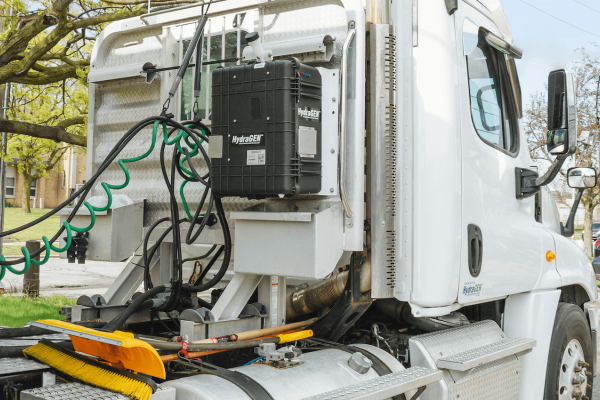

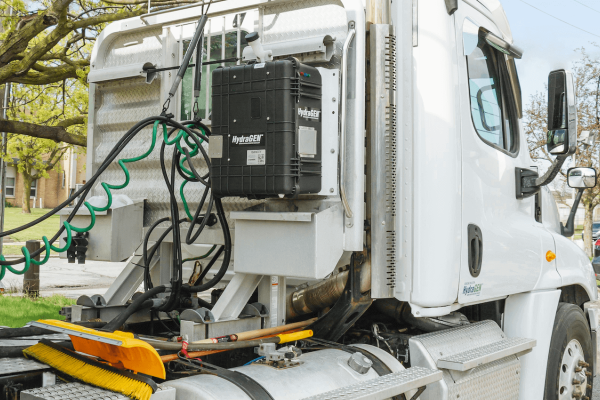

DYNACERT INC.

Commented by Armin Schulz on August 25th, 2021 | 11:40 CEST

Nel ASA, dynaCERT, Steinhoff - Boost for the portfolio with turnaround candidates

As the saying goes, the profit is in the purchase, but it is often not easy to determine the "bottom" on the stock market. Many factors need to be taken into account. First, there is the corporate sector and its sentiment. Is there fantasy? Is the market in trend? Then one should look at the fundamentals. Is there debt? Is the company making money? What is the sales growth, and what are the forecasts? After that, one can look at the varying analyst opinions and set up one's own rating system that awards points for different aspects. Using this checklist, one can quickly determine whether a company is attractive. In every portfolio there should be standard stocks, which make up the majority of the portfolio. A small part of the portfolio can be invested in speculative stocks, as they offer significant profits that can give the portfolio a boost. Today we take a closer look at three of these turnaround candidates.

ReadCommented by Nico Popp on August 20th, 2021 | 10:47 CEST

Volkswagen, dynaCERT, BYD: Sudden turnaround ahead?

When Volkswagen CEO Herbert Diess visits Markus Lanz's talk show, the corporate leader exudes an esprit that almost comes close to celebrity founders from the USA. Even if a comparison with Elon Musk would be far-fetched - they seem more modern and flexible, the managers of German corporations. This flexibility is probably also necessary to lead huge corporations into the future in a time of change. The challenges are great: In addition to the uncertainty about the future, numerous smaller companies are also digging in their heels and want to wrest market shares from the big players. We take a look at three stocks that focus on the future of mobility.

ReadCommented by André Will-Laudien on August 13th, 2021 | 12:36 CEST

NEL, dynaCERT, FuelCell Energy, Plug Power - Is hydrogen about to explode next?

Not only is the EU tightening its climate targets, but around the globe, more and more countries are decarbonizing their economies. The subject of hydrogen is providing the rainmaking impetus for discussion. Since the closing of ranks on e-mobility, however, it is no longer the focus of attention. However, according to the World Energy Council (WEC) analysis, at least 20 countries that account for almost half of global economic output have adopted a national hydrogen strategy or are at least close to doing so. Leading the way are Japan, France, South Korea, the Netherlands, Australia, Norway, Spain and Portugal. But Russia, China, Morocco and the USA are also working on their strategies. Australia and China are leading the way, while Europe and the Middle East are already doing a lot. We take a look at the premier league of H2 values.

ReadCommented by Stefan Feulner on August 2nd, 2021 | 12:27 CEST

Linde, dynaCERT, Nikola - Profiting from change

With the amended Climate Protection Act, the targets for lower CO² emissions have been raised once again by the German government. Germany is to achieve greenhouse gas neutrality by 2045, and even negative emissions are targeted after 2050. To achieve this, an emergency program worth EUR 8 billion has been launched. The program aims to accelerate the decarbonization of the economy, climate-friendly mobility, and green hydrogen production, among other things. Benefit from the energy transition!

ReadCommented by Nico Popp on July 27th, 2021 | 10:20 CEST

NEL, dynaCERT, Daimler: The winners of the mobility revolution

Whether with hydrogen or with battery technology, mobility is transforming. In this article, we discuss where the journey could lead, why established automakers are gaining ground with ambitious plans, and whether there are still innovative solution providers around the mobility of the future that the market has not yet noticed.

ReadCommented by Armin Schulz on July 23rd, 2021 | 12:47 CEST

Nel ASA, dynaCERT, Plug Power - Investments in hydrogen increase worldwide

Sustainability is a trend that is gaining more and more momentum. This can be seen well in the investments announced in the hydrogen sector. In February, members of the Hydrogen Council, which is made up of 109 global companies, wanted to put USD 80 billion into developing hydrogen projects. By July, that sum had increased by USD 70 billion to USD 150 billion. Europe is a frontrunner in hydrogen technology thanks to funding from the EU Commission's Important Projects of Common European Interest (IPCEI). According to McKinsey, it is only a matter of time before hydrogen is traded like all other commodities. Today we highlight three companies in the hydrogen segment.

ReadCommented by Carsten Mainitz on July 9th, 2021 | 13:21 CEST

JinkoSolar, dynaCERT, Vestas - Who is the best Cleantech investment?

Current extreme heat of up to 50 °C in North America, arctic temperatures here in southern Germany still in April: The weather is going crazy, and humankind does not seem to be entirely innocent if leading global climate researchers are to be believed. Thus the climatic warming caused by human industrialization seems to have extraordinarily rapid and powerful effects. Now that more sensible people are finally back in control of the levers of power in crucial countries, agreements on necessary immediate measures will be reached more quickly. The decarbonization of industry is one of the most important building blocks that should be addressed with many different Cleantech solutions. We present three stories with extremely promising approaches and corresponding share price potential.

ReadCommented by André Will-Laudien on July 1st, 2021 | 13:49 CEST

NEL, Plug Power, dynaCERT - Hydrogen, here we go again!

What momentum! In just 6 weeks, hydrogen stocks have gained up to 60% again. Of course, those who missed the first wave are happy. Maybe it will work out now with the second one. The framework parameters are suitable because both the EU and Joe Biden have agreed on more hydrogen within the climate targets. Germany's significant contribution to climate protection can create applications in these sectors that operate with low emissions using hydrogen. An important focus in developing a German hydrogen economy and strategy should therefore be the commercialization of applications.

ReadCommented by Stefan Feulner on June 23rd, 2021 | 13:33 CEST

Varta, dynaCERT, Nordex - Strong development

Renewable energies are essential concerning the targeted climate neutrality. For the long-term success of the energy transition and climate protection, alternatives to fossil energy sources are being sought. The switch to the new sources of photovoltaics, wind, hydrogen or geothermal energy opens up new economic sectors with considerable potential. Many companies have recognized the signs of the times, already initiated the turnaround and are now facing a bright future.

ReadCommented by Nico Popp on June 14th, 2021 | 08:48 CEST

NEL, dynaCERT, Volkswagen: Investment ideas from conservative to speculative

The automotive industry is on the move again! Premium manufacturers, in particular, are enjoying good business. Although the trend is towards electric cars, there are alternatives, especially for trucks and other machinery: In recent months, hydrogen titles have been elevated to a pedestal in the media. But despite its good prospects, the technology is not yet ready. We explain what forms of mobility are available and how investors can invest.

Read