April 10th, 2024 | 06:45 CEST

Attention: Biotech takeovers, after MorphoSys, now Bayer, Vidac Pharma, BioNTech and Pfizer are on the radar

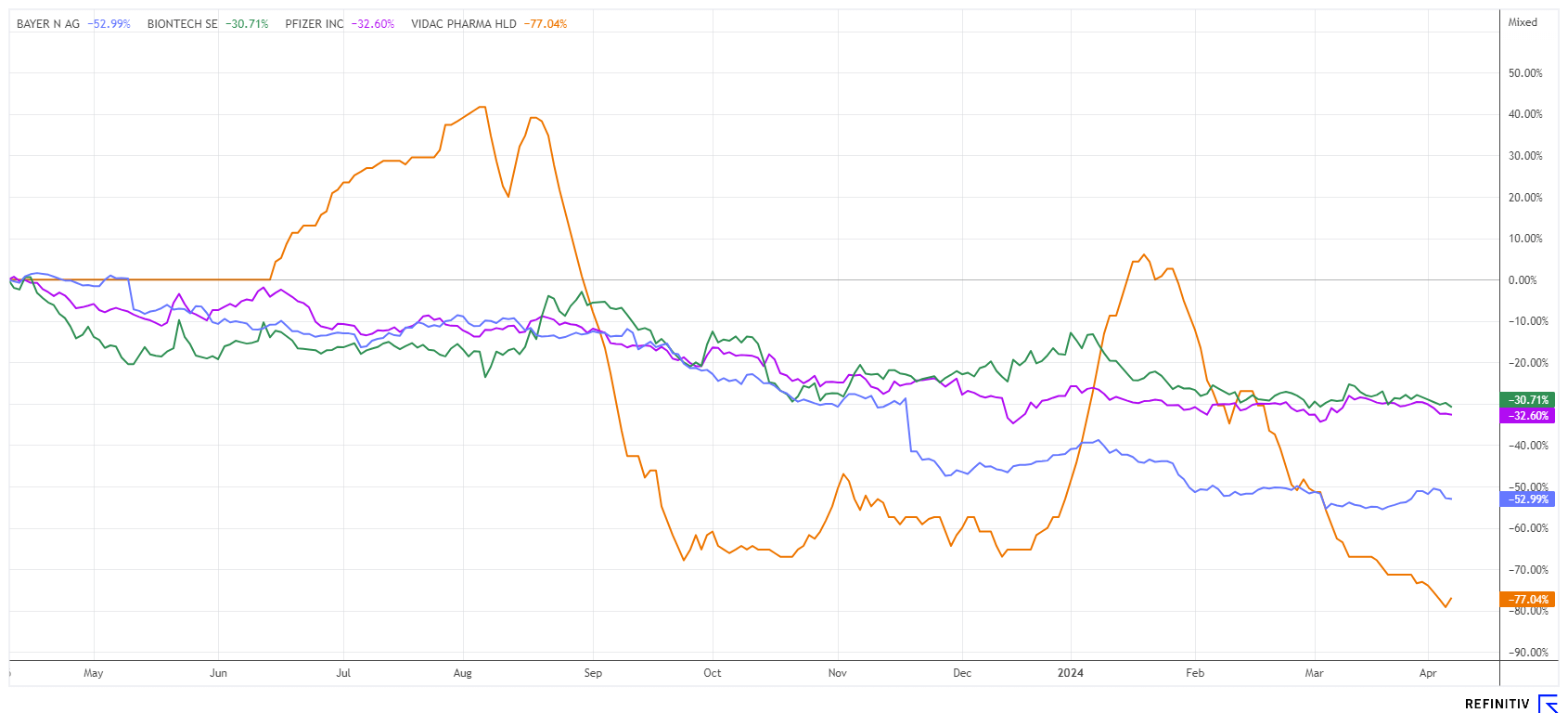

Since the onset of the COVID-19 pandemic, there has been little movement in the biotech sector. However, after a challenging year in 2023, the sector was at least able to start the new year on a solid footing. The surprising takeover of MorphoSys recently got hearts beating again, as Novartis put a whopping EUR 2.7 billion on the table for the cancer specialist from Munich. Only months before, MorphoSys had been traded on the stock exchange at just EUR 700 million. The special market situation in this case was also characterized by the high short ratio, which led to an exorbitant rise in the share price of almost 400% in the final phase. Speculative investors are now keeping a wary eye on potential takeover candidates as the sector is once again attracting considerable attention. We are taking a closer look and searching for the next pearl.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BAYER AG NA O.N. | DE000BAY0017 , VIDAC PHARMA HOLDING PLC | GB00BM9XQ619 , BIONTECH SE SPON. ADRS 1 | US09075V1026 , PFIZER INC. DL-_05 | US7170811035

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Bayer - Glyphosate and no end in sight

There are big question marks on the faces of Bayer analysts, who have had to constantly revise their share price targets downward for months. Most recently, there was a "shock lawsuit" in the US for USD 2 billion concerning glyphosate-related illnesses. At the beginning of the year, Bayer also had to report a decline in profits in the pharmaceuticals division, and most recently, the dividend of EUR 2.40, which was considered a certainty, was slashed to just 11 cents.

Investors are eagerly awaiting the approaching Annual General Meeting of the Leverkusen-based company on April 26. Before then, there may be some indications of how the first quarter really went. The current share price movement towards EUR 27, on the other hand, indicates trouble, as there has been another glyphosate ruling from the US. Bayer is now to pay only USD 611 million instead of USD 1.56 billion to three plaintiffs in the US. The plaintiffs were able to credibly demonstrate to the court that the glyphosate-based product RoundUp had caused cancer in them, and a jury in the US state of Missouri had already imposed a penalty payment of billions of dollars on the German company. Even though Bayer is appealing again, it seems that the wave of negative judgments has not yet reached its peak. Since the USD 62 billion Monsanto takeover in 2016, EUR 100 billion in market value has now been stamped out.

On the Refinitiv Eikon platform, only 4 out of 24 analysts now have the confidence to issue a "Buy" recommendation, while the 12-month price expectation has fallen from just under EUR 80 in mid-2023 to currently EUR 34.20. Whether there is a bottom at EUR 27 remains doubtful.

Vidac Pharma plc - Cancer treatment in the clinical phase

Vidac Pharma plc, based in the UK and Israel, has only cancer research in common with Bayer. Vidac is a clinical-stage biopharmaceutical company developing first-in-class oncology and oncodermatology therapies. Its breakthrough new technology, which corrects a common feature of all cancer cells, holds the promise of a fundamentally new approach to treating cancer and is becoming a routine part of oncology combination therapies. Founded in 2012, the Company is led by CEO Dr. Max Herzberg, one of the founding fathers of the Israeli biotech industry. Vidac Pharma develops drugs with the aim of reversing the abnormal metabolism of cancer cells and thus stopping the proliferation of cancer cells. The Company has a strong leadership team with decades of experience in science and management, supported by an international group of senior scientific advisors.

With a strong IP portfolio, Vidac's lead asset is undergoing clinical trials for two indications, while a powerful new drug candidate with a potential broad application in solid tumors is entering preclinical testing. Vidac's lead product VDA-1102, currently in clinical development as an ointment for patients with actinic keratosis, addresses an early form of skin cancer and is being tested in a separate study for a cutaneous T-cell lymphoma (CTCL) indication. A second molecule, VDA-1275, which could be used for a wide range of solid tumors, has already proven to be a powerful candidate in ongoing preclinical studies.

Vidac Pharma has been listed on the Hamburg and Stuttgart stock exchanges since mid-2023 and trades partially very liquid with over 100,000 shares a day. A recent company valuation put the enterprise value at a good EUR 80 million or EUR 1.15 per share. German coverage has now also been commissioned. It is expected that analysts will arrive at a similar conclusion, indicating a significant undervaluation. The promising share price is currently fluctuating between EUR 0.22 and EUR 0.35. Speculative investors should take a limited approach to benefit from the Company's promising pipeline in the medium term. The risk/reward ratio is good, as Big Pharma, in particular, is actively seeking successful clinical drug candidates.

BioNTech and Pfizer - The dip after the pandemic

Many investors are asking themselves why BioNTech and Pfizer are not budging at all. Both companies have a promising research pipeline and enough cash from the proceeds of the Corona pandemic. One possible explanation could be emerging lawsuits in connection with the controversial vaccinations, as these have not yet really come to the table. From an analytical perspective, it can be seen that after the strong sales growth in 2021 and 2022, there was a natural dip last year. This is weighing on the valuation and investor sentiment, which is now likely only preparing for significantly lower growth rates in 2024.

Only 50% of the experts on the Refinitiv Eikon platform are positive on BioNTech and give it a "Buy" recommendation with an average price expectation of EUR 106. As many as 10 analysts are warming to Pfizer shares, while 16 others remain on the sidelines for the time being. For those interested in turnaround opportunities, BioNTech offers a market capitalization of EUR 19.8 billion and a substantial cash position of EUR 17 billion. Pfizer is also analytically favorable, with a dividend of 6.8% on the current price of EUR 24.5 and a low 2024 P/E ratio of only 12.5. Both stocks seem to be exploring the lower end of their valuation range in the long term.

The biotech sector has faded into obscurity compared to artificial intelligence and defense. Valuations are still struggling with waning investor capital. Nevertheless, a positive, cyclical stock market phase could soon begin again for BioNTech, Bayer and Pfizer. Vidac Pharma has a promising pipeline and could become a speculative top pick through clinical trial successes.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.