October 26th, 2023 | 08:15 CEST

Omicron or Pirola? Biotech shows doubling opportunities again! BioNTech, Pfizer, Defence Therapeutics, MorphoSys in focus

We had ticked off the Corona pandemic long ago. But if you ask your acquaintances, you may find one or two who have recently been infected with the "Pirola" variant. The official code of the virus variant is BA.2.86, and it was first discovered in Israel. The current infections are spreading rapidly across Europe and have also reached Germany. So far, the new Omicron offshoot appears less contagious than its predecessors. The new symptoms associated with "Pirola" include skin rashes, diarrhea, changes in the mouth and tongue, itchy eyes and surprisingly, sore fingers or toes. What is going on here? It is a reason to look again at BioNTech and some other biotechs. Where are the opportunities lurking?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

DEFENCE THERAPEUTICS INC | CA24463V1013 , MORPHOSYS AG O.N. | DE0006632003 , PFIZER INC. DL-_05 | US7170811035 , BIONTECH SE SPON. ADRS 1 | US09075V1026

Table of contents:

"[...] As a company dedicated to developing treatments for rare heart diseases, we see this as an opportune moment to contribute to the fight against heart disease and make meaningful strides in improving heart health worldwide. [...]" David Elsley, CEO, Cardiol Therapeutics Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

BioNTech and Pfizer - Is another COVID rally coming?

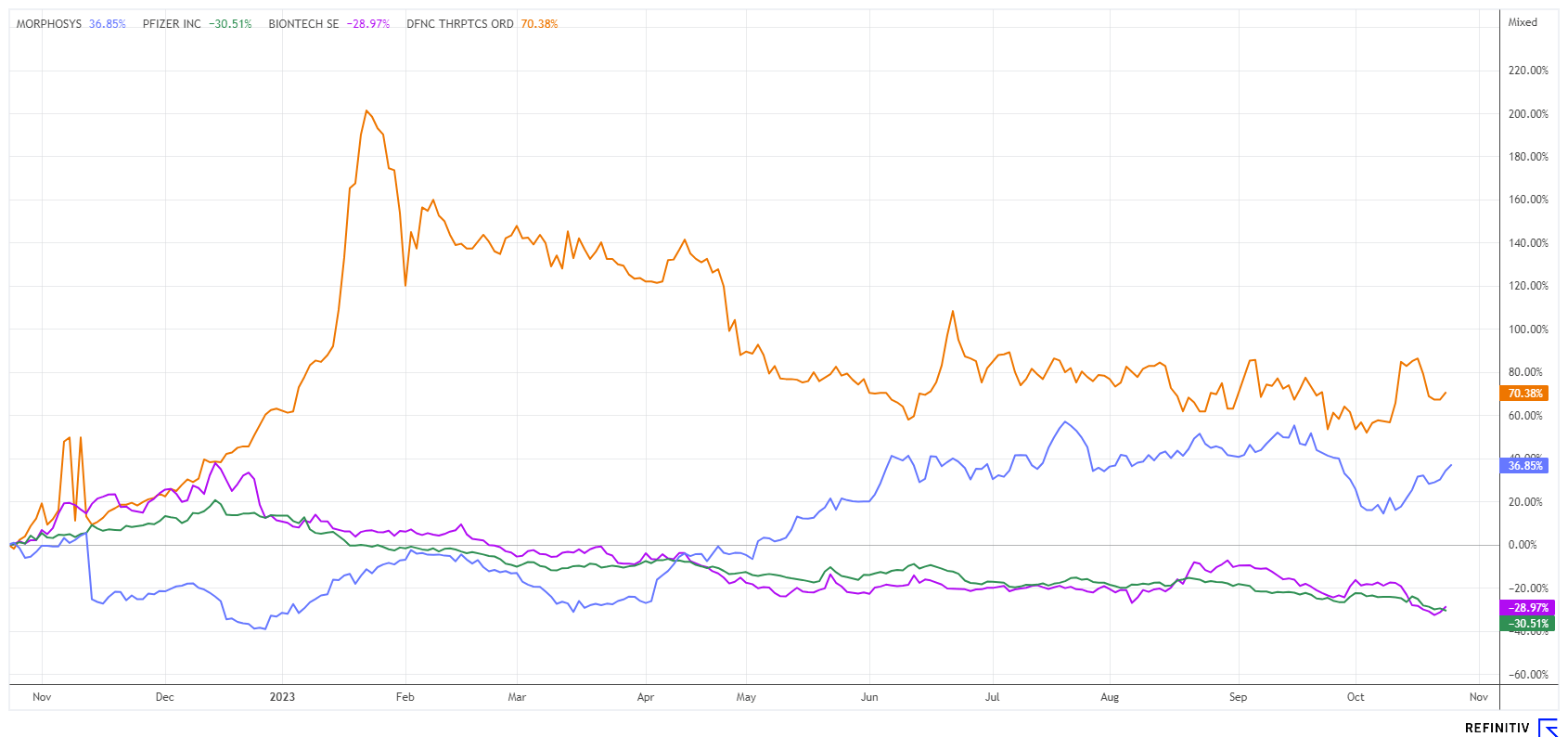

The years 2020 to 2022 were clearly in favor of vaccine stocks in the stock market. But as the pandemic wore off, there were sharp corrections in the industry. BioNTech, for example, lost 80% from the top, and US partner Pfizer has already lost 37% this year. Just as investors had bought into these stocks in droves, they were then sold off again in the downtrend. Those who acted cyclically and dynamically were able to achieve a tidy, triple-digit performance.

The new vaccine from the manufacturer BioNTech/Pfizer, as well as from Moderna and Novavax, is now adapted to the Omicron variant XBB.1.5. The new Corona variant EG.5 as well as the Pirola version, which are currently circulating, also belong to the Omicron family and are covered by the new vaccines. The vaccines have been available since September 18, and 14 million doses have been ordered. Whether the whole thing will lead to 67% of citizens getting vaccinated again remains questionable.

For both BioNTech and Pfizer, better times could be on the horizon as their valuations have significantly decreased. According to the Refinitiv Eikon platform, BioNTech and Pfizer are currently trading at 2023 P/E ratios of 22 and 18, respectively. On top of that, the Mainz-based company still has a good EUR 17 billion in its coffers. The market capitalization of EUR 21.2 billion is only EUR 4 billion above liquidity. Currently, researchers at the companies are focusing on cancer. Could this be a reason to consider investing, especially if vaccine-related revenue is less robust than before? In any case, keep an eye on both stocks with prices of EUR 88.50 or EUR 28.70. Fundamentally, it should not go much lower.

Defence Therapeutics - New discovery at AccuTOX

The Canadian biotech specialist Defence Therapeutics (DTC) can again come up with news. In the general consolidation trend of the last few months, the share has demonstrated good resistance so far because while other stocks have lost up to 50%, the DTC share has trended sideways at the EUR 1.85 line.

With the patented Accum™ platform, the Canadians have developed a flexible technology that holds great promise in current cancer research. Combining mRNA technology with modern delivery methods to affected cells represents a significant advance within recent research.

Now, a new function for the injectable cancer drug AccuTOX has been discovered in the context of cell-based cancer vaccine development. Defence has found that the delivery of unconjugated Accum™ exhibits strong and potent anti-cancer properties. This observation led to the development of the AccuTOX variant, which is capable of stopping the growth of established lymphoma, melanoma and cervical cancer when co-administered with various immune checkpoint blockers. AccuTOX not only destroys cancer tumor cells from the inside out but can also trigger an immune response that protects the host from tumor regrowth.

Surprisingly, transcriptomic analysis of tumor cells treated with AccuTOX has brought to light another therapeutic and beneficial effect: antigen cross-presentation. This process is vital in the context of cancer immunotherapy, as it will lead to the future development of cell-based cancer vaccines capable of activating CD8 T cells, which in turn can trigger cancer destruction. The Defence team recently completed an in vitro study that vividly demonstrates how low concentrations of AccuTOX can reprogram mesenchymal stromal cells to behave like antigen-presenting cells, similar to the leading ARM vaccine. Once validated, Defence can move forward with an optimized second generation of its ARM vaccine.

"This latest observation is indeed exciting and groundbreaking as it demonstrates how a single agent, AccuTOX, can be used as an injectable anti-cancer agent at a specific concentration on one target and is suitable as an agent to develop a cell-based vaccine when used at lower concentrations on additional indications," added CEO Sebastien Plouffe. The stock remains highly exciting and now offers a good entry point after months of consolidation. The current market capitalization of around EUR 81.4 million is favorable for a stock with a promising pipeline in cancer research. The DTC share is, therefore, well suited for a risk-conscious long-term investment.

MorphoSys - Now it gets exciting

At MorphoSys, the Q3 reporting date on November 15 is getting closer and closer. After a huge sell-off down to EUR 12 in December 2022, the popular biotech stock managed a revival up to EUR 32. But then there were minor disappointments again, bringing the chart back to EUR 23.

**At MorphoSys, it is important to keep an eye on the basic revenues in Monjuvi. For the first nine months, the preliminary net product revenues of Monjuvi in the US amounted to USD 67.8 million. It is still an increase of 6% but slightly below expectations. The preliminary gross margin for US net sales is 65%, which is due to one-time write-offs for raw materials. For the full year, the Munich-based company now expects net product sales in the US of USD 85 to 95 million with a corresponding margin of 75%. This is slightly above expectations and prompted investment bank UBS to maintain its "Buy" rating with a target price of EUR 45.

The Phase III studies for pelabresib, including the preparations for the pivotal MANIFEST-2 study, the results of which are expected by the end of the year, will be decisive for the MorphoSys share. After the setback to EUR 23, the stock is now clearly on the way up again from a chart perspective at EUR 27.30.

**The volatility in the biotech sector remains high but also stands and falls with the development of long-term interest rates in the US. Should the FED suspend inflation-related adjustments, the popular biotech stocks will also get a tailwind again. Our picks, BioNTech, Pfizer, Defence Therapeutics and MorphoSys, are excellently positioned and are currently at the lower band of long-term price development.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.