DYNACERT INC.

Commented by Nico Popp on April 25th, 2022 | 11:51 CEST

Hydrogen becomes marketable: Plug Power, dynaCERT, NEL

The energy transition is a long-term project. There must be no prohibitions on thinking about it. Only about a year ago, representatives of the automotive industry rejected hydrogen. In the meantime, however, a lot has happened. The sanctions against Russia have made energy more expensive, and hydrogen is now increasingly seen as a substitute for gas. In addition, more and more hydrogen projects around logistics projects and trucks are picking up speed. Reason enough to take a close look at the industry.

ReadCommented by Carsten Mainitz on April 19th, 2022 | 14:06 CEST

Nel, dynaCERT, Daimler Truck - Climate Targets: Hydrogen is the key technology!

As early as the summer of 2020, the German government set an important point with the adoption of the "National Hydrogen Strategy", which has suddenly gained importance in view of the Ukraine war. Politicians and experts are convinced that hydrogen, as a versatile energy carrier, will play a key role in achieving the energy and climate targets. It is now essential that the defined, coherent, but often still too theoretical framework for action is quickly filled with life. With the right stocks, investors can benefit from these developments.

ReadCommented by Fabian Lorenz on April 15th, 2022 | 12:07 CEST

Exciting hydrogen forecast: Shares of Nel ASA, Plug Power and dynaCERT facing golden times?

For many, hydrogen is a key factor in successfully implementing the energy transition. Accordingly, the technology is being promoted strongly. Since the start of the Russian war of aggression in Ukraine, hydrogen has again gained importance, and experts are overflowing with growth forecasts. First, in mid-March, the investment bank Jefferies published a forecast according to which the demand for hydrogen electrolyzers could rise to more than 400 gigawatts by 2030. By then, however, only 79 gigawatts would be available. So the supply gap is enormous. To fill it, hydrogen specialists like dynaCERT, Nel ASA and Plug Power could be in for golden times. And it gets even better. A new study puts the Jefferies forecast in the shade.

ReadCommented by Stefan Feulner on April 6th, 2022 | 10:19 CEST

Ballard Power, dynaCERT, Plug Power - Hydrogen more important than ever before

The consequences are already apparent, at the latest when you stand at the gas pump and look at the horrendous increases of the last weeks. Germany is paying the price because of its overdependence on one customer, in this case, Russia. It is also a fact that Germany is moving too slowly concerning the energy transition. Acceleration is now imperative. Hydrogen fuel cell technology has already been identified as the missing piece of the puzzle and is becoming all the more important due to the current geopolitical tensions.

ReadCommented by André Will-Laudien on March 22nd, 2022 | 10:08 CET

NEL, dynaCERT, Plug Power, Ballard Power - Oil & Gas infinitely expensive, where are the hydrogen stocks?

What a dramatic move for oil and gas! It was a movement with an announcement. Fossil fuels are being traded as if any sources were about to dry up. Due to the armed conflicts in Ukraine, analysts see the danger of a severe supply shortage of oil and gas if the Western countries impose an embargo on Russian oil and gas supplies. Europe, in particular, is likely to suffer because of its heavy dependence on the East. In order to secure the supply, one hopes for an OPEC production adjustment, which is probably not yet political consensus. For the past 3 weeks, concepts for alternative energy generation have again been in the spotlight. The acceleration of hydrogen technology remains a topic of desire for all politicians. What is the current status?

ReadCommented by Armin Schulz on March 18th, 2022 | 12:30 CET

Plug Power, dynaCERT, Nel ASA - Hydrogen market worth billions

The German government wants to become independent of Russian energy imports as soon as possible. One way to achieve this could be green hydrogen. Markus Söder recently called for more hydrogen pipelines to be built quickly. It is no wonder as it is a long way from wind farms in the north or ports in the Netherlands to Bavaria. Interest in hydrogen in Europe is high. The EU Commission wants to increase hydrogen production to 25 gigawatts by 2030. Already in February Goldman Sachs drew attention to the hydrogen topic. It considers hydrogen to be an important factor on the way to a zero-emission economy and expects the industry to grow strongly. The Ukraine crisis gives a corresponding tailwind.

ReadCommented by Nico Popp on March 7th, 2022 | 11:54 CET

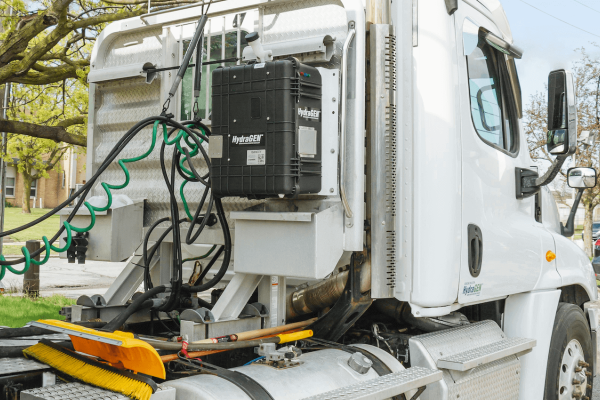

Linde, dynaCERT, NEL: Time for hydrogen technology

Gas is still flowing from Russia to the West. But the longer the war in Ukraine continues, the more likely it is that even more onerous sanctions will be imposed. In any case, it is clear that the long-term trend is away from Russian gas. Hydrogen suppliers have been profiting for days from the escalation of violence in Ukraine. Transitional technology could also be in demand to reduce fuel consumption and CO2 emissions in equal measure - after all, climate protection must not be neglected despite rising energy prices. We analyze three hydrogen stocks.

ReadCommented by Carsten Mainitz on March 3rd, 2022 | 13:49 CET

dynaCERT, SFC Energy, Coinbase - These are the winners!

The war in Ukraine, which is expected to last even longer, continues to weigh on the stock markets. The majority of the world community is determined to quell Putin's aggressiveness with all kinds of sanctions and bans, costing them a lot. More and more Western oil companies are leaving Russia. The share price of Gazprom, the world's largest producer of natural gas, has been pulverized in recent days. However, some sectors should also benefit from this mixed situation.

ReadCommented by Fabian Lorenz on February 22nd, 2022 | 12:01 CET

The boss sells at Nel ASA - Plug Power and dynaCERT with news

Growth stocks are having a hard time in the current stock market environment. The Ukraine crisis, rising interest rates and high inflation mean that investors prefer value stocks. Even the long-celebrated beneficiaries of the energy transition have taken a significant hit. However, the long-term positive outlook for the sector has not changed. Today we look at Nel ASA, Plug Power and dynaCERT. At dynaCERT, the correction has been going on for a year now, and management changes can provide new impetus. At Nel, the outgoing CEO is selling shares in a big way, causing renewed investor frustration. Plug Power, on the other hand, shows strength and expands into an exciting area through an acquisition and partnerships.

ReadCommented by Stefan Feulner on February 15th, 2022 | 11:14 CET

Delivery Hero, dynaCert, KWS Saat - Fallen angels

The German Foreign Minister Annalena Baerbock of the Green Party considers the Ukraine crisis to be "absolutely dicey". So far, however, she sees "no signs that the warlike confrontation is already a done deal," Baerbock said on ARD's Tagesthemen. The current situation at food delivery company Delivery Hero is also more than dicey. The DAX newcomer, included in the German benchmark index in place of Wirecard, has lost around 40% in stock market value. It could quickly fall back into the second tier.

Read