July 1st, 2024 | 07:00 CEST

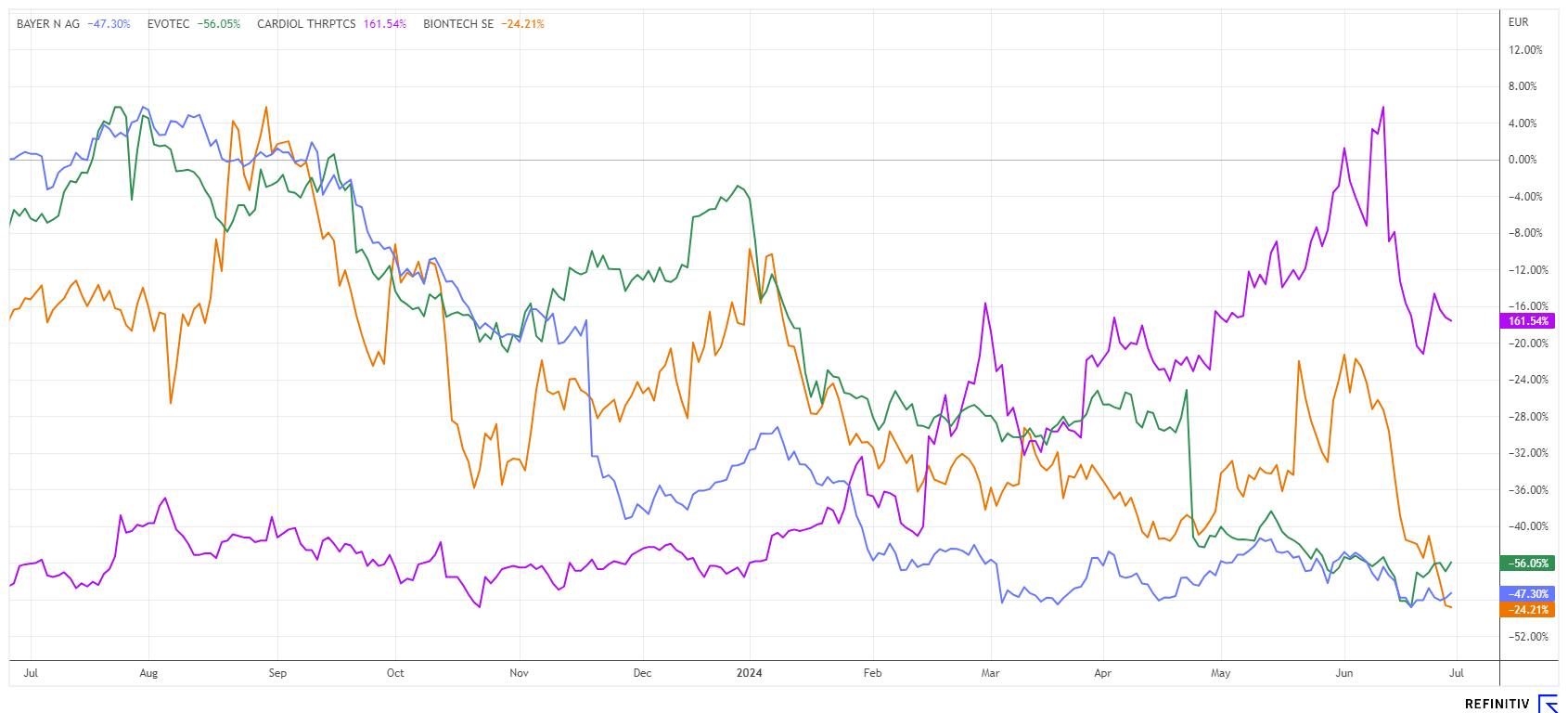

Attention: Biotech stocks! Evotec, Bayer, and BioNTech in the emergency room, but Cardiol Therapeutics shows strength!

Anyone looking at the buying frenzy on the NASDAQ is overlooking the fact that the US has long been in the emergency room. With the candidates currently up for election, it is unlikely that the most pressing issues of the day will be dealt with. One has difficulty using the right words in front of the camera, while the other ignores facts and slips into his own world. This election could be disastrous for the world's largest economy, but the financial markets are currently uninterested. Investors should, therefore, continue to separate the wheat from the chaff and act prudently. After the big AI and high-tech wave, biotechs are expected to make a comeback, as US interest rates will drop closer to the election. We present a solid selection for risk-conscious investors.

time to read: 4 minutes

|

Author:

André Will-Laudien

ISIN:

BIONTECH SE SPON. ADRS 1 | US09075V1026 , BAYER AG NA O.N. | DE000BAY0017 , EVOTEC SE INH O.N. | DE0005664809 , CARDIOL THERAPEUTICS | CA14161Y2006

Table of contents:

"[...] We are working closely with the University of Miami's Department of Psychology. [...]" Evan Levine, CEO, PsyBio Therapeutics

Author

André Will-Laudien

Born in Munich, he first studied economics and graduated in business administration at the Ludwig-Maximilians-University in 1995. As he was involved with the stock market at a very early stage, he now has more than 30 years of experience in the capital markets.

Tag cloud

Shares cloud

Evotec and Bayer - Bottom formation in progress

For weeks, things did not look good for the German biotech stars, but now there are increasing signs of improvement. The shares of the Hamburg-based biotech company Evotec showed a positive side on Friday. There was positive news from the Seattle-based subsidiary Just, which was selected by the US Department of Defense for the development of monoclonal antibodies. There was also good news from Tubulis, which received fast-track status from the FDA for its antibody-drug conjugate (ADC) with the abbreviation TUB-040 for the treatment of ovarian cancer. Today, Chrisitan Wojczewski will assume the position of CEO. Evotec is expected to provide an update on its mid-term outlook in mid-August. Investors hope the share price will quickly recover from the Lanthaler scandal. The share chart at least points to a stabilization. Collect!

Bayer is showing the first positive signs thanks to progress in the restructuring measures. CEO Bill Anderson announced rapid progress in savings by the end of 2024, raising hopes among investors. 70% of the reorganization is expected to be completed by then. The focus is on cutting costs, primarily by reducing bureaucracy and accelerating project progress. The Leverkusen-based company has already eliminated around 40% of its management positions in the pharmaceuticals business in the US. It has also made cuts in Canada, Mexico, Italy, Australia, and the Nordic countries. If sales remain stable, this will be the first successful downsizing since the Monsanto takeover. On the Refinitiv Eikon platform, there are currently only 5 out of 25 experts with a thumbs up and an average 12-month price expectation of EUR 31.80. The majority is likely too negative on Bayer at the moment, which creates buying opportunities for anti-cyclical investors.

Cardiol Therapeutics - Consolidation opens up a new entry opportunity

The situation is completely different with the booming biotech stock Cardiol Therapeutics. In June, the share price reached a new top level of EUR 2.80. In recent years, the Canadian company has developed a promising drug candidate called CardiolRx™. The pharmaceutically produced, oral solution formulation is now widely recognized, as CardiolRx™ blocks the activation of the inflammasome signaling pathway and is therefore considered a proven remedy against the dangerous inflammation of the heart muscle (myocarditis), which is particularly common in post-COVID-19 patients.

Cardiol is currently reporting positive 8-week topline data from the open-label Phase II MAvERIC-Pilot study; the focus is now on the decisive Phase III study. The stock market initially took the good data as an opportunity to convert some of the lavish profits of the last 3 months into cash. The share price fell back relatively quickly to EUR 1.85 and is thus around 35% below its high. In a research update on June 23, the brokerage firm Canaccord reiterated its price target of USD 8.00. Analyst Edward Nash sees a glaring disparity between the operating performance and the share price. CEO David Elsley took advantage of the downturn to make a reported additional purchase at CAD 2.77. He now owns over 1.2 of the 68.9 million shares. **All points from the recent Annual General Meeting were confirmed last week. The rally can now start again, and there are plenty of reasons to buy more shares.

BioNTech - Back in business with COVID

At first glance, it is difficult to understand why BioNTech SE shares have fallen by a full 20% to around EUR 75 in just two weeks, as the news situation is good. Just last week, the Mainz-based company and its Chinese partner DualityBio were granted fast-track status by the FDA for the antibody-drug conjugate (ADC) BNT324/DB-1311 for the treatment of patients with prostate cancer. The collaboration partners now have three ADC candidates in the US Fast Track program.

In addition, BioNTech, together with Pfizer, has received the EMA's recommendation for approval of its monovalent COVID-19 vaccine Comirnaty adapted to the Omicron variant JN.1. The Committee for Medicinal Products for Human Use (CHMP) recommends approval for active immunization against the COVID-19 virus in persons aged 6 months and older. This decision follows the recommendations of a technical advisory panel of the World Health Organization (WHO) and the Emergency Task Force (ETF) of the EMA. A final decision by the European Commission is still pending but is expected soon. The authorities expect an increasing demand for COVID-19 vaccinations in the upcoming fall and winter seasons. This should put BioNTech and Pfizer back in business. However, the BNTX share price reached a new all-time low of EUR 74.45 on Friday. Therefore, wait for stabilization; there is no hurry here!

The big biotech stocks are currently having a hard time. Investors are still focusing on high-tech and defense stocks, while the hardening of interest rates is hurting the refinancing-heavy business models of the life science industry. However, the charts at least indicate a bottom formation, and Cardiol Therapeutics offers interesting buy levels again after the correction.

Conflict of interest

Pursuant to §85 of the German Securities Trading Act (WpHG), we point out that Apaton Finance GmbH as well as partners, authors or employees of Apaton Finance GmbH (hereinafter referred to as "Relevant Persons") currently hold or hold shares or other financial instruments of the aforementioned companies and speculate on their price developments. In this respect, they intend to sell or acquire shares or other financial instruments of the companies (hereinafter each referred to as a "Transaction"). Transactions may thereby influence the respective price of the shares or other financial instruments of the Company.

In this respect, there is a concrete conflict of interest in the reporting on the companies.

In addition, Apaton Finance GmbH is active in the context of the preparation and publication of the reporting in paid contractual relationships.

For this reason, there is also a concrete conflict of interest.

The above information on existing conflicts of interest applies to all types and forms of publication used by Apaton Finance GmbH for publications on companies.

Risk notice

Apaton Finance GmbH offers editors, agencies and companies the opportunity to publish commentaries, interviews, summaries, news and the like on news.financial. These contents are exclusively for the information of the readers and do not represent any call to action or recommendations, neither explicitly nor implicitly they are to be understood as an assurance of possible price developments. The contents do not replace individual expert investment advice and do not constitute an offer to sell the discussed share(s) or other financial instruments, nor an invitation to buy or sell such.

The content is expressly not a financial analysis, but a journalistic or advertising text. Readers or users who make investment decisions or carry out transactions on the basis of the information provided here do so entirely at their own risk. No contractual relationship is established between Apaton Finance GmbH and its readers or the users of its offers, as our information only refers to the company and not to the investment decision of the reader or user.

The acquisition of financial instruments involves high risks, which can lead to the total loss of the invested capital. The information published by Apaton Finance GmbH and its authors is based on careful research. Nevertheless, no liability is assumed for financial losses or a content-related guarantee for the topicality, correctness, appropriateness and completeness of the content provided here. Please also note our Terms of use.