

MorphoSys and Cardiol Therapeutics in upward mode, while Bayer and Pfizer are in slow mode

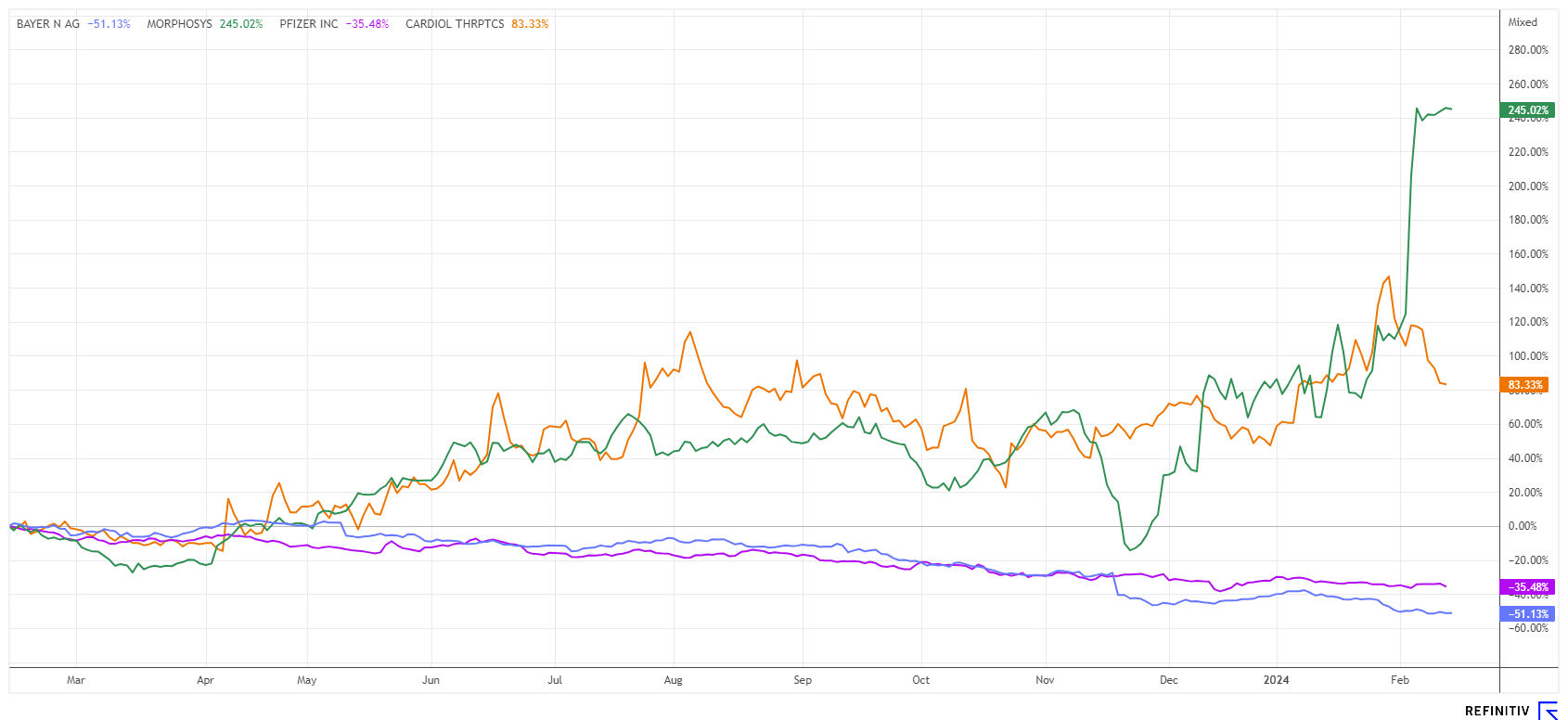

The biotech sector has made a very differentiated start to the new year. While the old favorites are barely moving, the second-line stocks MorphoSys and Cardiol Therapeutics are making a real splash. At Bayer, the bad news just won't go away, and despite a successful major takeover, Pfizer has not yet found its forward gear. After a rally of almost 15% in December, the Nasdaq Biotechnology Index (NBI) has taken a pause in the current year. Now, everyone is waiting for the first interest rate cut by central banks. Inflation is already falling, and the negative economic data for the Eurozone is increasing. The ECB would normally be in demand. What should investors urgently keep an eye on?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

MORPHOSYS AG O.N. | DE0006632003 , CARDIOL THERAPEUTICS | CA14161Y2006 , BAYER AG NA O.N. | DE000BAY0017 , PFIZER INC. DL-_05 | US7170811035

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

MorphoSys - Long ups and downs and then swallowed

The anomalies in the share price of the Munich-based biotech specialist MorphoSys in recent weeks are now being confirmed: The pharmaceutical giant Novartis wants to gain access to pelabresib, the greatest hope of the Martinsried-based company, through a takeover. However, the deal is not yet 100% certain, as insider activity remains high.

"We are excited about the opportunity to bring pelabresib, a potential next-generation treatment in combination with ruxolitinib, to people with myelofibrosis, a rare and debilitating form of blood cancer," said Shreeram Aradhye, MD, Chief Medical Officer of Novartis.

Whether the EUR 2.7 billion purchase price offered is the final word remains speculative. MorphoSys has recently been the focus of hedge funds, which have now had to close their short positions at a high price. If the approval rate of the shareholders does not reach the required 65%, a takeover battle may start. Otherwise, another popular German biotech company may disappear from the listings of the German stock exchange. The EUR 68 per share on offer is less than half of the EUR 152.50 that the share price reached in December 2019, three months after CEO Jean-Paul Kress took office. It is not a good end to his tenure, yet he recommends accepting the Swiss offer. Those who, against all warnings, bought the shares in December 2023 at a low price of less than EUR 17 will be rejoicing. A dream return of over 240% in less than 3 months.

Cardiol Therapeutics - FDA sends positive signals

Almost forgotten again, but now the coronavirus is back! This also revives the share price fantasies of the companies that have made the most progress in their developments to combat important side effects of COVID infection. Cardiol Therapeutics Inc. has developed a promising drug candidate called CardiolRx™ in recent years. The pharmaceutically manufactured, oral solution formulation is now the talk of the town again, as CardiolRx™ blocks the activation of the inflammasome signaling pathway. Yesterday, good news came from the US Food and Drug Administration (FDA). Cardiol received Orphan Drug Designation (ODD) for the treatment of pericarditis, including recurrent pericarditis. CardiolRx™ is currently in Phase II clinical trials for recurrent pericarditis and acute myocarditis.

"The FDA's decision was based on preclinical data in conjunction with initial clinical data from the Company's Phase II MAvERIC Pilot study," commented Dr. Andrew Hamer, Chief Medical Officer and Head of Research and Development at Cardiol Therapeutics. "This designation underscores the potential of CardiolRx™ to improve the lives of patients suffering from recurrent pericarditis, a debilitating heart disease associated with symptoms that interfere with quality of life and physical activity."

FDA grants ODD to a drug or biological product for the prevention, diagnosis, or treatment of a rare disease or condition affecting fewer than 200,000 people in the United States. ODD offers major benefits, including a potential seven years of market exclusivity, exemptions from certain FDA fees, and tax credits for qualified clinical trials. Products with ODD may also qualify for expedited regulatory review through Fast Track, Breakthrough Therapy or Priority Review Designations.

On February 21 at 18:00 CET, David Elsley will present live at the 10th International Investment Forum to discuss these exciting developments. Click here to register.

The Cardiol share price has risen by almost 150% in the last 12 months. The stock has been in demand not least because it has no refinancing difficulties. With the ODD label, things can really take off in 2024, as the rapidly growing market can now be addressed even faster. Continue to buy at the higher level.

Bayer and Pfizer - The year got off to a disappointing start

Things are not looking so good for Leverkusen-based pharmaceutical giant Bayer. In addition to a renewed acceleration in the glyphosate issue, there are now also problems in the pharmaceuticals division. In fact, Bayer's woes are based on the USD 63 billion takeover of Monsanto and its toxic baggage. The responsible manager, Baumann, equipped with a golden parachute, has long since abandoned the sinking ship. Today, Bayer itself is "only" worth EUR 27.8 billion, not even half of the megadeal that was hoped for at the time. In 2015, the Leverkusen-based company was the most expensive share in the DAX 30 index at the time; since then, more than 160,000 lawsuits have been filed in the "glyphosate" case and over EUR 90 billion in market value has been destroyed.

The analyst consensus on Refinitiv Eikon still stands at EUR 47.9 billion for 2024 sales, and an operating profit of EUR 7.9 billion should be achievable. If the figures are halfway valid, Bayer shares are trading at EUR 28.2 with a P/E ratio of 4.9 and a remaining dividend hope of over 7%. US pharmaceutical giant Pfizer is also surprisingly cheap at the moment. After several quarterly disappointments, only 10 out of 25 analysts on the Refinitiv Eikon platform still recommend the share as a "Buy". The average 12-month price target is seen at USD 30.10, which is only just under 10% of the current level. With an estimated 2024 P/E ratio of 11.8, the valuation has reached a 5-year low, and the dividend payout is still over 6%. Bayer and Pfizer are worth a closer look at the current levels.

The biotech sector is a guarantee for major movements. These do not always go in the expected direction. If a drug is unsuccessful, a stock can quickly lose more than three-quarters of its value, but conversely, it can also rise dramatically in a positive scenario. In a balanced portfolio, it is the mix that lowers the risks. Cardiol Therapeutics continues to move in the right direction, while the rally for MorphoSys could now be coming to an end. Bayer and Pfizer remain interesting long-term investments as standard stocks.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.