January 2nd, 2024 | 07:10 CET

Returns beckon here: The Biotech favorites for 2024! BioNTech, Pfizer, Cardiol Therapeutics and MorphoSys in focus

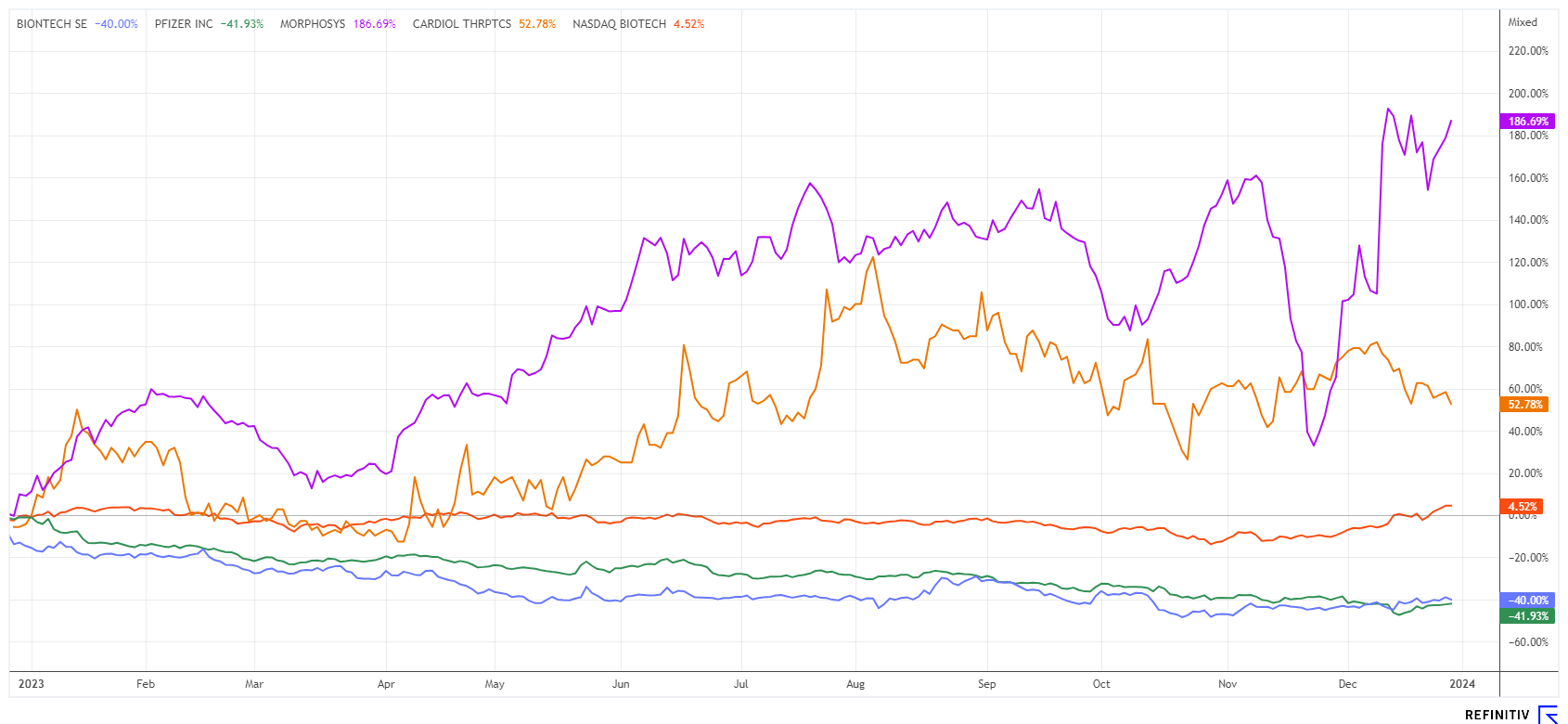

The past year was a disaster for investors in the Biotech sector - no golden check as often seen before. Despite all the gloom, the key indicator, the Nasdaq Biotechnology Index (NBI), has managed an annual gain of around 7% since the end of October, thanks to a fabulous 15% upswing. The index was temporarily down 12%. High capital costs made it difficult for research-based companies to refinance, and it is only now, with falling inflation rates, that interest rate hopes are reviving. The 10-year yield in the US fell by more than 100 basis points from 4.98% to 3.84% in a short space of time. Now, the industry senses a positive outlook again. At the end of the year, the positive environment helped some Biotech stocks shake off the negative trend and initiate a turnaround. Which stocks should we focus on?

time to read: 5 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , PFIZER INC. DL-_05 | US7170811035 , CARDIOL THERAPEUTICS | CA14161Y2006 , MORPHOSYS AG O.N. | DE0006632003

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

MorphoSys - Rollercoaster ride with new cancer hope

Anyone investing in MorphoSys requires nerves of steel because the cancer hope from Munich has rarely been as turbulent as it was in 2023. The reaction to the first trial results for pelabresib was akin to a sell-off, as critical comments from analysts rained down. The share price plummeted from EUR 32 to EUR 14.50 in the space of three days, with a huge turnover. Some experts were quick to dismiss the drug's effectiveness against the symptoms of myelofibrosis. Doubts quickly arose as to whether approval would be granted and whether the drug could subsequently succeed.

However, this assessment was completely revised by the opposite side, and with a smooth doubling in just 10 trading days, the sell-off low quickly became history again. Turnover soared, and now the market capitalization is back up to an astonishing EUR 1.22 billion. The presentation of the Phase III trial data on pelabresib at the ASH Annual Meeting has been successful after all. That is because when used in combination with the previous standard drug ruxolitinib, significant improvements were seen in all four disease characteristics of myelofibrosis. In this context, the reduction in spleen size is particularly important, which increases patients' chances of survival.

Investment analysts, above all from UBS and JPMorgan, quickly shifted their views and now believe that MorphoSys can obtain approval for pelabresib in the intermediate-risk patient group. According to the experts, there are now renewed hopes for future revenues in the billions. The adjusted price targets of UBS and JPM are currently EUR 31 and EUR 47, respectively, and further upgrades are to be expected. The MorphoSys share has tested the correction zone of EUR 12 to 15 twice and mastered the technical breakout at around EUR 25. Some short sellers are now getting cold feet because the short strategy could become really expensive if further surprises lurk in the new year. However, we will have to wait until March 13 for the annual figures; until then, things are likely to continue rodeo-style.

Cardiol Therapeutics - Into the new year with sufficient cash

Cardiol Therapeutics Inc. has developed a promising drug candidate called CardiolRx™. The pharmaceutically produced oral solution formulation has been the talk of the town since the coronavirus pandemic, as CardiolRx™ blocks the activation of the inflammasome signaling pathway. It plays an important role in inflammation and fibrosis associated with myocarditis, pericarditis and heart failure. With its innovative therapeutic methods for the treatment of cardiovascular diseases, Cardiol Therapeutics even made the leap to the Nasdaq in 2022.

Massachusetts General Hospital has now been accepted into the open-label Phase II MAvERIC-Pilot Study. The aim is to investigate the safety, tolerability and efficacy of CardiolRx™ in patients with recurrent pericarditis. In addition to standard safety assessments, the study will evaluate the improvement in objective measures of this rare condition and, during an extension period, the feasibility of discontinuing concomitant background therapy, including corticosteroids, while taking CardiolRx™ and freedom from pericarditis recurrence.

"*We are very pleased that the world-renowned Massachusetts General Hospital is participating in our MAvERIC-Pilot Study," said Dr. Andrew Hamer, Chief Medical Officer and Head of Research and Development at Cardiol Therapeutics. The MAvERIc-Pilot Study is enrolling 25 patients at eight leading medical research centers in the US that specialize in the treatment of pericarditis. The study recently exceeded 50% of its enrollment goal and is expected to complete enrollment in the first quarter of 2024. This is good progress.

Cardiol's share price has risen by almost 53% in the last 12 months. This means that the Canadians have clearly outperformed the entire Biotech sector in 2023. On the balance sheet, the high Q3 cash balance of CAD 40.5 million still shows a lot of operational flexibility. Cardiol could become a top pick in 2024 with the pace of progress shown.

Pfizer and BioNTech - Cheaper than ever after the vaccination scandal

BioNTech is currently in court with its German competitor CureVac. It is about the early CureVac patents for corona vaccines, which were declared null and void by the Federal Patent Court in Munich. The Tübingen-based company is now appealing against this decision, and a verdict is not expected until mid-2024. Meanwhile, BioNTech is starting production of vaccines against various infectious diseases in Rwanda, Africa. The past pandemic, in particular, has shown how dependent African countries are on vaccine supplies from Western countries. BioNTech's pipeline includes vaccines against life-threatening diseases such as malaria and tuberculosis. In future, they are to be produced and further developed locally at low cost.

With a war chest of almost EUR 18 billion, BioNTech is still beyond any doubt and can continue with its new research programs. The high cash reserves result from the cash windfall from the corona pandemic, which has been a boon for vaccine manufacturers with approved active ingredients and has enabled further necessary research. 8 out of 16 analysts on the Refinitiv Eikon platform have a "Buy" rating on BioNTech shares. The average 12-month price target is seen at USD 124.50, which is 17% above the current level. With a 2024 P/E ratio of 43.4, the valuation is high, but the Company's cash still accounts for around 80% of its current market capitalization.

The situation at BioNTech's US partner Pfizer is also interesting. Despite the decline in sales and profitability, the latest financial report shows that the Company is still profitable and has a very strong balance sheet. With USD 44.2 billion in cash and cash equivalents and a successful acquisition of Seagen for USD 43 billion, the market capitalization of USD 144 billion does not appear too high. The 2024 P/E ratio has fallen to 12.4, and there is a dividend of 5.8% on top. We believe both companies are now interesting again from a valuation perspective. CureVac, conversely, is a patent dispute bet against BioNTech with a digital outcome but fundamentally with little potential. The Company has not been able to present a market-ready product since 2000.

The biotech sector is in the process of reinventing itself. The high interest rates have pushed the NBI sector index down considerably, but it has been rising again for 2 months. Seasonally, the beginning of 2024 could now lead to a reverse cycle for many stocks that were punished. BioNTech and Pfizer are already sending positive signals; Cardiol Therapeutics and MorphoSys have already shown a lot of positive movement in recent months and should continue to surprise.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.