November 7th, 2023 | 07:00 CET

Caution: New Corona wave ahead? BioNTech, Pfizer, Cardiol Therapeutics and MorphoSys on the performance test bench

Smouldering lawsuits from vaccinated patients experiencing severe side effects have caused investors to doubt BioNTech and Pfizer in recent months. Will the plaintiffs be successful in court? This is rather unlikely, as the vaccine manufacturers can always invoke the time component in the fight against the pandemic. After all, what the WHO and all governments wanted was delivered: A quick solution! Moreover, these vaccines were finally approved by well-known health institutes. The biotech investment segment will become exciting again as winter approaches. The infection figures with the new coronavirus variants are rising noticeably again, and around 15% of the population wishes to get vaccinated. Where are the opportunities for investors?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

PFIZER INC. DL-_05 | US7170811035 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , CARDIOL THERAPEUTICS | CA14161Y2006 , MORPHOSYS AG O.N. | DE0006632003

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BioNTech and Pfizer - Deliveries of the new vaccines are underway

Whether Omicron, Arcturus, Eris or Pirola - they are all proper names of the new coronavirus variants that the Robert Koch Institute continues to have actively on the radar. In October, the 7-day incidence was 17 COVID-19 cases per 100,000 inhabitants. Large sections of the population are not interested in this survey or anything to do with pandemics for the time being - they are waiting to see how things develop. That is because the masses have come to terms with the topic and do not want to have to think about new horror scenarios.

Of course, biotech companies are staying close to the action. As the "winners of the pandemic", they currently have billions in their bank accounts and are simply continuing to research and develop the familiar. On September 1, BioNTech and Pfizer received approval for their vaccine adapted to the coronavirus variant XBB.1.5. The subsequent variants are also covered by this vaccine. According to the Federal Ministry of Health, 11.7 million doses are already in stock at the central warehouse. So, business is already picking up again for the well-known protagonists.

A look at the shares of the vaccine manufacturers reveals the 52-week low of EUR 86.7 for BioNTech shares. Fundamentally, sales of around EUR 4.4 billion are expected for 2023, and the market capitalization of the debt-free company is EUR 21.4 billion, just above the cash level of EUR 17.7 billion. Pfizer's share price is also trading near its 5-year low, with a 2023 P/E ratio of 20 and a dividend yield of over 5%. The stock is historically cheap. The medium-term risk in both stocks is manageable.

Cardiol Therapeutics - The next buying wave ahead

Cardiol Therapeutics Inc. is a Canadian biotechnology company specializing in the research and clinical development of innovative therapies for the treatment of cardiovascular diseases. The Company's promising product candidate, CardiolRx™ (cannabidiol), is a pharmaceutically manufactured oral solution formulation developed specifically for use in heart disease.

Since the COVID-19 pandemic, the incidence of heart problems has skyrocketed. Cardiol Therapeutics is strategically moving in the right direction because the active ingredient formulation CardiolRx™ blocks the activation of the inflammasome signaling pathway, which is known to play a significant role in inflammation and fibrosis associated with myocarditis, pericarditis and heart failure.

Cardiol Therapeutics has now reported to have exceeded its 50% targeted patient enrollment for its Phase II open-label pilot study (MAvERIC-Pilot), investigating the safety, tolerability and efficacy of CardiolRx™ in patients with recurrent pericarditis. In addition to standard safety assessments, the study is designed to evaluate improvement in objective measures of this rare disease and, during an extension period, assess the feasibility of weaning concomitant background therapy, including corticosteroids, while taking CardiolRx™.

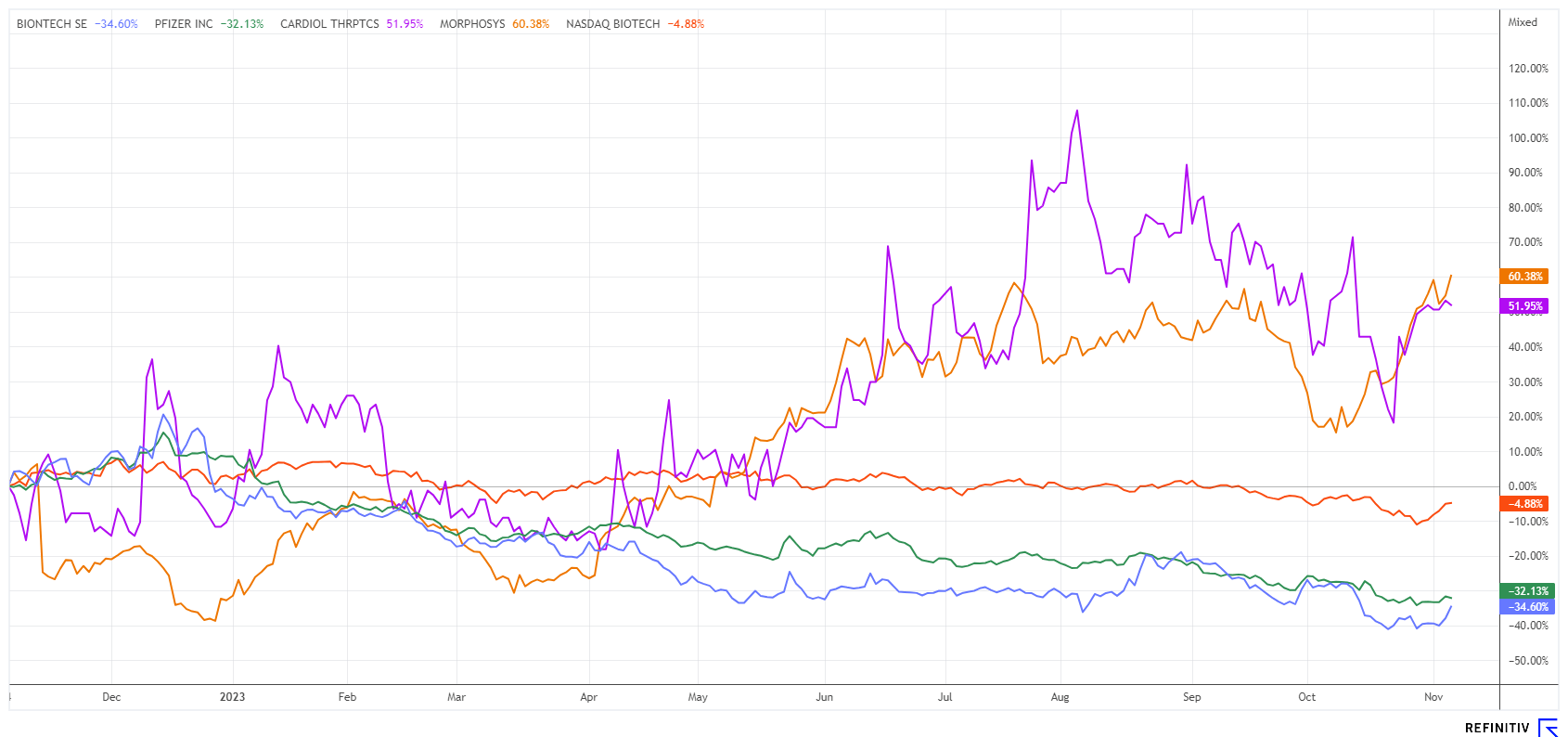

The performance of Cardiol's stock is quite enjoyable, with a 51% increase in just 12 months. While the Nasdaq Biotechnology Index is lagging with a good 5% gain, the Canadians can show a significant jump in performance. In addition, the Company still had CAD 44.9 million in cash as of June 30. A capital increase is, therefore, currently not necessary. The story continues!

MorphoSys - Cover, Cover, Cover

The short sellers of MorphoSys shares have probably made a real gamble. After the sell-off to EUR 12 in December 2022, the share price continued to head north in a volatile fashion. At its peak, 11.7% of the outstanding capital was sold short, a record figure for the German stock market landscape.

Now, however, the story is going the other way around, as MorphoSys is very much in the spotlight with its lead product, pelabresib. As the Munich-based company recently announced, detailed Phase III data from the MANIFEST-2 study of the myelofibrosis drug pelabresib will be presented in an oral presentation at the 65th annual meeting of the American Society of Hematology in San Diego on December 10. Initial results are expected to be released in the coming weeks leading up to the event, and groundbreaking results are anticipated.

The share is, therefore, red-hot and is rising upwards every day, causing short sellers to break out in a cold sweat. It has almost tripled from its low point, but the value began at EUR 127. So, the stock is being covered for all its worth. Yesterday, from a technical chart perspective, the EUR 30 mark was also breached, and the Q3 report is expected on November 15. Very speculative - but promising! Work with a stop-loss of around EUR 27.

The biotech sector is currently very indifferent. The high interest rates have pushed the industry index NBI down considerably. Only the companies that are performing well are able to rise at the moment. BioNTech and Pfizer are still on the sidelines from a technical perspective, while Cardiol Therapeutics and MorphoSys, in the view of momentum and trend investors, still hold the potential for further gains.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.