June 27th, 2024 | 06:45 CEST

Hydrogen 3.0 - Is it turning now? Nel ASA, Cavendish, dynaCERT, SMA, and Plug Power in focus!

Summer slump? Not at all! Artificial intelligence, high-tech, and armaments remain in upward mode; even a sharp correction at Airbus is not shaking the markets. There are currently increasing rumours that China and Japan could have problems with their financial systems. In China it is the collapsing real estate market, in Japan it is trillions of YEN invested in foreign bond markets and refinanced with negative interest rates. However, the era of zero interest rates is over, and persistent inflation is not subsiding as expected. This pushes the risk parameters through the roof and requires banks to have higher capital backing. Exciting times! In the hydrogen sector, all eyes are on the newcomer Cavendish. Will this be a jolt for the struggling sector?

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

NEL ASA NK-_20 | NO0010081235 , CAVENDISH HYDROGEN ASA | NO0013219535 , DYNACERT INC. | CA26780A1084 , SMA SOLAR TECHNOL.AG | DE000A0DJ6J9 , PLUG POWER INC. DL-_01 | US72919P2020

Table of contents:

"[...] dynaCERT's HydraGEN™ device offers a retrofit solution for diesel engines designed to protect the environment while providing economic benefits. [...]" Bernd Krueper, President & Director, dynaCERT Inc.

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Nel ASA - High volatility at the fueling station subsidiary Cavendish

The Norwegian hydrogen pioneer Nel ASA has had a difficult three years. Until 2021, things were going brilliantly; the first development work for a European H2 infrastructure was celebrated on the stock exchange, and the share price increased twentyfold. However, the glamour of those days has long since faded, as the fabulous rise was followed by an abrupt collapse. After an 85% price correction, the share price is now back at EUR 0.48, down from its peak of EUR 3.17 in January 2021.

As a formal spin-off in the form of a dividend in kind, the petrol station subsidiary Cavendish Hydrogen saw the light of day on the stock exchange at the beginning of June. With a converted initial listing price of EUR 2.05, the share price initially fell but then rose sharply again this week with the new value. There are no reasons for the substantial price fluctuations on the part of the Company. Neither Cavendish nor its parent company NEL have published any news relevant to the share price. One reason for the sharp sell-offs could be the many short sellers betting big on Cavendish's share price falling. The reason: Like the parent company, the subsidiary is still loss-making and the operating profit thresholds could be approaching in 2027 to 2029. The play of forces is, therefore, likely to continue for a while, although important technical support barriers can be identified for Nel ASA in the EUR 0.36 to EUR 0.42 range. Traders can position themselves here, but there are currently no fundamental reasons for an entry.

dynaCERT - The starting signal is just around the corner

Things are getting exciting for the Canadian niche provider of hydrogen add-on devices for larger diesel combustion engines such as buses, trucks, mining vehicles, or power generators. With the diverse applications of its proprietary HydraGEN® technology, the combustion process can be optimized by adding hydrogen, improving efficiency by double-digit percentages. German manager Bernd Krüper was recently appointed to the management team and will contribute his many years of experience at various technology companies to dynaCERT's hydrogen projects.

To increase its market potential and enter the carbon emissions trading market, dynaCERT is currently having its equipment certified by the globally active VERRA Institute. dynaCERT also recently acquired a stake in electrolyser manufacturer Cipher Neutron and this week will also see its Annual General Meeting. For the shareholders, Krüper's entry could also result in a consistent rollout of the technology in the US, as there are around 19,500 logistics companies across the southern border. In addition, trade between Canada, the US, and South America grew at a constant rate of 3.2 to 4.2% per annum between 2021 and 2023.

Once the VERRA certification is in place, large transportation companies will have a significant ESG lever at their disposal, enabling them to generate additional revenue through diesel savings. This would be crucial for an industry suffering from declining margins. In recent weeks, DYA shares have fluctuated rather unspectacularly between CAD 0.14 and CAD 0.17. There is too much suspense as to when the certification will come. If it comes through, the days of low entry prices will likely be over.

Plug Power and SMA Solar - Buy at the current low?

Things are getting political at SMA Solar Technology AG. First, the Kassel-based solar technology manufacturer lowered its forecasts, and then shareholders were warned of a right-wing shift in Europe and the return of Donald Trump. Apparently, the management expects fewer orders due to the political developments! SMA Solar has been struggling with headwinds for some time now, but it seems things are about to get even worse. After a previous expectation of EUR 220 to 290 million, the much-watched EBITDA is expected to be only EUR 80 to 130 million: a decrease of 74% - that is a significant drop. This is in stark contrast to last year when the Company was able to raise its forecasts several times. It is now suspected that the EU Green Deal will be watered down, resulting in fewer subsidies for companies in the alternative energy sector. SMA expects even more headwinds in the US, where a 3.5 GW plant is planned, and large subsidies are expected from the Inflation Reduction Act (IRA), which Donald Trump would prefer to roll back as soon as possible.

Things are not going much better with industry relative Plug Power. After rumours of billions in subsidies and jumps in the share price, calm has returned due to ongoing regulatory audits. As a result, the speculative potential in the stock has dramatically decreased. If Plug Power had not raised around USD 1 billion through a capital increase in the spring, the hydrogen giant from Latham, New York, would likely be in a very poor position now. Here, too, the expectation of a change of government could be a burden.

SMA Solar has received several downgrades from analysts on the Refinitiv Eikon platform. The average price target from 7 "Hold" recommendations is EUR 35.12, while the stock is currently trading at EUR 26.70. However, with a P/E ratio of over 20, investors should patiently wait out the current dip in business performance. Only 9 out of 28 analysts are still recommending Plug Power as a "Buy"; the 12-month price expectation is USD 4.72. At a price of USD 2.40, however, the share is only 5% above its 5-year low. Keep watch on both stocks for now - we will report further.

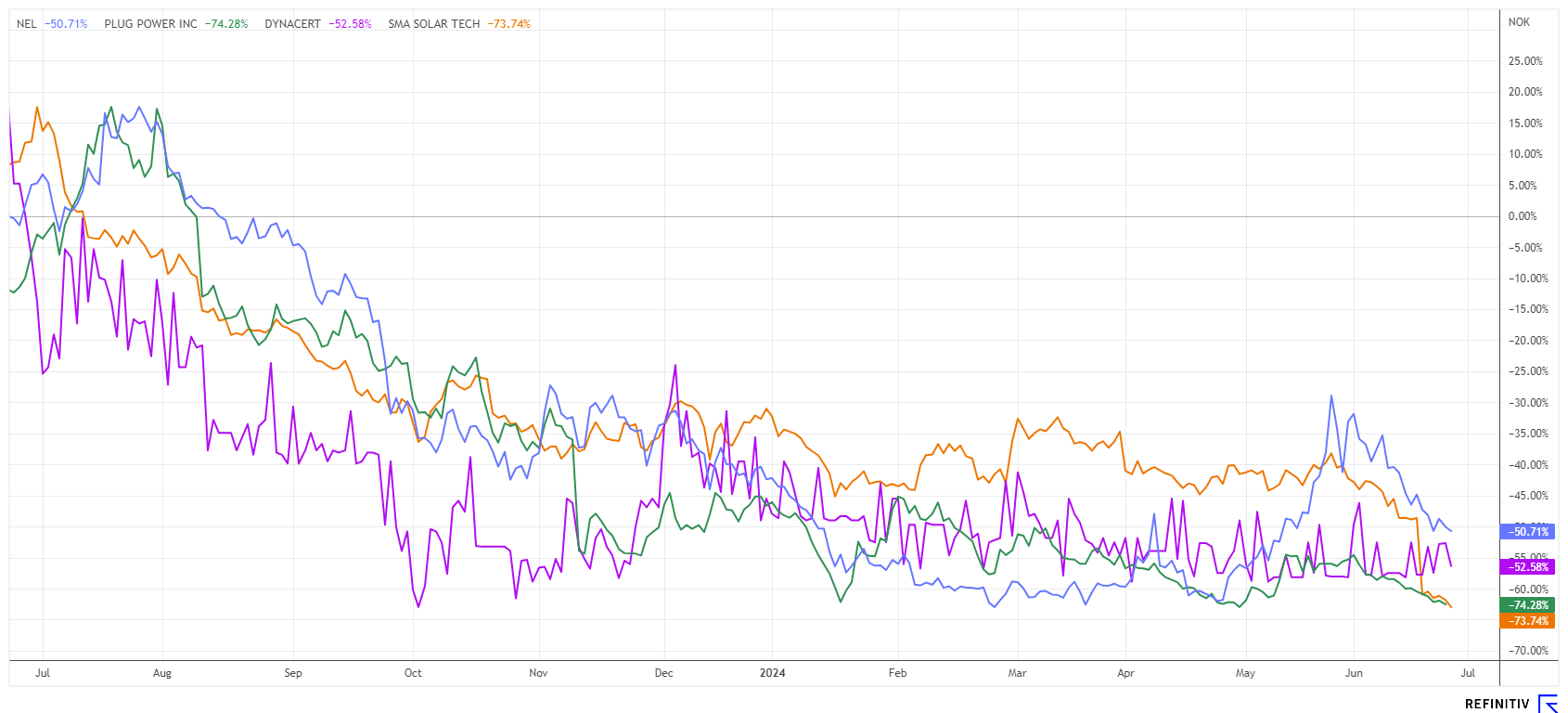

GreenTech stocks seem to be out of favour. After quite rosy years between 2019 and 2022, there are no longer enough public funds to continue filling climate budgets. Due to warlike activities and increasing skepticism towards large funding budgets, investors are currently only interested in companies that can still stand tall even in a storm. With VERRA certification, dynaCERT is expected to reach the break-even point in 2025.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.